Save With Blue Advantage

Blue Cross members can save on medical care, vision care and many other products and services offered by participating providers across Canada.

No receipts to submit save right away when you purchase at a pharmacy or other health provider.

Simply present your Blue Cross identification card to the participating provider and mention the program.

Affordable Care Act Answers

The Affordable Care Act has significantly changed the U.S. health care system, bringing guaranteed issue of coverage, tax credits, and the Health Insurance Marketplace. Here’s what Kansans like you need to know right now:

Quality coverage for all

The ACA provides greater access to health insurance by making it possible for anyone, regardless of their current or previous health condition, to purchase health insurance. It also mandates that all plans offered on the Marketplace include the same essential health benefits and preventive services.

Essential health benefits

No matter what plan you purchase, you are guaranteed to have essential health benefits including coverage for: ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance abuse disorders, prescription drugs, rehabilitative and habilitative services, laboratory services, preventive and wellness services, chronic disease management, and pediatric services, including oral and vision care.

Preventive services

Plans sold on the Marketplace also include preventive services you can receive with no cost-sharing involved. So things like breast and colon cancer screenings, screening for diabetes, blood pressure and high cholesterol, and routine vaccinations will all be provided without you having to pay a copay, deductible or coinsurance as long as the primary purpose of the visit was for the recommended preventive service.

You may get financial assistance

How Does Pet Insurance Work

If your pet has an accident or becomes unwell, you can make a claim with your pet insurance provider. If your claim is successful, your insurance company will either:

- ask you to cover the cost upfront and they will reimburse you

- pay the money directly to your vet

This can vary depending on the insurance provider and vet clinic.

Also Check: How To Pass The Life And Health Insurance Exam

Are You And All Applicants Residents Of Bc Or The Yukon Actively Enrolled Under The Government Health Plan

Our Individual Insurance Plans are provided ONLY to residents of BC or the Yukon who are actively enrolled in the Government Health Care plan.

-

Are you a resident of another province?Please contact Blue Cross Canada at www.bluecross.ca to find your provinces’ blue cross.

-

Are you a visitor to Canada and arrived within the last 30 days?You may find more information about our “Visitors to Canada Travel Plan”.

Please feel free to contact us if you have any further questions at or e-mail us.

Vision Care

Pacific Blue Cross covers the cost of prescription lenses, frames, contact lenses and laser eye surgery up to a predetermined maximum.

Registered Therapists

Benefits are paid for visits to: naturopaths, massage therapists, physiotherapists,chiropractors, speech pathologists, chiropodists/podiatrists, psychologists, audiologists,acupuncturists, and nutritionists. This is an increasing benefit coverage up toa predetermined maximum.

Benefits cover costs for semi-private or private hospital rooms .

Hospital Daily Cash Benefit

If you are confined to a hospital, we will pay you $20 a day, for up to 90 days,from the 4th day of hospitalization, up to age 65.

Local Ambulance Private

Benefits cover the cost of ambulance fees in emergencies, including air ambulanceand Treat No Transport.

Includes payment for Treat-No-Transport, charges for treatment when an ambulanceis called to the scene of an accident or place of illness and transportation tohospital is not required.

Learn More About Medicare Part C In South Carolina

Medicare Part C is also known as Medicare Advantage or MA plans, which bundles Original Medicare Part A and Part B into one health insurance plan. Original Medicare is a health insurance program administered by the federal government, but Medicare Advantage plans are offered by health insurance companies approved by the federal government.

Most Medicare Advantage plans also bundle Part D – prescription drug coverage.

Medicare Advantage can also include extra services not included in Part A and Part B, such as vision, hearing, dental, and wellness programs.

Also Check: How Long Can My Dependent Stay On My Health Insurance

What Is A Qualifying Life Event

A qualifying life event is a change in your life that allows you to enroll or change your health insurance plan during a special enrollment period . The length of your SEP varies. Some examples of qualifying life events:

- Losing health insurance

- Changes in the size of your household

- Changing your residence

Learn More About Medicare Supplement Insurance Plans In South Carolina

Medicare Supplement Insurance Plans cover costs not included in Original Medicare Part A and Part B, including deductibles, copays, and coinsurance. Medicare Supplement Insurance Plans are also known as Medigap, because they cover the gaps in Part A and B. Although Original Medicare is administered by the federal government, Medigap plans are offered by health insurance companies approved by the federal government.

Get Advice & Sign Up Help

Speak with a Licensed Insurance Agent

No obligation to enroll. Find your plan online or speak with a licensed insurance agent to get help signing up for the right plan for you! Plan availability depends on your location. Licensed agents may not be able to provide assistance for all plans shown on this site.

Healthplanradar.com is for research purposes only. Information and figures shown on Healthplanradar.com are based on publicly available information from healthcare.gov and medicare.gov. By using Healthplanradar.com you agree to our Terms of Service and Privacy Policy.

Healthplanradar.com is owned and operated by a private company, Amabo LLC, and is not affiliated with the federal government health insurance marketplace healthcare.gov or state-based marketplaces. Healthplanradar.com is not connected with or endorsed by the United States federal government or the federal Medicare program. For official federal government information, please visit Healthcare.gov or Medicare.gov .

You May Like: How Much Does Health Insurance Cost In Mexico

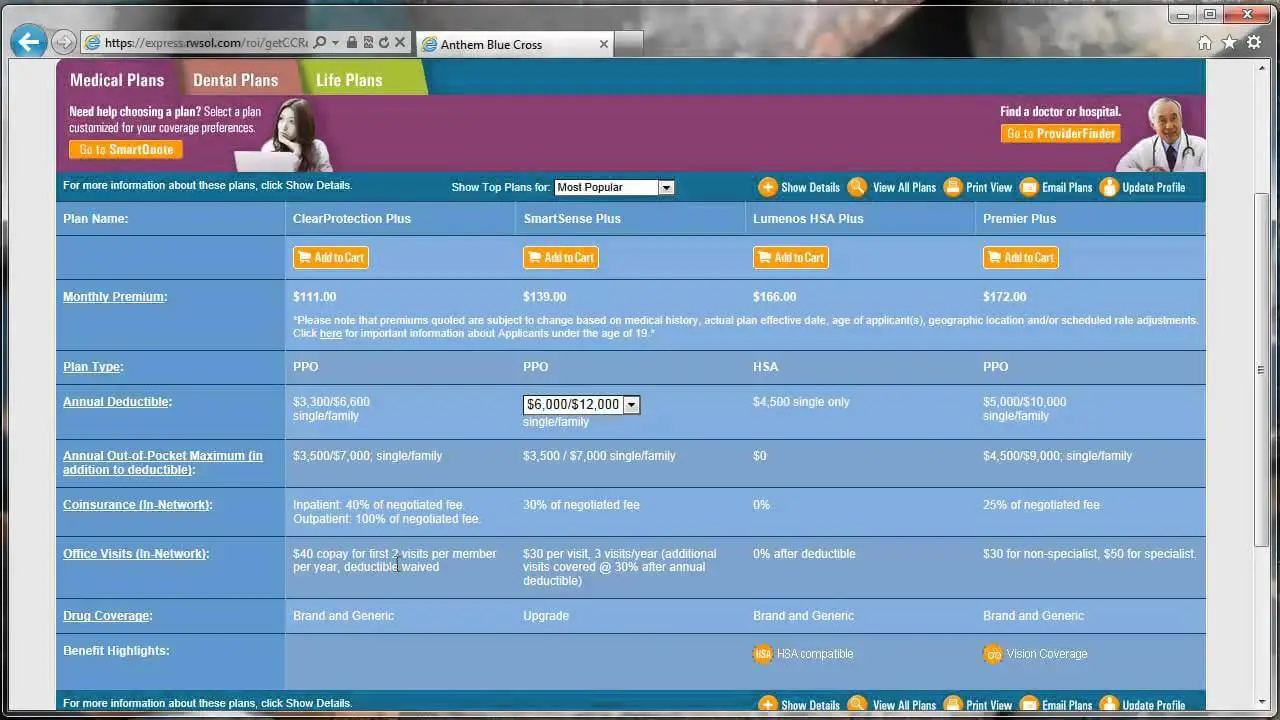

How Do Health Insurance Payments Work

You choose a health insurance plan based on the cost of the plan and the services and benefits it covers. For most health plans, you pay a fixed amount each month, known as a premium. In addition to your premium, you may also pay each time you receive care medical care or have a prescription filled. These payments are often called cost-sharing, or out-of-pocket costs, and come in the following types:

Review This Checklist Of What You May Need To Make Changes To Your Policy With A Qualifying Life Event:

- Social Security number

- Spouses Social Security number

- Birthdates for you and your dependents

- Tobacco status

This website is owned and operated by USAble Mutual Insurance Company, d/b/a Arkansas Blue Cross and Blue Shield. Arkansas Blue Cross and Blue Shield is an Independent Licensee of the Blue Cross and Blue Shield Association and is licensed to offer health plans in all 75 counties of Arkansas.

Linking disclaimer

IE support ending soon

Read Also: How To Buy Travel Health Insurance

How To Register For Maple Watch This Video

- Visit getmaple.ca/medavie to sign up.

- Enter your information including your name, policy number, and identification numbers as shown on your Medavie Blue Cross card.

- If you already have a Maple account you can link t to your group coverage. Just look for instructions during the registration process.

- If you have an iPhone / iPad, or Android device, you can download the free Maple mobile app on your devices app store.

If you have any issues, you can speak to a Maple representative directly on the site simply click on the chat icon in the bottom corner!

Learn More About Medicare Part D

Medicare Part D is prescription drug coverage, which can be combined with other Medicare health insurance. Part D plans are offered by health insurance companies which are approved by the federal government.

It is optional to add a Part D plan to Original Medicare Part A and B, Medicare Supplement Insurance plans, or Part C – Medicare Advantage plans .

You May Like: Does Health Insurance Cover Hair Transplant

Can I Get Travel Medical Insurance With Blue Cross

You will have to check your specific plan to know if travel insurance is included. Travel insurance is particularly important in Canada because provincial health insurance plans cover less once you are out of your home province. This can mean unpleasant surprises when you see your bill. Travel abroad and you may not have any access to health care services at all without a plan or paying up-front.

Travelling without proper health coverage can be an expensive mistake. Read HelloSafe’s complete guide to travel insurance to learn more.

This message is a response to . Cancel

What Is A Pre

A pre-existing condition is one where symptoms exist that would cause a reasonable person to seek diagnosis, care or treatment within a one-year period before the effective date of the policy or a condition for which you received medical advice or treatment from a physician or other clinician within a five-year period before the effective date of the policy, whether or not a specific condition was diagnosed. Coverage is not available for pre-existing conditions. This does not change whether or not you list the names of your providers, we ask, or if you tell us about the condition on this application or if the services or benefits needed are medically necessary.

Read Also: Do I Need A Health Insurance Broker

Choose Your Own Insurance

If you already have a plan and buy your own insurance, learn the dates for your specific open enrollment period. If you don’t have a plan, the Open Enrollment Period is the time every year when you can shop for and choose a plan.

If you are currently enrolled in a marketplace health insurance plan, your plan will automatically renew. However, the plan may make changes to its provider network, copays, coinsurance or drug coverage. Your plan must send you a notice of any changes it will make for the next year.

You may have received a tax credit toward your premium last year. To be sure your financial assistance is accurate for the upcoming year, you must verify that your information is correct on the marketplace website.

Choose carefully during open enrollment, because you cant make any changes until the next years OEP or if you have a qualifying life event.

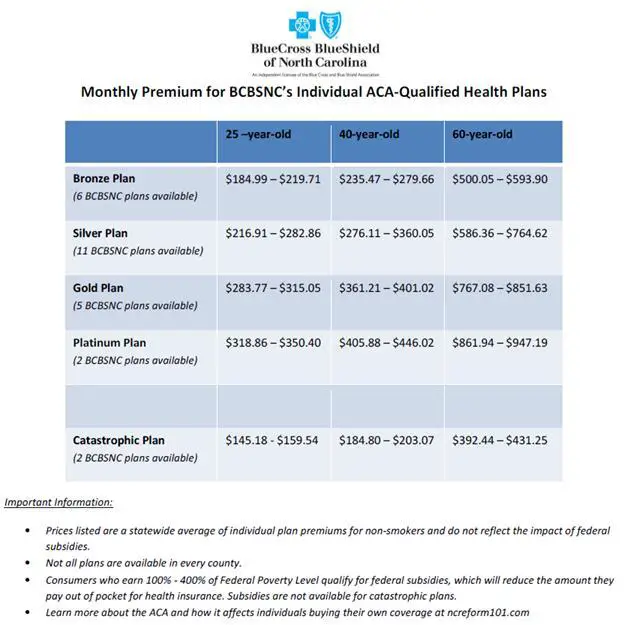

Gold Silver Bronze Or Catastrophic Coverage

The best way to shop for health insurance is to get a better understanding of the individual and family plans that are available. The Affordable Care Act requires all plans to be organized by the level of coverage they offer. Theres also a catastrophic coverage plan available for people under 30, or for those who qualify for a special exemption. All plans cover the same essential health benefits the difference is what you pay in monthly premium and out-of-pocket costs when you need care.

The following chart helps you decide what type of health plan is best for you based on how much you are willing to pay towards your premium each month, and the cost youll pay when you receive care. For example, a gold health plan may be best for you if you use a lot of health care services, are able to pay more in monthly premiums, and want to pay less when you receive care.

| Gold |

|---|

Don’t Miss: Can I Be On My Parents Health Insurance

Why Register With Medavie Blue Cross

Registering as an approved provider means your clients with Blue Cross coverage will be eligible to submit claims for services you provide. You’ll also appear in our approved provider list, which our members can search using Medavie Mobile.

You’ll have access our advanced ePay* network. ePay allows you to submit claims electronically using our secure web portal, and receive payment directly into your bank account. *Not all provider types have access to ePay. Check eligibility here.

With over 75 years experience, Medavie Blue Cross is an industry leader. We provide group and individual health, travel, life and disability benefits to over a million Canadians.

Where Should I Go If I Need Medical Assistance

An urgent health issue is one that requires attention soon, but it is not an emergency. For urgent health issues, you can contact the Concordia Health Services and speak with a nurse. You can also get same-day/urgent care in external clinics in Montreal. Information about how to find and book these appointments can be found in the Urgent care section of the Health Services website.

Another health care resources that is available to international students is Online Doctors , which provides mental health care and other health services.

You can also contact your provincial Telehealth line .

If you think your health issue may require immediate attention, call your provincial Telehealth line to speak with a nurse for assessment and guidance.

If you think your life, or the life of someone you know, is in danger, go to the nearest emergency department or call 9-1-1. Those outside of Canada can consult International Emergency and Crisis Lines, by Country for resources.

If you are advised to visit a clinic or go to the emergency room, please make sure that you have your Blue Cross insurance card with you. You can download the card from the Medavie Blue Cross web site. You must have photo ID with you. We suggest you have your Concordia ID card and a photocopy of your passport.

You May Like: How Do I Get Health Insurance If I Retire Early

Is Blue Cross Blue Shield Medicare

BCBS companies have been part of the Medicare program since it began in 1966 and now offers multiple Medicare insurance options. Though quality and costs vary by company and by specific plan within those companies, most BCBS plans offer decent value and benefits across a range of health plan options.

Blue Cross: Canadas Trusted Insurance

A recognized symbol of health care globally

Being trusted, professional and familiar is what you need in your coverage provider when travelling out of province

Covering over 7 million Canadians each year

One in five Canadians chooses Blue Cross to protect them and those they love with the right coverage for their needs

Over 80 years as a health care provider

Since 1938, Blue Cross continues to provide quality healthcare, including for provincial governments.

#1 for travel insurance for 5 years in a row

With flexible and affordable travel insurance, more Canadians choose Blue Cross than any other provider.

Also Check: What Is The Federal Health Insurance Marketplace

Thousands Of Vermonters To Pay Higher Insurance Premiums Following Rate Hike Approval

- to copyLink copied!

- to copyLink copied!

- to copyLink copied!

MONTPELIER, Vt.

Thousands of Vermonters could be hit with increased insurance premium rates next year following a ruling from the Green Mountain Care Board.

The board approved double-digit premium rate increases for Vermonters and small businesses using Blue Cross Blue Shield of Vermont and MVP Health Plan in 2023.

Blue Cross Blue Shield of Vermont premiums will increase by 11.4% for individuals and families, while small group premiums will increase by 11.7%.

MVP Health Plan premiums will increase by 19.3% for individuals and families, while small group premiums will increase by 18.3%.

The decision is expected to affect about 72,000 Vermonters who are currently insured under the two carriers.

The Green Mountain Care Board said the insurance companies had initially requested higher rate increases than the ones that were approved.

The board cited the rising costs for specialty pharmaceuticals and the higher costs paid to health care providers because of inflation as reasons for the large premium rate increases.

What Is Health Insurance

Health insurance is designed to protect you and your family from the costs of the medical services you need when youre sick or injured. You choose a plan and agree to pay a specific rate, or premium, each month. Your insurer then agrees to pay a portion of your covered health care costs. These payments are typically based on discounts that health insurers negotiate with doctors or hospitals.

Read Also: Will My Health Insurance Pay For An Auto Accident

Find The Answers To Your Questions

Insurance doesn’t have to be complicated.

Do you have concerns about the situation in Ukraine? Do not hesitate to contact our Customer Relations Centre at 1-888-822-5383 with your questions. We continue to support you and recommend you be extra vigilant.

No, the situation in European countries for which no government advisory has been issued does not fall within the conditions eligible for the cancellation and interruption of a trip.

As the situation is changing rapidly, we urge you to monitor government warnings that may affect your travels and contact our Customer Relations Centre at 1-888-822-5383 who will answer your questions. We continue to support you and we recommend you be extra vigilant.

No, the situation in European countries for which no government advisory has been issued does not fall within the conditions of cancellation and interruption of travel.

As the situation is changing rapidly, we urge you to monitor government warnings that may affect your travels and contact our Customer Relations Centre at 1-888-822-5383 who will answer your questions. We continue to support you and we recommend you be extra vigilant.

The Emergency Medical Care benefit covers you in case of sudden illness or accident that may arise during your trip, as long as it is not a pre-existing condition. However, this benefit does include an exclusion for all expenses related to war, revolt or revolution or voluntary participation in a riot or insurrection.