How To Choose The Best Plan For You

If youre considering short-term health insurance, be aware that if you had a qualifying life event, such as losing your job, youre eligible to enroll in an ACA-compliant plan through the marketplace at any time, so you may have options beyond a short-term plan. There are not that many circumstances in which you have to rely on short-term coverage, says Norris.

If youve decided short-term health insurance is right for you, there are several factors to consider to ensure youre choosing the best plan for your needs. Norris suggests asking yourself these questions:

Health Insurance In Alberta Cost: Explained

Canada spent 11.4 percent of the total Gross Domestic Production health care in 2009. This put it on the higher end of the OECD countries. This likely has to do with the lower unit cost of health care in this country.

On average, $1,200 is paid for an MRI in the US, while in Canada it costs $824. It also has to do with the lower administrative costs. For example, Alberta doctors spent approximately $22,205 annually dealing with single payer agencies, compared to $82,975 spent by American doctors dealing with the private insurance companies, Medicaid and Medicare.

How Do I Get Cheap Health Insurance In California

The best way to find the cheapest health insurance in California is to compare policies from multiple health care providers. By getting quotes from several companies, you’ll be able to understand which company has the most expensive rates and why. Finally, by evaluating what you need in a health plan, you will be able to select a policy that fits your needs at an affordable rate.

Don’t Miss: Starbucks Part Time Insurance

Getting Health Insurance Out Of Open Enrollment

Out of the open enrollment period, you can only sign up for a new plan if you have a qualifying life event. For instance, if you lose your job, you could then sign up for a new plan through the marketplace. Or, if you get married or have a baby, that would allow you to buy a new plan. Even moving to a new county may count.

How We Chose The Health Insurance Companies

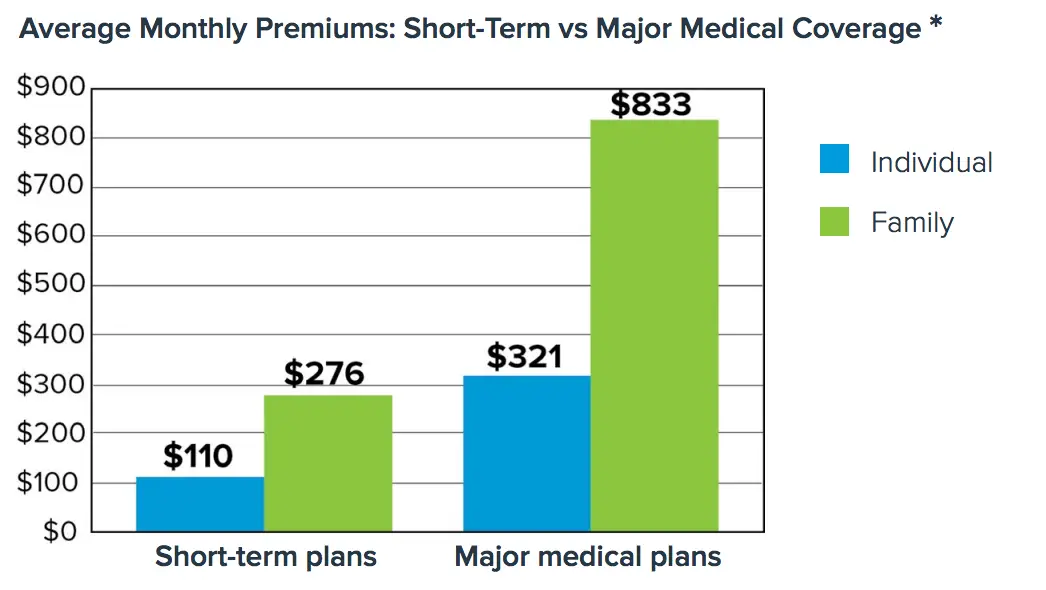

We looked at short-term health insurance plans through insurance companies and independent health insurance marketplaces to discover what options exist. We investigated the waiting periods, qualifications, coverage types, common exclusions, maximum limits, deductibles, and copays across the different plans. Our goal was to highlight some of the best short-term health insurance options offered through reputable insurance companies to help you compare and decide if short-term health insurance is a good idea for you.

Don’t Miss: Starbucks Dental Benefits

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Private Health Insurance Reviews And Guides To Help You Compare Policies

You can explore prices by using a comparison site such as Activequote.com.

Check out our reviews of individual private health insurance companies.

Or investigate lowering costs through our article Cheap Health Insurance. And you can check out our Health Insurance Offers to save up to 20% on your health insurance.

We have also written guides to the best life insurance, income protection insurance and dental cover, in case you are interested in these products.

If you are interested in pet insurance, Bought By Many offers £15,000 of vet fee cover on our Complete policy. You can get a quote here.

* Quotes obtained for an individual, 33 years old, living in OX2 9QH, insuring only themselves, with the lowest levels of cover selected for each cover option, and a £500 excess with Full Medical Underwriting. Note that each section will change one of these factors to see the effect on price – this is stated in each section. All prices obtained in October 2018, unless otherwise stated.

Recommended Reading: What Insurance Does Starbucks Offer

How Much Does Health Insurance Cost Without A Subsidy

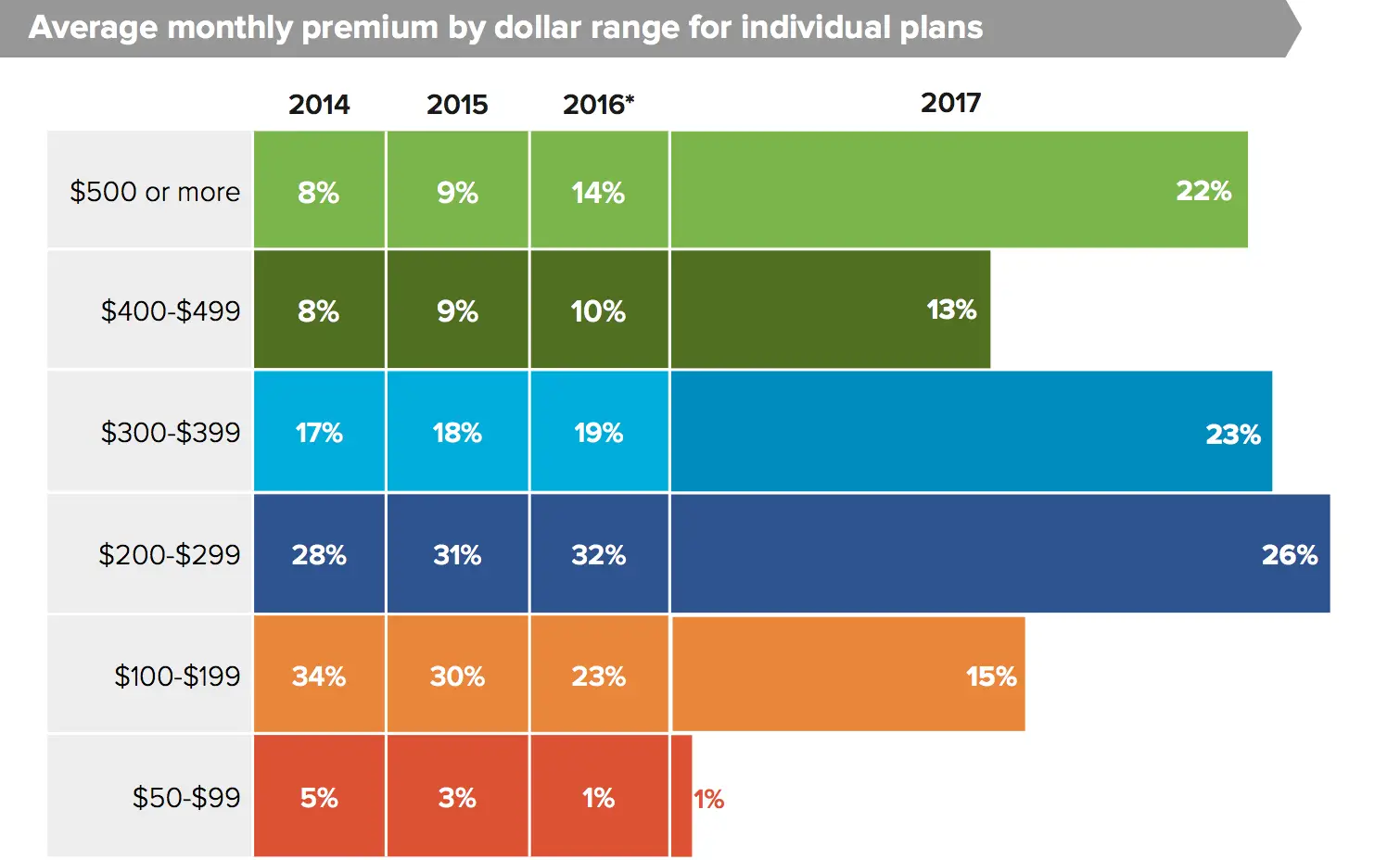

Health insurance premiums have risen dramatically over the past decade in response to the rising cost of health care services. The ACA helped to make health insurance accessible to more Americans than previously through the creation of health insurance marketplaces or exchanges and by providing government subsidies to lower income Americans.

However, most middle-class Americans dont qualify for subsidies. Its important to understand if you qualify for subsidies. And, if not, the average cost for non-subsidized health insurance you can expect to pay. eHealth can help walk you through health insurance costs without a subsidy, and when youre ready, get you started with an individual or family health insurance plan that fits your needs and budget

What Are The Costs For Cancer Cover

As a now common and significant illness, cancer is usually covered as standard to at least some degree. However, there are sometimes limits on specific treatments, specific drugs or time limits for which treatment will be paid for – so it is worth understanding the details. Once again, insurers take different stances with their cover – Aviva, for example, offers no flexibility in the cancer cover they provide under their ‘Cancer Pledge’.

AXA includes cancer cover and care within its core cover which gives full cover for experimental treatment, chemotherapy and radiotherapy and unlimited out-patient cancer treatment.

It allows you to opt for an ‘NHS cancer support’ option which removes this support and leaves you reliant on the NHS for any cancer treatment – doing so saved our 33 year old just £4 per month on their premium but this could be larger for older buyers or those from different postcodes.

Vitality also take the approach of providing their maximum cover as standard but allowing you to downgrade it if you should so wish. This lower level of cover applies a 12-month limit on the use of biological therapies and a three-month limit on hormone or bisphosphonate therapy when prescribed on their own. Our 33-year-old saved just a few pence per month by doing this.

You can compare UK prices for private medical policies using Activequote.com which allows a detailed comparison of health policies online.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Basic Health Insurance Terms

If youre just learning the ins and outs of health insurance, I feel your pain. Health insurance is complicated stufflike rocket-science complicated. You might not even know where to start.

Before we look at how much health insurance costs, lets break down some terms into plain English.

First, there are only two main kinds of health insuranceprivate and public.

Private coverage is health insurance through your employer, union or even the armed forces. You can also get it on your own through the governments marketplaceHealthcare.gov.

Public insurance is provided by the government. It includes Medicare , Medicaid or care from the Department of Veterans Affairs.

Your premium is the amount you pay monthly for your coverage.

The deductible is the amount you have to fork over before your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what you will pay in a year. For example, if your plans maximum out-of-pocket costs are $8,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts as a financial safety net so you dont totally break the bank from medical costs.

Would Insurance Be Cheaper Through An Employer

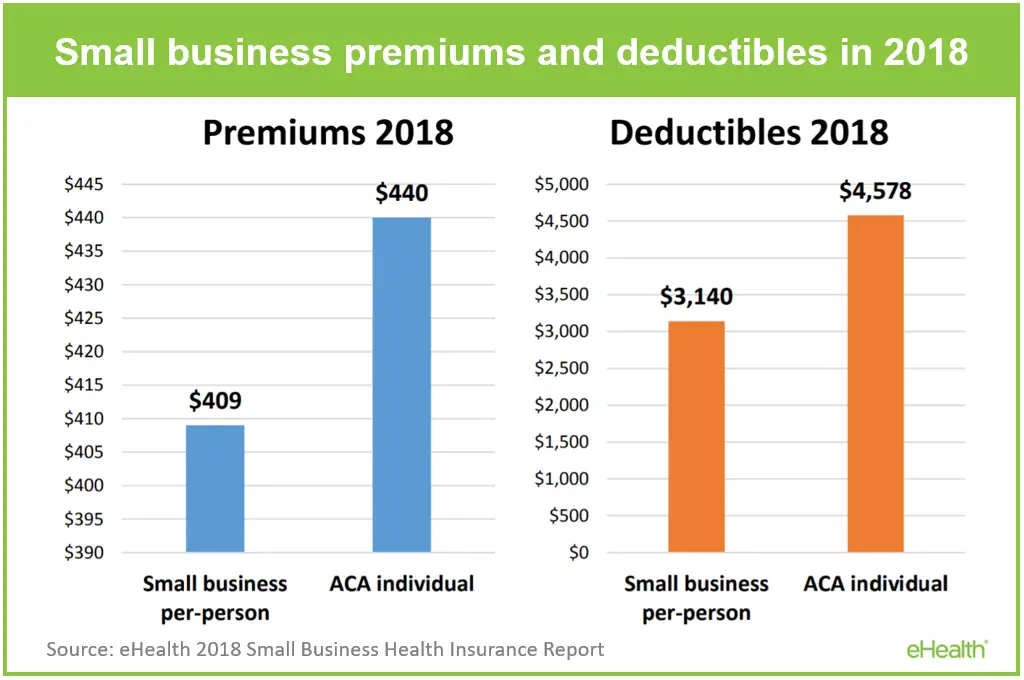

It’s no surprise that employer-sponsored health insurance is often cheaper than marketplace plans.

According to the Kaiser Family Foundation, covered workers kick in 17% of the cost of single coverage. This works out to an average of $101 for HMO plans and $111.25 for PPO plans. Compare that to the eHealth data, which showed that the average cost for a single person of any gender was $456.

Costs vary from state to state. For instance, in Hawaii, the average is $718 per year for the worker. But, in Massachusetts, the worker may pay $1,793 per year. This is at the high end of the cost scale. Below is the state by state breakdown from the Kaiser Family Foundation to see the differences by region.

Per the Census, 55.4% of people got their insurance through their employer in 2019.

Also Check: Can I Go To The Er Without Health Insurance

How To Reduce Costs

The amount and the speed at which premiums for health insurance in Canada are rising have individuals and families looking for ways to reduce their costs. While some may be tempted to drop their private insurance and just rely on their provincial plan, most people do recognize the benefits of health insurance.

If you’ve been looking for a way to reduce your costs, you should read Insurdinary’s article on how to tell which insurance company is the best for you.

Your Gender And Marital Status

Under the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.8 But other factors do make a difference. For instance, if youre married and have kids, you can expect to pay more to cover your familys needs. Note that if your familys income falls below a certain level, a tax credit could save you money.9

But marital status arent the only things that determine how much you could be shelling out. Here are some other things insurance companies look for.

Read Also: Does Starbucks Give Health Insurance

How To Choose Your Premium And Deductible

Premiums and deductibles work together. Plans with higher deductibles usually have lower premiums, while plans with lower deductibles often have higher premiums. One thing to consider when choosing a plan is how much you think you will use your insurance.

- I will use my insurance often: Do you have small children? Or do you or a family member get sick often or have an ongoing illness or disability? If you think you’ll need to see doctors regularly, you may want to consider a plan with a higher premium and lower deductible. You’ll pay more each month, but you’ll also meet your deductible faster which means lower total out-of-pocket costs.

- I will not use my insurance often: If you’re healthy and don’t go to the doctor often, you may want to consider a plan with a lower monthly premium and higher deductible. If you don’t think you will meet your deductible with the amount of health care services you may use, a lower premium may be the best way to keep your overall annual costs down.

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on November 24, 2020

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

You May Like: Starbucks Medical Insurance

Digging Deeper For Pricing Information

For more details, we consulted the 2020 Health Insurance Exchange Premium Landscape Issue Brief linked to the bottom of the press release. It reveals that 27-year-olds buying silver plans will see their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In fact, the benchmark plan premium for a 27-year-old in 2020 is a whopping $723 in Wyoming. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Mexicos 2020 benchmark plan premium for a 27-year-old is the lowest in the nation at $282.

All of these numbers only apply to the 38 states whose residents buy plans through the federal exchange at Healthcare.gov. Residents of California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York, Rhode Island, Vermont, Washington, and Washington, D.C. buy insurance through their state’s exchange.

How Much Does A Platinum Plan Cost

In 2021, the average premium for an ACA platinum plan is $709 per month for a 40-year-old person.1 Deductibles for platinum plans with a combined medical and prescription deductible averaged $0.2 Deductibles for plans with separate medical and prescription deductibles averaged $459.2 But, its important to note that platinum plan premiums vary by region, age, and tobacco use.

Don’t Miss: What Health Insurance Does Starbucks Offer

What Are The Specific Costs Involved

There are a number of costs associated with individual health insurance that you may have to pay, depending on the type of policy you have.

- A premium is the amount you pay your insurance carrier each month.18

- A deductible is the amount of money you must pay out of your pocket before your insurance begins to pay a benefit.19

- A copayment is a flat dollar amount you may have to pay for certain services

- Coinsurance is a percentage of covered health services that you are responsible for paying for once youve met your deductible.20

- An out-of-pocket maximum is the total amount of money you may have to pay for healthcare services in a particular plan year. 21

In some cases, a person may have to pay each of these costs. For example, a consumer may have a healthcare plan with a $1,000 deductible that costs $300 in monthly premiums. After hes met his deductible, he may have to pay $50 for a doctors office visit and 30% of the cost for any laboratory services. The good news is this consumer knows his total out-of-pocket costs will be capped by his out-of-pocket maximum in case he becomes seriously ill or injured.

How Much Youll Pay

Many variables affect how much youll pay for health care coverage, some of which are under your control.

How Much Are Life Insurance Rates For Seniors

Those buying life insurance in their 80s can pay over $1,000 a year for a $10,000 or $20,000 final expense or guaranteed issue policy. So youll skip the medical exam in exchange for high rates on low coverage.

Most insurers stop offering term life insurance at 75 or 80 years old, and permanent policies stop around age 75. However, each insurer has its own approval guidelines, so you may get approved with one insurer and not another.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

In 2020, health insurance premiums for unsubsidized individual customers were $456 per month on average, while family premiums averaged $1,152 per month. The average individual deductible was $4,364 the family deductible averaged $8,439.

Over the course of a year, the average health spending for a family of four in the U.S. was $25,011 in 2020. This figure includes spending on monthly premiums. It also includes meeting the deductible.

What Are The Other Aca Metal Levels

Each health insurance plan is given a metal level under the Affordable Care Act . Each category covers a percentage of your medical costs. Within each metal level, the percentage covered takes into consideration the cost of premiums, deductibles, copayments, coinsurance, and out-of-pocket maximums. So, the plan category with the highest percentage covers the most medical expenses.

Heres a look at the coverage percentages for each metal level:

- Platinum plans: 90%

- Gold plans: 80%

- Silver plans: 70%

- Bronze plans: 60%

Don’t Miss: Does Starbucks Have Health Insurance

Who Is Eligible For Short

Short-term health insurance provides limited coverage as a temporary bridge while you wait to qualify for an ACA-compliant plan. It can be used when you do not yet qualify for a group insurance plan or are waiting for the next open enrollment. Some people choose short-term health insurance as temporary coverage in case of an emergency if they are suddenly without coverage for various reasons. Here are some examples:

- Leaving a job that had a health insurance plan and not qualifying for COBRA plans

- Retiring early and looking for temporary insurance until qualifying for Medicare

- No longer qualifying for a group plan due to divorce

- Moving to a new state where an existing plan cannot follow and waiting until a new plan starts

- Students or young adults turning 26 who no longer qualify for their parents insurance

- People who want to have a plan with no network and find ACA plans too expensive

Anyone can apply for short-term health insurance. However, because short-term health is not ACA compliant, it uses medical underwriting and may refuse to insure you . Depending on which state you are in, coverage may only be available for a very limited time for a maximum of three years.