Switching Health Insurance During Annual Open Enrollment

Open enrollment is the time of year when anyone can change their health insurance plan, for any reason. The open enrollment period is every year from November 1 to December 15 .

During open enrollment, you can accept your current plans health insurance renewal, or you can shop around to find a better fit for you and your family. The new plan you choose will begin January 1.

Want to shop around? Here are a couple ways to make the experience a little simpler:

- If you want to look at new plans with your same insurance provider, you can usually compare plans online or call their team. At HealthPartners, its easy to review health insurance plans online or get personal help by calling .

- If you want to see options from different health insurance providers, you can either contact them directly, call your broker or use the health insurance marketplace. On the health insurance marketplace, you can see plan information from many different companies all at once. You can also find out if you qualify for financial assistance. In Minnesota, get started at MNsure.org. In Wisconsin, go to healthcare.gov.

Its All About You We Want To Help You Make The Right Legal Decisions

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesnt influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

Employer-based healthcare is the most common type in the United States. Depending on the state youre in, the rules can vary. Obamacare requires every state to meet certain standards, but they can be higher in states like Hawaii. Of course, there are times when you dont necessarily want a workplace plan. Maybe your spouse has coverage for your family. In some cases, you might just not like the plan they offer. If you prefer a marketplace plan, you may end up paying a higher monthly premium because your employer is offering an alternative health plan. But if you meet the right qualifications, you could choose alternative coverage.

In many cases, not only can the employer refuse to allow you to terminate and drop your insurance coverage, they must. Federal law limits when an employee may add, subtract or change coverage or coverage options.

What Are The Main Reasons People Lose Health Insurance Coverage

There are several reasons a health insurance company may drop your coverage. They are within their legal rights to do so, and in most cases do not have to give you prior notice of the cancellation. Health insurance companies are in the business to make money.

The most common reason people lose their health coverage is the loss of a job. If you are on a group health insurance policy and lose your employment, the company sponsored insurance will no have you on the policy. If your hours are reduced to part time and your employer does not offer coverage for part time employees you may lose your health insurance.

If your company is required to offer Cobra health insurance you may be able to extend your health insurance while you look for a new job. Cobra insurance allows you to keep your insurance coverage for up to 18 months as long as you pay 102% of the premiums.

Health insurance fraud is also for cancellation of your policy. This includes falsifying your application. If a company finds evidence of fraud they can drop you immediately and do not have to pay any claims filed on the policy. They may even file charges and demand repayment of past claims paid by them.

Read Also: How Much Does Health Insurance Cost In Ct

Who Qualifies For Cobra Health Insurance

Not all companies have to offer COBRA coverage. The law is designed to cover companies who maintain health insurance coverage on at least 20 employees.

The company has to continue to offer group health insurance as well.

This law applies to health care plans for private businesses and some state and local government plans. It does not apply to any federal government sponsored health plans, and some church organizations are exempt as well.

To qualify for COBRA, you must have health insurance with your company before you go through a qualifying event. Loss of your job is a qualifying event.

It can be voluntary or involuntary. The exception is if you are terminated for gross misconduct or illegal activity.

If your hours are reduced from full time to part time, you may also qualify. The reduction in hours must cause you to lose eligibility for benefits.

If you have a health insurance plan that covers your family, they will continue to receive benefits when you qualify for COBRA. Your spouse can also apply for COBRA if you pass away or divorce. Any dependent children would also be covered.

If you become eligible for Medicare, your spouse, and dependent children can apply for COBRA benefits. This would allow them to continue their benefits until they can find new ones.

How To Cancel Private Health Plans

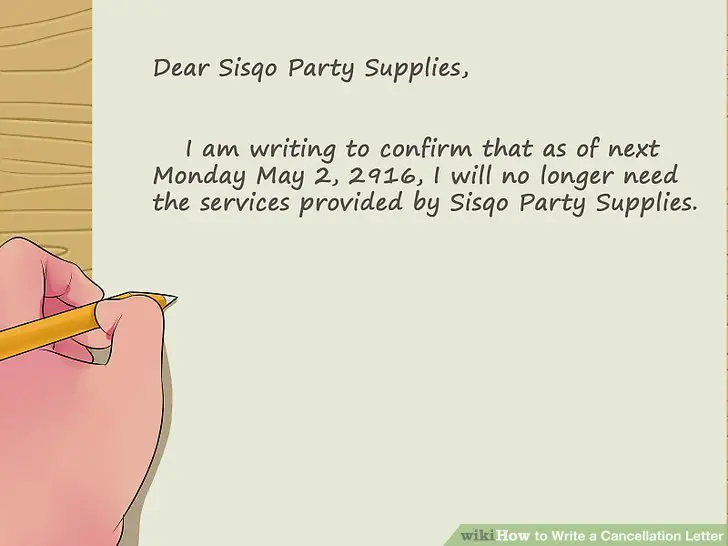

Check your policys terms of cancellation to understand the steps you need to take. Most companies require that you call them directly when canceling a health plan.

Gather up all the information you will need including the name of the health plan, your policy number and any security questions attached to your account. Follow the cancellation steps as guided by the insurance representative that you reach. Some insurance companies may require that you fax or mail them a letter confirming the cancellation.

Write down confirmation numbers and the name of the insurance representative that you spoke to and the date. Find out about refunds or any pre-payments. If you paid in full for a one-year policy and you want to cancel before the policy ends, ask the insurance representative about being reimbursed for the remaining months. Many insurance companies will offer you a refund.

Do not cancel your old policy until you have a new policy in place. Take the time to review the new policy. Make sure it is giving you the coverage that you need.Check your credit and bank statements to make sure you are not being billed for your old health plan coverage after you cancel your health plan.

Recommended Reading: How Does Health Insurance Work Through Employer

How To Cancel Health Insurance By Your Employer

To cancel your employers health care plan, its a good idea to start with your companys HR. Ask them what the policy on your plan is and how can the plan be cancelled. You may need to provide your HR with paperwork and documents to process as part of the cancellation. The IRS provides with two scenarios that allow for group health care benefits to be revoked. One is if the employees duties and the number of hours changed within the company and secondly if the employee wanted to purchase the insurance from the marketplace through an open enrollment period or the special enrollment period.

How To Cancel Obamacare

Lets say you get a new job that offers healthcare and you wont need to get coverage from the Health Insurance Marketplace, known as Obamacare, any longer. You can feel free to cancel your Obamacare health plan at any time. This is also the case if you are enrolling in Medicare and want to leave Obamacare. You can terminate your healthcare coverage through Healthcare.gov or buy calling customer service at 1-800-318-2596. Wait to cancel your Marketplace plan until you know the date that your new insurance starts. You can even schedule to cancel your Marketplace plan on the exact date when your new employer coverage begins. You also can choose to cancel your Marketplace plan the same day you put in the cancellation notice.

Read Also: What’s The Penalty For Not Having Health Insurance In California

The Pebb Program’s Annual Open Enrollment

From November 1 to 30 each year, you can make changes to your PEBB Program account that will take effect January 1 of the following year.

During open enrollment you can:

- Change your medical or dental plans.

- Enroll or remove eligible dependents from your PEBB medical or dental plan.

Note: If you enroll a dependent, you may need to provide proof of the dependents eligibility with your enrollment form before they can be enrolled. Visit Dependent verification to find a list of acceptable dependent verification documents.

Changes You Can Make Online

During the PEBB Program’s annual open enrollment you can make changes online using PEBB My Account. You can:

- Change your medical and/or dental plan.

- Remove dependents from your coverage.

Please print or save your confirmation page when youve completed your changes. Check back in a two business days to verify the coverage you selected and your spousal or registered domestic partner coverage attestation is correct.

When you submit an online plan change, please wait two business days to make any additional online plan changes.

You May Like: How To Get Health Insurance Fast

Can Health Insurance Be Canceled Retroactively

Yes, but its rather difficult. Health insurance can be canceled retroactively, but your employer and the insurance provider would have to have a pretty solid case of fraud or misrepresentation against you.

Rescission of coverage, thats what retroactive cancellation is called in the Affordable Care Act, is strictly prohibited. However, if it can be proved that the insured performed an act, or omission that constitutes fraud or if a misrepresentation of material facts was intentionally submitted, a policy can be canceled retroactively.

How To Make Changes

To make changes, such as enroll a dependent or elect a different health plan, you must complete and submit the required form during the annual open enrollment or when a special open enrollment event occurs, within the timelines listed below.

To make a change during the PEBB Programs annual open enrollment:The PEBB Program must receive the appropriate PEBB Continuation Coverage Election/Change or PEBB Continuation Coverage Election/Change form. You may also make some changes using PEBB My Account.

To make a change when a special open enrollment event occurs:The PEBB Program must receive the appropriate PEBB Continuation Coverage Election/Change or PEBB Continuation Coverage Election/Change form no later than 60 days after the event that created the special open enrollment along with proof of the event that created the special open enrollment . If adding a newborn or newly adopted child, and adding the child increases your premium, your employer must receive this form no later than 60 days after the birth or adoption.

Also, if you or your eligible dependent are interested in enrolling in a PEBB Medicare supplement plan, you have 6 months from the date of your enrollment in Medicare Part B to enroll.

Recommended Reading: How To Find Personal Health Insurance

How Does Cobra Health Insurance Work

Your employer is required by law to notify you of your COBRA eligibility and notify their insurance provider. The provider will then send you information on enrollment and costs. You will be given 60 days to decide if you want the coverage. See below for a few things you need to know:

- If you chose COBRA coverage, you would have 45 days to make your first payment.

- You will be required to make any premium payments you missed during the 60-day enrollment period. Payments are due every 30 days after that.

- If you have a medical emergency during your 60-day enrollment period, you can get retroactive coverage.

- The coverage will be backdated to the date you lost your coverage, but you must enroll during the first 60 days.

You can maintain your coverage for up to 18 months provided you continue to pay your premiums and your former employee offers group insurance to current employees. Failure to make payments can result in loss of coverage.

If you become physically challenged, you can file for an 11-month extension of benefits. However, the cost of benefits will go up significantly during this period. The standard rate 102 percent of the plans cost with a disability it will cost you 150 percent of the plans cost.

Start comparing low-cost health insurance quotes today with our FREE online tool!

How Does Medicare Work With My Job

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

You may be able to get COBRA coverage to continue your health insurance through the employers plan .

Dont wait until your COBRA coverage ends to sign up for Part B Getting COBRA doesnt extend your limited time to sign up for Medicare.

|

If you get COBRA: |

This happens: |

|---|---|

|

Before you sign up for Medicare |

Your COBRA coverage will probably end when you sign up for Medicare. |

|

After you sign up for Medicare |

COBRA pays after Medicare . |

You May Like: How To Get Health Insurance For My Small Business

What To Consider Before Canceling Your Car Insurance

While canceling car insurance is easy, it may put you in a high-risk pool if you dont have a new policy lined up. Being considered a high-risk driver means youll pay higher rates in the future. Before canceling your car insurance entirely, consider the effects of:

Can I reinstate my car insurance after canceling?

If you regret canceling your car insurance policy, some companies allow you a full 24 to 48 hours to have it fully reinstated without any consequences. Other insurers, like Progressive, require you to have your policy reinstated within the same day of canceling.

If youve passed the timeframe allowed for reinstatement, youll either be required to have your policy fully re-written with your current car insurance company or shop around for a new car insurance policy. To avoid a lapse of coverage, get your new policy started as soon as possible, or ask for your policy to be backdated to the day you lost coverage.

Involuntary Loss Of Other Coverage

The coverage youre losing has to be minimum essential coverage, and the loss has to be involuntary. Cancelling the plan or failing to pay the premiums does not count as involuntary loss, but voluntarily leaving a job and thus losing employer-sponsored health coverage does count as an involuntary loss of coverage. In most cases, loss of coverage that isnt minimum essential coverage does not trigger a special open enrollment.

. And although they are not technically considered minimum essential coverage, they do count as minimum essential prior coverage in the case of special enrollment periods that require a person to have previously had coverage .)

Your special open enrollment begins 60 days before the termination date, so its possible to get a new ACA-compliant plan with no gap in coverage, as long as your prior plan doesnt end mid-month. the code of federal regulations 155.420, and the that makes advance open enrollment possible for people with individual coverage as well as employer-sponsored coverage.) You also have 60 days after your plan ends during which you can select a new ACA-compliant plan.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Becoming A Dependent Or Gaining A Dependent

Becoming or gaining a dependent is a qualifying event. Coverage is back-dated to the date of birth, adoption, or placement in foster care . Because of the special rules regarding effective dates, its wise to use a special enrollment period in this case, even if the child is born or adopted during the general open enrollment period.

The current regulation states that anyone who gains a dependent or becomes a dependent is eligible for a special open enrollment window, which obviously includes both the parents and the new baby or newly adopted or fostered child. But HealthCare.gov accepts applications for the entire family during the special open enrollment window.

How Do I Cancel My Car Insurance

In many cases, you can cancel your car insurance in just a few minutes with a phone call or written notice of your cancellation. But be ready with your next steps, like having another insurance policy in place before canceling.

What info do I need to cancel my insurance?

Don’t Miss: Are Abortions Covered By Health Insurance