Learn More About The Benefits And Options For Freelancers

Look for health care coverage that suits your freelance work and lifestyle. The options presented in this article are intended to start you in the right direction of finding an affordable health insurance plan that meets your needs. There are numerous plans on the market, so we also recommend seeking advice from insurance agents.

At ZenBusiness, we understand youre being pulled in every direction as a new business owner. Let our dedicated team take care of the details of starting a business so you can focus on succeeding.

Best Medical Insurance For Self Employed

Buying health insurance takes some research. Heres our best advice for streamlining that process:

How Do You Calculate Your Self Employed Health Insurance Deduction

Contrary to what you may think when youâre thinking about the self-employed health insurance deduction, there is no set limit to how much the deduction is. A lot of times when it comes to taxes, people think there are set amounts or percentages that define everything. But that isnât always the case

For example, as a self-employed person, you might be used to paying both income taxes as well as self-employment taxes. Both of those numbers are set percentages, right? Of course, there are different tax brackets and such, but itâs all just a percentage. But when you go to take the self-employed health insurance deduction, it isnât a percentage or an amount.

The maximum amount that you can deduct is the full amount that you paid for health insurance premiums. But the deduction cannot exceed the total net profit of how much you brought in as income during the year through your self-employment. And if you lost money during the year, you are unable to deduct anything at all. If that seems a little confusing, letâs run through a detailed example to make it crystal clear.

Don’t Miss: How Long After Quitting Job Health Insurance

What Does It Take To Qualify For An Advance Premium Tax Credit

Its based on the size of your family and how your income compares to the governments current official poverty level. You can use our subsidy calculator to determine what kind of savings you would qualify for in 2021.

You might be able to get help paying for your health plan from the government or the state of New Jersey. See if you qualify or learn more about Health Care Reform and how it affects you.

If your income is low enough, you may even qualify for New Jersey FamilyCare .

Designating Your Plan Sponsor

If you qualify, you get the health insurance deduction whether you purchase your health insurance policy as an individual or have your business obtain it. If you purchase your health insurance plan in the name of one of your businesses, that business will be the sponsor. However, the IRS says you may purchase your health coverage in your own name and still get the self-employed health insurance deduction. This may be advantageous because it allows you to pick which of your businesses will be the sponsor at the start of each year. Obviously, you should pick the business you think will earn the most money that year.

Moreover, if you have more than one business, you can have one purchase medical insurance and the other purchase dental insurance and deduct 100% of the premiums for each policy, subject to the income limits discussed above. This will be helpful if no single business earns enough income for you to deduct both policies through one business.

Read Also: Kroger Health Insurance Benefits

Average Costs Of Health Insurance For Freelancers

The cost of health insurance plans for freelancers will vary depending on the plan you choose, your age, location, pre-existing conditions, and whether youll be enrolling as an individual or with your family members.

Here are some terms you also need to be familiar with to better understand your health insurance plan coverage:

- Premiums: Your health insurance premium is what youll pay yearly or monthly to your provider to be enrolled in a plan.

- Deductibles: This is the amount of money youll need to pay out of pocket for any medical service you receive before your plan starts covering the costs. Deductibles reset every year for most insurance policies.

- Copays: A copayment is a fixed amount that youll be expected to pay for any service covered by your plan. Each service covered by your insurance will have a specific copay amount. Youll start paying copays after you meet your annual deductible.

- Coinsurance: Coinsurance is like a copay, but instead of a fixed amount, youll pay a percentage of the cost of any medical service you receive.

- Out-of-pocket costs: This refers to any medical expense that you must pay for on your own. Deductibles, copays, and coinsurance are considered out-of-pocket costs.

- Out-of-pocket maximums: All plans set out-of-pocket maximums. When this amount is met, any medical expense covered in your policy will be paid for by your plan.

What Else Goes Into Health Insurance Price Besides The Monthly Premium

Whenever we think about how much insurance costs, we are typically focusing on the monthly insurance premium. If you were to ask a friend or coworker what they pay for insurance, thatâs almost always the number that youâll hear. But that isnât the entire story when it comes to health insurance costs.

Letâs take a look at a few other things that will affect how much self-employed health insurance will truly cost you before we get into specific plans.

You May Like: Sidecar Health Dental

Putting It All Together

Yes, self-employed health insurance options are a bit complicated for freelancers to navigate. You might want to combine several of the ideas above to help keep your healthcare costs down. There are many options. Thats why you should start learning about your alternatives so you can make an informed decision.

One note: The open enrollment period in November/early December isnt the only time of year you can get health insurance! If you have a life event such as getting married, adopting, or losing your job-related coverage, you may be able to enroll in the off-season. So if you move into freelancing months from now, you may still be able to get into a plan at that time.

Im not going to lie here: Freelancers can get coverage but self-employed health insurance costs. Depending on your family size and situation, maybe a lot. It can be a bit of a shock, if youve been at a company that picked up all or most of the premiums. This is one reason freelancers need to earn high hourly rates you have costs you didnt have as an employee.

My personal advice, as the child of an insurance salesman? Dont go uninsured. Youll be at risk of losing everything if you have a medical crisis.

How have you gotten self-employed health insurance for freelancers? Leave a comment and share.

Coverage From A Partner

If youre not married to your partner, but you live together, you might still be able to get coverage on their plan. Some companies, as well as some city and state governments, offer health coverage to the domestic partners of their employees. Definitions of domestic partners vary, but in general, the term refers to couples who have lived together in a committed relationship for a specified period of time.

In its 2019 report on employer health benefits, the KFF found that 43% of all employers that provided health benefits offered coverage for same-sex domestic partners and 35% offered it for opposite-sex partners. However, this number had fallen since the previous year, when it was 45% for both same-sex and opposite-sex partners.

In the KFF survey, large companies were slightly more likely to say they offered coverage for domestic partners. However, that doesnt necessarily mean small companies are less willing to provide this coverage. According to the KFF, more than one in five small companies said the issue had simply never come up.

Also Check: Minnesotacare Premium Estimator Table

Best With Dental: Ambetter

-

Strict late payment terms

-

Limited to 25 states

Unemployed individuals often find themselves having to purchase separate dental insurance or forego it entirely. With Ambetter, you can add dental and vision coverage in some states. Coverage is ACA-compliant and can be purchased on the Marketplace. In our test markets, Ambetter was consistently among the three cheapest insurers.

In addition to low-cost dental coverage, some of the benefits youll enjoy with Ambetter include Virtual Teledoc visits, a 24-hour nurse advice line, and a healthy living rewards program . Through the program, youll be rewarded for positive habits like getting a flu shot and watching educational videos. The rewards you earn have a dollar value that can be put toward your premiums or used to pay for utilities, rent, childcare, and more.

Like many health insurers, Ambetter offers coverage only in certain geographic areas, with 25 states currently served. The companys digital tools also fall a bit short compared to competitors with a slightly outdated web portal and no mobile app. If you do sign up for a policy, make sure you can afford the premiums the company has a strict late payment policy and will cancel your coverage if you fall more than 30 days behind.

Should I Take Public Or Private Health Insurance

As a freelancer in Germany, you have the possibility to choose between the two, public and private health insurance. However, when it comes to which one you should purchase, the decision is entirely up to you.

In addition, you should keep in mind a few things before making your choice. If you plan on moving to Germany permanently, it would probably be best for you if you joined the public healthcare system. As you get older, the monthly premiums are likely to change in the private healthcare sector. Moreover, adding additional cover would also have its own challenges since the risk status increases with age.

Freelancers registered with private health insurance providers, on the other hand, have a few more advantages. This means, if your income is relatively low, you may choose to begin with a basic private health insurance tariff and later on switch to a more comprehensive one. You may combine the tariffs of different services according to your needs and create a health insurance package that is perfect for you.

It is not easy to suggest a health insurance plan that fits perfectly to everyone. However, DR-WALTER has numerous affordable health insurance plans you might want to check out, like DR-WALTER.

PROVISIT by DR-WALTER is suitable for foreign citizens who plan to stay in Germany for up to two years. It provides you with comprehensive coverage, consisting of:

- travel health insurance

Also Check: Can You Buy Dental Insurance Anytime

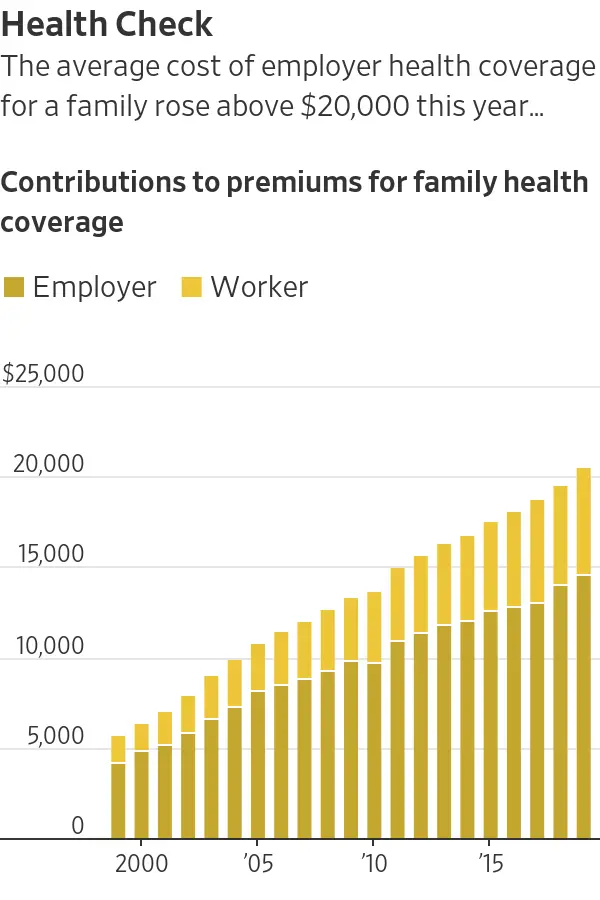

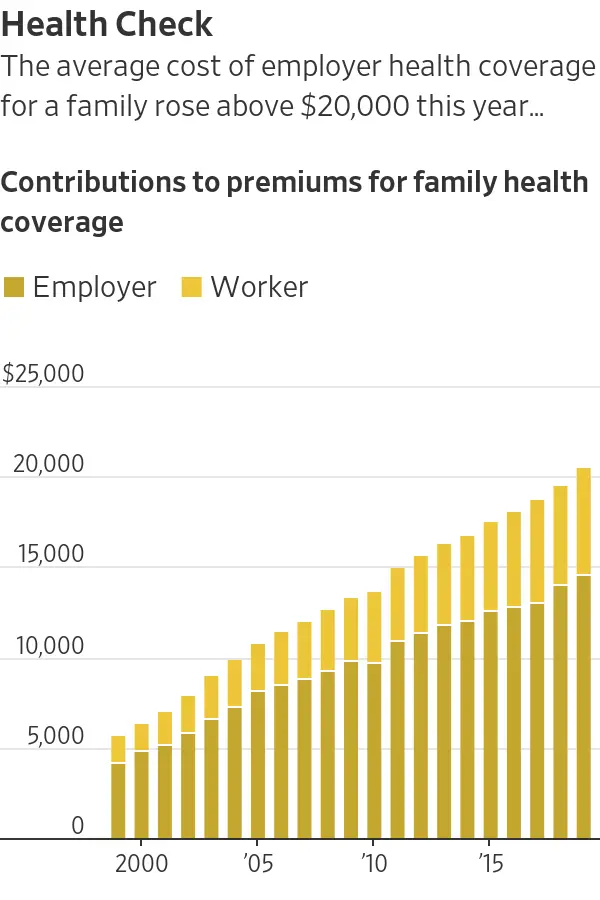

How Has The Average Cost Of Employer

Average employer-provided health insurance costs haveincreased modestly in recent periods. The KFF 2019 survey found that theaverage single premium increased by 4 percent, and theaverage family premium increased by 5 percent over theprevious year.

However, a long-term view of employer-sponsored healthinsurance costs reveals a larger change in the costs over time. According tothe KFF report, the average premium for employer-sponsored family healthcoverage increased 22 percent over the last five yearsand 54 percent over the last ten years.

Although average premium costs have risen over the pastseveral years, employer-provided health insurance may often be a more affordable option than individual healthinsurance coverage.

Source:Kaiser Family Foundation 2019 Employer Health Benefits Survey

Canada Pension Plan Disability Benefits

The Canada Pension Plan provides monthly payments to people who contribute to the plan during their working years.

You may be eligible for CPP disability benefits if:

- you contributed to the CPP for a certain number of years

- you’re under 65 years old

- you have a severe and prolonged mental or physical disability

- your disability prevents you from working on a regular basis

The benefits include payments to children of a person with a disability.

Apply as early as possible if you think you’re eligible for CPP disability benefits. Quebec residents may be eligible for a similar program called the Quebec Pension Plan . It may take several months to process your application.

If you applied for CPP or QPP disability benefits and were told that you’re not eligible, you can ask to have your application reviewed or considered again.

Once you reach age 65, your CPP disability benefit will automatically change to regular CPP payments. Your regular CPP payments may be less than the CPP disability payments you got before.

If so, consider:

You May Like: Evolve Medical Insurance

Can An Llc Deduct Health Insurance Premiums

If you are a shareholder in an LLC taxed as an S corporation, you can deduct health insurance premiums as long as you own at least 2 percent of the companys shares and receive a salary from the company. Alternatively, the company can pay the premium and include the amount as income in your W-2.

References:

|

What Is The Cheapest Health Insurance

Short-term and catastrophic coverage plans are usually the cheapest health insurance options for anyone who recently has lost their job. However, there are downsides to both. Short-term coverage lasts only for up to one year and is banned or restricted in some states. Youll need to be younger than 30 years old or meet low-income requirements to qualify for catastrophic coverage, and even if you do, those low premiums come at the expense of high deductibles.

Recommended Reading: Proof Of Va Health Insurance For Taxes

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

Insurance Policies That Cover Critical Illness

Critical illness insurance plans provide coverage for a limited number of life-threatening disorders. There may be long-term treatment or even a lifestyle modification required for some conditions. Critical Illness coverage is purchased by the consumer, rather than by the hospital, and the payment is based on that coverage rather than the actual hospital expenditures.

To use the money, you can adjust your lifestyle or take new drugs. When you are unable to work because of illness, it might supplement your income, naics workers comp codes. Rather than requiring proof of initial medical expenses, these insurance pay out depending on the diagnosis of the illness.

Recommended Reading: Starbucks Insurance Benefits

Hire A Real Estate Agent Or Broker To Help You

In order to assist you in choosing a suitable policy, an insurance agent or broker has the knowledge and expertise to do so. To locate a private insurance broker with market experience, use the Find Local Assist tool offered by the federal government, naics workers comp codes. If you want the most options and the least biassed advice, you might want to engage with a broker who offers both market and non-market plans.

When health insurance plans are sold, brokers are reimbursed by the insurance companies. Consumers do not pay higher rates to work with brokers because they do not impose fees, naics workers comp codes. Broker and agent are two different terms used to describe the same person who sells insurance products from a variety of different companies, naics workers comp codes.

On private enrollment sites, insurance firms and web brokers may also give you options through private insurance brokers. As a result, if you want subsidies, you must apply through Healthcare.gov or your state’s exchange, naics workers comp codes.

The government’s health insurance navigators will only show plans available on Healthcare.gov. There is no charge for a navigator’s assistance with any of these plans, which are all subsidy qualified, naics workers comp codes.

How Do I Get Health Insurance If I Lose My Job

There are many ways to get health insurance if you lose your job. The first is COBRA, which allows you to keep your previous employer’s insurance plan but can be expensive. Becoming unemployed also qualifies you for a special enrollment period, which means you can purchase any new insurance policy for up to 60 days after you lose your job. In some states, short-term health coverage is an affordable option that can keep you insured for up to 364 days while you look for new work.

Also Check: Do Part Time Starbucks Employees Get Benefits