Health Insurance: What Is Covered

See what is and isn’t usually covered by health insurance policies.

01134950976^

^ Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 12:30pm. We may record or monitor our calls.

Email us

One addiction treatment programme only.

Subject to your benefit limits.

To support addictions we fund one addiction treatment programme per membership lifetime. To support chronic mental health conditions we have removed restrictions on cover from June 2019. If you joined Bupa, or renewed your policy, before June 2019, there will be still be restrictions on chronic mental health cover until your next renewal. Please call us if you would like to discuss the benefit limits on your policy.

As of July 2021, this analysis is based on an internally conducted review of the consumer health insurance market using publicly available information from the major insurers in the UK consumer health insurance market. Combined, Bupa, AXA PPP, Aviva and Vitality hold approximately 90% of the Gross Written Premium income of UK Private Medical Insurance providers. Refers to standard mental health cover when this is included in the selected consumer health insurance product.

See PDF How we compare: Individuals

Digital GP is not regulated by the Financial Conduct Authority or the Prudential Regulation Authority.

Digital GP services are provided by Babylon Healthcare Services Limited. Registered in England and Wales No. 09229684. Registered office: 60 Sloane Avenue, London SW3 3DD.

Health Plans By State

Cigna offers Individual and Family Health Insurance Plans in AZ, CO, FL, IL, KS, MO, NC, TN, UT, and VA.

Select your state to see the plans we offer.

Loading…

1 Cigna provides access to virtual care through a national telehealth provider, MDLive located on myCigna, as part of your health plan. Providers are solely responsible for any treatment provided to their patients. Video chat may not be available in all areas or with all providers. This service is separate from your health plans network and may not be available in all areas or under all plan types. $0 virtual care benefit not available for all plans in AZ and CO. Some plans may apply a copay, coinsurance or deductible. Virtual care does not guarantee that a prescription will be written. Refer to plan documents for complete description of virtual care services and costs, including other telehealth/telemedicine benefits. A primary care provider referral is not required for this service.

2 Plans may vary. Includes eligible in-network preventive care services. Some preventive care services may not be covered, including most immunizations for travel. Reference plan documents for a list of covered and non-covered preventive care service.

3 Referrals are required for residents of Illinois.

5 Discounts available with the Cigna Patient Assurance Program. $25 is the maximum out-of-pocket cost for a 30-day supply of covered, eligible insulin.

- I want to…

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

In 2020, health insurance premiums for unsubsidized individual customers were $456 per month on average, while family premiums averaged $1,152 per month. The average individual deductible was $4,364 the family deductible averaged $8,439.

Over the course of a year, the average health spending for a family of four in the U.S. was $25,011 in 2020. This figure includes spending on monthly premiums. It also includes meeting the deductible.

Don’t Miss: Can I Buy Dental Insurance Without Health Insurance

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Here’s How That Breaks Down

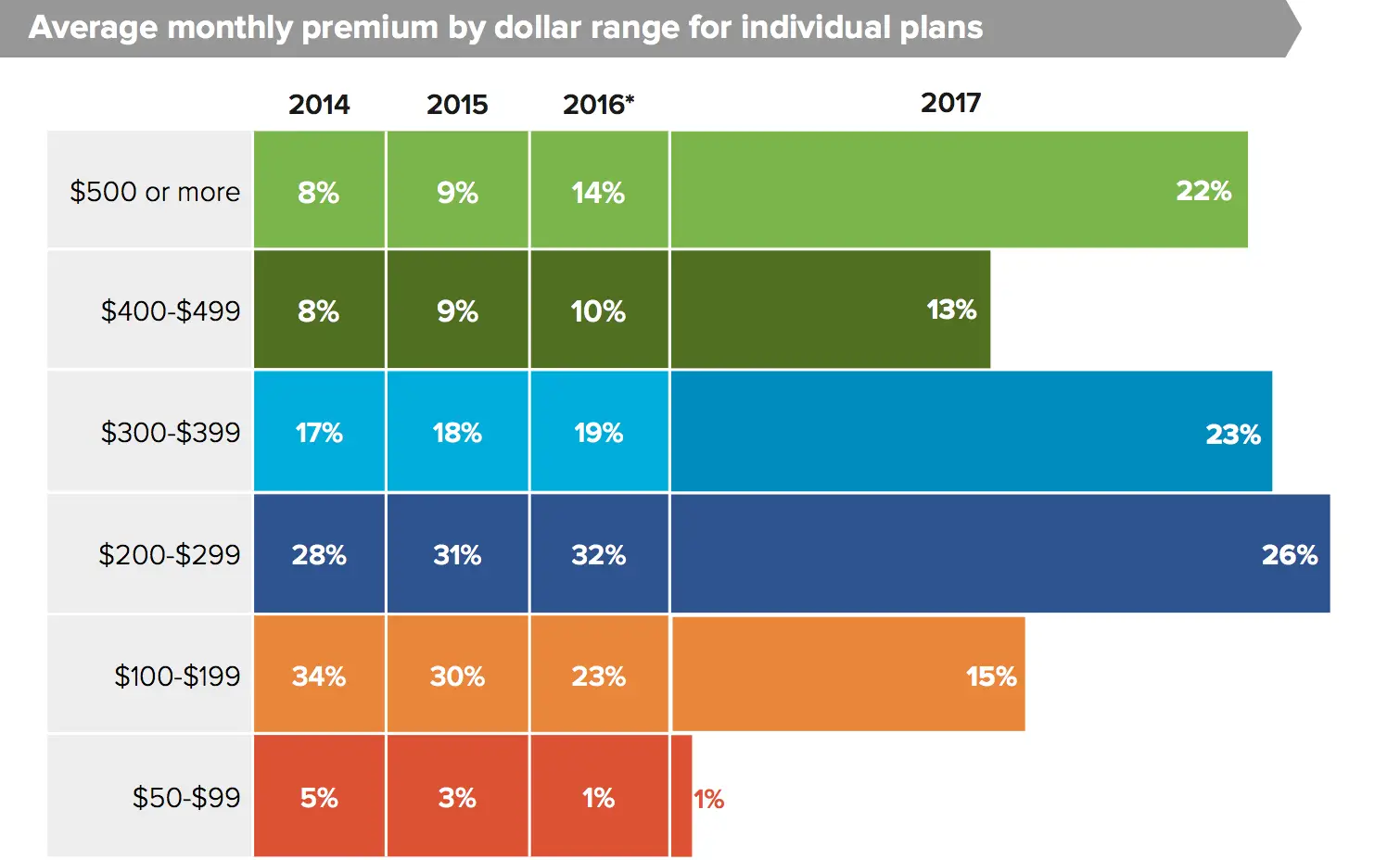

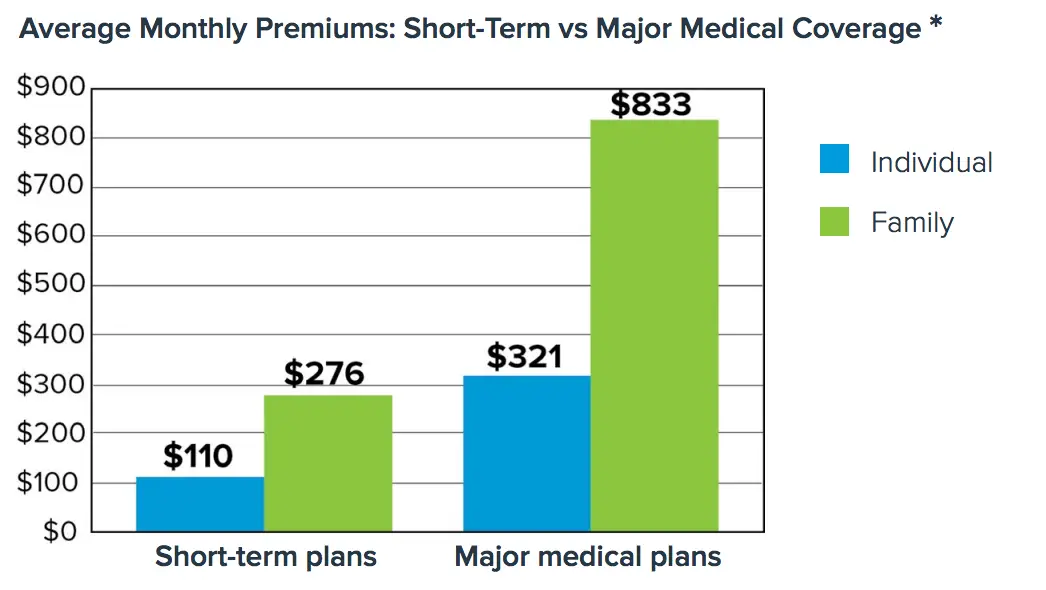

According to eHealthInsurance, for unsubsidized customers in 2016, “premiums for individual coverage averaged $321 per month while premiums for family plans averaged $833 per month. The average annual deductible for individual plans was $4,358 and the average deductible for family plans was $7,983.”

That means that, last year, the average family paid $9,996 for coverage alone, and, if they met their deductible, a total of just under $18,000.Meanwhile, an average individual spent $3,852 on coverage and, if she spent another $4,358 to meet her deductible, a total of $8,210.

These figures do not take into account any additional co-insurance responsibility she might have. In addition to co-pays and deductibles, an increasing number of plans now require co-insurance payments, which require that, even once you meet your deductible, you continue paying some percentage of all costs until you hit your out-of-pocket maximum.

Also Check: Does Health Insurance Pay For Abortions

Costs For Acute Or Emergency Care In The Usa

People who call us often ask how much an emergency room visit will cost them. We always quote them the current average and they are often surprised with the numbers.

According to a study by the National Institute for Health, the average cost of an ER visit is $1,900 to $2,100. But this depends on the kind of medical emergency you are in, so you may be paying a lot more or less than this range.

The chart here shows some of the variations in pricing you will see in different hospitals and clinics. The minimum and maximum charge widely varies per illness. This kind of price range can catch you off-guard in case you are diagnosed with any medical problem.

One of the biggest benefits of having international health insurance is that you will often receive the best healthcare service at the lowest prices. You can receive treatment from your doctor at their office or clinic, and in most cases, the cost will be 3 to 4 times less expensive compared to when you get it at a hospital from the same doctor without any health insurance coverage.

How Do I Sign Up For Obamacare

You can begin signing up for Obamacare by visiting healthcare.gov. Here you can apply for benefits through your stateâs marketplace website. You can also fill out a paper application and send it in by mail. When you are applying, there will be an option to ask for Premium Tax Credits to help reduce your monthly health insurance cost. Your estimated annual income will be used to determine if you are eligible or not.

Read Also: Do You Have Health Insurance

Lower Level Pricing Plans

While we cant give a definitive dollar amount, lower-level plans are obviously the most affordable and are attractive for those who dont want to pay a lot of money for services they might need one day.

If youre concerned about your provincial plan not covering enough and you want to have the peace of mind of having a safety net, this could be the right option for you, but be aware that many of these more basic plans have very limited coverage for prescription drugs.

The caveat with these plans is that they sometimes dont cover enough. You have to look at what youre paying for your policy, and the cost of things you need above and beyond that. It often happens that the extra expenditures cost more than a better plan would. Also, unexpected things like a broken tooth or prescriptions needed to treat an illness are harder to budget for.

Our website also offers a free quoting app to help you to calculate the costs of a health and/or dental plan.

How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is $12,880 for an individual, so individuals earning less than $51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

Read Also: Is Eye Surgery Covered By Health Insurance

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

How Much Do You Pay For Health Insurance

How much are your health benefits?

Monster Contributing WriterPrivate Health Insurance

Recommended Reading: How Much Health Insurance Do You Need

Is An Employer Required To Pay For Health Insurance

If you decide to offer health insurance to your team, in many cases, your responsibility doesnt end there. In the majority of states, carriers will require you to cover 50% of the premium cost for employees. This requirement, however, only applies to premiums for the employee, not their covered dependents. For other tiers of coverage, such as employee and spouse, employee and children, or family, the insurers want employers to pay 33%.

For 2020, the affordability threshold is 9.78% of an employees income.

Many employers even choose to contribute more than this amount. In fact, last year, on average, covered workers contributed only 17% of their premium for single coverage and 27% for family coverage. One reason for this, especially in companies with lower-wage workers, is that large employers covered by the ACA must offer affordable coverage or be penalized. For 2020, the affordability threshold is 9.78% of an employees income.

Healthcare For 80% Less

Eligibility for the tax subsidy is determined by the year you are looking for health coverage, not on the previous yearâs tax return. Therefore, when you apply for subsidies, you estimate what you believe your annual income will be. If you earn more than expected, you may have to pay some money back to the government, and if you earn less than expected, you may be entitled to additional assistance at the end of the year.

You can receive your subsidy in two different ways: in advance or at the end of the year. If you want to receive Advanced Premium Tax Credits , you can select this option when enrolling in public marketplace insurance. If you qualify, you will estimate an amount for the federal government to pay towards your monthly health insurance premium to reduce the cost. Or, you can receive the entire credit when you complete your tax return at the end of the year. Either way, you will receive the same amount because the amount paid in advance will be reconciled to match your actual annual income.

Recommended Reading: How Much Is Temporary Health Insurance

How Much Does Cobra Health Insurance Cost

If you lose or quit your job, get a divorce, or no longer qualify as a dependent on a parent’s health plan, you may be eligible for continued coverage under a U.S. law known as COBRA.

COBRA, or Consolidated Omnibus Budget Reconciliation Act of 1985, gives workers and their families who lose their health benefits the right to continue coverage for a limited period of time under certain circumstances.

This article explains what to expect in terms of the cost, including how to calculate your premium, how COBRA coverage affects your taxes, and what alternatives are available.

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

Also Check: Is It Legal To Marry For Health Insurance

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Is Health Insurance Getting More Expensive

It certainly feels like it. And its true that over the last decade, health care costs have risen significantly. The average family is paying 55% more in their premium in 2020 versus 2010 according to the Kaiser Family Foundation.5 And that number is up 22% since 2015.6 But premiums have only risen 4% when comparing 2020 against 2019.7

Health care costs also change based on where you live. In some states theyre up, in other places theyre lower.

If you feel like youre drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Dont give up hope. You always have options, even if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesnt cover.

And if youre trying to cut costs while paying off debt, or youre just starting to budget and barely making ends meet, you might want to choose a high-deductible and lower-premium plan that will kick in if you have serious medical issues or an accident. This allows you to focus on your necessities before you tackle an expensive health care plan.

Read Also: Does Short Term Health Insurance Cover Pre Existing Conditions

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

What Is The Average Cost Of Private Health Insurance

In truth, its difficult to say exactly how much a typical health insurance policy costs, as not everyone will choose the same cover. Its entirely down to your personal circumstances and what youre looking to be covered for.

However, there are two major factors that can affect how much your health insurance costs.

Recommended Reading: Where Do You Go If You Have No Health Insurance

Five Factors That Shape Health Insurance Premiums For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

- State laws these can dictate what health insurance must cover and affect competition. For instance, a 2017 Maine law instructs insurers to compensate customers who find a better deal on certain services. On the flipside, some states have certificate-of-need laws that may decrease competition.

- Your employers size larger employers tend to have access to cheaper cover. Those who dont have access through their employer will often pay more.

- Geography health insurance can be cheaper in cities than in remote locations.

- Plan type preferred provider organizations tend to cost the most, while high-deductible health plans cost the least.

- Personal factors such as age.

What are the best places for American expats to live abroad?

Find out more here

What Are The Costs Associated With A Small Group Health Insurance Plan

Like most individual plans, the cost of a small group health insurance plan usually comes with a number of different payments, such as deductibles and premiums.

- A premium is a regular payment, usually made once a month, that policyholders must pay every month to remain enrolled in health insurance.

- A deductible is a sum of money that a policyholder must pay out of pocket before his or her insurance will kick in and start contributing to medical costs.

To illustrate these concepts, imagine that your health insurance has a premium of $400 a month and a deductible of $1000. That means you have to pay $400 each month to keep your insurance. It also means that if you generate $2500 in medical bills one year, you will have to pay the first $1000 before the insurance company starts paying its share. After that, youll typically pay a copayment or coinsurance for each doctor visit. Youll generally pay a small portion of the remaining $1500 of covered services. Browse eHealths affordable small business health insurance plans to compare different options and find the coverage thats right for you and your business.

Recommended Reading: How Much Does Health Insurance Cost In Ct