Aarp Medicare Supplement Plans: Are They Right For You

AARP endorses Medicare Supplement insurance plans through UnitedHealthcare. AARP is not an insurer UnitedHealthcare pays AARP royalty fees for the use of its name. In terms of name recognition with seniors, AARP Medicare Supplement plans are noteworthy. But do those plans really stand up against other plans without the flashy endorsement? Keep these pros and cons in mind.

How Much Does Supplemental Health Insurance Cost

Since health insurance rarely covers all health-related expenses, insurers offer a variety of supplemental insurance policies. These insurance plans typically provide benefits for specific health needs and are much less expensive than a regular health insurance policy. However, they are not a substitute for having health insurance.

Common types of supplemental insurance and typical premium costs include:

What Are Common Types Of Supplemental Health Insurance

Here is a look at some of the most common types of supplemental health insurance.

Critical Illness Insurance

Typically, critical illness insurance pays out a fixed amount of money if the insured experiences a major health problem, such as a stroke, heart attack, organ failure or cancer. While premiums can be relatively inexpensive, these policies are often very specific as to the health conditions that are eligible for a payout.11

Also known as catastrophic illness insurance, this insurance usually pays out as a lump sum that can range from $1,000 to $100,000, depending on the policy. You can then use the money to cover costs related to the illness, including medical costs not covered in your regular policy as well as things like childcare, travel, groceries, and mortgage payments or rent.

Accident Insurance

Accident insurance, also known as supplemental accident insurance or personal accident insurance, pays benefits if you experience an accident or injury. Policies will usually exempt injuries sustained due to negligence, acts of God and natural disasters, or during activities deemed risky.12

You can purchase accident policies bundled with other insurance policies or separately. Travel companies also offer specific, short-term accident policies, such as an accident policy when you rent a car.

Accidental Death and Supplemental Accident Plans

Hospital Indemnity Insurance

Adult Dental and Vision Coverage

Childrens Dental and Vision Coverage

Recommended Reading: How Much Does Private Health Insurance Cost In California

How Much Does Private Health Insurance Cost

This is an individual health insurance plan that a person buys on their own and is the only person covered under the plan.

While many people get group health insurance coverage through their employer, this isnât an option for everybody. If youâre self-employed, a contractor, work part-time, or you work for a small business that doesnât offer health insurance, you may need to get your own coverage. This is especially true if youâre 26 years of age or older. This is the age you are not legally able to be covered by your parentsâ health insurance plan.

One of the goals of the Affordable Care Act was to make health insurance more affordable for people who couldnât get employer-sponsored coverage. Under the law, people who buy private health insurance through HealthCare.gov receive federal subsidies. The subsidy amount you receive is based largely on your income. Where you live also determines your premium cost under the ACA.

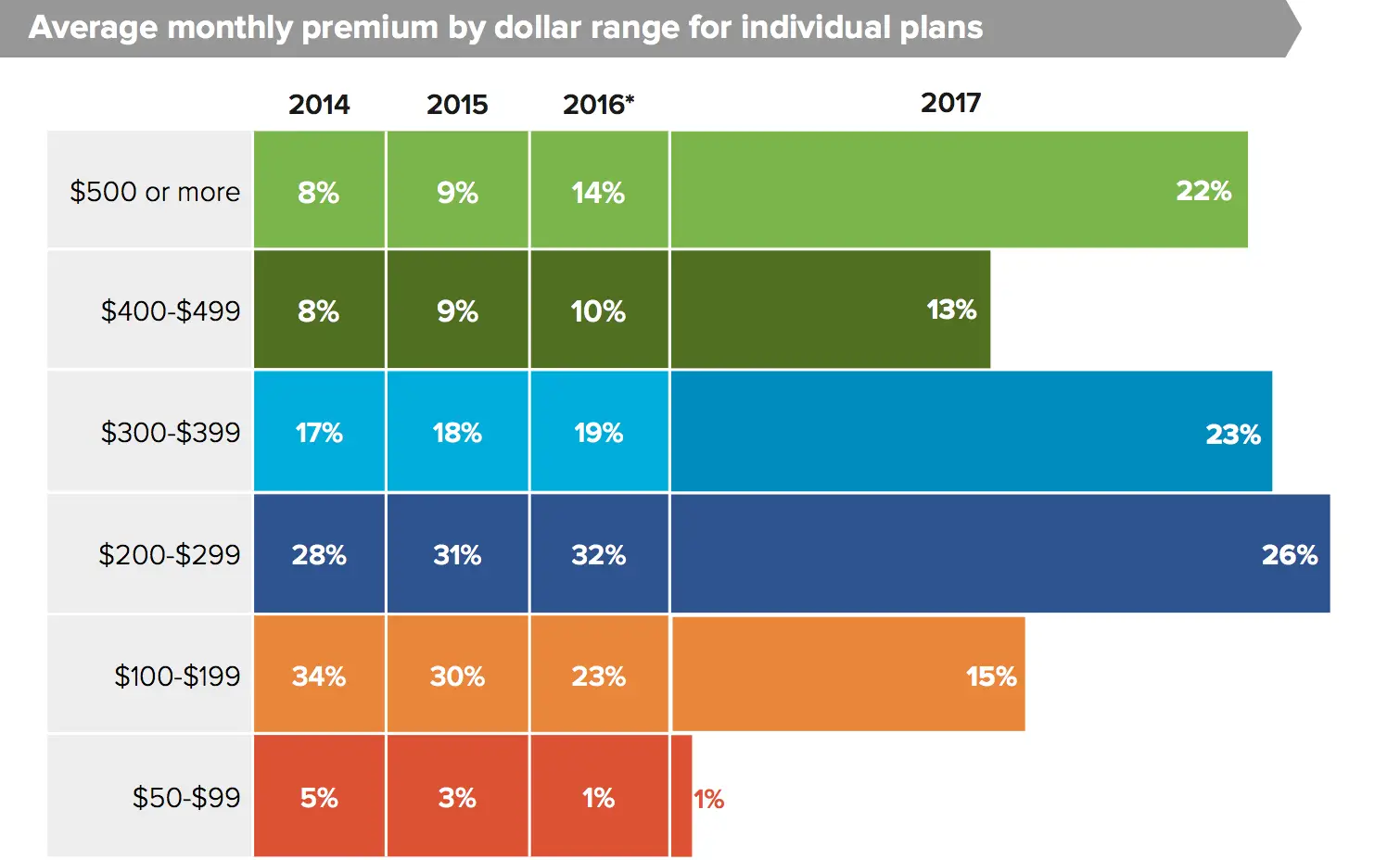

According to one study of ACA premiums nationwide, the average monthly premium for an individual policy was $456 in 2020, a 2 percent increase over 2019. That comes out to $5,472 for the year.

The data also showed that women spent $473 a month on average for health insurance through the ACA in 2020. Men paid $438 on average. The ACA prohibits charging more for health insurance based on gender. The difference in average costs is due to more women than men selecting higher-tiered plans that cost more.

Finding The Right Supplemental Health Insurance Plan

It can be difficult to find the right supplemental health coverage even when you know what your budget and needs are. Common sense will go a long way in helping you find the best policy. Our online services will provide you with free, instant quotes for supplemental health insurance plans from the top insurance companies in California.

Just take a few seconds to complete our confidential form. No contact information is needed, and you are under no obligation to buy.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

You May Like: Who Pays First Auto Insurance Or Health Insurance

Medigap: Medicare Supplemental Insurance

One of the most common types of supplemental insurance is Medigap, which is sold by private insurance companies to people enrolled in Original Medicare. .

Original Medicare, which includes Part A hospital insurance and Part B medical insurance, covers many, but not all, health-related services and medical supplies. Things not covered by Original Medicare include:

- Dental care

- Basic vision care

However, even for the medical services that Original Medicare does cover, you still have some cost-sharing expenses:

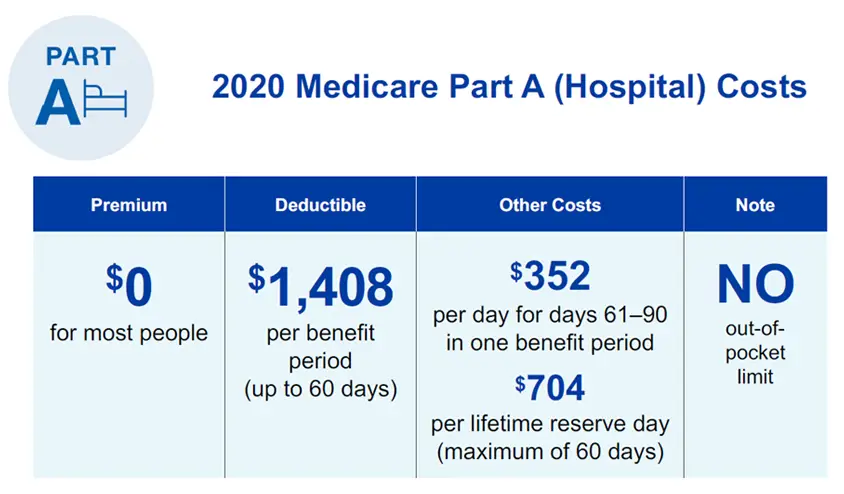

- A deductible for inpatient care

- Daily coinsurance, if you’re in the hospital for more than 60 days

- A deductible plus coinsurance for outpatient and physician care

You can purchase a Medigap policy to cover some or all of those deductible and coinsurance costs that you’d otherwise have to pay yourself under Original Medicare.

These can add up to a lot, especially if you need extensive outpatient services and have to pay Medicare Part B’s unlimited 20% coinsurance for all of it.

If you have Original Medicare but lack Medigap coverage, there’s no limit to how high your out-of-pocket costs can be. By contrast, Medicare Advantage plans cap out-of-pocket expenses without the need for supplemental insurance, but tend to have higher out-of-pocket costs than you’d have with Original Medicare plus a Medigap plan. Medicare Advantage plans also tend to have more limited provider networks.

If you’re enrolled in Original Medicare and have a Medigap policy:

Whats The Average Cost Of Medicare Plan F

Plan F offers the fullest coverage of all the Medigap plans, making it the most popular.

| Plan F Average Monthly Cost in Palm Harbor, FL * |

| Gender: Female, Age: 65 |

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Don’t Miss: Will My Health Insurance Pay For An Auto Accident

Deductibles Coinsurance And Out

Three critical health care insurance impactors – deductibles, coinsurance and out-of-pocket costs – also factor into the need to purchase supplemental health insurance. Each of the three impactors is so important it deserves an explanation on why gap insurance is sorely needed for today’s health care consumer.

Compare Health Insurance Plans For Retirees

If youre looking for health insurance coverage as a retiree, its good to take advantage of any government programs you qualify for and shop around to ensure that you have the coverage you need. For example, even if you qualify for Medicare, you may need to purchase supplemental plans for services that are not covered, like dental work.

When evaluating different plans, there are a few different factors that you should consider. You should make sure that the insurance company has in-network providers in your area, and that they offer a plan that meets your specific health needs. You should also compare policy premiums and deductibles, waiting periods, and customer satisfaction.

Also Check: How To Get Health Insurance As A Real Estate Agent

Limited Perks And Resources

USAA membership comes with a lot of benefits but not necessarily resources. This might be partially due to the fact that health insurance is only one of many types of insurance offered by the company, not the focus.

Resources that members have include, as would be expected, many phone numbers, addresses, and email addresses for contacting the company.

There are several different sectors to contact in health insurance here, including claims representatives and services personnel. These are the primary ways to contact USAA if members have questions.

Aside from these, though, there is a member community where members can post questions and comments and connect with other members. The articles on this site range in topics from finances to health care to all the various insurance industries that USAA caters to.

There’s also a section for current healthcare news and plenty of resources for member advice. In fact, that’s one of the main provisions through the company’s website-advice.

Whether members want help shopping for a health plan or if they need financial advice, there are tons of resources for this. Members cannot contact USAA 24/7, but they do maintain certain business hours.

Minnesota And Wisconsin Residents

| Plans available only if first eligible for Medicare before 20204 | |

|---|---|

| Benefits | |

|

Medicare Part A Coinsurance and Coverage for Hospital Benefits |

check |

|

Skilled Nursing Facility Care Coinsurance |

check |

|

Hospice Care Coinsurance or Copayment |

check |

|

Medicare Part B Coinsurance or Copayment |

check |

|

Medicare Part B Excess Charges |

check |

|

Foreign Travel Emergency |

check |

|

Additional Programs and Savings offered by Cigna6 |

check |

Also Check: How To Get Medication Without Health Insurance

How Secondary Health Insurance Works

Secondary health insurance functions by paying you directly. Your primary insurance provider pays your healthcare insurer directly for medical expenses. But with secondary health insurance coverage, cash benefits get paid directly to you if you experience a qualifying event. These benefits can be used for many expenses.

Which Blue Cross Blue Shield Medigap Plan Is Right For Me

Now that you’ve learned a bit about each type of plan, let’s figure out which one is right for you. Our outline below will help you better understand which plan might work best for you or your spouse.

Seniors with limited funds who don’t go to the doctors as often

Do you rarely visit the doctor? Are you active and healthy? Then you may not need as much supplemental coverage as others. Plan N could be a good option for you, given its low premium. Just know that you’ll owe a $20 copay for each office visit and a $50 copay for ER visits.

FYI: If you’re still not sure which plan or provider is right for you, head to our Medigap guide. We cover tips for choosing the right plan, how to enroll, and more.

Seniors with a chronic illness, frequent appointments, or needed surgeries

If you know that you’ll be regularly attending doctor’s appointments, scheduling surgeries, or visiting specialists, a Plan G high-deductible option may be a good fit. In 2021, Plan G has a $2,370 deductible. In other words, after you pay $2,370 in out-of-pocket costs, the plan kicks in to help pay your out-of-pocket Medicare costs.

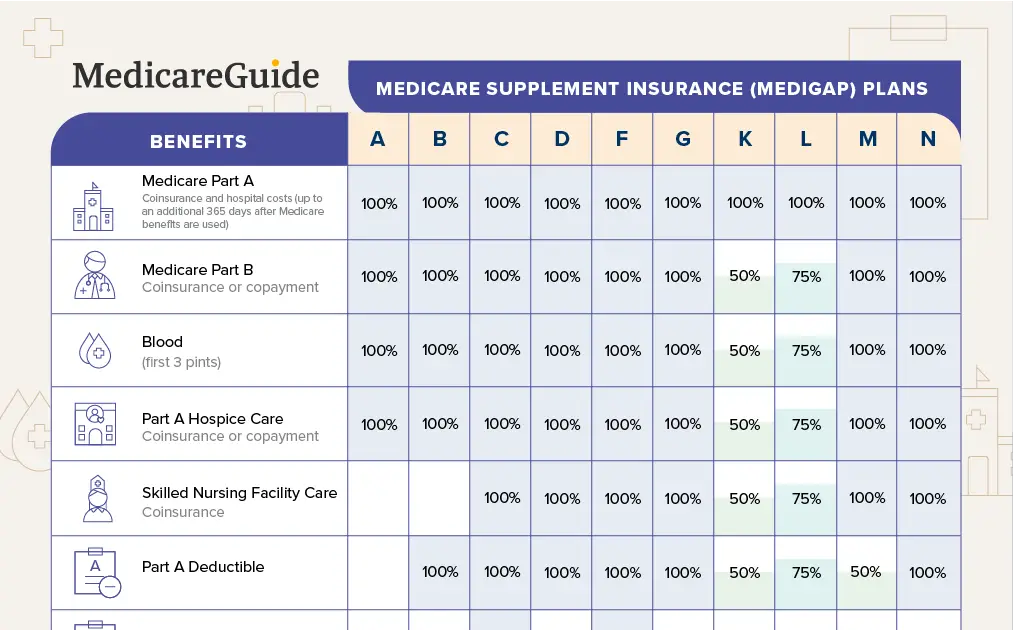

Pro Tip: Plans A through G have higher premiums with limited out-of-pocket costs. Plans K through N give you similar benefits at lower premiums, but you’ll have higher out-of-pocket costs.

Seniors who love to travel

Seniors who want basic coverage and lower premiums

Read Also: How To Find Good Health Insurance

What Is The Best Supplemental Medicare Plan

Theres no single supplemental health insurance plan for seniors that fits everyone. But there is most likely a plan that will fit your specific needs. HealthMarkets can make finding a plan easy. Get a free quote for supplemental health insurance for seniors. Or, if youre looking for the cost of Medicare Supplement plans, answer a few quick questions about your preferences. Then, HealthMarkets FitScore® technology will help you compare Medicare supplement plans and find one thats the right fit for your needs. Get started today!

46568-HM-1020

What Is The Best Medicare Supplement

As mentioned above, your best Medicare supplement will be the plan that balances costs and coverage. Unfortunately, the most comprehensive plans, C and F, will not be available for new enrollees. In lieu of these new regulations, it is critical to reassess and evaluate all available Medigap policies.

It is important to note that policies that offer more comprehensive coverage for deductibles and care will have significantly higher monthly premiums. Below you can find an analysis of the level of coverage and monthly premium ranges for all of the Medicare supplement plans.

| Plan A |

|---|

You May Like: When Does A Business Have To Offer Health Insurance

Best Alternative To Plan G Medicare Supplement: Plan N

Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Policyholders of Plan N will miss out on the Medicare Part B deductible and excess charges, which can add up quickly, since Part B covers many routine medical expenses like outpatient care and preventive services. For this reason, you should try to forecast your costs and compare them to the annual premium for Medigap Plan N, which is between $1,752 and $3,468.

Undisclosed Provider Network Details

One thing the company could do better would be to provide more tools to find doctors and health care facilities. USAA provides basic information about its health plans online, but to find more details about them, customers just have to work with the insurer underwriting their policy. However, it’s important to be aware that health insurance plans are not USAA’s only product. Most health insurance companies only offer health insurance.

Potential clients can view price quotes on insurance premiums online. The cost of plans will vary depending on your age and type of plan selected. The annual deductible also varies plan to plan.

To receive more information regarding USAA’s Medicare policy offerings, you must already be a member and sign into your account.

While it would be nice fore there to be more easily accessible general information about USAA’s Medicare offerings and health care providers, this information USAA does a good job giving customers plan information and the ability to compare plans.

Also Check: What Is A Good Cheap Health Insurance

How To Enroll In An Aarp Medicare Supplement Plan

Before you qualify for an AARP Medicare Supplement plan, you must become an AARP member. Luckily, thats simple and inexpensive to do a membership costs about $16 per year.

Next, pay careful attention to your enrollment period. The best time to join a Medicare Supplement plan AARP or otherwise is during your Initial Enrollment Period . During this time, you are guaranteed to be accepted into a Medicare Supplement plan, regardless of any health problems. Your Initial Enrollment Period begins three months before your 65th birthday month, includes your birthday month, and ends three full months after your birthday month.

Best Overall Medicare Supplement For New Enrollees: Plan G

Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible â $203 a year for 2021 â before insurance benefits will begin to pay out.

However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473. Therefore, you should weigh the cost of this monthly premium with your potential medical expenses for the year.

You May Like: How Much Is Health Insurance Usually

People Forget About Health Care Costs

Many retirees and people getting ready to transition out of the workforce forget to budget for healthcare when they estimate their expenses in retirement. Why? Their employer is often picking up the majority of the tab and the remaining cost comes out of their paycheck. They think they need the same amount of take-home pay that they currently have, but they forget that they will now be responsible for paying their health care premiums in addition to the out-of-pocket costs.

How Much Does The Average Medicare Supplement Plan Cost In 2020

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Based on our analysis, we noted several key takeaways:

-

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

-

Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

| Average Monthly Cost of Plan F | Age in Years |

|---|---|

| $235.87 |

Recommended Reading: Is Ivf Covered By Health Insurance

Find A Medicare Supplement Plan For You

A Medicare Supplement Insurance plan, also called a Medigap plan, is a separate policy that supplements your coverage from Original Medicare Part A and Part B. Medicare Supplement insurance helps protect you against high out-of-pocket costs by helping pay for eligible health care expenses that Medicare does not pay for.

Before you compare plans, you might find it helpful to review the basics of Medicare Supplement Insurance and eligibility and enrollment information.

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Don’t Miss: Can You Add Your Mom To Your Health Insurance