Applying For Cobra Coverage

In order to begin COBRA coverage, an individual must confirm that they are eligible for assistance according to the requirements listed above. Typically, an eligible individual will receive a letter from either an employer or a health insurer outlining COBRA benefits. Some individuals find this notification difficult to understand because it includes a large amount of required legal information and language. If you have any difficulty determining whether you are eligible for COBRA or how to begin coverage through this program, contact either the insurer or your former employer’s HR department.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options, such as a spouse’s health insurance plan.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options. In some cases, a spouse’s health insurance plan may be a possibility. Or you might explore your options on the federal health insurance marketplace or a state insurance marketplace. Loss of a job will open up a special enrollment period.

How Long Does Cobra Continuation Coverage Last

If you like your job-based health plan, you can keep itwell, for a little while at least.

Again, continuation coverage under COBRA is designed to be a temporary extension of the health insurance you had at your old jobthe key word here is temporary. In most cases, COBRA coverage lasts 18 months from the time you choose to sign up for it.

Under special circumstances, you might be able to extend COBRA coverage to 29 or 36 months for you and your dependents.

But beware: If youre late on that first payment, youll lose your right to COBRA coverage, and you wont be able to get it back. The due date for your first payment is defined as 45 days after you elect coverage. If youre late on a monthly payment after that, your coverage will be canceled that day. However, if you make your payment within the 30-day grace period, your COBRA coverage can be reinstated.

How To Enroll In Cobra When Losing A Job

If you lose your job, you dont need to give up your job-based health insurance at least not right away.

The Consolidated Omnibus Budget Reconciliation Act of 1985 allows employees and their dependents to temporarily maintain their employer-sponsored health insurance benefits after leaving a job.

While the opportunity to continue your current coverage is very attractive, there are pros and cons to enrolling in COBRA. You need to take the time to understand how COBRA works and weigh it against other health insurance options.

Recommended Reading: What Is A Good Cheap Health Insurance

Key Points About Health Insurance

- Health maintenance organizations HMOs are typically the least expensive type of health insurance, while preferred provider organizations are the most expensive.

- High-deductible health plans can be combined with health savings accounts, which offer tax benefits.

- The average benchmark premium for a Marketplace plan is $452 per month, according to the Kaiser Family Foundation.

What Is Aca Health Insurance

ACA health insurance refers to individual health insurance plans that meet the minimum essential coverage and other requirements of the Affordable Care Act. You can explore and enroll in ACA health insurance plans by putting in your zip code belowthis tool will show you if youre eligible for Medicaid or a subsidy on Marketplace insurance, and how much a plan would cost you.

Recommended Reading: Who Pays First Auto Insurance Or Health Insurance

Do I Qualify For Health Insurance After I Lose My Job What About My Family

Unless you work for the government or a church, and as long as you are employed by a business with 2 or more employees, you are a covered employee and eligible to continue your group health coverage. There is no requirement that you work for your employer for a certain amount of time. Your employer must also offer you a COBRA extension even if you are also covered by another policy, such as a spouses policy through his or her job.

What Is A Qualifying Event

When losing health insurance, there must be a qualifying event that makes them eligible for coverage under COBRA. With the exception of gross misconduct, a qualifying event for employees will include leaving your place of employment either voluntarily or involuntarily. A reduction of your hours causing you to lose your health benefits is also considered a qualifying event. Losing your health insurance due to eligibility for Medicare will also qualify you for COBRA.

A spouse or dependent children, who have been covered under health plans provided by an employee may also qualify for coverage from COBRA under certain conditions. If the insured employee passes away, a separation, or divorce from the insured employee, if a dependent reaches the age of 26, or the employee becomes eligible for Medicare and is taken off the health care plan provided by the employer then a spouse or dependent would become qualified for COBRA.

In order to initiate COBRA health coverage, the administrator of the plan must be informed of the qualifying event. An employer must notify the plan administrator of a qualifying event within 30 days if one of the following were to occur.

- The employee has voluntarily or involuntarily left his position

- The employee’s hours have been reduced and no longer qualifies for health care under the company’s policies

- The employee died

- The employer has filed for Chapter 11 bankruptcy

Don’t Miss: Is It Legal To Marry For Health Insurance

What Is Cobra Health Insurance Coverage

Better known as COBRA, The Consolidated Omnibus Budget Reconciliation Act of 1985, requires that health insurance coverage continue to be offered to workers and their families when it would otherwise be lost due to a change in employment status. If offered by an employer, dental and vision coverage may also be continued under COBRA if the terminated employee was enrolled.

However, COBRA generally only applies to employers with at least 20 employees that offer group health plans. If the employer does not offer a group health plan, then it is impossible to obtain COBRA coverage from them.

Rules may vary, and you should check with the human resources department of your employer to confirm, but typically to be eligible for COBRA the following applies

- Must have been covered by the group plan for three months

- Must not have been terminated for gross misconduct

- Must not be covered or eligible for Medicare

How much are COBRA premiums?

Remember, COBRA allows you to basically re-enroll in your previous employers group health plan, but without their contribution. Typically, Your COBRA premium would be the full monthly cost of the health insurance plus a 2% administrative fee. For example, lets say you are paid twice a month, and you were paying $50 a paycheck for your coverage, and your employer was paying $200, your COBRA premium would be as follows

How do I sign up for COBRA?

How long does COBRA last?

Who processes COBRA coverage and collects premiums?

Questions? Comments?

What Is Cobra Health Insurance

Consolidated Omnibus Budget Reconciliation Act is a federal law that requires your employer to allow you to keep your current health insurance plan for a period of time. If you quit or lose your job, your hours are reduced, or something else happens that negatively impacts your job or ability to keep your employer-sponsored health care, COBRA ensures you will be able to maintain your insurance.

COBRA health insurance will allow you to pay for all of your health insurance, including your employers portion, in order to continue the plan for a period of time. The COBRA insurance definition comes down to one important thing making sure you are able to keep your current insurance plan while you are between jobs.

The COBRA benefits bring many people comfort, because even though their job may have been impacted, they can rest assured that they will continue to have health insurance for them and their family. Prior to 1985, when COBRA became federal law, if you were between jobs, you would lose your health insurance. COBRA health insurance became the remedy for this situation, so that people are able to choose to remain covered.

Read Also: How To Become A Health Insurance Broker In California

What Is Cobra Insurance And How Much Does It Cost

11 Minute Read | September 14, 2021

Losing your job or getting your hours cut at work can feel like a punch to the gut. Once youre over the initial shock, youve still got to live with the realities of being without a job.

One of those realities is figuring out what youll do about health insurance. You probably received a letter from your employer letting you know that you qualify for COBRA insurance. Two questions probably popped into your head as you tried to make sense of it all: What in the world is COBRA insurance? Do I need this?

Youll face a lot of important questions as you figure out your next steps, but dont put your health insurance needs on the back burner. A medical emergency can happen at any time, so you have to get this stuff figured out now.

Before you decide if COBRA insurance is right for you and your family, there are some things you need to know.

Should You Get Cobra Consider This Alternative First

Leaving your job for any reason and a number of other life events, like having a baby, qualify you for Special Enrollment. A Special Enrollment Period gives you 60 days to enroll in an individual health insurance plan through the Obamacare marketplace. You will likely have multiple plans to choose from and they will almost certainly cost less than COBRA.

If you elect COBRA coverage and receive the maximum length of coverage, you can also request a Special Enrollment Period at the end of your COBRA coverage. Check the marketplace plans in your area by visiting healthcare.gov.

Learn more about how to buy a plan during Special Enrollment.

The health insurance marketplace will also help you understand whether you qualify for a federal program like Medicaid or CHIP . Both of these plans help low-income individuals pay for health insurance coverage.

If you are healthy and just need a couple of months of insurance to last until the beginning of Open Enrollment , you could buy short-term health insurance. These plans typically last only a few months and donât provide extensive coverage. They may not cover all health conditions or a prescription drug plan. Again, these are best as a temporary solution until Open Enrollment begins. Short-term health insurance doesnât count as minimum essential coverage under the Affordable Care Act , and some states may charge you a tax penalty for not maintaining minimum coverage.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

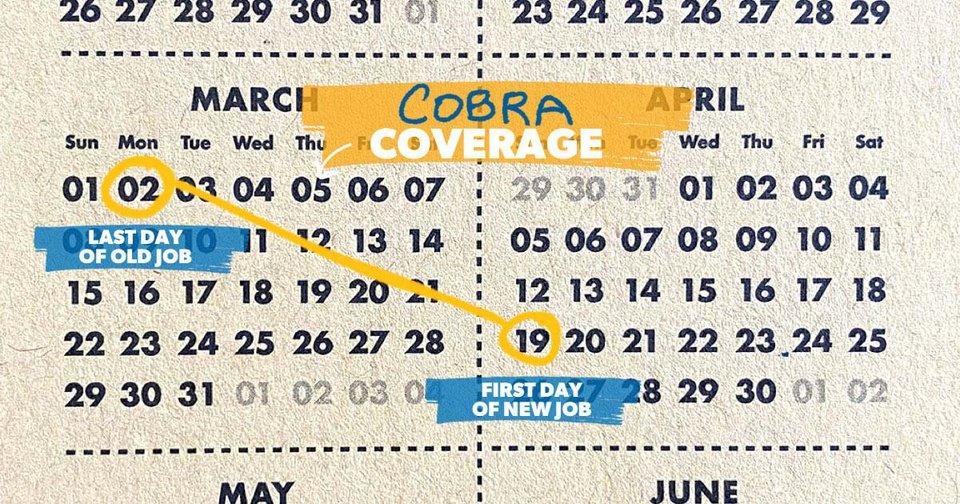

Cobra Coverage Timeline For Eligible Employees

If you qualify for COBRA coverage, you must choose it within 60 days from either:

- The termination date of your insurance

- The date you receive the COBRA notification

Remember, the timeline is based on the latest notification you receive. For instance, if you are laid-off on May 24th and you receive the COBRA notification on May 26th, and your group insurance ends on May 29th, then you should enroll for the COBRA coverage by July 29th. That date marks 60 days after the termination of the group insurance, which in this case, is the latest alert.

If you enroll before the end of 60 days, you will enjoy coverage continuously. This is because COBRA becomes active immediately after you lose coverage. For instance, if your employer insurance lapses on May 29th, then COBRA will become active on May 30th.

When Does The Cobra Coverage Period Start And End

COBRA continuation coverage is only temporary. COBRA coverage starts on the date the qualifying event occurred and ends after a period of 18 to 36 months. The duration of your coverage will depend on the type of qualifying event experienced. This COBRA coverage period is the minimum employers must offer by law some plans may provide longer periods of coverage.

This applies to any employer-sponsored health insurance group plans, including medical, vision, and dental insurance.

Depending on your coverage time period, youll need to be prepared for the next steps when your COBRA coverage runs out.

Don’t Miss: Is It Required For Employers To Offer Health Insurance

Which Employers Offer Cobra Coverage

COBRA doesn’t apply to health plans sponsored by the federal government, churches, or church-related organizations. It also doesnât apply if an employer had fewer than 20 employees for 50% or more of its typical business days over the past year. This can apply for companies with seasonal or part-time employees.

Many states have laws similar to COBRA that require employers with fewer than 20 employees to offer coverage. These state plans are sometimes called mini-COBRA.

Are You Required To Provide Cobra Insurance

You must provide COBRA continuation coverage if you:

State and local governments must also provide COBRA health coverage. However, COBRA does not apply to any health plans offered by the federal government, churches, and some church-related organizations.

Read Also: How To Get Life And Health Insurance License In Texas

How Do I Decide Between Cobra And Other Health Insurance Options

Whether youre trying to choose between health insurance plans or what to eat for dinner tonight, its always good to have plenty of options. And like we said earlier, you do have other options besides COBRA.

If youre still on the hunt for a new job, decide to go into business for yourself, or need insurance to bridge the gap until your health care benefits at your new job kick in, youll probably discover that buying health insurance from the marketplace is less expensive than COBRA.

So how do you decide which health plan is best for you? Here are some things to think about:

What Happens To My Health Insurance If I Quit My Job

If you quit your job, your employer may or may not offer COBRA insurance. You can find out by asking a manager if they have any programs in place to provide health coverage after the employee leaves the company. If there are no provisions available from one’s employer, then individuals will need to look into other options like purchasing individual healthcare policies on their own or looking into public services including Medicaid for example.

Also Check: What Is The Self Employed Health Insurance Deduction

Ending Your Cobra Coverage Early

You can terminate your COBRA continuation coverage at any time, but you may not be able to enroll in another health insurance plan until there is an Open Enrollment Period or if you start a new job and get new workplace coverage.

The group health plan can end your insurance coverage early if any of the following occurs after you elect COBRA coverage:

-

You havenât paid your premiums in full

-

Your employer stops having any group health plan

-

You, a spouse, or a dependent on your plan begins coverage under another group health plan

-

You, a spouse, or a dependent on your plan becomes entitled to Medicare benefits

-

You, a spouse, or a dependent on your plan engages in inappropriate conduct, such as fraud

The plan must notify you if itâs terminating your coverage early. You will receive information on why you’re losing coverage, the date it will end, and alternative group or individual coverage that you can elect.

Health insurance and life insurance work together to offer financial protection.

Health insurance can pay your medical expenses. Life insurance keeps your loved ones whole after you die.

Does Cobra Cover The Cost Of Sober Living

If sober living costs are covered by your commercial health plan, they will also be covered by COBRA. With some private insurance plans, transitional living facilities are a covered benefit.

Sober living homes can be covered by COBRA as a form of outpatient treatment, but coverage may depend on the state you live in.

For any questions about your COBRA insurance coverage, you can talk to a customer support representative from your insurance carrier. If you need help verifying coverage or feel overwhelmed by the process, you can also talk to one of our addiction treatment specialists who can handle this task for you.

Read Also: Does Colonial Life Offer Health Insurance

What Do I Need To Know About Paying For Cobra

Your COBRA administrator should tell you within 14 days about the COBRA4 continuation coverage thats available to you.

If you qualify for ARPA there is a 100% subsidy, which means COBRA premiums are covered including the 2% administrative fee that health plans are permitted to charge for COBRA. This subsidy is available April 1, 2021 through September 30, 2021.

Under regular COBRA youd have to pay the full premium for your health care coverage, plus an administrative fee. When you were employed, your employer generally paid for some of the cost of your health insurance premium, and now you will responsible for the full amount. That means you may pay more for COBRA coverage.

Short Term Health Insurance

It is also known as gap insurance and short-term health policies will ordinarily provide coverage for six months to a year, depending on the insurer. These plans are relatively inexpensive, but they dont always offer the extensive coverage of the COBRA policy. However, if a person is healthy and will be employed once again in a few months, a short-term health plan could be ideal.

Don’t Miss: How Much Is Health Insurance Usually

What If You Are Eligible For Medicare

If you become eligible for Medicare less than 18 month before leaving or losing a job, your spouse and dependents can receive COBRA coverage for up to 36 months after the date you qualify for Medicare. If, for example, an employee becomes eligible for Medicare 6 month before the date their employment ends, COBRA coverage will be an option for a spouse and dependents for 30 months . 8

Important: If you sign up for COBRA and then become eligible for Medicare, you should still sign up for Medicare Part B. COBRA coverage is not considered a qualified alternative healthcare plan. Therefore, if you wait until COBRA ends to sign up for Part B coverage, you will likely face ongoing late penalties.9