How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on November 24, 2020

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

How Can You Cover Your Medical Costs In The Usa

So what can a frugal traveler or expat do? How do you reduce the cost of receiving proper health care without sacrificing quality or convenience?

Firstly, reassure yourself that common over-the-counter medications and first aid supplies are widely available and very affordable in the United States. Headache medication, mild heartburn medication, muscle cream, sinus decongestant pills, and skin ointments are all available for under $25 sometimes they’re as cheap as $5.

A chat with a pharmacist is always free and they can provide sound recommendations for treating non-urgent, minor conditions. A bad cold is no more costly in the United States than it is in most other countries.

Secondly, make sure that you have health insurance in the USA. As you’ve seen up above, if you are traveling and fall ill, a relatively uncomplicated problem like an inflamed appendix can cost several times more than the trip itself. For non-residents, there is health insurance in the USA for foreigners that can greatly reduce costs of medical services, especially when you need them.

You do not need to face a life-threatening problem and then get slammed with sanity-threatening costs after. There is a wide variety of insurance products and packages designed for travelers. They range from the extremely comprehensive and inclusive to the more streamlined option, with a focus on coverage for the most serious and expensive of emergencies.

How Much Does The United States Spend On Healthcare

The United States has one of the highest costs of healthcare in the world. In 2018, the United States spent about $3.6 trillion on healthcare, which averages to about $11,000 per person. Relative to the size of the economy, healthcare costs have increased over the past few decades, from 5 percent of gross domestic product in 1960 to 18 percent in 2018. The Centers for Medicare and Medicaid Services project that by 2028, such costs will climb to $6.2 trillion, or about $18,000 per person, and will represent about 20 percent of GDP. However, those projections do not take into account the impacts of the COVID-19 pandemic while the extent of the effect is still uncertain, testing and treatment costs are expected to be high and can potentially drive the cost of healthcare up.

You May Like: What Jobs Give Health Insurance

Tips For Finding Healthcare Coverage

With the rising costs of healthcare, how can Americans save on healthcare and the cost of insurance? Be diligent, and do your research to compare plans. That way, you can get the most comprehensive health coverage you can afford.

If your employer offers health insurance and pays for a large portion of the premium, it is a great option to think about. If not, shop the health insurance exchange for affordable coverage. Check to see if you qualify for any subsidies to help offset the cost of health insurance. Health savings accounts can also help you pay for out-of-pocket expenses such as co-pays and deductibles.

Finally, if you have a catastrophic accident or illness, ask the hospital for help with a payment plan. Many hospitals will reduce their charges for those who are unable to obtain insurance.

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Recommended Reading: How Much Is Health Insurance Usually

The Kaiser Family Foundation

Premiums Paid Directly: $104.2 billion

8.3 percent market share

Kaiser Foundation Health Plan, Inc. is a 501 not-for-profit health plan. The organization provides allergy, audiology, cardiology, dermatology, oncology, hospice, laboratory, nephrology, occupational therapy, pain management, pediatric rehabilitation, and pharmacy treatments. The firm serves patients in the United States of America.

Individual Health Insurance Premiums On The Exchanges

The federal exchange at healthcare.gov is alive and well in 2021, despite years of efforts to kill it by its political foes. It offers plans from about 175 companies. Many states operate their own exchanges, which basically mirror the federal site but focus on plans available to their residents. You can use either.

Each of the available plans is offered in four levels of coverage, each with its own price. In order of price, they are labeled platinum, gold, silver, and bronze. The benchmark plan is the second-lowest-cost silver plan available through the health insurance exchange in a given area, and it can vary even within the state where you live. It’s called the benchmark plan because it’s the plan the government usesalong with your incometo determine your premium subsidy, if any.

The good news is, prices are going down a bit. According to a government report, “the average premium for the second-lowest-cost silver plan is decreasing by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states experienced double-digit percentage declines in average second-lowest-cost silver plan premiums for 27-year-olds, including Delaware , Nebraska , North Dakota , Montana , Oklahoma , and Utah .”

Read Also: What’s The Penalty For Not Having Health Insurance In California

Can You Get A Health Plan For Free

Many people pay nothing if they qualify for the Affordable Care Acts premium tax credit subsidy. This tax credit is taken in advance to lower the amount of each monthly health premium you must pay, although it goes straight to the insurer.

You must apply for the subsidy and purchase a plan through your states health insurance exchange, also known as the Health Insurance Marketplace.

The amount you receive will depend on the household income that you disclose when you apply. You must make between 100% and 400% of the federal poverty level to qualify.

The American Rescue Plan allows more households, including those with incomes over 400% of the poverty level, to qualify for subsidized health plans through the Marketplace in 2021 and 2022. You may be eligible for tax credits in these years that lower the cost of your health plan, even if your income was too high in prior years.

You must file a tax return at the end of the year to reconcile your income with the tax credit you received. You may have to pay back some of the tax credit that lowered your costs if you ended up with more income than you thought you would have at the time you first applied.

You won’t have to pay back any excess tax credit you received in 2020 because the IRS has waived this rule for just this one tax year.

The Marketplace will send the credit directly to your insurer to be applied to your monthly plan premium. You may not have to pay out of pocket at all for health care costs in some cases.

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for “cost-sharing reductions” : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

Also Check: Can You Put Boyfriend On Health Insurance

The 10 States With The Lowest Health Insurance Costs

In the study of states’ health insurance plans, some plans stood out as offering higher value while charging lower premiums — the lowest is less than half of the cost of the most expensive health plan identified in this study. Lower premiums enable plan participants to save money in their monthly budgets, and lower deductibles and copays mean residents of these 10 states are also more likely to pay less when they need to use their insurance. Click through to see the 10 states where health insurance providers give customers better deals.

Read: When to Use Your Emergency Fund

What Is Health Insurance

Health care insurance is a form of insurance that pays for medical expenditures incurred due to a medical condition. These charges might be connected to hospitalization costs, the cost of medications, or the cost of physician consultations. These are the top 10 health care insurance companies in the USA.

There are several private healthcare insurance experts in the United States. However, according to the Insurance Information Institute, life/annuity and property/casualty insurers also issue similar coverage, often referred to as accident and healthcare insurance.

According to the National Association of Insurance Commission, the top 10 insurers combined wrote 55.3 percent of the overall US market .

According to NAIC statistics for 2020, the following are the top ten accident and health insurance groups.

You May Like: How To Check If You Still Have Health Insurance

How Premium Costs Have Changed In Recent Years

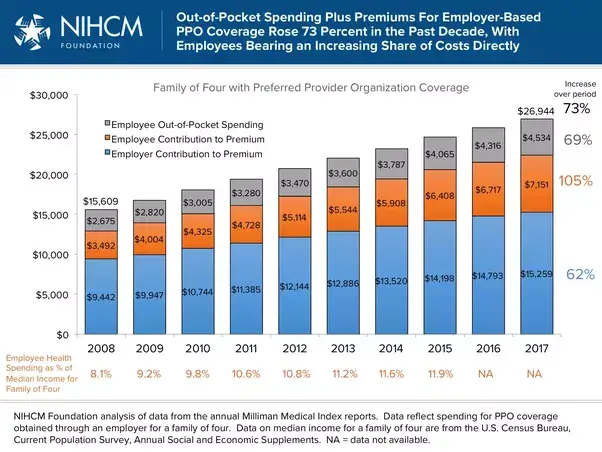

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by 22% since 2015 it’s increased by 55% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, compared to $3.8 trillion in 2019.

What The Average American Spends A Year

According to the most recent data available from the Centers for Medicare and Medicaid Services , “the average American spent $9,596 on healthcare” in 2012, which was “up significantly from $7,700 in 2007.”

It was also more than twice the per capita average of other developed nations, but still, in 2015, experts predicted continued sharp increases: “Health care spending per person is expected to surpass $10,000 in 2016 and then march steadily higher to $14,944 in 2023.”

Indeed, average annual costs per person hit $10,345 in 2016. In 1960, the average cost per person was only $146 and, adjusting for inflation, that means costs are nine times higher now than they were then.

Don’t Miss: Does Amazon Have Health Insurance

How Much Does It Cost For Health Insurance In Canada

Despite the rumors, health insurance in Canada isn’t really free. The actual cost of health care in Canada is thousands of dollars and can reach tens of thousands of dollars.

Universal health coverage covers everyone who is a citizen or deemed a permanent resident. It doesn’t cover everything they need.

In fact, it isn’t even really universal. There is no one plan. There are actually 15 different provincial and territory plans that makeup “health insurance, Canada.”

Why Is Health Insurance So Expensive

The driving factor for why health insurance is so expensive is that health care is so expensive, says Louise Norris, a licensed health insurance agent based in Colorado and author of The Insiders Guide to Obamacares Open Enrollment. The price of health care in this country is really high.

According to a 2020 report from the Kaiser Family Foundation, insurers said the reasons they had to increase premium costs included the continued cost of COVID-19 testing, the rebounding of medical services that had been delayed during the pandemic and morbidities related to foregone care.

Read Also: How To Get Your Parents On Your Health Insurance

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

In 2020, health insurance premiums for unsubsidized individual customers were $456 per month on average, while family premiums averaged $1,152 per month. The average individual deductible was $4,364 the family deductible averaged $8,439.

Over the course of a year, the average health spending for a family of four in the U.S. was $25,011 in 2020. This figure includes spending on monthly premiums. It also includes meeting the deductible.

Best For Health Savings Plan Option: Kaiser Permanente

Kaiser Foundation Health Plans

-

Kaiser offers its own HSA

-

ACA-compliant plans available for individuals and families

-

Several top ratings in J.D. Power’s 2021 U.S. Commercial Health Plan Study

-

Coverage only available in eight states and Washington D.C.

Kaiser began offering health insurance plans to the public starting in 1945 and has grown to become one of the largest not-for-profit health insurance providers in the nation. Kaiser serves more than 12.5 million members in eight states plus Washington D.C. We chose this provider due to the fact they offer their own Health Savings Account option, which lets you save money for health expenses if you have an eligible plan.

When you pair a high deductible health plan from Kaiser Permanente with a Health Savings Account , you get a convenient debit card that lets you cover eligible expenses with your HSA funds directly and without any added paperwork. Your HSA plan also comes with no hidden fees, and you can get the $3.25 monthly plan fee waived if you maintain an HSA balance of $2,000 or more.

Also be aware that Kaiser may offer ACA-compliant plans in your area, so it’s possible you could apply subsidies you receive to make your premiums more affordable.

You May Like: Can You Add Spouse To Health Insurance

Here’s How That Breaks Down

According to eHealthInsurance, for unsubsidized customers in 2016, “premiums for individual coverage averaged $321 per month while premiums for family plans averaged $833 per month. The average annual deductible for individual plans was $4,358 and the average deductible for family plans was $7,983.”

That means that, last year, the average family paid $9,996 for coverage alone, and, if they met their deductible, a total of just under $18,000.Meanwhile, an average individual spent $3,852 on coverage and, if she spent another $4,358 to meet her deductible, a total of $8,210.

These figures do not take into account any additional co-insurance responsibility she might have. In addition to co-pays and deductibles, an increasing number of plans now require co-insurance payments, which require that, even once you meet your deductible, you continue paying some percentage of all costs until you hit your out-of-pocket maximum.

Can I Combine Health Plans

You can try mixing indemnity insurance, designed to pay a set daily benefit if youre hospitalized or in an accident, with a short-term medical plan that can let you get to the doctor a few times a year for more minor ailments.

In her former role as senior vice president of advisor services at Manning & Napier, Shelby George noticed people trying to rig these set-ups on their own, sometimes with poor results. They had to file every claim with all insurers so that every dollar could be recouped. That was complex, so the company rolled out combo plans with single insurers to make the claims process smoother.

Still, eHealth’s Nate Purpura notes that you have to take heed of two things when choosing health plans. Is the plan underwritten based on your health, or is it guaranteed issue so it must enroll you regardless of your age, health status, or other factors? What does the plan cover if you have to be hospitalized?

Always make sure you know what youre getting for what youre paying before choosing a health plan.

Also Check: How To Get Health Insurance Without Social Security Number

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as