The Two Types Of Hras That Business Owners Need To Know About

Lets look at them briefly.

The individual coverage HRA has several advantages over traditional group plans that may be appealing to some employers. For instance, the reimbursement model gives employers greater ability to control costs and provides employees with more options to choose from. Key advantages of the ICHRA include:

- Works for businesses of any size

- Can reimburse both premiums and expenses

- Note the reimbursement limits

In America How Much Do Employees Pay For Health Insurance

From the insurance plan your company chooses to your employees health conditions, many factors affect how much employees pay for health insurance. Before detailing these items, lets take a look at some facts that reflect, on average, what these payments look like in America. This data is from the 2020 National Compensation Survey by the U.S. Bureau of Labor Statistics :

- The average cost for health care per employee-hour worked was $2.64 for private industry workers.

- 86% of workers participated in medical care plans with an employee contribution requirement, where employees paid $138.76, and employers paid $459.70 per month.

- 72% of workers participating in single coverage medical plans with contribution requirements had a flat-dollar premium, and the median amount was $120.06.

Kaiser Family Foundation reported in their 2020 Employer Health Benefits Survey: In 2020, the average annual premiums for employer-sponsored health insurance are $7,470 for single coverage and $21,342 for family coverage.

In terms of premiums, the report found that most covered workers contribute to the cost of the premium for their coverage .

Specifically, for covered employees at small firms, the average premium for single coverage is $7,483 and $20,438 for family coverage. The average annual dollar amounts contributed by covered workers for 2020 are $1,243 for single coverage and $5,588 for family coverage, the report continues.

Your Parents Or Spouses Health Insurance Plan

Many employers allow a person to add spouses and children to their health insurance plans.

This is a great option for stay at home parents, children that havent found jobs yet or even a spouse between jobs.

An employer does not have to subsidize coverage for family members even if they subsidize coverage for their employees.

That means:

The additional cost to add a spouse or child to a policy could be much different than the premium for the employee only.

A spouse or child can be added during the plans annual open enrollment period.

If you lose coverage due to a qualifying event, you may be able to get health insurance from your spouse or your parents during the year, too.

Your spouse or parent can inquire with their companys HR department to see what options they have. If youre trying to qualify for insurance through a qualifying event, act fast.

Qualifying events may only allow you to make changes for 30 days. This can be different from marketplace health insurance.

Recommended Reading: What Is The Average Monthly Cost Of Health Insurance

You May Like: What Health Insurance Does Starbucks Offer

How Much Do Employers Pay For Health Insurance

If youre an employer offering health benefits for the first time, allocating a part of your budget to pay for a health benefit is fundamental, not only to retain talent, but also attract new employees.

KFF found that in 2021, the average health insurance cost for employers was $16,253 annually, or 73% of the premium, to cover a family and $6,440, or 83% of the premium for an individual. These premiums for both families and individuals have increased 22% over the last five years and 47% over the last ten years.

Employee Health Insurance: How Much Should The Employer Pay

Health insurance is a benefit most full-time employees expect, but businesses struggle to find the right balance between cost and benefit.

By: Sean Peek, CO Contributor

There are several ways that small businesses can offer employee health insurance benefits in an affordable manner.

Health insurance is a standard benefit that many full-time employees expect from their employers. However, for many businesses, this often means devising the best way to offer this benefit while keeping costs as low as possible.

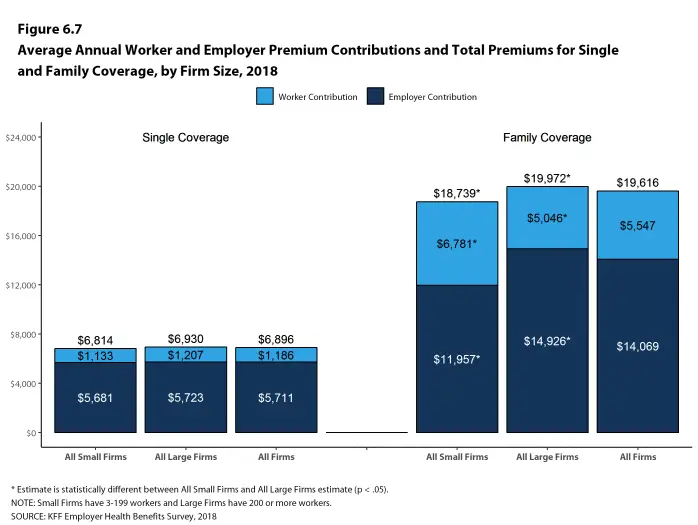

Reports have indicated that 2018 employer health insurance costs are up 5% from 2017, so its crucial to find a plan that not only works for your employees, but for your businesss long-term health as well.

If youre looking to provide health insurance to your employees, or you want to change your existing offering, its important to understand the various plans and costs associated with the process.

You May Like: What Is The Cheapest Health Insurance In Florida

Don’t Miss: Do Part Time Starbucks Employees Get Benefits

Picking The Right Option For You

If youve found yourself without health insurance, you should investigate all of your options.

You may find you only have one option to get the coverage you need. In this case, you have to decide whether that option is worth the cost.

In other cases, you may find you have several options that meet your needs. If youre lucky enough to be in this situation, make sure you fully understand each option first.

Then, compare your options.

In particular, you should look at:

- What is covered

How Much Does Fehb Cost In Retirement

FERS retirees must elect a survivors pension of 50% or 25% in order for the spouse to be eligible for FEHB coverage in retirement after the beneficiary dies. The 50% election will cost you 10% of the entire pension and the 25% election of the survivors pension will cost you 5% of the entire pension.

Do federal employees get health insurance after retirement? After retirement, federal employees enjoy a monthly pension and medical coverage. To qualify for coverage, you will need to meet minimum service requirements, including being covered as a federal employee for at least five years. Your spouse will receive coverage without the five-year rule.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Case Study: Cantilever Architects London

Cantilever Architects is a small team of London based architects consisting of 5 members that want a Business Health Insurance scheme that covers all of their employees.

Theyre looking for a scheme with full outpatient cover, psychiatric cover, £100 excess, and moratorium underwriting. Below are some rough quotes of how much this type of policy will cost from each of the different insurers on an annual basis as well as per employee.

|

Insurer |

|---|

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2019:

- $1,655: Average general annual deductible for a single worker, employer plan

- $2,271: Average annual deductible if that single worker was employed by a small firm

- $1,412: Average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from Healthcare.gov., Plan Year 2020 |

|---|

| Bronze |

| $1,430 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Also Check: Starbucks Part Time Health Insurance

Do Employers Have To Cover Family Members

With a group insurance plan, employers usually offer coverage to legal spouses and dependent children.

The ACA requires you to provide dependent coverage to age 26. If you do not, you might have to pay a penalty. You can choose to cover dependents over 26 years old, but you are not required to.

Employers are not obligated to pay premiums for dependents. However, you can contribute towards premiums for dependents. Or, you can require employees to pay the full premium cost for dependents.

You are not required to cover your employees spouses. Some companies decline coverage when a spouse can receive insurance from their own employer. Or, they might charge the employee more to cover the spouse.

According to the Kaiser Family Foundation, most small businesses pay part of their employees family plans. Compared to single plans, small employers usually pay the same amount or more:

- 45% provide the same dollar contribution for single and family plans

- 45% make a higher dollar contribution for family plans than single plans

- 3% vary their approach with the class of the employee

- 7% take a different approach

On average, small businesses contribute more to single coverage but less for family coverage than large companies do. Employees of small firms pay $1,021 for single coverage vs. the large firm cost of $1,176. Small firm employees pay $6,597 for family coverage vs. the large firm cost of $4,719.

The Most Common Option: State Or Federal Online Marketplaces

These marketplaces, including the federal Small Business Health Options Program, or SHOP, are typically available to small businesses with 50 or fewer full-time equivalent employees. Marketplaces in California and Colorado are open to businesses with 1-100 employees.

A calculator to figure out your full-time equivalent count is available here. Just be warned that a full-time employee is one who, in the past calendar year, averaged just 30 hours a week in a month. And oddly, while you have to count part-time workers hours toward your full-time tally, you dont have to offer them health insurance, even if you have more than 50 workers.

The online marketplaces offer a set number of plans from private insurance companies that are geared to the pocketbooks of small businesses.

A small business can enroll any time during the year as long as enough of its employees participate in its plan or have coverage elsewhere. A calculator for that is here. Otherwise, your small business can sign up during open enrollment between Nov. 15 and Dec. 15 any year.

Recommended Reading: Starbucks Dental Insurance

How Much Do Companies Pay For Employer Health Insurance

A number of small business owners fear that offering employer health insurance will hurt their bottom line. For instance, they worry that paying a share of premiums will hurt profits or even force them to reduce the number of workers they must cover. On the other hand, an eHealth survey found that many employers believed a small business health plan benefited their business by reducing turnover and keeping employees healthy.

Before any small business owners can weigh the pros and cons of providing group medical benefits, they should understand all of the costs and benefits of their choice to provide employer health insurance or not. Also, some employers may pay higher taxes or miss tax credits if they fail to offer qualified group health plans.

Average Cost Of A Business Health Insurance Scheme Per Employee

Business Health Insurance schemes are very similar to Private Medical Insurance paid for by individuals, with the main difference being that the policy is paid for by the company rather than the individual receiving the cover.

This means that the same factors affecting the cost of Private Medical Insurance will also have an impact on your group scheme.

Group size

Generally speaking, the more employees you add to Private Medical Insurance the cheaper cover becomes per worker. Larger groups achieve economies of scale unavailable to smaller companies.

Employees ages

Older employees cost more to insure than younger ones. This reflects that theyre more likely to make a claim. For example, you might expect to pay around £40 per month for a worker in their 30s, while an employee aged 60+ could cost more than £120 per month.

Occupation

Private Medical Insurance premiums depend partly on the occupation risk class your workers are in. Office-based workers tend to cost less to insure than a team of scaffolders, say, who might be at greater risk of a claim.

Location

The cost of private healthcare varies depending on where you are in the UK. Central London hospitals tend to be the most expensive, while those in the regions are generally cheaper. If youre located in an area where treatment is costlier, cover costs more per worker.

The policy options you choose will also affect the cost of your policy and many of these choices will depend on your needs as a company.

Also Check: Does Starbucks Give Health Insurance

Most Companies Pay The Majority Of Their Employees Health Plan Premiums And The Rest Is Deducted From Your Paycheck

How much does cobra insurance cost in ct. So, if you choose a plan from the marketplace, you can always check with an independent agent that will allow you to shop around a bit more successfully. $650 a month +. That means you could be paying average.

Often times there is a 2% administration fee that may be. Her cobra coverage would retroactively cancel as of december 1 if she does not mail a cobra premium payment for the december coverage period postmarked on or before december 31. Cobra allows you to keep your health insurance if you lose your job.

Were covered by your employers group coverage when separated from your job. With cobra insurance, youre on the hook for the whole thing. You are now responsible for the entire insurance premium, whereas your previous employer subsidized a portion of that as a work benefit.

This change applies to employees covered under connecticut fully insured small employer and large employer plans of any size. The monthly cobra insurance costs depend on what a particular health insurance plan costs. Individuals who were covered under state or federal cobra as of may 5.

You are laid off from work between september 1, 2008 and december 31, 2009. Employees paid on average about $5,600 for that health coverage. Healthinsurance.org says the average cobra insurance rate for a single employee on a group plan in 2015 was $530.4 per month.

Understanding Employer Health Insurance Cost

Eden Health Team

Over half of all Americans receive their healthcare through employer-sponsored health insurance programs. Due to the spiraling costs of healthcare, its becoming more difficult to find a plan that maximizes coverage at an affordable price.

When deciding on the right health plan for you, its important to consider the average cost of employer health insurance and whether a group plan is the best deal.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Todays Workforce Is Highly Mobile

Employees often move from job to job, changing employers after only a couple of years, rather than staying at the same company for decades. Younger workers are statistically twice as likely to leave their jobs in search of better offers, according to data from Visier. They make these changes for a variety of reasons advancement, compensation, cultural fit, and more. Health insurance considerations may not always be top of mind when navigating job changes, however their effects on employees are more than trivial.

When employees switch jobs mid-year, even if theyve already met their health insurance deductible on their previous employers plan, they must effectively start over under their new employers plan. There are other downstream effects too, like potential changes to in-network providers and coverage. These factors may create increased, unanticipated out-of-pocket responsibilities, and sometimes may impact peoples ability to access the care that they need.

In this respect, decoupling insurance from employment may make a lot of sense, so that job changes do not disrupt healthcare consumption or create unexpected expenses for consumers particularly these younger and highly mobile demographics.

Are Benefits Better Than Higher Pay

Higher pay means improved cash flows and buying power for immediate purchases or investments. Greater benefits, which may be challenging to put an exact dollar amount on, often provide a security net for a health event or during retirement. Employer benefits differ significantly in terms of scope and generosity.

Also Check: Starbucks Medical Insurance

How Do Health Insurance Companies Determine Employer Costs

Age, gender, tobacco use, family size, claim history, business size understand which factors impact health insurance costs.

No account yet? Register

Studies show that 56% of small businesses offer health insurance to at least a portion of their employees. Whether youre part of that group or intend to be at some point you should know the factors that drive employer premiums. This will help you effectively manage your costs.

Assuming the health insurance plan is fully insured, how does the insurer arrive at the employers rates?

The first thing to understand is that if your business is a small employer/group, the insurance company must follow the Affordable Care Act , plus applicable state regulations when calculating the cost of health insurance.

You May Like: Can Federal Employees Keep Their Health Insurance After Retirement

The Rate Of Health Insurance For Student

Health insurance is a crucial part of your college admission. Generally, college students pay around $1500 to $2000 yearly for their health insurance. However, this value differs for each school the prestigious schools might charge more than the community colleges.

Usually, guardians or parents are the ones who cover the health insurance of students. If not, then colleges offer their health insurance plan, added to your tuition fee. The medical insurance plan provided to a student by the university is from private insurance firms. This plan should include all health benefits that are under the ACA plan.

There are mixed reviews about college offered insurance plans. Sometimes they are easily manageable, and students can pay around $120 monthly to cover their medical insurance. However, in many cases, the students have also gone into debt due to expensive medical care.

Also Check: Do Starbucks Employees Get Health Insurance