How To Choose Health Insurance: Your Step

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

You typically have a limited amount of time to choose the best health insurance plan for your family, but rushing and picking the wrong coverage can be costly. Heres a start-to-finish guide to help you find affordable health insurance, whether its through a state or federal marketplace or through an employer.

How Do I Register A Complaint Against A Doctor

Since the provinces and territories, rather than the federal government, are primarily responsible for the administration and delivery of health care services and the management of health human resources, you should contact your local provincial/territorial Ministry of Health – the phone numbers and websites are located inside the back cover of the current Canada Health Act Annual Report. You can also contact your province or territory’s College of Physicians and Surgeons, which is the organisation that governs physician licensing and conduct. Links to each provincial and territorial medical regulatory authority can be found on the College of Physicians and Surgeons of Canada website.

Canada Health Act Division

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

Also Check: Does Kroger Offer Health Insurance To Part Time Employees

Understanding The Rules For Health Insurance Can Be Confusing

Do you have to have health insurance? The Affordable Care Act , signed into law in 2010, was designed to make health insurance coverage more affordable for Americans through the creation of tax subsidies, while also opening up Medicaid eligibility to more low-income individuals and families. The ACA effectively made having health insurance mandatory not having it meant that you would incur a tax penalty.

But what about now? What is the penalty for not having health insurance today? If you dont have it, does the rule still apply?

Heres what you need to know about mandatory health insurance coverage.

More Help Before You Apply

-

Estimating your expected household income for 2022

- You can probably start with your households adjusted gross income and update it for expected changes.

- Learn more about estimating income, and see what to include.

Including the right people in your household

Read Also: Kroger Employee Discount Card

Choosing A Health Insurance Policy

Once you’ve decided what level of cover you need, compare different providers and their policies.

You can compare all private health insurers on the Australian Government’s PrivateHealth.gov.au website. Read through each policy’s product disclosure statement to understand the inclusions and exclusions.

Before you sign up, think about:

- Who the cover is for You can take out policies for singles, couples and families.

- How much you can afford Use our budget planner to work out how much money you can spend on health insurance.

- What extras you need You may need to prioritise certain extras. For example, if everyone in your family has glasses, you may need a policy that covers optometry.

- How long the waiting period is Most health funds have a waiting period before you can claim on any services. The length of the waiting period often depends on the type of medical treatment you receive.

Be honest about your health history when you sign up to a policy. If your insurer believes you have misled them, they may not pay your claim.

Comparison websites might only include some health insurers, not the whole market. See what to keep in mind when using comparison websites.

How Much Does Health Insurance Cost

Finder research has shown that a basic private hospital plan costs an average of just $79.86*. These starter plans will usually offer ambulance cover and include some common treatments like dental surgery. At the other end of the scale, gold hospital plans cost $170.90 on average. These top-end policies typically include cover for pregnancy, IVF and weight loss surgery.

Extras cover can range from around $12.85 to $81 per month on average depending on the level of cover you choose.

Remember that private health insurance costs vary from fund to fund. A more comprehensive policy with extras is likely to increase your premiums. Your age, your lifestyle and where you live are just some of the factors that an insurer will take into account when working out the cost of your insurance. Another factor that’ll affect the cost of private health cover is whether your policy is a single plan, or a joint or family policy.

*All prices quoted are based on a single policy in Sydney, earning less than $90,000 with a $500 hospital excess from August 2020.

Also Check: Health Insurance Starbucks

What Are Health Insurance Plans Through Work

Around 49% of Americans get health insurance coverage through their employers. Thats nearly 157 million people.1 Employer-sponsored health plans play a big role in benefits packages. Depending on your employer, there may be several health plans for you to choose from. If you get your health plan through work, check into UnitedHealthcare plans to learn what benefits are included with our plans. From personalized support to helpful digital tools and large provider networks there’s a lot to consider when making your choice.

When Can I Buy Private Health Insurance

Most types of health insurance have an open enrollment period during which you can sign up for private health insurance. This is true whether you buy insurance via the Affordable Care Act health insurance exchange in your state, sign up directly through the insurer, enroll in the plan that your employer offers, or sign up for Medicare.

Certain life events can trigger a special enrollment period, which will allow you to change your health insurance coverage outside of the normal enrollment period. These events include getting married or divorced, having a baby, losing your job-based health insurance, or moving out of your health plans service area.

Read Also: Starbucks Insurance Plan

Hmo Ppo Epo Plans & More

- Critical-illness insurance, which pays you a lump sum if you are diagnosed with cancer, heart attack, stroke, and certain other serious illnesses

- Accident insurance, which gives you a cash payout in case of covered accidents

- Fixed-benefit indemnity medical insurance, which provides cash payouts if you suffer from specific illnesses or injuries covered by your policy

| Plan Type | |

| $273.83 | 105 |

*Average for monthly premiums for each product type, where available through eHealth, for a 29-year-old. With the following exceptions: Critical Illness Insurance is not available at eHealth.com in Hartford Connecticut and Fixed-Indemnity Insurance is not available at eHealth.com in Hartford, Connecticut Los Angeles,San Diego and San Francisco, California Baltimore, Maryland or Seattle, Washington

Clearly, your choices for health care coverage are varied but, at the end of the day, theres only one set of plans thats right for you and your familys needs and budget. Use eHealths tools and services to get help finding a health plan thats suited to your circumstances.

Is There Ever A Right Amount Or Coverage That One Needs To Look At

The right amount of coverage depends on several factors like the type of hospital you prefer, current age and health conditions of yourself and your family members, your affordability etc. Healthcare costs vary significantly by hospital and the facilities opted. For example, the cost of a knee replacement surgery nearly doubles if you opt for an imported implant instead of an indigenous one. This way, the size of your Health Insurance should be linked to your income and lifestyle.

While there is no ideal sum assured for Health Insurance policy for an individual, there are two market-broadly-accepted rules on its quantum. First, your health cover should be at least 50% of your annual income. And second, the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice. Most personal finance experts recommend a minimum health cover of Rs 5 lakh. You can have similar sum assured as a family floater to include your family members.

The rising costs of medicines and treatments may render your individual Health Insurance cover inadequate to cover all expenses. The basic Health Insurance policy may not cover expenses related to recovery phase such as extensive nursing care, counseling sessions, rehabilitation. But you can substantially enhance your health cover over and above your basic policy with tools like Riders and Top-Ups without corresponding increase in the premium.

Also Check: Starbucks Benefits Part Time

Is Your New Tier The Right Product For You

If you already had health insurance before the private health insurance reforms, your policy will have changed to align with these new tiers. As such, you may have lost features you enjoyed previously, or worse you may be paying for cover you dont need.

Thats why its always the right time to review your health insurance against other policies to make sure your hospital insurance covers everything you need and that youre not overpaying.

What Is The Minimum Amount Of Life Insurance You Need

You can buy as little as $5,000 of life insurance if you buy a burial insurance policy, whereas most term life insurers require you to have a benefit of $50,000 or more. Most of the term life insurance providers on the Policygenius marketplace have a coverage minimum of $100,000.

But the smallest amount of coverage available isnt the same as the minimum amount of protection you should have. At the lowest end, your life insurance policy should be able to support your dependents everyday needs for several years and cover your end-of-life expenses. You can potentially lower the benefit of the new policy you buy if you have significant savings or existing life insurance.

Also Check: How Much Does Starbucks Health Insurance Cost

For Visitors To Canada

If you are an international traveler visiting Canada for a short trip or a stay of less than one year, a less comprehensive and more affordable travel insurance plan may be the best option. These travel medical insurance plans cover the costs of medical treatment for emergencies and illnesses that occur while traveling. They also offer additional benefits such as coverage for adventure sports, trip interruption, medical evacuation and transportation, and more.

If you also want to cover the cost of your trip, consider a trip cancellation plan.

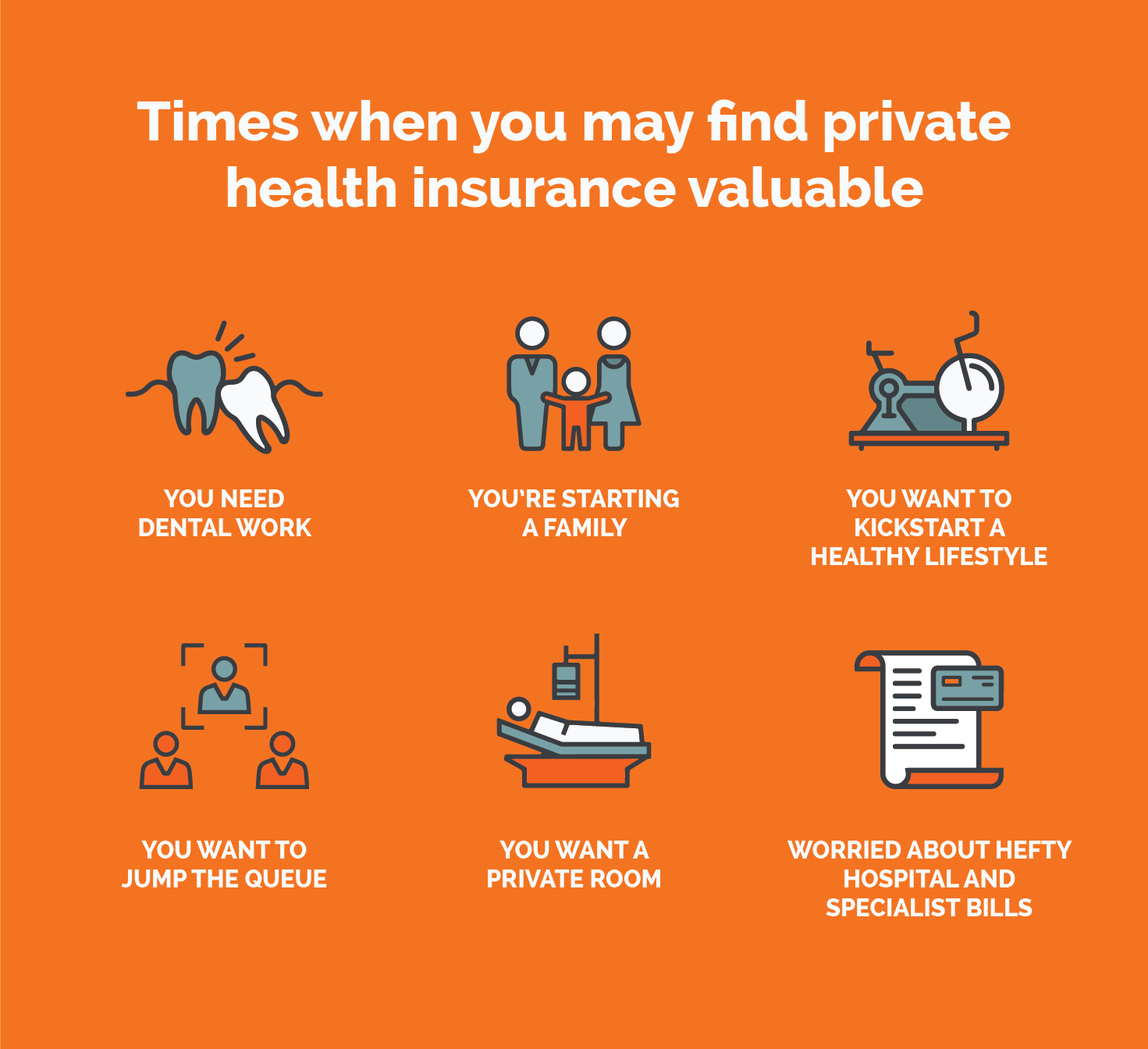

More Health Cover And Choice

Depending on your policy, private health insurance pays some or all of the costs of:

- treatment in public or private hospitals as a private patient with the doctor of your choice

- health services that are notcovered under Medicare such as physiotherapy, dental and optical.

Private health insurance might also help you access some hospital services more quickly.

Find out more about what private health insurance covers.

You can still choose to be a public patient in a hospital if you have private health insurance.

Also Check: Insurance Lapse Between Jobs

Top Tips From Our Health Insurance Expert Anthony Fleming

Out Of Pocket Expenses: When Will You Have To Pay Them

There are situations where doctors and specialists decide to charge more than what the Medicare Benefits Schedule fee is for certain services and treatment. This means that while you do receive some cover from Medicare and private health insurance , you may still have to pay a portion of the cost.

Depending on your health fund, there may be gap cover arrangements to cover some or all the difference between the doctors fee for services and the combined Medicare and health insurance benefit.

Your health fund may also have a list of allied health professionals and agreement hospitals, where youll have lower out-of-pocket expenses. Before a surgery you can also get multiple quotes to find out which doctor is the most cost-effective .

Also Check: Substitute Teacher Health Insurance

How Much Health Insurance Is Needed For Family

Meanwhile, with medical inflation estimated at 15% per annum, the cost of healthcare has been rising steadily since last one decade or so. With rising healthcare costs, not having a Health Insurance irrespective of an individuals age can be risky. You can never be sure when an illness will strike, leaving you with huge medical bills. If not prepared, a single instance of hospitalization can very well disturb a familys well-calculated budget. Amid such possibilities, having a Health Insurance policy is of utmost importance to cover you and your family against any emergency medical situation.

Well, having a Health Insurance policy is good, but it is the basic requirement. It is equally important to have an optimal mix of coverage to have to get the most out of a Health Insurance policy. Most policyholders in India cover their families for around Rs 7-9 lakhs and the average as the common sum insured is shared by a single family. For 2 adults and 2 Kids go for at least a sum insured of 10 lakhs.

Alternative Options If You Want To Go Private

- Use savings for all or part of your medical costs around one in five private patients do this. Hip and knee replacements cost an average of £10,000 each, while MRI scans cost from £500. You can shop around for scan prices your GP can help you do this.

- Pay for a private consultation if you want an expert or second opinion. Then, if necessary, your consultant will refer you back into the NHS for treatment.

Recommended Reading: How Long After Quitting Job Health Insurance

What Is Private Health Insurance

In Australia, private health insurance allows you to be treated in hospital as a private patient. It can also help pay for health care costs that Medicare doesnt cover, such as physiotherapy. How much and what it covers depends on your policy.

To get private health insurance you must:

- buy a policy from a registered health insurer

- pay regular premiums to stay covered.

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Also Check: Does Medicare Pay For Maintenance Chiropractic Care

Consumer Guide To Understanding Health Insurance

Many of the requirements discussed in this guide do not apply if your employer “self-funds” its health benefits plan. This Self-fund means that the employer pays your health claims from its own funds and does not pay premiums to an insurance company. The employer decides the plan coverage, including employee eligibility, covered benefits and exclusions, employee cost-sharing and policy limits. Federal law exempts these self-funded plans from state insurance laws, so these plans do not need to include state mandated benefits. You can ask your employer if your health plan is self-funded.

Other Types Of Insurance To Consider

If you fall ill or have an accident and cant work, you might find it hard to keep up mortgage payments or handle the bills especially if you dont have enough savings or sick pay from your employer.

Your priority should be insurance that keeps you out of financial difficulty, such as income protection.

You May Like: How To Get Insurance Between Jobs

Who Doesnt Need Private Health Insurance Cover

You dont need private medical insurance if:

- youre happy to rely on the NHS for your care

- you already have medical insurance through your employee benefits package

- youre worried about your child becoming sick children get immediate priority on the NHS

- you only have spare cash for basic insurance, such as car and home insurance and life insurance if you have dependants

- you have debts to repay and no savings its best to put your money towards those, rather than private medical insurance

- you can pay for individual treatments if you have enough savings it might be more cost-effective to pay for any treatment you might need privately than to pay regular insurance premiums.