How Can You Save Money On Health Insurance Costs

If the cost of health insurance seems too steep for you, there are ways you can minimize the costs.

Under Obamacare, you may qualify for a subsidy, or premium tax credit that lowers the amount of money you must pay each month if your income falls below a certain level.22 If you are eligible for a subsidy, the amount you qualify for is based on how your income compares to the federal poverty level.

You can also purchase supplemental health insurance, which can cover some of your out-of-pocket costs such as deductibles and coinsurance.23

If you are self-employed and have a high deductible health plan , you can open a health savings account or a medical savings account 24 that lets you save pre-tax dollars to pay for qualified medical expenses.25

Factor in ALL Costs Before Deciding

When choosing a plan, factor in ALL costsnot just your monthly premiums, but also your out-of-pocket costs both before and after you meet your deductible.

How Much Does Health Insurance Cost Average Health Insurance Costs By Us State

Health insurance costs vary a lot between states. According to a 2019 report by the Commonwealth Fund:

- Hawaii has the cheapest individual health insurance contributions of any US state, at US$755 annually.

- Texas, Tennessee, South Carolina and Michigan all see personal health insurance costs close to the US national average US$1,427.

- Massachusetts was the most expensive state for health insurance. Here, individual contributions stood at US$1,903.

Ways To Get A Health Plan

There are many different ways that you can buy a health plan in Massachusetts. Many people get their health plan through their place of employment. For people that can’t do this, there are several other ways to get a health plan.

Through Your Employer or Union

In Massachusetts over 70% of all employers offer health insurance as a benefit to their employees. Most of these employers pay part of the premium and also offer a choice of several health plans. You can choose the health plan that is best for you from the choices offered.

Qualified Student Health Insurance Plan

If you are enrolled as a student in a Massachusetts college or university, you can buy a health plan through your school. This SHIP id designed for students and is only available while you are enrolled.

Directly from an Insurance Company

Massachusetts residents can buy health plans directly from an insurance company. And the company can’t turn you down if you have a health condition. Sometimes the company will direct you to purchase their health plan through an intermediary. An intermediary is a company that takes care of the enrollment and premiums.

MassHealth

If you meet certain income requirements, you may be eligible for MassHealth. This is a Medicaid program paid for by the state and federal taxes for eligible persons. You can learn more at or call 1-800-841-2900

Through the Connector

Medicare

Other Government Health Plans

Don’t Miss: Is Health Insurance Tax Deductible

What Are The Other Costs Associated With Health Insurance

Monthly premium costs are just a portion of the overall price of health insurance. It would help if you also considered the out of pocket expenses you need to cover before your health insurance covers the service and the annual deductibles. On average, the deductible on a family plan for 2020 rose 5% to $8,440 from the previous year. The median family deductible for a family of 4 last year was $7,770.

The following table highlights the most inexpensive health insurance policies for all the tiers, their maximum out-of-pocket costs, their deductibles, and of course, the monthly premium a 40-year-old individual would have to pay. These plans should be seen as a base to evaluate what type of coverage you require accurately and the expected associated cost of each tier.

| Plan Tier |

|---|

| $254 |

Single Male Health Insurance Options

Before you choose a plan, check these sources of health insurance coverage:

- Your employer.

- The marketplace.

- Your domestic partner’s health plan. Some people consider themselves single but don’t realize they may qualify for coverage as domestic partners.

- Your parents’ health plan if you are under age 26, or health plans through your school.

- If you are unemployed or have low income, review sources for affordable coverage.

Always check to see whether you qualify for tax breaks that can really help you save on the monthly costs.

You May Like: When Did Health Insurance Start In The Us

Countries With High Cost Of Medical Care

The United States has the highest cost of healthcare in the world, as the country spends significantly more per capita for its medical welfare than anywhere else in the world.

In Europe, Switzerland leads the way in terms of cost of care with the Netherlands and Germany close behind.

In Asia, Japan, China, Singapore, Hong Kong, and Korea have higher than average costs to treat medical conditions.

Check out the OECD website to know which countries spend high on health care. You can see how other countries in this list, including Iceland and Australia fare, compared to others.

Is there an underwriting process when applying for expatriate healthcare?

Medical underwriting, which pertains to the review of your medical history, is required by international healthcare companies when you apply for one of their global medical insurance plans.

If you are apply for an international family health insurance plan, all family members will have to provide their medical history.

For US citizens familiar with the benefits and protections provided by the Affordable Care Act , take note that it does not apply here. You can be turned down or denied coverage.

The underwriting process is generally done to obtain and review your medical history. It is not overly burdensome to do as most providers can complete the underwriting process in 3 to 5 business days. However, the process may take longer in case some unusual circumstances arise.

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

- $170$3,501

Read Also: Can I Apply For Medicaid If I Have Health Insurance

How Can I Get Affordable Health Insurance

The cheapest health insurance plan depends on your situation. First, check to see if you qualify for Medicaid coverage, which will always be the lowest-cost option available. If you are not eligible, then using ACA subsidies for individual health insurance coverage is the next most affordable option.

Administrative Factors And Health Insurance Cost

Estimates suggest 15 to 30% of healthcare spending in the USA is for administrative services, such as billing costs a large part of the difference between healthcare costs in the USA in Canada can be explained by administration spending. These might be higher due to the complex structure of healthcare in the USA, where federal, state and local governments, employers, insurers and citizens all have a share to pay.

Read Also: How Much Does Private Health Insurance Cost In California

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

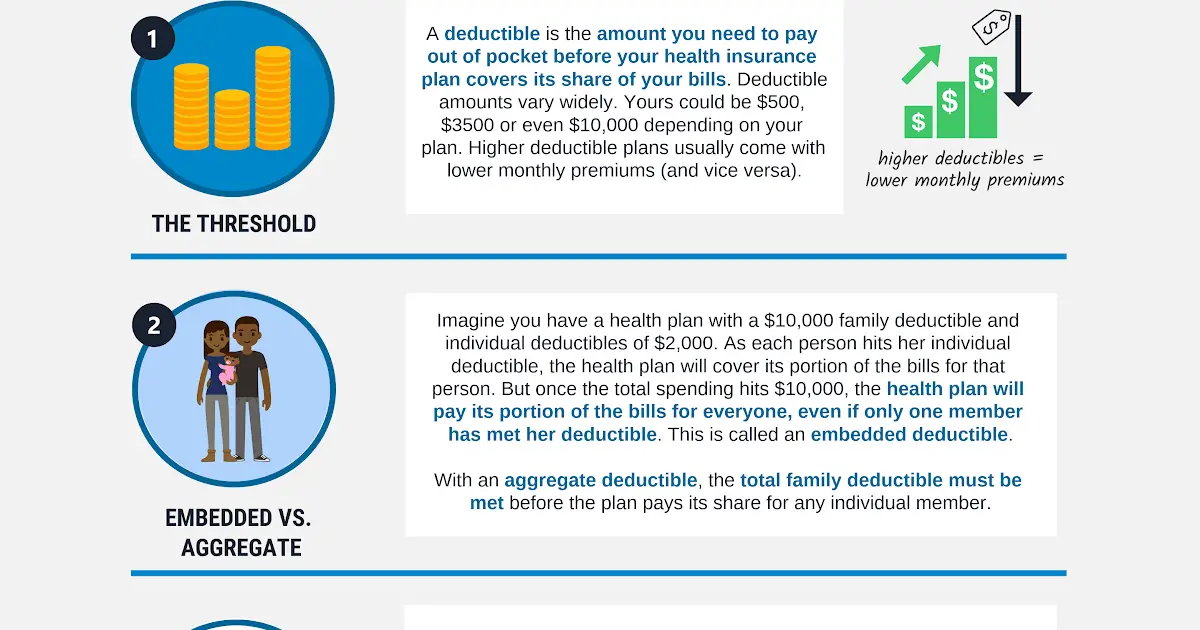

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type Silver Plans

Scroll for more

Dont Miss: Substitute Teacher Health Insurance

Also Check: Can You Prepay Health Insurance

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Lower Level Pricing Plans

While we cant give a definitive dollar amount, lower-level plans are obviously the most affordable and are attractive for those who dont want to pay a lot of money for services they might need one day.

If youre concerned about your provincial plan not covering enough and you want to have the peace of mind of having a safety net, this could be the right option for you, but be aware that many of these more basic plans have very limited coverage for prescription drugs.

The caveat with these plans is that they sometimes dont cover enough. You have to look at what youre paying for your policy, and the cost of things you need above and beyond that. It often happens that the extra expenditures cost more than a better plan would. Also, unexpected things like a broken tooth or prescriptions needed to treat an illness are harder to budget for.

Our website also offers a free quoting app to help you to calculate the costs of a health and/or dental plan.

Also Check: Is It Cheaper Not To Have Health Insurance

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

- $641

Recommended Reading: Is Health Insurance Really Worth It

Factors That Affect Premiums

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

Investopedia / Ellen Lindner

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

How Can I Buy Health Insurance

Health insurance companies cant decline you for coverage or charge you soaring premiums because youre sick or have a health condition, such as diabetes and heart disease. Before the ACA, people with health problems coped with higher premiums to cover a pre-existing condition or couldnt be eligible for an individual health plan at all.

Moreover, you may meet the criteria for premium discounts in the form of tax credits or subsidies to reduce your out-of-pocket health insurance costs if your income is low or moderate.

The ACA provides tax credits to assist you in paying for a marketplace plan for people who are up to 400% of the federal poverty level. Thats $51,040 for a single person, $68,960 for a couple, and $86,880 for a three-person family.

Subsidies can spare you hundreds of dollars a month. The Centers for Medicare and Medicaid Services estimated a 27-year-old at 150% of the federal poverty level would pay on average $57 per month for the lowest-cost Silver plan. Thats a savings of more than $300 per month if the plan didnt have subsidies. People with incomes below 138% of the federal poverty level may be eligible for Medicaid. Thats $17,609 for an individual and $36,156 for a family of four. The ACA permitted states to expand Medicaid for more people. Thirty-eight states have extended the program, which lets more people get Medicaid.

Also Check: Can I Enroll In Health Insurance Anytime

Is There Ever A Right Amount Or Coverage That One Needs To Look At

The right amount of coverage depends on several factors like the type of hospital you prefer, current age and health conditions of yourself and your family members, your affordability etc. Healthcare costs vary significantly by hospital and the facilities opted. For example, the cost of a knee replacement surgery nearly doubles if you opt for an imported implant instead of an indigenous one. This way, the size of your Health Insurance should be linked to your income and lifestyle.

While there is no ideal sum assured for Health Insurance policy for an individual, there are two market-broadly-accepted rules on its quantum. First, your health cover should be at least 50% of your annual income. And second, the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice. Most personal finance experts recommend a minimum health cover of Rs 5 lakh. You can have similar sum assured as a family floater to include your family members.

The rising costs of medicines and treatments may render your individual Health Insurance cover inadequate to cover all expenses. The basic Health Insurance policy may not cover expenses related to recovery phase such as extensive nursing care, counseling sessions, rehabilitation. But you can substantially enhance your health cover over and above your basic policy with tools like Riders and Top-Ups without corresponding increase in the premium.