Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

Health Insurance In The Usa: Whats The Cost

Avin Talabani

Transformation Manager

The cost of health insurance in the USA is a major talking point for Americans and visitors alike here, we explore the averages and factors impacting policy fees. The USAs healthcare system is unlike many others, so we look at why the cost of average American healthcare insurance seems to be rising and how other nations compare.

Key takeaways:

- Age, geography, employer size and plan type all influence the cost.

- Healthcare costs in the USA are partly due to administrative factors.

- Fees are going up, with plan trends contributing.

- Almost half of American adults were underinsured in 2020.

- Voluntary health payments are higher in Switzerland than the USA, though Americas costs are among the worlds highest.

- On the flipside, American expats abroad often find they pay less for insurance overseas.

Also Check: How To Find Good Health Insurance

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

In 2020, health insurance premiums for unsubsidized individual customers were $456 per month on average, while family premiums averaged $1,152 per month. The average individual deductible was $4,364 the family deductible averaged $8,439.

Over the course of a year, the average health spending for a family of four in the U.S. was $25,011 in 2020. This figure includes spending on monthly premiums. It also includes meeting the deductible.

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for “cost-sharing reductions” : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

Don’t Miss: What Causes Health Insurance Premiums To Increase

Individual Versus Family Plans

An individual plan has one member, or just one person covered by the plan. Family plans cover two or more members.

Your plan’s deductible and out-of-pocket maximum are based on whether you have an individual or family plan.

The deductible and out-of-pocket maximum for a family plan is usually double of an individual plan. So if the deductible for a plan is $2,000 for a family, it’s $1,000 for an individual. If the out-of-pocket maximum for an individual plan is $6,000, it will be $12,000 for a family, no matter how many people the plan covers.

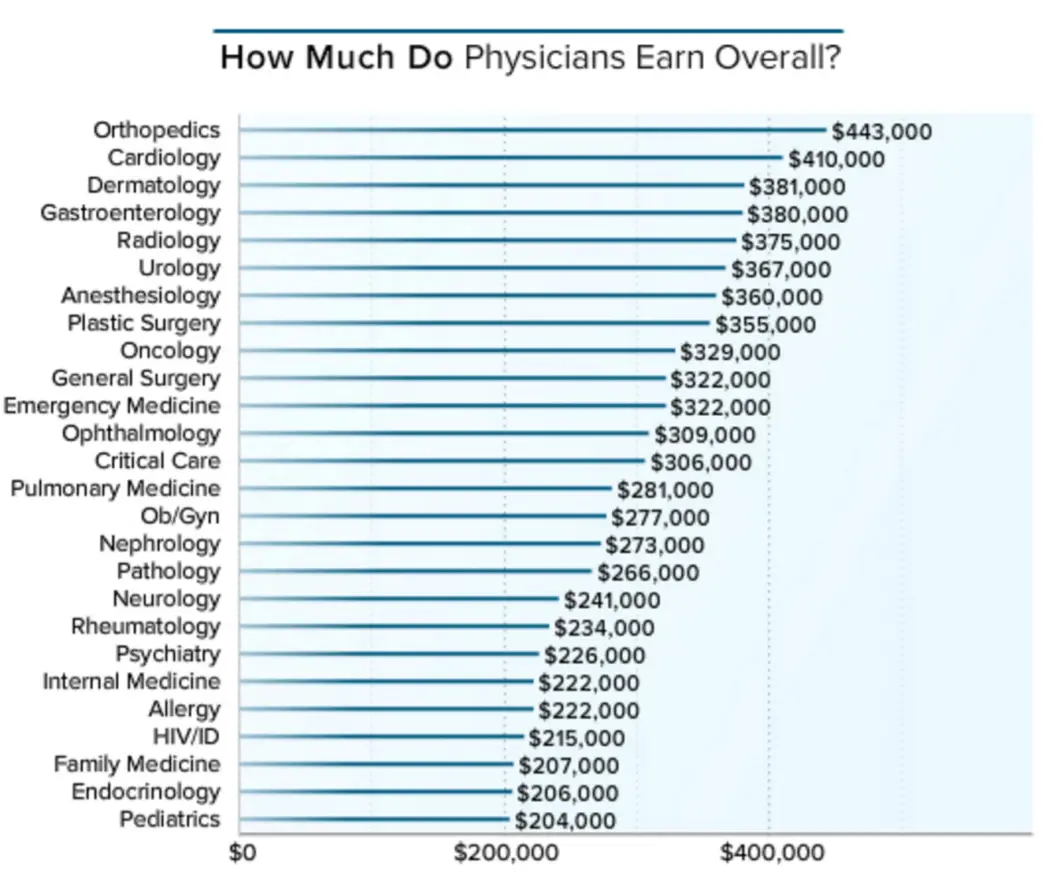

The American Treatment Cost Gap

The raw cost of treatment is higher in the USA than in many countries, so this influences the cost of insurance. There are several reasons for this cost gap:

- Pharmaceutical drugs, for instance, cost nearly four times more in the USA than other similar countries.

- American doctors and nurses enjoy some of the worlds best pay the average registered nurse in California earns $113,240 so this also drives up cost.

- The American system also tends to favour more frequent interventions and complicated procedures, which comes with a price tag.

Due to the sizeable treatment cost differences, many international insurers including William Russell do not cover treatments that take place on American soil as part of our standard policies.

However, if youre an American citizen working overseas, then its good to know some of our international health insurance policies provide short-term cover for visits of up to 45 or 90 days. Find out more about our USA-45 and USA-90 international health policies.

Don’t Miss: What Is Meridian Health Insurance

Expats From The Eu/eea

If you are from the European Union or European Economic Area , you are obliged to obtain a health insurance in The Netherlands when:

- You have a job and/or pay income tax in The Netherlands

And/or:

- You are 30 years or older and your stay in The Netherlands is not temporary

In other cases you will likely not be able to take out Dutch health insurance. However, you could choose an expat insurance to cover medical care in The Netherlands.

Catastrophic Health Insurance Plans

For qualifying Americans under the age of 30, catastrophic plans are available to provide what can be considered last-resort health insurance. Catastrophic plan premiums are lower than even Bronze tier plans. However, you pay more for visits and prescriptions due to high deductibles, which are $8,550 for the year in 2021.

Recommended Reading: Can You Get Health Insurance While Pregnant

Action Steps To Take Before Early Retirement Or Ft Entrepreneurship

If you are on your own, there is a high likelihood that health insurance premiums will feel outrageously expensive . Only those of you within 400% of poverty level wages will get any sort of subsidy.

Take a look at the chart below and focus on the very right column. It highlights that once you make over $47,520 as an individual, you will get $0 healthcare subsidy.

For an average family of three or four, that household income maximum is $80,640 and $97,200, respectively. But remember, the subsidies are graduated.

The closer you are to the 400% FPL income, the less subsidy you will have until it goes away completely. Youve got to be earning only 100% 200% of FPL to really get some assistance. But if you are at those income levels, you may have more pressing things to worry about.

How Does The Size Of My Family Impact My Insurance Cost

Who is this for?

If you purchase your own health coverage, this explains how the number of people covered by your insurance affects your monthly payment and other costs.

The size of your family doesn’t necessarily determine what you spend on doctors and prescriptions. A healthy family of six could spend less than a married couple with chronic conditions. But when it comes to your health insurance costs, the number of people on a plan does affect what you pay. We’ll show you how.

Also Check: How Much Is Private Health Insurance In Spain

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than $1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth $2,745 per capita.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

Costs Of Private Health Insurance In Germany

Only certain individuals in Germany are eligible for choosing private healthcare over public healthcare

This includes those earning over 60,750, freelancers, those earning under 450 and students over 30.

The cost of private health insurance in Germany is not regulated in the same way as the cost of public healthcare and can therefore vary hugely in price. Private premiums are set by the risk of the patient, which means those with chronic conditions and older people will generally pay more for private insurance. Find a holistic comparison of private health insurance pros and cons here.

Young people on high incomes will certainly make savings by choosing private over public. A young, healthy person can pay as little as 175 a month, which can be far less than public healthcare for those on high salaries. However, high-risk patients may have to pay private health premiums as high as 1,500 per month.

Most private healthcare providers offer savings on monthly premiums if you choose high deductibles. This may mean that you have to pay the first few thousand Euros for treatment, should the worst happen, but your monthly rate is quite low. Only choose this option if you have that amount of money in savings should you need it and you are generally in good health.

You can find out more about private health insurance on our Health Insurance in Germany page.

Read Also: Does Health Insurance Cover Transplants

Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars from their employer. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

Individual and group health insurance premiums and deductibles typically vary on a yearly basis, but the QSEHRA has annual contribution limits that the IRS sets annually. This means that employers are limited in how much tax-free money they can offer their employees through the benefit.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Don’t Miss: How To Extend Health Insurance

Think About Heath Insurance Costs Before You Quit

If you plan to leave the safety net of an employer, your goal should be to make AT LEAST 5X your annual health insurance premiums first. 5X comes from taking the inverse of 20 percent, which is the top percentage in my healthcare affordability ratio recommendation.

I always recommend people start a side-hustle while working to minimize financial disaster and maximize the probability of eventually breaking free.

Now Ive provided you with a concrete annual side income figure you can shoot for before retiring early or becoming a full-time entrepreneur.

How Do I Find Out If I Am Eligible For Dutch Health Insurance

Do you have any doubts about your insurance status and want to make sure if your need Dutch health insurance?

- Contact Zorgverzekeringslijn

Expats can also do an assessment with the Sociale Verzekeringsbank to find out whether you are insured under the Dutch Wlz scheme and must take Dutch health insurance.

Don’t Miss: How To Switch Your Health Insurance

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on November 24, 2020

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

What Is A Deductible

A deductible is the amount you must pay toward your health insurance costs before your health plan begins to pay for your covered services. For example, if you have a $1,500 deductible, your plan won’t pay for some services until you’ve paid $1,500. Your premium and deductible costs are connected. Typically, the higher your deductible, the lower your premium. The lower your deductible, the higher your premium.

Read Also: Is Colonial Health Insurance Good

How Much Does Average Health Insurance Cost In The Usa

Health insurance means different things to people across the world the USAs system is known for several distinguishing features, including a high relative cost to the individual and a lack of universal coverage.

You may be wondering why the cost of healthcare insurance seems to be rising and how the picture compares to other nations. In a country that spends nearly $4 trillion on healthcare yet finds coverage varies widely, theres a lot to weigh up.

Across the United States, Americans pay wildly different premiums monthly for health insurance. The average annual cost of health insurance in the USA is $7,470 for an individual and $21,342 for a family as of July 2020, according to the Kaiser Family Foundation a bill employers typically fund roughly three quarters of.The cost to each person can vary a lot, however, based on factors such as age, geography, employer size and the type of plan theyre enrolled in. While these premiums are not determined by gender or pre-existing health conditions, thanks to the Affordable Care Act, a number of other factors impact what you pay.

Of course, not all companies offer health benefits to employees 44% of firms did not offer insurance to staff in 2020.

Insurance costs are rising in 2021.

Find out what’s driving up prices

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

Also Check: How Much Is Health Insurance For Seniors

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In the past, insurers would price your health insurance based on any number of factors, but after the Affordable Care Act, the number of variables that impact your health insurance costs decreased significantly.

In 2021, the average cost of individual health insurance for a 40-year-old across all metal tiers of coverage is $495. This represents a decrease of close to 2% from the 2020 plan year.

How To Choose Your Premium And Deductible

If you know you’ll be using your insurance often, you may want to choose a plan with a higher premium and lower deductible. This means you’ll pay more each month, but you’ll meet your deductible faster and your plan will begin to pay for your covered services sooner. Overall, you’ll spend less when you go to the doctor over the course of the year.

The opposite of this is true too. You may want to choose a plan with a lower monthly premium and higher deductible if you know you won’t use your insurance often. This way your monthly health insurance costs are lower because you take the chance that you may not need to pay your deductible.

Don’t Miss: What Is Employer Group Health Insurance