Ehealth: Your Guide To Exchange And Off

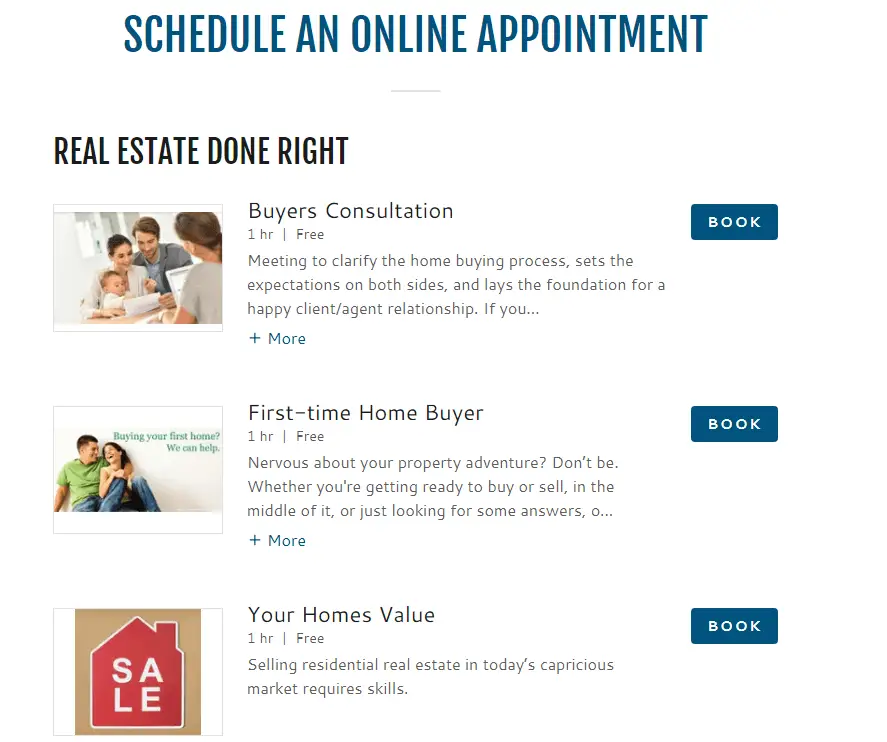

As an insurance brokerage firm, eHealth is committed to helping you find affordable health insurance that meets your personal circumstances. Working with an eHealth health insurance agent or broker can help get you the insurance you need at the best price. We deal with a wide range of types of health insurance and services. And we have the qualifications needed to recommend the policies that best suit your needs ACA medical coverage through the government-run exchange, ACA- compliant coverage off the exchange, short-term policies, medical indemnity plans, and more.

Take a closer look. We invite you to explore some of the many types of plans available through eHealth and our licensed health insurance agents and brokers. Simply click here: Individual & Family Health Insurance.

North Carolina Insurance License Application

Once you have completed your pre-licensing education, you are now ready to apply for your license. If you have more than one line of authority that you have passed the exam for, be sure to apply for all of those lines.

The fee for an online application is $50 per line, plus a $44 application fee, the $38 fingerprint fee, and a $6 NIPR fee for a total cost of $138.

Fill out your online application on the NIPR North Carolina page.

Types Of Insurance Products

This section will cover the different types of insurance products a new or experienced insurance agent may sell.

I discuss the different products into 3 different categories.

Learning how to sell insurance successfully means you must decide on what product works best for you.

My goal is discuss the pros and cons of each product. That way youll have a better understanding which insurance products to sell.

Lets get started!

Recommended Reading: How To Get Health Insurance For My Family

South Carolina Insurance License Exam

The next step after completing all of your pre-license coursework or self-study is to take the insurance exam. You will take one exam for each combined line of insurance you wish to carry. The Property line and Casualty line are combined as one exam. The Lifeline and Accident and Health line are combined as one exam as well.

This is a proctored test, which means that you will be in a controlled environment with a person watching over you. For people who havent tested in a situation like this should be aware of this fact, and work on taming their nerves prior to sitting for the exam.

The fee for each attempt of the combined exams is $45. When you show up you must have a photo ID any other documents that the testing facility has asked you to bring.

Each of the exams consist of one hundred fifty questions. You have one hundred sixty-five minutes to complete each test. The minimum score required to pass is 70% correct answers.

PSI Exams provides content outlines for each exam. Be sure to study them before you attempt the test:

Insurance license tests are intentionally difficult, but not impossible by any means. You should study to the point of comfortability with the information before you attempt the test. Failing the exam isnt the end of the world, but keep in mind that you will need to pay the fee each time you attempt the test.

Tip:

StateRequirement recommends that you study for one exam at a time

How Do You Get A 220 License

State Licensing Requirements:

Recommended Reading: Do I Have To Offer Health Insurance To All Employees

A Tough Negotiator Proves Employers Can Bargain Down Health Care Prices

Some insurer’s pitches, however, clearly reward brokers’ devotion to them, not necessarily their clients. “To thank you for your loyalty to Humana, we want to extend our thanks with a bonus,” says one brochure pitched to brokers online. Horizon Blue Cross Blue Shield of New Jersey offered brokers a bonus as “a way to express our appreciation for your support.” Empire Blue Cross in New York told brokers that it would deliver new bonuses “for bringing in large group business … and for keeping it with us.”

Delta Dental of California’s pitches appears to go one step further, rewarding brokers as “key members of our Small Business Program team.”

ProPublica reached out to all the insurers named in this story, and many didn’t respond. Cigna said in a statement that it offers affordable, high-quality benefit plans and doesn’t see a problem with providing incentives to brokers. Delta Dental emphasized in an email that it follows applicable laws and regulations. And Horizon Blue Cross said it gives employers the option of how to pay brokers and discloses all compensation.

The effect of such financial incentives is troubling, says Michael Thompson, president of the National Alliance of Healthcare Purchaser Coalitions, which represents groups of employers who provide benefits. He says brokers don’t typically undermine their clients in a blatant way, but their own financial interests can create a “cozy relationship” that may make them wary of “stirring the pot.”

Bad faith tactics

How To Become A Blue Cross & Blue Shield Agent

Increasing health care costs have made more people aware of the importance of insurance coverage, not only to lower overall health care costs, but to make sure your family is protected should something happen. Becoming an agent for Blue Cross Blue Shield Association means maintaining a trusted brand and living up to expectations of the company.

Become familiar with the Blue Cross Blue Shield Association. Learn the standards it keeps and its requirements. Familiarity with each of its services is an excellent way to help get your foot in the door.

Be licensed to sell life, accident and health insurance in order to be considered as an agent for Blue Cross Blue Shield Association. If you aren’t already licensed, apply for one and take the test. Choose the correct license. There are agent, broker, adjuster and commercial insurance licenses.

Fill out a contract with a general agency once you have your license. General agencies provide training, support and administrative help while you are an agent.

Meet your annual sales quota once you’ve been approved to sell Blue Cross and Blue Shield insurance. Each agent has a required minimum of policies that they must sign. o learn more about becoming an agent, call 878-0139, ext. 21507.

Also Check: What Does Health Insurance Cost In Retirement

What An Insurance Sales Call Is Like

During each sales call, we spend time getting to know the prospect.

This is called rapport-building, meaning youre breaking the ice, and getting to know the prospect.

After that, insurance agents transition to asking underwriting-related questions.

If you sell life insurance, youll ask about the prospects health, then present what we have to offer to them.

Then, they decide to buy or not.

If they have objections to buying, we rebuttal them to come to a mutually beneficial outcome.

Finally, whether we sell the deal or not, we wrap up the appointment and then go on to the next one.

Where To Find Sales Presentations

Now, if you dont have preset appointments, agents will work purchased or self-generated insurance leads.

Agents show up at the door unannounced to ask for an appointment on the spot or to set it for another day.

Even to this day, you have agents that will go out and actually prospect cold for appointments, whether thats house-to-house or business-to-business.

They repeat this process over and over again until they hit their presentation activity goals.

Activity Is King For Insurance Salesmen!

Let there be no confusion!

Agents LIVE AND DIE off of how many presentations they complete every week.

Why?

Because the number of presentations determines their financial position over the long haul.

If they routinely FAIL to hit those numbersthen they will fail out of the business.

After The Presentation

It is yourself and your mindset!

Insurance Sales Presentation 101

In this section, I break down the different ways you can learn how to sell insurance.

Then, we discuss the actual insurance sales presentation I teach my insurance agents.

Ill go over how you would go about selling your product with my four-step strategy.

Lets get started!

The majority of insurance is sold is face-to-face.

Selling face-to-face is the traditional strategy that still works effectively.

Whether your sell mass-market products like final expense or lucrative, multi-million dollar deals, face-to-face is the customary medium to sell to insurance prospects.

And this is despite the technological disruptions and upheavals experienced in many industries over the past few decades.

Don’t Miss: How To Get Temporary Health Insurance

Insurance Agent Career Profile

Texas was home to more than 33,290 insurance sales agents in 2019, reports the U.S. Bureau of Labor Statistics . Most professionals in this field make approximately $68,740 per year, or slightly over $33 per hour. Some are independent and represent different companies, while others sell insurance products for a single company.

Independent agents may sell one or more types of insurance, such as health coverage, life insurance or disability insurance policies. Many of them also specialize in other financial products, from annuities to mutual funds. As an independent agent, you can either start your own business or work for brokerages and insurance agencies. The BLS reports that 12 percent of insurance agents are self-employed.

Captive agents are typically employed by the insurance company they represent. Therefore, they receive a salary and benefits plus a commission per sale. The downside is that they can only sell specific products. Independent agents, on the other hand, can provide their clients with multiple quotes from different companies and help them choose the best policy for their needs.

Choosing Carriers For Appointments

There is nothing to stop you from applying to each and every carrier that will accept you based on your qualifications. In fact, many life insurance agents write business for half a dozen carriers or more. However, if you would prefer to work with a small handful of insurers instead of casting your net far and wide, here are a few points to consider when you make your decision about which companies will receive your applications for appointment.

- Company RatingMany agents prefer to work with companies that have at least an A rating through AM Best so they know their customers are getting the best service possible.

- LeadsWill the carrier provide leads for you, or will you be responsible for obtaining all leads on your own? This is one factor that can make or break many life insurance agents.

- QuotasVirtually every carrier will require a minimum level of production in order to keep your appointment from being terminated. However, those numbers will vary from company to company, so choose wisely.

- Quoting ProcessSome carriers will not allow their agents to create quotes on their own, but rather require them to contact the company itself for a quote. Depending on how hands-on you prefer to work, this may be a good or a bad thing.

- TrainingHow much training does the carrier provide? Although you may already have a good grasp of what you will be doing, being left to sink or swim is rarely a position new agents are comfortable in.

Recommended Reading: How To Apply For Health Insurance With No Income

The Role Of The Exchange Navigator

The health insurance navigator provides impartial education about the exchanges and exchange health plans, helping applicants determine whether they qualify for subsidies or Medicaid, and assisting them in the enrollment process. In 2020 Health & Human Services approved certain optional duties. Optional duties some navigators may perform include:

- Assisting consumers with post-enrollment coverage issues

- Helping consumers file eligibility appeals

- Filing for shared responsibility exemptions

- Providing basic information regarding premium tax credits

- Communicating basic concepts related to using health coverage

- Providing targeted assistance to vulnerable or underserved populations

Navigators cant recommend one plan over another or direct consumers towards a particular plan. They can provide general information that you can use to understand what health coverage is available to you. Navigators are paid by state and federal grant programs, not by insurance companies.

What To Expect During Your Insurance License Exam

The exam process usually is not difficult, especially if you have completed pre-exam requirements and come prepared. Youll arrive at your scheduled time and be placed at a computer. Test questions are usually in multiple-choice format. When the exam is complete, youll immediately find out if you passed. If you dont pass on the first try, you can reschedule and take it again.

You May Like: How Much Is Health Insurance Through Work

Become A Cigna Broker Or Consultant

Your clients have unique needs. And Cigna has solutions.

As a health insurance broker, we know that you care about both the well-being of your clients, as well as the quality and competitiveness of the products you offer.

As a Cigna broker, your clients can expect:

- Lower health care costs

- Improved employee health and productivity

- Easy-to-use plans

| Employer Health and Related Plans | Contact your sales representative |

| Medicare Advantage Plans and Part D Prescription Drug Plans | Call the Cigna Agent Resource Line at or email |

| Medicare Supplement Insurance | |

| International Group Plans and Individual and Family Plans | Contact your sales representative or contact us |

Insurance Agent License In Texas

All states require insurance agents to carry a valid license. Texas is no exception. The licensure progress is regulated by the Texas Department of Insurance and has several steps. First, candidates must access Pearson VUE and create an account so they can make an appointment for the licensing exam. The reservation must be made online or by phone at least 24 hours prior to the desired examination date.

The next step is to contact MorphoTrust via their website or by phone and schedule your fingerprint appointment at least 24 hours in advance. Candidates who have previously submitted their fingerprints to TDI are not required to do it again, according to the Texas Insurance Licensing Candidate Handbook. Your application will be processed as soon as TDI receives your criminal history reports from the state department of public safety and the FBI.

All applicants must take and pass the exam to get their insurance agent license in Texas. The test has two sections: one that focuses on the primary types of insurance products and another one covering the state laws and regulations for insurance professionals. Candidates must also answer several pretest questions for statistical purposes. Those who fail can take the exam again within one day . If you pass the test, you must apply for your license online within one year.

Read Also: Are Health Insurance Companies Open On Weekends

Become An Appointed Agent

If youre interested in growing your business and competing at a higher level with personal, commercial, and accident & health insurance products, now is a great time to consider becoming an appointed agent with Chubb.

Chubb is seeking agents like you who are interested in

- Partnering with a carrier that has a breadth of insurance products for small and mid-sized business, successful individuals and families, specialty, accident and health risks

- Expanding their business by selling premium insurance from a financially strong company that offers an exceptional claims experience

Chubb looks for ways to do more for our clients you can too

Cost For Online Training:

- The DC Health Benefit Exchange Authority is providing the training at NO COST for brokers who have a resident license in the District of Columbia. The training is also available at NO COST for brokers with a non-resident license in the District of Columbia who also have a resident license in Maryland or Virginia.

- There is a $79 fee for brokers that have a non-resident license in the District of Columbia with a resident license in a state other than Maryland or Virginia.

To register for the above training, visit .

Don’t Miss: Where Can I Go For Health Care Without Insurance

About The California Department Of Insurance

The CDI is the largest consumer protection agency in the state. Consumer protection is the core of its mission. It oversees over 1,300 insurance companies and over 390,000 agents, brokers, adjusters and business entities. The Insurance Commissioner, an independent statewide officer elected by popular vote, oversees and directs all of its functions.

The CDI means to protect consumers by:

- Overseeing insurer solvency

Which Insurance Licenses Do You Need

The first step to getting your insurance license is choosing which licenses you need. The most common licenses new insurance agents get are the property & casualty license , life and health insurance license .

The types of insurance products and policies youll be selling will determine which licenses you need. Here are some examples of the types of policies you can market with each license:

- Life and Health Insurance License Life Insurance, Annuities, Medicare, Health Insurance, etc

Most insurance agents and producers choose to get both P& C and L& H licenses, but if you plan on specializing in only one category then you dont need every license.

Insurance adjusters require a separate license. You can find more information on becoming an insurance adjuster here: North Carolina Insurance Adjuster License

Note:

Also Check: How Long Can I Get Cobra Health Insurance

How To Sell Insurance Successfully

Now lets discuss the top 5 qualities of successful insurance agents.

Additionally, Ill describe qualities that dont matter much, which may come as a surprise .

There are common traits that will show you how to be successful at learning how to sell insurance over the long-term.

Ive interviewed dozens of agents on my YouTube channel. And I know agents across the country in different niches that sell different insurance products.

Whats funny is that in doing these interviews for my best-selling book on top producers, Ive come to find that there is MORE in common with successful insurance agents than there are differences.

My goal is to uncover how top-producing insurance agents succeed at selling insurance in a short, straight-to-the-point way.

That way you can better understand how to mimic those behaviors and experience your own success.

Successful insurance agents believe that what theyre doing is MORE than just a job.

They believe in their heart of hearts they are doing GOOD work.

In a sense, some of the BEST insurance salesmen are evangelists by nature.

They want people to know how insurance helps solve problems.

Bottom line, they have passion and want to help!

Empathy Is Important

If you want to be successful at learning how to sell insurance, you must have empathy for your clients.

If you have contempt if you DONT like the people youre selling to OR if you dont like people in general

Youre NOT going to do well in the insurance business.