Can An Employee Opt Out Of An Employer’s Health Insurance

In almost all situations, an employee can opt out of an employer’s health insurance. The exceptions to this rule are if the employer entirely covers employees’ health insurance premiums, or the employment or union agreement requires an employee to use the employer’s insurance.

An employee can opt out of their employer’s health insurance during the company’s open enrollment period. Should an employee choose to forgo their employer’s health insurance, they’ll need to sign up for a healthcare marketplace plan during the national open enrollment period . They can also purchase insurance plans directly from certain nonmarketplace insurers.

Two common reasons why workers opt out of an employer’s health insurance are that the plans have a high deductible or there is a limited range of medical services covered. For workers who forgo employer-sponsored insurance in favor of marketplace insurance, the premiums and plan options are determined in part by the individual’s income.

If the employee’s income is within 400% of the federal poverty line for their family size, they may be eligible for a tax credit that reduces healthcare costs by lessening premiums. Upon filing next year’s tax return, if the annual income exceeds the amount they listed on their marketplace application, they will need to pay the IRS the difference between their new tax credit amount and the previous year’s. Likewise, if income decreases, they will get a refund.

Esi: Accident Of History

Although the funds employers use to purchase insurance are widely recognized to come partially from reductions in employees take-home pay, the purchase is known as Employer-Sponsored Insurance , likely because employers chose the plans offered to employees. Employees thought that good jobs included health care benefits, although employers in effect paid for insurance through reductions in employee compensation.

ESI was created with an obscure post-World War II regulation that enabled employers to purchase health insurance for their employees using tax-free income. Yet, people who bought health insurance individually could not deduct the expense from their income taxes, except under rare circumstances. Tax policy changes behavior, and so it was for the health insurance market. Businesses thrive when the right personnel are doing the right jobs, but ESI forced the HR VPs to become health insurance shoppers.

They got their best deal from the big insurance companies and offered a few plans they hoped could meet their employees diverse needs. In 2019, only one-fifth of insured workers in all firms had a choice of more than two plans and 36%overall had no choice. Although substantial research indicates that increasing the selection of plans and insurers increases employee welfare and controls costs, some employers may worry that increasing choice will increase administrative costs. But the fees for defined contribution pensions, typically with 27 choices, decreased over time.

Blind Decisions Are Bad Decisions

This is why Remodel Health has developed our proprietary Health Benefits Analysis for your team. This secure and compliant evaluation of your organization will provide you with the exact outlook for what getting started with managed individual health benefits can look like. Before you dont click on the link, dont worryits only $35 per employee. Yeah, thats it! While it would normally cost about $9,500 to accomplish this, you can get it done cheaper and more easily than ever.

Head on over to remodelhealth.com/analysis to get started today in the future of health benefits!

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.

Don’t Miss: How To Apply For Health Insurance In Arizona

Why Is Health Insurance Important

Almost 2/3rds of bankruptcies in the United States were caused by medical bills. Health insurance is not just insuring your health it insures your wealth. Even after the passage of the Affordable Care Act, most people in the US receive their health care through their employer. Insurance can be difficult to obtain if you retire before youre eligible before Medicare. The ability to have access to any sort of coverage between retirement and Medicare is a huge benefit. Not just for federal employees, but also their spouses, and family members.

How Much Should You Contribute To Your Employees Health Insurance Premiums

If youre reading this, its probably because your health insurance rates are going up, you feel like youre out of options, and youre considering pushing more costs onto your employees. Dont do it. Why? For starters, lets remember why you offer benefits in the first place to attract and retain talent, right? That said, pushing additional costs onto your employees will undermine your efforts to attract and retain talent, and according Employee Benefits News, it can cost as much as 33% of an employees annual salary to replace them. Second, we need to understand why your rates are going up in the first place. Has your broker explained the underlying factors and provided you with proven risk management strategies to address them? If your rates are going up, its most likely because you dont have the right pieces in place. With the right strategies in place, there is no need push more expenses onto employees. In fact, many companies are able to reduce costs without reducing provider choice or raising deductibles or copays. Contact us if youd like learn how our high-performance health plans bend the cost curve.

Don’t Miss: How To Get A European Health Insurance Card

Health And Worker Productivity

The existing studies found little evidence that workers with health coverage are absent less often than are workers without coverage. For example, the Rand Health Insurance Experiment found that the effect of insurance coverage on work loss days was small and insignificant . Similarly, despite years of research outside mainstream economics , there is almost no direct evidence regarding the effect of health insurance coverage on morale and worker productivity and the firm’s performance. In those fields, although the link between employment practices and productivity is widely recognized, the linkages between productive behavior and psychosocial job structure have remained unclear in the eyes of many observers . However, there is compelling research demonstrating that health insurance has a powerful influence on access to health care, the timeliness of care, the amount and quality of care received, and fundamental health . People without health insurance are less likely to seek medical care, less likely to get it, and, as a result, more likely to be in worse health and have higher death rates than are people with insurance coverage . Uninsured persons have a much greater risk of health decline and death, with several studies showing them to be 1.2 to 1.5 times more likely to die than are insured persons .

Are Benefits Better Than Higher Pay

Higher pay means improved cash flows and buying power for immediate purchases or investments. Greater benefits, which may be challenging to put an exact dollar amount on, often provide a security net for a health event or during retirement. Employer benefits differ significantly in terms of scope and generosity.

Don’t Miss: Why Did My Health Insurance Go Down

Know Your Hra Options

QSEHRA: a Qualified Small Employer HRA allows small employers to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free. This means employers get to offer benefits in a tax-efficient manner without the hassle or headache of administering a traditional group plan and employees can choose the plan they want. The key thing to remember here is that all employees must be reimbursed at the same level. The QSEHRA is designed for employers with less than 50 employees to reimburse for premiums and medical expenses if the plan allows.

ICHRA: an Individual Coverage HRA allows employers of any size to reimburse any amount per month for healthcare expenses incurred by employees on a tax-free basis, starting at any time of the year. The distinguishing element of this HRA is that employees can be divided into an unlimited number of classes, like hourly vs. salary or even based on location, and be reimbursed at different levels. The ICHRA is for companies of any size. There are no limits to how much an employer can offer for reimbursement.

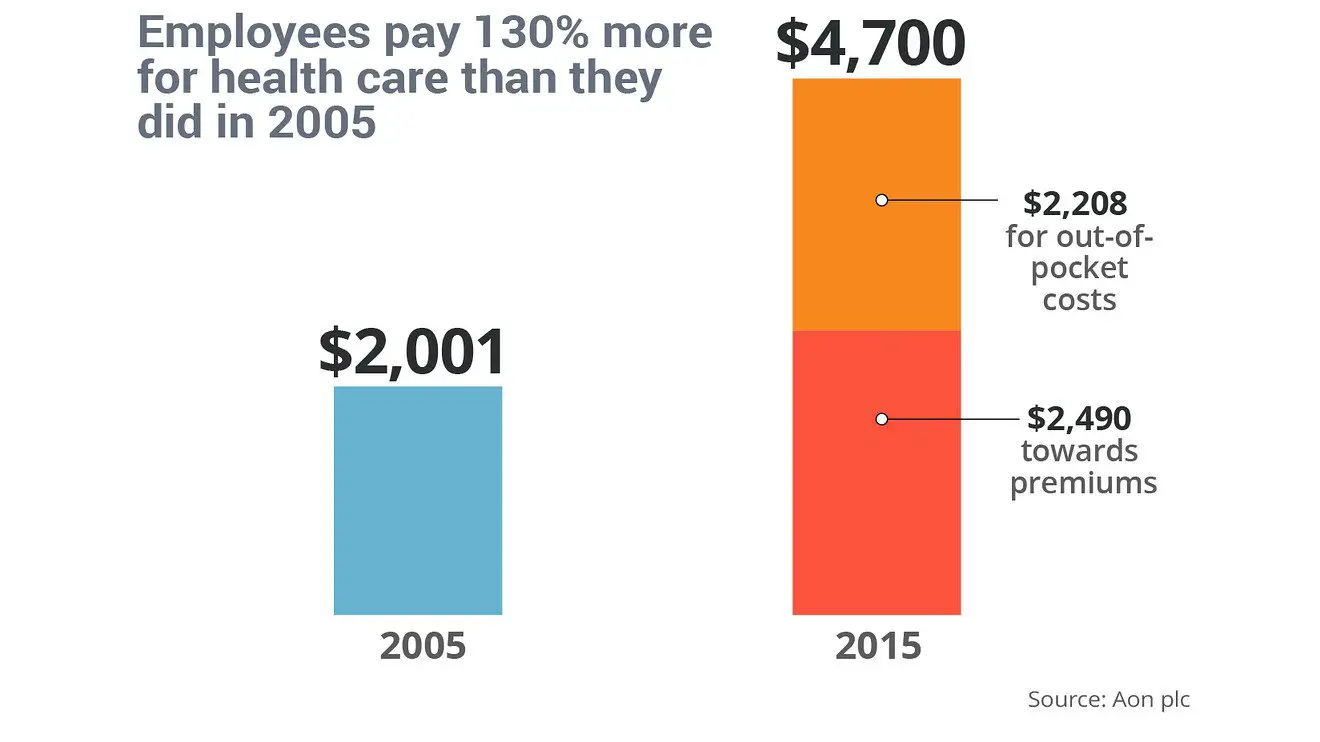

Health Insurance Costs Rising

All the noise pointed people away from the real meat of the Fraser studies. That was how much health costs had increased and how fast they were increasing.

For that average family, the cost of health insurance rose 1.4 times faster than their incomes did between 2006 and 2016. Incomes were up 26% in that time, but health insurance was up 37%.

To put it in perspective, the cost of shelter rose 36% during that time and the cost of food rose 30% during that time. Insurance costs rose 1.3 times as fast as these basic costs.

You May Like: How Much Is High Deductible Health Insurance

Fehb And Medicare Parts A & B

You can enroll in Medicare part A when youre 65. Youre expected to enroll in Medicare Part B when you turn 65 if you are retired. If you do not enroll at age 65, you will be penalized if you try to enroll later. You should know that while you can continue your FEHB benefits for life, your FEHB insurance company expects you to enroll in Medicare Part B. Therefore, if you dont enroll in Medicare Part B at age 65 because you participate in the FEHB, you may find an unpleasant surprise in the form of the coverage gap when you visit a doctor.

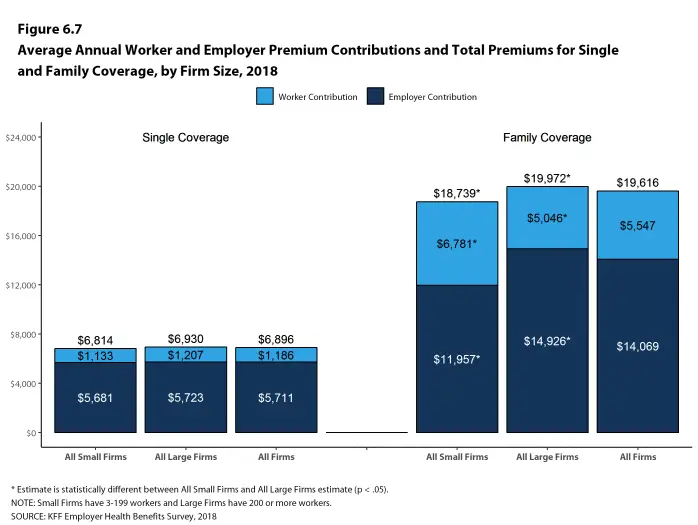

How Much Do Health Benefits Cost Employers

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

Read Also: Do Real Estate Brokers Offer Health Insurance

Paycheck Deductions: How Much Do Employees Pay For Health Insurance On Average

56 percent of Americans got health insurance from their employers in 2017. If you have an employer-sponsored health insurance plan, you will have a certain amount deducted from your paycheck to cover your premiums.

Understanding how much is taken out of your paycheck to cover health insurance is essential to figuring out how to best pay for your coverage. If your employer-provided plan is too expensive, it may make sense for you to change to a private plan.

Its important to ask how much do employees pay for health insurance also because you want to make sure that youre not overpaying your employer.

Does A Federal Employee Get Free Health Insurance After Retirement

Unfortunately, federal employees do not receive free health insurance upon retirement. However, federal employees can keep their current federal employee health benefits plan upon retirement. Employees continue to pay the employee portion of the premium. The government pays the remainder of the retirees premium at the same rate as they do for current employees. .

Don’t Miss: Is It Cheaper Not To Have Health Insurance

Factors That Affect The Cost Of Offering Employees Health Insurance

As mentioned above, there are several factors that can impact the cost of offering health insurance to your employees. Some of the main factors that can cause the price to fluctuate include your employee demographics, your location, the size of your group, other healthcare inflation factors, and the type of plan you decide to purchase for your company.

Small Employers Contribute Significantly Less To Family Coverage

While large employers contribute a significant amount to employees healthcare, small employers tell a different side of the story. 27% of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. Similarly, 28% of covered workers are in a plan where they must contribute more than half of the premium for family coverage, compared to 4% of covered workers in large firms.

A likely reason for this is that small businesses simply cant afford to make the kind of contributions larger employers can. After all, even a 50% contribution may be more than whats available in a small employers benefits budget.

Considering that only 48% of firms with three to nine workers offer coverage compared to virtually all firms with 1,000 or more workers that offer coverage, small employers may also feel that they dont have enough employees to make investing in health benefits worth it at all. in order to offer a health benefit at all.

Don’t Miss: Can I Put My Wife On My Health Insurance

How To Reduce Costs

The amount and the speed at which premiums for health insurance in Canada are rising have individuals and families looking for ways to reduce their costs. While some may be tempted to drop their private insurance and just rely on their provincial plan, most people do recognize the benefits of health insurance.

If you’ve been looking for a way to reduce your costs, you should read Insurdinary’s article on how to tell which insurance company is the best for you.

Group Or Individual Coverage Hras

Within a group or stand-alone coverage HRA, employers can offer HRA options that meet the legal requirements and offer financial relief to employees. The group coverage HRA targets small employers that offer a high-deductible health plan. Group coverage HRAs can be compatible with other group health insurance programs.

With group-affiliated HRAs, employers select a monthly benefit allowance of tax-free money to offer each enrolled employee. Employees then purchase what they need throughout the month, saving their receipts for the employer to review. Once the review process is complete and the expense is approved, the employer reimburses the employee up to the monthly cap they’ve set.

Employers execute the stand-alone program the same way they would a group coverage HRA. The employee has a set amount of pretax money each month, and the employee submits receipts for their qualifying expenses. Also, there are no IRS-regulated contribution caps on stand-alone HRAs, so the employee can be reimbursed for any qualifying expense the IRS lists.

Read Also: Can I Pay For My Employees Individual Health Insurance

Employer Vs Employee Contributions To Health Insurance

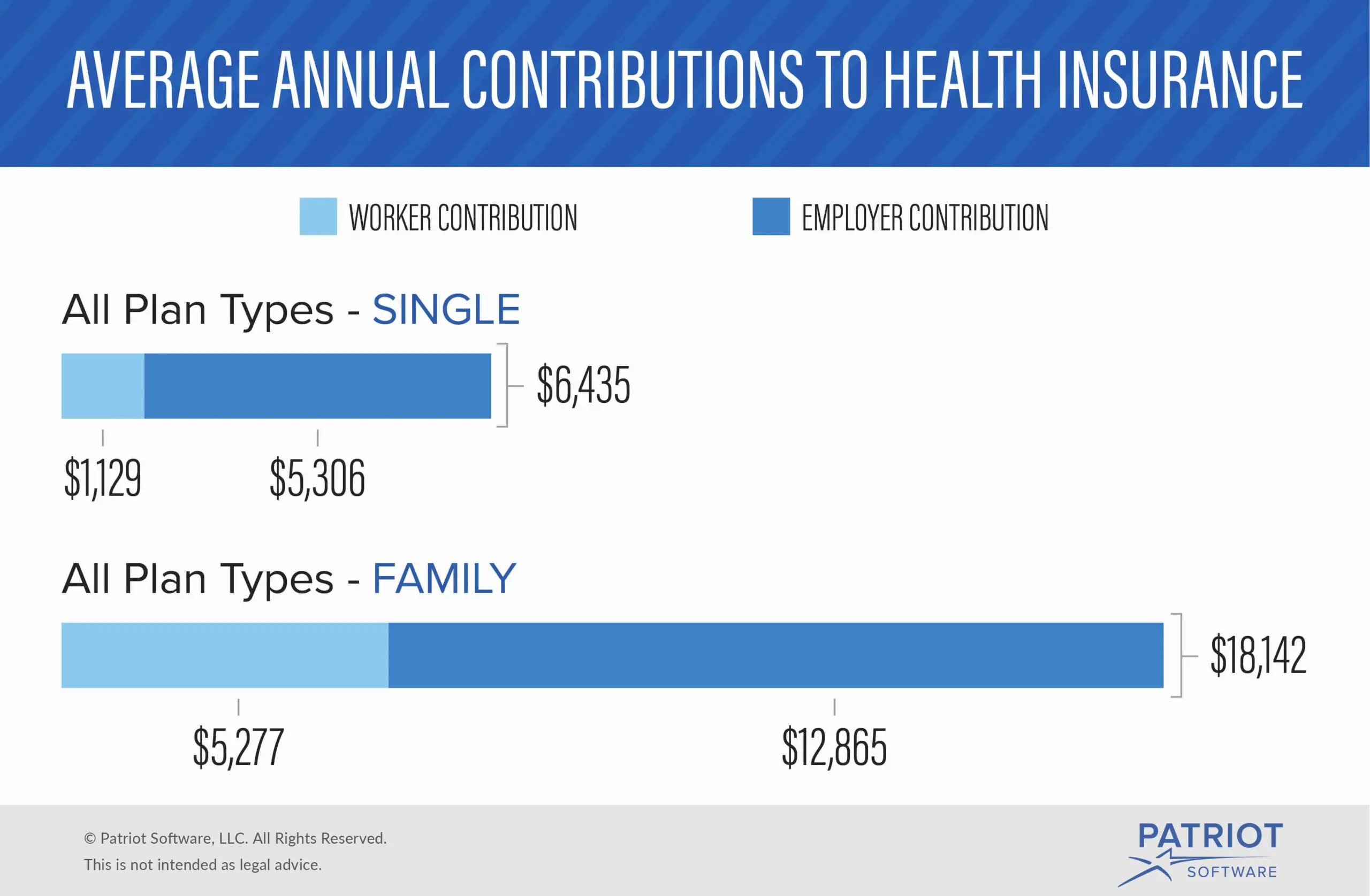

In 2019, employers contributed an average of:

- $5,946 for single coverage. Employees contributed $1,242.

- $14,461 for family coverage. Employees contributed $6,015.

The numbers above reflect all plan types, but theres a fair amount of variety between each plan type:

- For HMOs, the average employer contributed $6,180 for single coverage, while employees contributed $1,058. For family coverage, the split was $14,668 and $6,009, respectively.

- For PPOs, the average employer contributed $6,222 for single coverage, while employees contributed $1,454. For family coverage, the split was $15,045 and $6,945, respectively.

- For POSs, the average employer contribution was $6,112 for single coverage, while the employee contribution was $1,072. For family coverage, the split was $12,894 and $6,945, respectively.

- For an HDHP with a savings option, the average employer contribution was $5,341 for single coverage, while the employee contribution was $1,071. For family coverage, the split was $14,114 and $4,866, respectively.

Digging Deeper For Pricing Information

For more details, we consulted the 2020 Health Insurance Exchange Premium Landscape Issue Brief linked to the bottom of the press release. It reveals that 27-year-olds buying silver plans will see their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In fact, the benchmark plan premium for a 27-year-old in 2020 is a whopping $723 in Wyoming. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Mexicos 2020 benchmark plan premium for a 27-year-old is the lowest in the nation at $282.

All of these numbers only apply to the 38 states whose residents buy plans through the federal exchange at Healthcare.gov. Residents of California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York, Rhode Island, Vermont, Washington, and Washington, D.C. buy insurance through their state’s exchange.

You May Like: Can I Change My Health Insurance Plan Covered California

Employer Health Insurance Continuation Laws

If your employer does offer group health insurance, you have the right to continue it after you leave employment. The federal Consolidated Omnibus Budget Reconciliation Act requires employers with 20 or more employees to allow their employees to continue health care coverage at their own expense.

If you quit, are laid off, or are fired for reasons other than gross misconduct, you can continue to receive your group health coverage, as long as you pay the full amount of the premium.

If My Employer Does Not Provide Health Insurance Benefits Or If I Am Working Only Part

Yes. Several programs are available for people without insurance in California.

Medi-Cal is Californias joint federal-state Medicaid program that provides free or low-cost health coverage. In general non-elderly adults with household income up to 138 percent of Federal Poverty Level , pregnant women with household income up to 213 percent of FPL, and children from birth through age 18 with household income up to 266 percent of FPL qualify for Medi-Cal. You can also get Medi-Cal if you fall within certain categories. To see if you are eligible for Medi-Cal, contact the Department of Health Care Services.

Childrens Health Insurance Program may provide health coverage to children in families that do not qualify for Medicaid. Similarly, Medi-Cal Access Program may provide health coverage to pregnant women with household income more than 213 percent of FPL.

Covered California Health Exchange is the California agency offering subsidized health insurance plans in accordance with the Affordable Care Act . Covered California helps individuals and families obtain health coverage that includes the minimum essential benefits required by Obamacare. If your household income is at or below 400 percent of FPL, Covered California may qualify you for subsidized plans with reduced premiums. If your household income is between 138 percent and 250 percent of FPL, Covered California may qualify you for extra discounts that reduce their cost for medical services .

You May Like: How Does Health Insurance Work Through Employer