Insurance Companies That Cover Bariatric Surgery In The United States

Almost all insurance companies in the U.S. have policies that cover bariatric surgery. Whether you have insurance that covers bariatric surgery depends on what type of policy you have:

- An Individual/Family or Small Group Policy covers weight loss surgery if you live in one of the 23 states that mandate it

- A Large Group Policy covers bariatric surgery if your employer has chosen to include it in your plan

- Medicare covers weight loss surgery

- Medicaid covers weight loss surgery

If your insurance policy covers weight loss surgery, insurance will only pay for it if:

- You have a qualifying body mass index of 35+ with obesity-related health problems or a BMI of 40+

- You participate in a medically supervised diet program before having the procedure

Scroll down for the full bariatric surgery insurance coverage list by U.S. Insurance company.

For more information about plan types and general bariatric surgery insurance qualification requirements, see our Bariatric Surgery Insurance page.

What Are The Documents Required To Avail Bariatric Surgery In Health Insurance

What is required is a documented detailed history of your obesity-related health problems, difficulties, and treatment attempts demonstrating that a multidisciplinary approach with dietary, other lifestyle modifications , and pharmacological therapy, if appropriate, have been unsuccessful, at least for past 6 months.

Insurance Coverage For Weight Loss Surgery

Insurance coverage for obesity surgery varies according to the insurance carrier. Those that cover bariatric, or weight loss, surgery often limit their coverage to certain types of surgery.

Insurance companies that cover bariatric surgery have varying requirements. Some may require medical records documenting that you have medical problems caused by your weight or records of your participation in medically supervised weight loss programs. In fact, many insurers require at least six months participation in a supervised weight loss program within two years of your proposed surgery date.

Our office participates with many insurance plans. But whether we participate or not, our surgical scheduler can work with you and your insurance company to obtain authorization for your surgery. Each insurance plan is unique, and getting authorization for surgery is often a long, labor-intensive process.

Prior to visiting our office, please:

- Write down the name of the person you speak with, including first name, last name, and direct phone number.

Your insurance carrier may request the name of the surgery and the CPT/ICD-9 codes. Insurance companies use the following codes to identify the type of procedure or surgery:

- Lap Gastric Banding: 43770

- Lap Gastric Sleeve: 43775

- Diagnosis Code for Morbid Obesity: E66.01

When you have a surgery date, it may take another two weeks to two months to obtain approval from your insurance carrier.

Also Check: How To Enroll In Starbucks Health Insurance

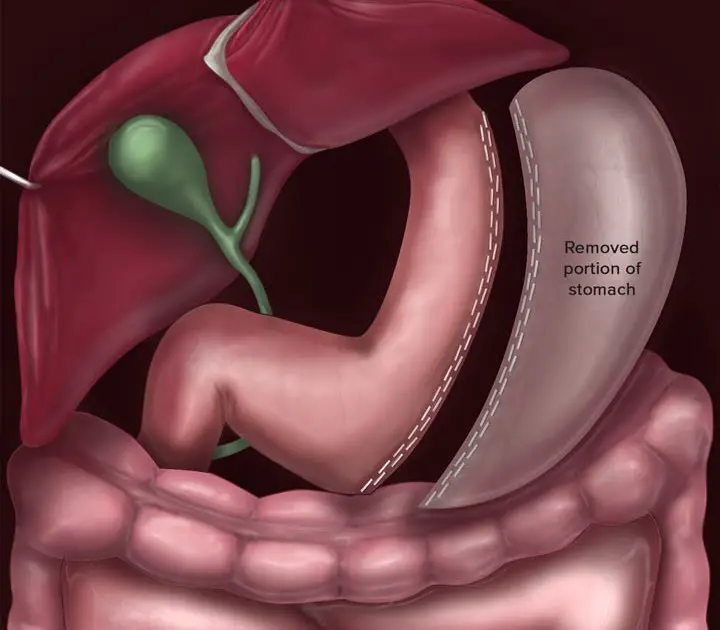

Overview Of Gastric Sleeve

The gastric sleeve procedure also called gastric sleeve resection, vertical sleeve gastrectomy, tube gastrectomy, sleeve gastrectomy, and laparoscopic sleeve gastrectomy is a treatment for obesity considered well worth its cost. It may be performed as the first step before a gastric bypass, or may be performed on its own. During a vertical sleeve gastrectomy, approximately 80% of the clients stomach is removed. The remaining portions of the stomach are then joined, creating a sleeve-like shape. The doctor will use a laparoscope, which is a device with a tiny camera that transmits images to a monitor so that the doctor can enjoy a high degree of precision.

Since the stomach is now much smaller, the patient feels fuller faster and may lose as much as 75% of their extra pounds. Because the stomach is now secreting fewer hormones, hunger cravings are greatly reduced.

The gastric sleeve treatment differs from a gastric bypass in that it is a more appropriate surgery for those who are at least 100 pounds or more over their ideal weight. The ideal candidate for gastric bypass should have a BMI of at least 40 as a general rule.

Tools Provided To Complete Your Insurance Requirements

- A unique concierge service to help you complete your surgeon visit, dietary, and psych evaluations all on the same day and in the same office as your seminar.

- An insurance advocate that will help you understand your personal requirements and help you with all of your questions and concerns throughout your weight loss journey.

- Some of our locations are open on Saturdays to work around your schedule.

- A login for our patient portal to track your progress and see what else youre required to complete before surgery.

- Nine clinic locations across South Texas for appointments and fully stocked with bariatric protein and vitamins.

- Support Group meetings once a month and an online Support Group if you prefer to stay home. Pre-operative patients are urged to check out one of our support groups to ask questions and learn about life post-operative from former weight loss surgery patients.

- If you have a smartphone, we have a free app available in the iTunes and Google Play store. Click here for more information about our Smartphone App here.

Even with insurance hoops, at Texas Bariatric Specialists, we strive to make your entire experience effortless. TBS will be with you every step of the way so you will never feel alone or lost in your journey.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

What Is A Gastric Sleeve Surgery

The doctor will remove one part of your stomach in gastric sleeve surgery and join the remaining parts to make it look like a sleeve. Hence, what remains is 1/10th of your actual stomach. Thus, your ability to eat more will decrease, and youll feel full only after taking a few bites.

A gastric sleeve surgery also removes the hormone that boosts your appetite, so you wont feel like eating too much. That means this surgery will reduce your ability to eat more and will also make you lose your appetite. So, it will benefit your weight reduction journey a lot.

Bariatric Surgery Procedures Covered

Cigna Health Insurance covers Roux-en-Y gastric bypass, biliopancreatic diversion with duodenal switch for individuals with a BMI greater than 50, adjustable silicone gastric banding, gastric sleeve as either a staged or stand-alone procedure, and vertical banded gastroplasty.

NOTE: Cigna does cover all lap band adjustments and fills.

Procedures such as Fobi-pouch, intragastric balloon, gastric bypass, duodenojejunal bypass liner, transoral gastroplasty, single-anastomosis DS, vagus nerve blocking, vagus nerve stimulation, mini-gastric bypass are some of the procedures not covered with Cigna Insurance. Make sure that your surgeon ensures that the process you choose is covered by your insurance plan before proceeding.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Tests Are Done Before Bariatric Surgery

Certain basic tests are done prior to bariatric surgery: a Complete Blood Count , Urinalysis, and a Chemistry Panel, which gives a readout of about 20 blood chemistry values. All patients get a chest X-ray and an electrocardiogram. Many surgeons ask for a gallbladder ultrasound to look for gallstones.

Free Bariatric Surgery Consultation Is Available

Book in for your free, no-obligation consultation with our Perioperative Nurse, Surgical Assistant, Shirley Lockie. In this consultation you will be provided with information on the different types of surgeries, program appointments and we will answer any questions you may have about the process. Shirley will also help guide you on Medicare cover and how to navigate your private health insurance options.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Cover For Weight Loss Surgery Vs Weight Management

Cover for weight loss surgery

You’ll only find health insurance for weight loss surgery with a gold-tier hospital policy. If you’re not already on one, you’ll want to get on one soon because there will be a waiting period, usually around 12 months.

Cover for weight management

Many extras policies cover weight management programs like fitness classes, money off gym memberships and nutritional consulting programs such as WW and Jenny Craig. This can give you a chance to learn new wellness habits pre-surgery or, in some cases, avoid having surgery altogether. Waiting periods are a lot shorter usually around 2 months.

How Much Does Gastric Sleeve Surgery Cost With And Without Insurance

Severe obesity affects millions of Americans and brings with it a host of potentially life-threatening health problems. Because of this, weight loss surgery is often considered the best and most effective treatment for people who are considered morbidly obese. However, insurance coverage and cost often play a major role in the decision to undergo a weight loss procedure.

If youve been considering Gastric Sleeve Surgery, you may be wondering what costs are associated with it and if it is covered by insurance. The following is a guide to Gastric Sleeve costs, with or without insurance, and other factors that will help you decide whether this weight loss surgery is right for you.

You May Like: How Much Is The Er Without Insurance

How Much Does Gastric Sleeve Surgery Cost

According to one research, it takes an average of three years from the time you contemplate gastric surgery to the time you actually get it. You may spend many hours studying, reading, and speaking with post-operative patients regarding their procedures.

But, how much is gastric sleeve surgery? A Gastric sleeve surgery costs an average of $23,000, while a gastric bypass surgery costs $14,500, and sleeve gastrectomy surgery costs $14,900. So, before you get too excited, find out if your insurance will cover weight reduction surgery or not.

Patients belonging to the middle to upper classes are the majority of people who undergo this surgery. In addition, most people considering weight reduction surgery may not afford to pay the $20,000 gastric sleeve cost to reduce weight.

However, insurance companies are also beginning to pay weight reduction surgery amounts in more significant numbers than ever before. So, if you are determined to get this even after knowing how much is gastric sleeve surgery, talk to your insurance provider.

Read More: Celiac Disease Symptoms, Causes, Effect And Treatment

How Do I Get Approved For Bariatric Surgery

Dealing with insurance approval and rejection and appeals and denials creates a roller-coaster of emotion. Let the experts do their part. Your surgeon should have an in-house expert that will contact your insurance and start the process for approval.

Do not assume that your job is finished after youve been approved!

Make sure you are staying on top of your duties and appointments. There will be many. Keep documented records of everything and check in with the specialist regularly.

This is also a great time to change bad habits. Youre on your way to getting a life-changing procedure. Start changing your eating and exercising habits now or the change after surgery will be harder to make. Remember, surgery does not guarantee success. In fact, if you dont change your habits, even though youve had weight loss surgery you will fail. And surgery is actually easier for the surgeon if youve lost some weight before surgery. This decreases the size of your liver which makes it easier during the operation and it decreases your risk of complications due to anesthesia.

Read Also: Starbucks Health Insurance Cost

How Much Does Gastric Sleeve Cost Out Of Pocket

The surgery for a sleeve gastrectomy is about $17,500 and for bypass its about $27,000 . The good news: the price hurdle is often one that patients can overcome on their way to healthier lifestyles because more and more, insurers are willing to cover the surgeries especially when employers demand coverage.

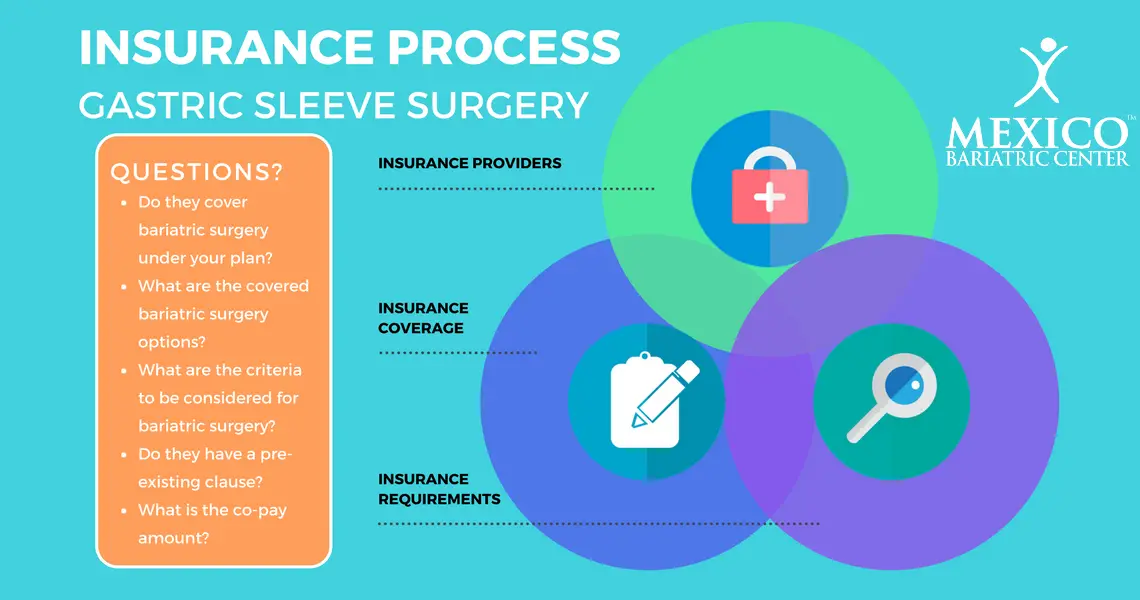

So How Does Bariatric Surgery Insurance Work

Few years back, bariatric surgery was a standard exclusion across the industry. However, with the changing needs of the world and the technical advancements, bariatric surgery is considered by many insurance companies now. If you are hospitalized for a Bariatric Surgery which is medically necessary, on the advice of a Medical Practitioner, we cover the related medical expenses. However, it is to be kept in mind that Bariatric Surgery Insurance benefit can be availed only when it is medically necessary and not for cosmetic purposes.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Bariatric Surgery Is Excluded From My Bcbs Planwhat Do I Do

Despite the success rate and track record of bariatric surgery improving health, not all plans or groups include coverage for weight loss surgery. This does not mean you do not have options! Memorial Advanced Surgery offers competitive self-pay options that may suit your needs, including working with third party financing. If you do not have coverage for surgery, or you have a high deductible or out-of-pocket to be met, we invite you to speak with our team to learn more about how we can assist you. You may also wish to compare plans available through a spouses coverage or contact the HR department at your workplace to see if they have incentives for weight loss and bariatric surgery or if changes might be made in the next open enrollment period.

Does Blue Cross Blue Shield Florida Blue Cover Bariatric Surgery

Blue Cross Blue Shield of Florida now known as Florida Blue is our states largest health insurance provider with over 50% of Floridians covered under their plans. BCBS offers members a range of plans including Individual & Family, Medicare and Group Health. The Memorial Advanced Surgery providers are in-network for most of these plans. Our team is happy to discuss your benefits and coverage for weight loss surgery and help guide you through what is required for coverage.

Note: In network providers are able to offer a lower out of pocket expense to patients than providers that are out of network by the plan.

Recommended Reading: Does Starbucks Give Health Insurance

What Will My Out Of Pocket Expenses Be

Exact coverage for surgery will vary based on your benefits. We encourage patients to call BCBS Florida Blue directly using the phone number on the back of your insurance card or speak to your HR department for policies through your employer. During your office consultation, our Bariatric Coordinator will spend time with you to review your specific benefits and obligations, including what may be required for coverage.

Many plans have deductibles, co-insurances and out of pocket maximums that reset with the calendar year each January 1st. If you are approaching the end of the year, your actual out of pocket expenses for surgery may be lower if you have already paid for medical treatment earlier in the year. Please keep in mind, there may be several required visits prior to surgery being scheduled and it is best to plan several months in advance, even if you plan to take advantage of a paid deductible or met out-of-pocket max for bariatric surgery.

If Your Insurance Is Through Work: Large Group

If you get your insurance through your work and your employer has 51 or more full time employees, it is completely up to your company to decide whether or not to cover weight loss surgery.

To confirm your coverage, you have a three options:

- Option 1 : Your local surgeon will contact your insurance company to confirm your benefits for free. Their office will be very familiar with your insurance companys requirements and approval process, so its usually a good idea to let them do the leg work for you. .

- Option 2: Ask your Human Resources Department whether or not weight loss surgery is an included benefit under your plan.

- Option 3: Contact your insurance company yourself and/or check your Summary Plan Description . for the full list of United States insurance companies, contact information and bariatric surgery coverage policy details.

If you find out that bariatric surgery insurance is NOT included under your plan, you may want to head over to our Weight Loss Surgery Insurance Secrets page to learn how you may be able to get your company to add the coverage.

If you have short term disability insurance through your employer, you may be able to receive portion of your monthly salary while youre having and recovering from surgery. See our Short Term Disability section for more information.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Gastric Sleeve Insurance Coverage: What Is Covered

Almost all PPO Insurance companies recognize the necessity of the Gastric Sleeve operation for patients who have been unable to find success using other non-surgical weight loss methods. They understand that as you lose more weight, the less likely it is that you will suffer from other obesity-related conditions, such as type 2 diabetes, hypertension and obstructive sleep apnea.

Gastric sleeve insurance coverage may also even include the post-operation elements that are necessary to be successful with your procedure such as support groups, exercise and nutrition counseling.

Whether or not your coverage is denied, our trained staff of insurance professionals are experts at helping you get your gastric sleeve surgery approved. Just call our Gastric Sleeve Insurance Hotline at or fill out our FREE Gastric Sleeve Insurance Verification Form!

Where Do I Find Coverage Requirements For My Policy

Each insurance provider will require different documents and different tests. They may also require that you visit approved specialists. These can range from an approved psychotherapist to an approved cardiologist.

The best thing to do is to call your insurance company or your HR department if your insurance is supplied through work. We have our own list that you can check as well.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Contact Us To Learn More About Gastric Sleeve Surgery Costs

Birmingham Minimally Invasive Surgery is a caring group of professionals who specialize in all types of bariatric surgery. Our surgeon Dr. Jay Long has highly specialized training in bariatric surgery, having completed a fellowship in minimally invasive and bariatric surgery at The Methodist Hospital in Houston, Texas, where he focused on taking care of patients that are morbidly obese. And we are so proud of our pricing that we publish the costs right on the front page of our website! Insurance wont pay? We have a variety of financing options we can offer you so that you are able to get the healthy body youve wanted for years. Visit us today at www.bmisurgery.com or give us a call to set up a consultation at 205-833-6907.