Health Insurance Metals Explained

alarm

As we move from the summer to the winter Olympics, it seems only fitting to talk about bronze, silver, and gold. Like the Olympic metals, types of health insurance plans are categorized into metal levels. Unlike Olympic metal categories, health insurance metals have nothing to do with quality or performance. Rather, health insurance metals help people understand the amount of cost-sharing that goes on between the plan holder and the insurance company in any given plan.

Remember that the exact amount of cost-sharing can vary from plan to plan. According to healthcare.gov, at each metal level, youll pay a different percentage of total yearly costs of your care, and your insurance company will pay the rest. Total costs include premiums, deductibles, and out-of-pocket costs like co-payments and co-insurance.

When choosing a plan, youll want to think about how much you are likely to use your insurance coverage. Consider things like how often you see a doctor, what medications you take, and whether you foresee scheduling any elective surgery during the year to come. If you think youll use your healthcare plan frequently or have prescription medications you take regularly, you might want to consider a higher metal level that offers lower deductibles and makes your costs easier to predict . If you dont expect needing many healthcare services, a lower-premium/higher cost-share plan might be a better fit.

Will I Still Have Copays After My Out

Typically, you will not have to still pay copays after you meet your out-of-pocket maximum. However, there can occasionally be discrepancies on this with individual plans. Make sure you familiarize yourself with the details of your health plan to understand your financial obligations for your healthcare. And again, the HealthSherpa Consumer Advocate Team is always on-hand to go over any details about your plan while you shop and after you enroll.

What Are Obamacare Metal Plans

The Affordable Care Act set out to standardize small-group and individual health insurance policies by creating a metal ranking for policies, with each level based on actuarial value.

All new small group and individual market health insurance plans including plans sold in the exchange as well as plans sold outside the exchange must fall into one of the metal levels .

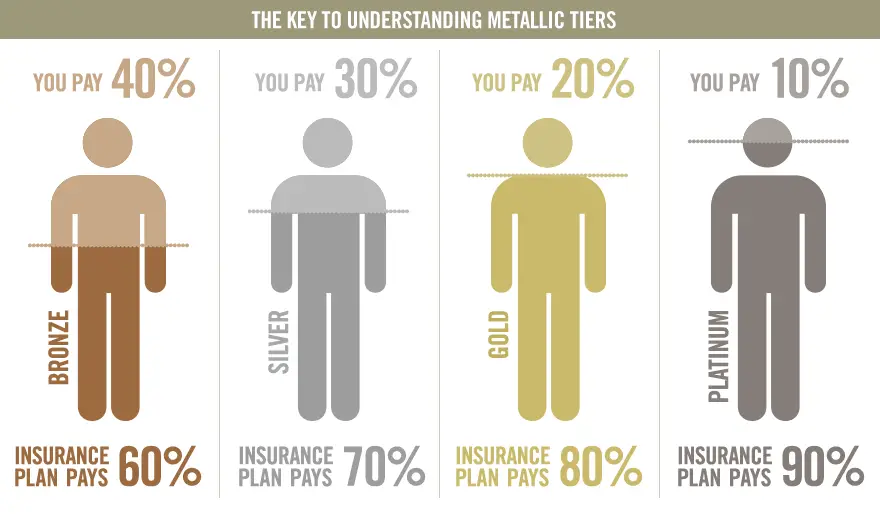

With a Bronze plan, the plan members pay roughly 40% of costs. That drops to 30% on a Silver plan, 20% on a Gold plan, and 10% on a Platinum plan.

But these percentages apply to an entire standard population they arent applicable to specific individuals who have coverage under the plan. People with very low overall healthcare spending will typically pay a larger share of their own costs , while a person with exorbitant health care costs during the year might pay only a tiny fraction of the total costs and the health plan will pay the vast majority of the total.

And a person who is healthy enough to only need preventive care during the year might end up with 100% of her health care costs covered by the plan, regardless of what metal level she has, since specific preventive care is covered with no out-of-pocket costs regardless of the metal level.

So across a standard population, bronze plans pay an average of 60% of costs, silver plans pay an average of 70%, gold plans pay an average of 80%, and platinum plans pay an average of 90% .

- Bronze: 56-62%

- Gold: 76-82%

- Platinum: 86-92%

Recommended Reading: Eligibility For Aarp

Need Help We Can Help You

Contact your broker or Health Net sales representative.

Member information is available on provider.healthnetarizona.com.

Already have an account?Log in now

Note: HNA providers can log in by using their existing HNA user name and password to access Allwell and Ambetter member information.

Need to create a new account?

Member information is available on provider.healthnetcalifornia.com.

Already have an account?

Need to create a new account?

Member information is available on provider.healthnetoregon.com.

Already have an account?

Need to create a new account?

< Back

What Does Metal Tier Cost Sharing Imply For You

The health insurance metal table reveals the percentages shared between you and the insurer. This way, it makes it easy to analyze the best-suited plan for you and your family. The category of plan that needs you to pay more money from your pocket would not be a wise option if you need medical facilities more frequently. However, they are a good option for you if you are sure that you will not require medical facilities too frequently.

The cost-sharing percentages do not imply the actual cost you pay for the medical expenses. In fact, they indicate the average cost that your insurer pays throughout the year for those services. This percentage is called the Actuarial Value. We have discussed the details of the actuarial value in the next section.

The effective costs that you shall pay over the year depend greatly on your insurance plan and the services you have utilized. We can understand this through an example.

Let us assume you have a Bronze insurance plan, so you will be covered for 60% of your medical care. This will be a good choice if you do not have too many medical visits. Therefore, you will be paying for 40% of the medical expenses you incur.

However, if you have an ailment requiring frequent visits to the physician, this plan may not be the ideal choice. In that case, opting for a Gold or a platinum plan will be a wiser decision.

Don’t Miss: Evolve Health Products

General Differences In The Metal Levels

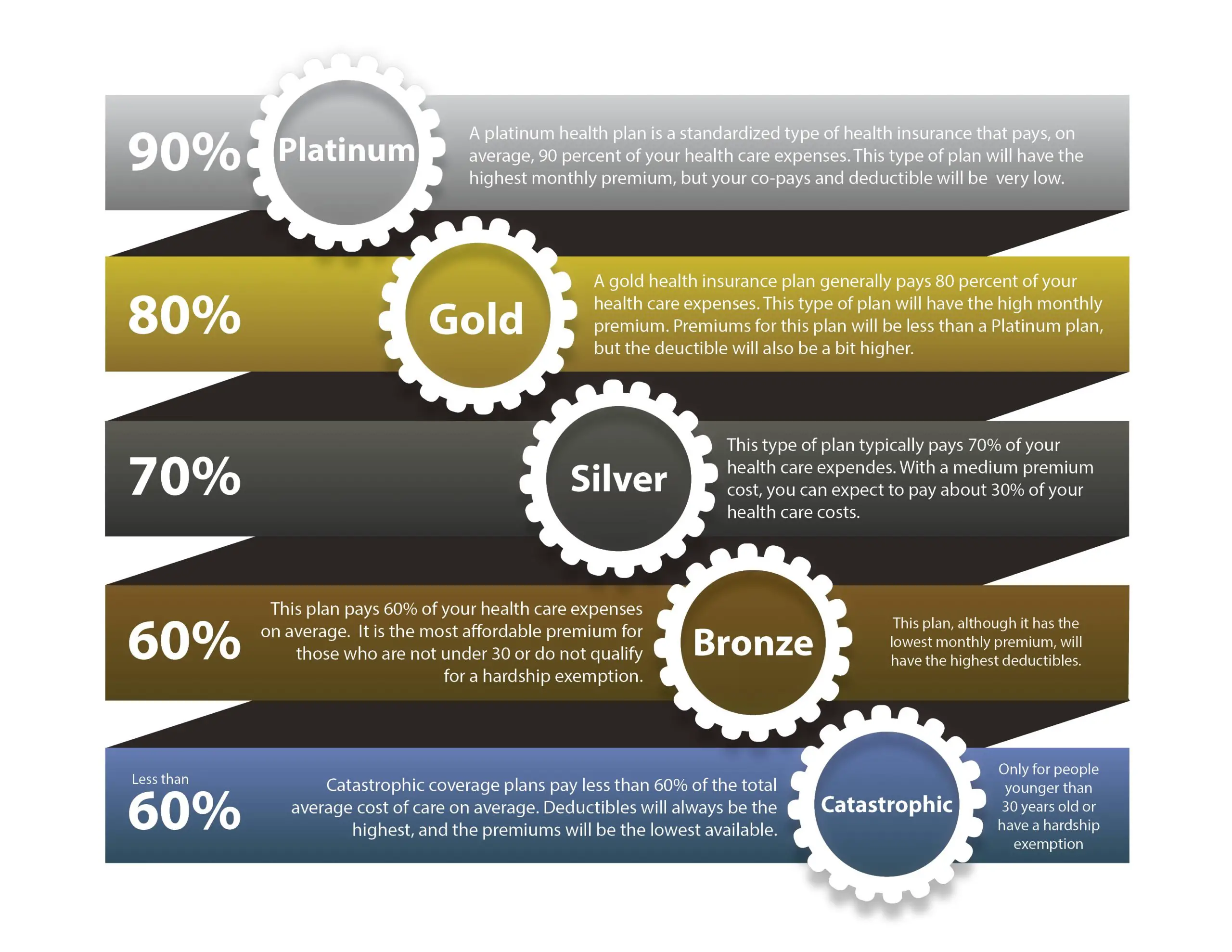

- Gold or platinum plans: these plans generally have higher monthly premiums but pay more of your costs when you need care.

- Silver or bronze plans: these plans cost you less per month, but pay less of your costs when you need care.

- Catastrophic plans: these plans have high deductibles and cost you less per month than a bronze plan, but pay the least when you need care. You must be under 30 years old or have a hardship exemption to purchase a catastrophic plan.

$150 Billion To Expand Affordable Home Care

The plan provides funding for a Medicaid program that supports in-home health care, helping to reduce a backlog of people waiting to receive subsidized home care and improve wages for providers. Thousands of seniors and disabled Americans have been unable to receive care they need, including more than 800,000 on state Medicaid waiting lists, the White House says. Many home care issues have been exacerbated by the COVID-19 pandemic.

Donât Miss: Does Health Insurance Cover Tooth Extraction

Don’t Miss: Starbucks Health Coverage

Can I Get A Tax Credit If I Get Insurance From An Employer

In general, people who get insurance through an employer probably wonât use a state Marketplace. And the Marketplace is the only place where this kind of financial aid is available.

Some people, though, may want to buy a health plan through a Marketplace even though an employer offers affordable insurance. In that case, the employee will not be eligible for tax credits or subsidies, even if the familyâs income falls within the ranges listed above.

In some cases, an employerâs plan may not be affordable enough. If either of the statements below is true for you, you may enroll in a health plan in a state Marketplace:

- None of the health plans available from your employer covers at least 60% of your average health care costs.

- The cost of enrolling in a plan from your employer would cost more than 9.6% of your annual income.

If one of these statements is true and you do enroll, you may be eligible for a tax credit if your household income falls within the eligibility ranges listed above.

Read Also: Where To Get Health Insurance When Unemployed

Catastrophic Plans: High Deductibles Plus Primary Care And Preventive Care

- Catastrophic plans cover all of the essential benefits defined by the ACA, but with very high deductibles, equal to the annual limit on out-of-pocket costs under the ACA .

- They must still limit members out-of-pocket costs for in-network services to no more than the annual out-of-pocket maximum that applies to all plans .

- Catastrophic plans cover up to three primary care visits per year before the deductible is met .

- And like all ACA-compliant plans, catastrophic plans cover certain preventive care with no cost-sharing.

- Other services beyond preventive care and some primary care will be paid by the insured until the deductible is met.

You May Like: Do Substitute Teachers Get Health Insurance

How To Choose The Right Metal Level For Your Health Insurance Plan

Cost is usually a decisive factor for individuals and families shopping for a health insurance policy.

All of the plans offered on the Health Insurance Marketplace and through most of the carriers are qualified health plans , meaning that they have been certified and contain the essential health benefits required by the Affordable Care Act .

The differences between the metal plans Bronze, Silver, Gold, or Platinum lie in the cost schemes of each. The category you choose affects how much your premium will cost each month and what part of the bill you will pay out-of-pocket for services like hospital visits or prescriptions.

What Metal Tier Cost Sharing Means For You

The percentages in the table above are useful because they give you a quick way to compare health plans. Plans that require you to pay more of your own money probably arent the best option for someone who knows they will need to regularly visits the doctor, but they may be perfect for someone who is healthy and doesnt expect to go to the doctor very much.

However, the cost-sharing percentages are not what you will actually pay for your health care. Theyre based on the total average costs that an insurer will pay over the course of a year for covered services and benefits.

The actual costs that you pay will depend on which health care services you use during the year and the details of your individual plan. Lets say you have a Bronze plan, you go a whole year without getting needing medical care, and you only see your doctor for an annual physical. You will pay for less than 60% of your care over that year. On the other hand, an illness that requires major medical care and surgery could leave you paying for more than 60%.

Learn more about the different types of health insurance.

Recommended Reading: Starbucks Health Insurance Benefits

What Is A Catastrophic Plan

The catastrophic plan is a plan that covers a tiny number of primary care visits each year. Usually, they cover at least 3 primary care visits before the deductibles are met. Beyond this, the coverage is available only for people under the age of 30. They are offered at very low premiums and high deductibles.

Catastrophic plans can provide respite in emergencies such as an accident or an injury. People over the age of 30 can avail of this plan only when they have an affordability exemption.

If you are eligible for a premium tax credit, opting for a Bronze or Silver plan could be fruitful.

Deductibles in the case of a catastrophic plan are incredibly high. Once you have paid the deductibles, the insurer pays the remaining amount without any copays or coinsurance.

Types Of Health Insurance

Your out-of-pocket expenses will vary based on the type of health insurance you get.

-

HMO: Lower premiums, but no out-of-network coverage. Youll also need to pay to see your primary care doctor just to get a referral to see your specialist.

-

PPO: Higher premiums, but some coverage available out of network. No referrals required to see your specialist.

-

EPO: Combines features of HMOs and PPOs by offering specialist visits without referrals but no out-of-network coverage.

Also Check: Are Health Insurance Companies Open On Weekends

Recommended Reading: Starbucks Health Insurance Options

Considerations And Approach To Impurity Limits For Cosmetics

Acceptable limits for heavy metals vary according to:

- the subpopulation of interest

- the amount of product used

- the site of application

Assessment of dermal absorption by a single component in a cosmetic product is complex and depends on factors such as the concentration in the product, the amount of product applied, the length of time left on the skin and the presence of emollients and/or penetration enhancers in the cosmetic productFootnote 18. Given this complexity, and the lack of well-conducted dermal absorption studies incorporating these factors, determination of heavy metal limits in cosmetics based on human health risk alone is a challenge.

There are currently no international standards for impurities in cosmetics. Limits have been established in GermanyFootnote 19. Rather than taking a risk-based approach, the German limits are based on levels that could be technically avoided. Thus, heavy metal impurities were limited to anything above normal background levels.

The German federal government conducted tests to determine background levels of heavy metal contents in toothpastes and other cosmetic products . Based on their studies, it was determined that heavy metal levels in cosmetic products above the values listed below are considered technically avoidableFootnote 19:

- Lead: 20 ppm

How Does Actuarial Value Work

The percentage of total average expenditures that a health insurance plan will pay for covered benefits for a year is called actuarial value.

The Affordable Care Act mandated that plans begin grouping themselves according to pre-determined actuarial values of 60%, 70%, 80%, and 90%. This segregation or grouping was done to make it easier for customers to analyze and evaluate the plans based on their requirements. Large group plans, which the employers mostly offer, are exempt from the tiers however, they must have an actuarial value of 60%.

To develop the actuarial values, the insurance companies compute and add up all of the possible expenses that a customer will be paying. These costs include copays, deductibles, and coinsurance.

The actuarial value of a plan, on the other hand, is just the average amount you will pay. You may pay a higher or smaller percentage of your total charges. Your real expenditure will vary depending on your plan and the services you utilize throughout the year.

Also Check: Starbucks Insurance Cost

Do You Have To Be Poor To Get Zero

No, not at all! Its true that premium subsidies are income based, and that people with household income up to 150% of the poverty level are automatically eligible for zero-premium plans at both the Bronze and Silver level this year.

But the availability of zero-premium plans also depends a lot on where you live and how old you are, and can extend to folks with income much higher than 150% of the poverty level.

As an example, consider a single 60-year-old in Montgomery, Alabama, who earns $55,000 this year. She would be eligible for a subsidy thats large enough to completely cover the cost of the two Bronze plans that are available in her area. She could choose to pay more for a Silver or Gold plan, but she also has the option to enroll in a zero-premium plan.

$55,000 for a single person in Montgomery would certainly not be considered poor. In fact, it amounts to 427% of the poverty level, which would have been too high for any subsidy eligibility at all before the American Rescue Plan was implemented .

But if this same 60-year-old lived in Detroit, Michigan, she would have to earn no more than about $35,000 in order to qualify for a zero-premium plan. This is because the benchmark plan is much more expensive in Montgomery , and the difference in price between the lowest-cost plan and the benchmark plan is much smaller in Detroit than it is in Montgomery. So the subsidy amount doesnt cover as much of the cost of the lower-priced plans in Detroit.

What Are All Of My Health Insurance Options

Don’t Miss: Starbucks Benefits Package

Catastrophic Plans Are Not Hsa

A health savings account is a type of tax-advantaged account to which people can contribute pre-tax money as long as theyre covered by an HSA-qualified high deductible health plan . In laymans terms, catastrophic and high-deductible are often used interchangeably. But in health policy, they each have strict definitions:

- HDHPs that allow a member to contribute to an HSA are not allowed to cover any care before the deductible, with the exception of preventive care , and the maximum out-of-pocket amount for an HDHP in 2022 is $7,050 for an individual .

- Catastrophic plans are required to cover at least three primary care visits before the deductible, and they have deductibles that are higher than the allowable limits for HDHPs .

So by definition, catastrophic plans cannot be HSA-qualified, and catastrophic plan enrollees cannot contribute to HSAs. If you want to be able to contribute to an HSA, youll need an HSA-qualified plan. These plans can be found at the Bronze, Silver, and Gold levels, depending on the area and the insurer offering the plans, but they cannot be catastrophic plans.