If My Employer Does Not Provide Health Insurance Benefits Or If I Am Working Only Part

Yes. Several programs are available for people without insurance in California.

Medi-Cal is Californias joint federal-state Medicaid program that provides free or low-cost health coverage. In general non-elderly adults with household income up to 138 percent of Federal Poverty Level , pregnant women with household income up to 213 percent of FPL, and children from birth through age 18 with household income up to 266 percent of FPL qualify for Medi-Cal. You can also get Medi-Cal if you fall within certain categories. To see if you are eligible for Medi-Cal, contact the Department of Health Care Services.

Childrens Health Insurance Program may provide health coverage to children in families that do not qualify for Medicaid. Similarly, Medi-Cal Access Program may provide health coverage to pregnant women with household income more than 213 percent of FPL.

Covered California Health Exchange is the California agency offering subsidized health insurance plans in accordance with the Affordable Care Act . Covered California helps individuals and families obtain health coverage that includes the minimum essential benefits required by Obamacare. If your household income is at or below 400 percent of FPL, Covered California may qualify you for subsidized plans with reduced premiums. If your household income is between 138 percent and 250 percent of FPL, Covered California may qualify you for extra discounts that reduce their cost for medical services .

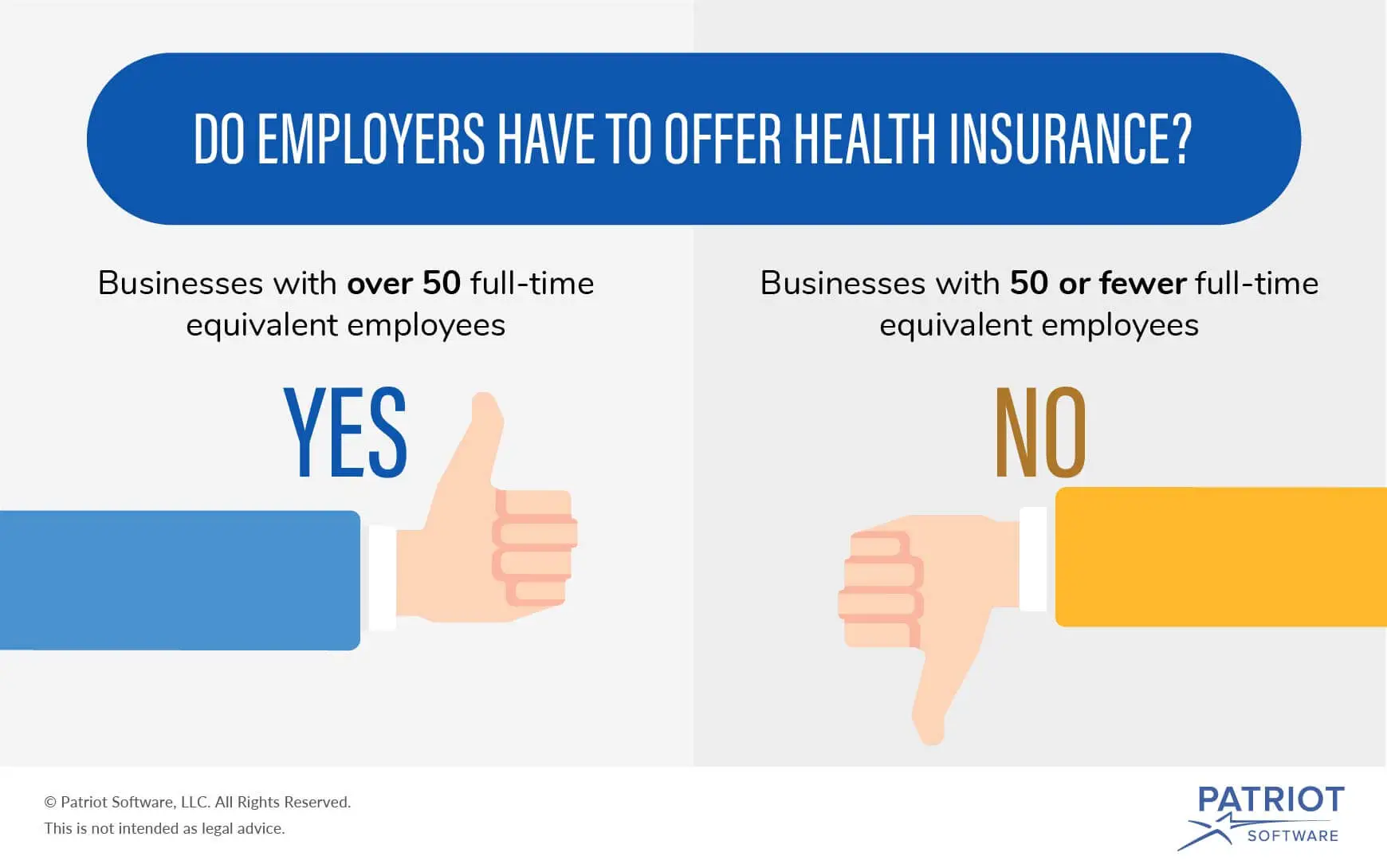

Do Employers Still Have To Offer Health Insurance

The main change made to the ACA as of 2019 is the repeal of the individual insurance mandate. The employer shared responsibility provisions of the ACA remain unchanged. This means businesses with 50 or more full-time equivalent employees must continue to offer employer-provided health insurance to full-time employees as part of their employer benefits package.

How Will I Know If I Have Been Assessed A Penalty

The Internal Revenue Service sends Letter 226J to employers and plan sponsors relating to compliance for any given year. You have 30 days to respond if you are found out of compliance. When a penalty is assessed, you are informed via IRS Notice 220J. This notice will inform you of the penalty, if any. The Notice will advise you of your rights of appeal.

Also Check: Who Pays First Auto Insurance Or Health Insurance

Do Small Businesses Have To Offer Health Insurance

The short, simple answer is, no. But as always with health insurance, the short, simple answer is not quite the right one. For one thing, it depends on what we mean by small.

Under the Affordable Care Act , businesses with the equivalent of 50 or more full-time employees have to offer health care to their employees or pay a penalty. The choice is up to their management.

Can Business Owners Buy A Plan On The Marketplace

As a small business owner, you have two health insurance options through Healthcare.gov, a.k.a. The Marketplace. If you are a sole proprietor, you may purchase an individual health insurance plan. Your options may include bronze, silver, or gold plans with a range of monthly premiums, deductibles, and coverage.

You may also qualify for the Small Business Health Options Program if you have one to 50 full-time equivalent employees. If your company has fewer than 25 full-time employees who meet the maximum income threshold , you may be eligible for the Small Business Health Care Tax Credit. In this situation, you must offer SHOP to all of your full-time employees and pay at least 50% of their premium cost.

This tax benefit credits 50% of all premiums paid on company tax returns. Since these are IRS guidelines with amounts changing annually, based on inflation and other factors, it is best to check with your tax advisor on eligibility.

Read Also: What Is The Average Monthly Cost Of Health Insurance

Expert Offers Advice For Enrolling In Health Care This Fallyour Browser Indicates If You’ve Visited This Link

Many employersoffer open enrollment for health care coverage during the fall months, and Medicare enrollment runs through Tuesday, Dec. 7. David Milich is the CEO of UnitedHealthcare in Texas and Oklahoma and shared some thoughts and tips for shopping options to make educated decisions in choosing the coverage that best fits someone’s needs.

Houston Chronicle

Summary Of Benefits And Coverage Disclosure Rules

Employers must provide employees with a standard “Summary of Benefits and Coverage” form explaining what their health plan covers and what it costs. The purpose of the SBC is to help employees understand their health insurance options. You could face a penalty for non-compliance. Learn more about SBCs and see a sample completed form.

You May Like: Does Health Insurance Cover Pre Existing Conditions

Requirement For Individuals To Have Health Insurance

Starting in January 2014, most individuals must have health insurance that is considered “minimum essential coverage” or qualify for an exemption. Otherwise, the individual will owe a tax penalty during the following year.

Any job-based plan as well as plans purchased in the Health Insurance Marketplaces, Medicare, Medicaid, state Children’s Health Insurance Programs , most TRICARE plans and the Veterans health care program, and certain other coverage meet this requirement.

If health insurance is not considered affordable for an individual, that person will qualify for an exemption from the tax penalty. Individuals who are uninsured for less than three consecutive months of the year also will qualify for an exemption from the tax penalty. Other exemptions exist.

Learn more about the individual requirement at www.healthcare.gov.

Do I Have To Comply With Health Care Reform

The Affordable Care Act does not apply to everyone. Certain individuals are exempt, including:

- Individuals who would be paying more than 8% of their income for health coverage

- Individuals who dont have to pay taxes because their incomes are so low

- Individuals who dont want to buy or carry insurance for religious reasons

- Individuals who are undocumented immigrants

- Members of Native American tribes

- Incarcerated individuals

Read Also: New York State Insurance Licensing Exam

Read Also: How Much Is Private Health Insurance In New York

Coverage Unaffordable Or Too Skimpy

If an employer does offer coverage but its not affordable and/or doesnt offer minimum value, the employer would face a penalty if any full-time employees end up getting a subsidy in the exchange.

- An employer-sponsored plan is considered unaffordable if the employee contribution for premiums is more than 9.83 percent of household income in 2021 for employee-only coverage .

- To provide minimum value, an employers plan has to cover at least 60 percent of average expected medical costs, and provide substantial coverage for inpatient care and physician services.

If an employers plan is unaffordable and/or doesnt provide minimum value, the employer would face the lesser of two penalty options: $4,060 per employee receiving premium subsidies in the exchange , OR the $2,700 per full-time employee penalty described above.

Consider a business that has 120 full-time employees and offers coverage, but its either not affordable and/or doesnt provide minimum value: If 70 employees get subsidies in the exchange in 2021, the employer would pay a penalty of $243,000 for the year x 2,700 = 243,000, since thats smaller than the alternative penalty calculation .

But if only 20 of the employees get subsidized coverage in the exchange, the employer would pay $81,200 for the year , since thats smaller than the alternate calculation of x 2,700, which would be $243,000.

Q: If My Employer Doesn’t Provide Health Insurance Do I Have To Buy Health Insurance

A: As of December 2017, the individual mandate for insurance was repealed. This means that while it is still technically a requirement for an individual to be insured, there is no penalty for an individual that doesn’t have insurance.

Individuals that want to cover themselves for insurance can use the federal marketplace, a local broker, or a state exchange to enroll in major medical coverage. Some individuals choose to go without coverage, or purchase plans that don’t qualify as minimum essential coverage. Either way, there is no penalty.

Don’t Miss: How Much Is Travel Health Insurance

Do I Have To Offer Health Insurance To All Employees

Whether you are incentivized to offer health insurance as an ALE to avoid penalties or are a small employer considering offering health insurance benefits, you might wonder if such benefits have to be applied to all employees.

Heres where things get a little tricky. There are laws to prevent discrimination. If two or more employees can be considered similarly situated, health benefits must be offered to them equally. You can only offer different benefits if there are clear distinctions between employee classifications, such as full time versus part time, different geographical work sites, or distinctly different job types.

Whether or not you are required to offer insurance, if you choose to do so, the employer plans you offer must be equally offered to all individuals in similarly situated groups. This requirement comes from the Health Insurance Portability and Accountability Act , which also applies to discriminatory practices, such as discrimination based on health factors or health history.

Also, if you offer employees an employment contract when you hire them and the contract includes a statement indicating that you will offer health insurance, you will remain obligated to offer that insurance as long as the contract is in effect.

How To Know If You Qualify For The Shop Marketplace

-

SHOP insurance is available to employers with 1-50 full-time equivalent employees in most states . Use our FTE Employee Calculator to find out if you qualify to use SHOP.

-

You must offer SHOP coverage to all of your full-time employees generally those working 30 or more hours per week on average.

-

In many states, at least 70% of employees offered coverage must accept the offer, or be covered by another form of coverage, for the employer to participate. For help calculating the SHOP minimum participation rate in your state, visit the MPR Calculator.

-

You must have an office or employee work site within the state whose Small Business Health Options Program you want to use.

Get more details on SHOP eligibility rules.

Don’t Miss: What Is Aetna Health Insurance

Benefits Of The Shop Insurance

- You control the coverage you offer and how much you pay toward employee premiums.

- You can choose from high-quality private health insurance plans that meet the needs of your business and employees.

- You can choose to offer health only, dental only, or both health and dental coverage. If offering dependent coverage and an employee enrolls, the employees dependents can enroll in health only, dental only, or both health and dental coverage.

- You can start coverage any time of the year.

- If you have fewer than 25 employees, you may qualify for a Small Business Health Care Tax Credit worth up to 50% of your premium costs . You can still deduct from your taxes the rest of your premium costs not covered by the tax credit. The tax credit is generally available only when an employer offers SHOP plans. Use the Small Business Health Care Tax Credit Estimator to find out if you may qualify and how much you may save.

As A Small Business Owner Are You In Need Of Health Insurance

As a small business, it’s important to assess your needs for health insurance plans for employees. Many times, providing access to coverage is a big benefit to employees and one they appreciate. If your company has 50 or more employees, finding affordable health insurance options is essential, especially if you plan to cover some or all of the costs for employees. Even companies with fewer than 50 employees benefit from health insurance coverage, especially if employees want it.

Read Also: What To Do When You Lose Health Insurance

Enrollment Options And Procedures

Once you have your health plan in place, youll need to manage all the details of signing up and dropping employees. Below, we explain how to do this and the rules you need to understand.

Adding and Dropping Employees

You can add employees to the medical plan when they are hired, usually on the first of the month following date of hire, or the first of the month after completing a waiting/probationary period. Once the employee chooses a plan, it stays in effect until one of two things happens:

- Open enrollment. See below for more information.

- Qualifying status change. Go to Making Enrollment Changes below for more information.

You can drop employees from the plan at any time during the year due to:

- Termination. Layoff, firing, retirement or quitting.

- Change in hours or classification. Employees who reduce their hours so that they are no longer eligible for insurance, or who move into a classification that is not offered insurance . Employees who lose coverage must be offered the opportunity to continue their medical coverage at their own expense.

Laws such as COBRA govern how employers may extend medical benefits to employees after termination in the tool box see Laws Related to Health Insurance for more information.

Open Enrollment

Making Enrollment Changes

Employees generally can make changes to their benefit elections during the year only if they have a qualifying status change. Events that qualify as a status change include:

Waiver of Coverage

Why Do Workers Want Employment

Workers want health insurance for themselves and their families in order to protect against the catastrophic costs of serious illnesses and to ensure access to medical care. For those without the time or income to save for it, insurance may be the only way to obtain medical care that would otherwise be unaffordable . Although it is possible for individuals to purchase insurance on their own, the high cost of private individual coverage, barriers to access to that coverage, and steep transactions costs help account for the value of group coverage to workers and thus explain why, in the absence of any viable alternative, workers demand coverage through their employers.

Employment-based coverage is far less expensive than individually purchased coverage, for several reasons. First, through pooling, employers can reduce adverse selection and administrative expenses. These cost advantages are significant, especially for large firms. Moreover, employers are able to offer relatively inexpensive health insurance because most people covered by employment-based plans are in good health. Those people who are most expensive to insurethe elderly and people with serious disabilities and chronic conditionsare typically covered by public programs such as Medicare and Medicaid, thereby reducing the cost of employment-based insurance .

Also Check: Will Health Insurance Cover A Breast Reduction

Selecting A Health Insurance Policy That Works For You

Once you have a good idea of what type of coverage to purchase and from whom, the next step is to apply for a policy. Work closely with the insurance company to gather data on the next steps. This generally will include providing all employee names and personal information.

Most often, the insurance provider will set up a time to come to the place of employment to enroll employees and educate them on their options. Others handle this through a set of forms each employee must complete.

Most of the time, a benefits package is issued, which contains all of the terms and features of the policy and instructs employees on their next steps. It’s common to see a booklet outlining information. There may be resources for setting up online accounts and how to start using the policy within this. Some companies have mobile apps, too.

The insurance company will then mail health insurance cards to the covered employees once the policy is active. They will also provide insight into available features, including preventative care services. Employees can then start using their policies as they want and need to do so.

Additional Details On The Employer Mandate

Employers with 50 or more full-time and/or FTE employees must offer affordable/minimum value medical coverage to their full-time employees and their dependents up to the end of the month in which they turn age 26, or they may be subject to penalties. The amount of the penalty depends on whether or not the employer offers coverage to at least 95% of its full-time employees and their dependents.

Employers must treat all employees who average 30 hours a week as full-time employees.

Dependents include children up to age 26, excluding stepchildren and foster children. At least one medical plan option must offer coverage for children through the end of the month in which they reach age 26. Spouses are not considered dependents in the legislation, so employers are not required to offer coverage to spouses.

Assume each employer has 1,000 full-time employees who work at least 30 hours per week.

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

Here are some considerations to help determine how part-time and seasonal employees equate to full-time and FTE employees.

U.S.-issued expatriate plans meet the employer mandate.

Effective July 16, 2014, the employer mandate no longer applies to insured plans issued in the U.S. territories . A territory may enact a comparable provision under its own law.

Also Check: How To Get Health Insurance For My Small Business

Improves The Hiring And Recruitment Techniques

When a business owner caters to health insurance needs, the employees will want to work for that business. The employer will stand out among other business owners in the market. Such businesses will also have a higher retention capacity for their employees.

An employee will also be loyal towards the business, and hence they will always ensure that they maintain companys quality service. When you offer health insurance to the employees, you can use the idea in the pace of increasing their salaries.

Health insurance is directly related to the satisfaction of an employee. Make sure that you come up with the best small business health insurance suitable for the employees. Ensure that you select the best insurance company to acquire the best services.