How To Fill Out Form 8962

Form 8962 is only five sections, over two pages, and most people donât even have to fill out the whole form. Hereâs a quick rundown of each part of the form.

Part I requires you to put information like how many people are in your household, what your householdâs modified adjusted gross income was for the year, and what percentage of the federal poverty line your income was.

Part II is where you âreconcileâ your APTC. You list how much you received from the APTC each month of the year , and then you compare that to how much you should have received based on your final annual income. If you received more in advance payments than you should have, you will have to pay back the excess. If you didnât receive enough, you will get money refunded to you.

Part III is where you write how much you need to pay back if you received more of a credit than you should have. You donât need to fill it out unless you got excess APTC.

Part IV isnât necessary for most people. It only applies if your credit is split between multiple taxpayers. For example, you may fill out this part if you got divorced. If you need to split your credit, Part IV is where you state what portion of the credit each taxpayer should receive.

Part V of the form only applies if you got married during the year. This section allows you to account for different household incomes before and after your marriage.

Find Cheap Health Insurance Quotes In Your Area

A health insurance tax credit can reduce your monthly health insurance cost. It’s only available for those who purchase insurance through the marketplace, and you must meet income criteria to qualify.

You can sign up for a health insurance tax credit during open enrollment or when you have a qualifying life event, such as getting married, having a baby or moving. If you own a small business with fewer than 25 employees, you may also qualify for government subsidies, which can help pay for your employees’ health insurance.

Rate And Comment On The Answer

This site uses Akismet to reduce spam. .

My brother and his wife had marketplace insurance due to limited income. Our father passed away in June of 2020 and left his estate to us both. He is now being told he needs to repay $8400 due to his income including the inheritance. He did not receive the inheritance until late in 2020. His estimated income was $7000 which was their 2019 income so that was the amount the premiums were based on. Does he have to repay the $8400 for the entire year since he didnt have the inheritance until later in 2020?

Read Also: How To Get Life And Health Insurance License In Texas

Eligibility Requirements For The Premium Tax Credit

You must meet all of the following criteria to qualify for the premium tax credit:

- You must get your health care coverage through the Marketplace

- You can’t be eligible for health care coverage through alternative options such as your employer or the government

- Your income needs to fall within a certain range

- Another person can’t claim you as a dependent on their return

- You must file a joint return if you’re married

Changes in income and family size may affect your eligibility, so report these to the Marketplace to ensure you receive the appropriate tax credit. The premium tax credit program uses the federal poverty line to determine the income ranges that qualify you for the credit.

The U.S. Department of Health and Human Services reports the annual federal poverty levels, which vary depending on whether you live in the contiguous 48 states and the District of Columbia, Hawaii, or Alaska.

The range is 100% to 400% of the federal poverty line amount for the size of your family for the current tax year.

For example, an individual earning between $12,880 and $51,520 in 2021 meets the income criteria to qualify, while a family of four qualifies with household earnings between $26,500 and $106,000.

Even if your income makes you eligible, you must meet the other qualification criteria as well. You’ll use Form 8962 to determine your full eligibility to claim the premium tax credit.

How Can I Avoid Paying Back My Premium Tax Credit

When you apply for the APTC, you need to estimate your income for the upcoming year. If you underestimate, you will likely receive more APTC than you actually should have. In that case, you will need to pay back the extra premium tax credit you received. To avoid this, itâs best to estimate as accurately as you can. You can use the figures on last yearâs W-2 or your tax return to help you if you expect your income to be similar. Make sure to consider any raises, bonuses, or other income you expect to receive during the next year.

If you underestimate your income, you will probably receive a bit less of the credit than you should have, and the IRS can send you the amount you missed after you file your tax return. If youâre afraid of owing money when you file your taxes, you may choose to overestimate your income a bit during the application process. Just remember that overestimating too much will result in higher premiums during the year.

Also Check: Does Colonial Life Offer Health Insurance

What Are The Premium Tax Credits

Premium tax credits, also known as health insurance premium subsidies, were created by the U.S. government in 2014 as a way to provide discounts for health insurance to eligible individuals and families.

The discounts were designed to help lower-income Americans buy affordable individual or family health insurance coverage through the health insurance marketplaces, also known as exchanges, created by the Affordable Care Act.

Some Other Tips For Claiming The Deduction

- Enter your self-employment health insurance deduction on line 29 of Form 1040.

- A worksheet is provided in the Instructions for Form 1040 to calculate the deduction, and a more detailed worksheet can be found in Publication 535.

- Use Worksheet P found in Publication 974, Premium Tax Credit if you obtained insurance through a health insurance exchange and received a premium assistance tax credit.

Recommended Reading: How Much Do Health Insurance Agents Make

What Is The Small Business Health Care Tax Credit

If you own a small business, then you may qualify for a tax credit that subsidizes the health insurance premiums you pay for your employees.

Usually, small business owners are not required to offer health insurance if they have fewer than 50 full-time employees. Therefore, the small business health care tax credit, which was created under the ACA, encouraged small business owners to offer health insurance to their employees.

You and your business would be eligible for the credit if you:

- Purchased insurance through the Small Business Health Options Program marketplace.

- Have fewer than 25 full-time employees.

- Pay average wages of less than $50,000 per year.

- Pay at least half of all employees’ health insurance premiums.

If you qualify, the federal government would give you a subsidy to help pay for your portion of employee premiums. The size of your business and number of employees that you have would determine the amount of the credit you can receive. For example, if your business had fewer than 10 full-time employees, you can receive the maximum credit possible. A larger business with 25 employees would qualify for a lower tax credit.

What Is Tax Form 8962

If you purchased health insurance from the Healthcare.gov site â or your state healthcare marketplace if you live in a state that maintains one â you’ll need to use Tax Form 8962. This form has two parts you’ll need to fill out:

Form 8962 is also used to reconcile the premium tax credit you might be eligible for with any advanced premium tax credit payments youâve already received.

The first part of the form determines your annual and monthly contribution amount based on your family income and tax family size. Your tax family generally includes you and your spouse if filing a joint return and your dependents. You must include all of your family’s or household’s income.

After filling in this information and determining your applicable federal poverty level, you can figure out the amount of credit you can claim. You have two choices for how to claim it:

- A credit to reduce your monthly payments on your health insurance premiums

- A credit to reduce your taxes on your return

If you choose the monthly payments, the government pays your insurer over the course of the year, which lowers your monthly premium costs.

If you can claim the premium tax credit and your insurer received advanced payments from the government, the second part of Form 8962 compares how much credit you used and your final available credit. There are three possible scenarios:

Also Check: How To Become A Health Insurance Broker In California

Will I Qualify For The Subsidy

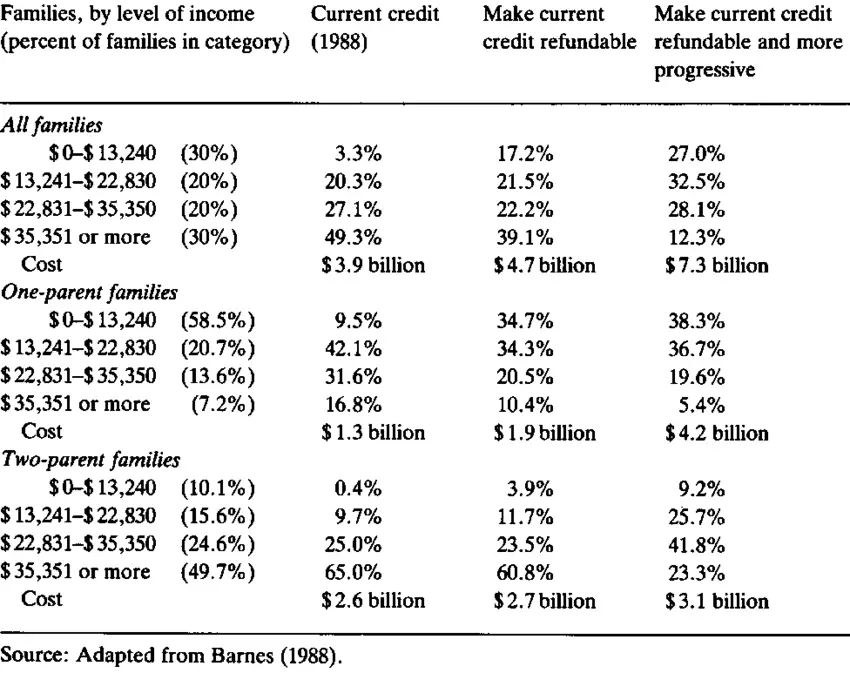

Prior to 2021, the rule was that households earning between 100% and 400% of the federal poverty level could qualify for the premium tax credit health insurance subsidy . Federal poverty level changes every year, and is based on your income and family size.

You can look up this years FPL here, and this article explains how income is calculated under the ACA.

But the American Rescue Plan has changed the rules for 2021 and 2022 : Instead of capping subsidy eligibility at an income of 400% of the poverty level, the ARP ensures that households with income above that level will not have to pay more than 8.5% of their income for the benchmark plan.

If the benchmark plan costs more than 8.5% of income, a subsidy is available, regardless of how high the income is. So the ARP accounts for the fact that full-price health insurance premiums are much higher in some areas than in other areas, and are higher for older enrollees. Subsidies are available in 2021 and 2022 to smooth out these discrepancies. But if a household earning more than 400% of the poverty level can pay full price for the benchmark plan and it won’t cost more than 8.5% of their income, there is still no subsidy available.

- Household of one: 138% of FPL is $17,774, and 100% of FPL is $12,880

- Household of four: 138% of FPL is $36,570, and 100% of FPL is $26,500

But even if you meet the income qualifications, you may still be ineligible for a subsidy. That would be the case if:

You May Be Allowed A Premium Tax Credit If:

- You or a tax family member enrolled in health insurance coverage through the Marketplace for at least one month of a calendar year in which he or she was not eligible for affordable coverage through an eligible employer-sponsored plan that provides minimum value or eligible to enroll in government health coverage like Medicare, Medicaid, or TRICARE.

- Your health insurance premiums for at least one of those same months are paid by the original due date of your return. They can be paid either through advance credit payments, by you, or by someone else.

- You are within certain income limits.

- You do not file a married filing separately tax return.

- There are exceptions for certain victims of domestic abuse and spousal abandonment. For more information about these exceptions, see the Premium Tax Credit questions and answers.

You are not eligible for the premium tax credit for coverage purchased outside the Marketplace. Answer the yes-or-no questions in our eligibility chart or use the Am I Eligible to Claim the Premium Tax Credit interview tool to see if you may qualify for the premium tax credit.

Also Check: How To Get Health Insurance For My Small Business

Understanding Health Insurance Premiums

Health insurance premiums, the amount paid upfront in order to keep an insurance policy active, have been steadily increasing as the cost of healthcare has increased in the United States. Premiums can be thought of as the “maintenance fee” for a healthcare policy, not including other payments that consumers have to pay such as deductibles, co-pays, and other out-of-pocket costs.

When the Affordable Care Act was passed by President Barack Obama in 2010, it allowed certain families to access premium tax credits on their health insurance plans, relieving some of the burdens of skyrocketing health insurance premiums.

According to research by the Kaiser Family Foundation, a non-profit organization that focuses on healthcare issues in the U.S., roughly half of Americans receive health insurance through an employer-based plan.

If your medical premiums are deducted through a payroll deduction plan, it’s more than likely that youre covering your share of your insurance premium with pre-tax dollars. So, if you deducted your premiums at the end of the year, youd effectively be deducting that expense twice.

If You Already Have A Marketplace Plan

You can also wait until you file and “reconcile” your 2021 taxes next year to get the additional premium tax credit amount. But, we recommend you update your application and review your plan options. You may be able to choose a plan with lower out-of-pocket costs for the same price or less than what youre currently paying.

Note: If you didnt update your application by early August, we tried to automatically apply these savings for you, starting September 1, 2021. We weren’t able to do this for everyone, so the only way to be sure you get these savings is to log in, and update your application yourself.

Preview 2021 health insurance plans & prices before you log in.

Don’t Miss: Can You Terminate Health Insurance At Any Time

How Does The Health Insurance Tax Credit Work

You can get the health care tax credits in two ways:

- Advance premium tax credit uses estimates to reduce how much you spend on health insurance each month.

- Federal tax refund allows you to receive your health insurance subsidy all at once at the end of the year or to reconcile any differences with your monthly tax credits.

The two methods would qualify you for the same number of credits, but they differ in when you would receive the subsidy and eligibility requirements. Here’s how advance premium tax credits can reduce your monthly bills.

You can apply for advance premium tax credits when you apply for health insurance through the marketplace. With this program, the government sends advance payments directly to the health insurance company every month. The insurer would then credit that money toward the cost of your health insurance premiums, decreasing your out-of-pocket costs each month.

Therefore, if you expect to have low disposable income, taking the advance premium tax credit could be more beneficial if you qualify.

Do I Have To Wait Until I File My Taxes To Get The Subsidy Since It’s A Tax Credit

You dont have to wait until you file your taxes. You can get the premium tax credit in advancepaid directly to your insurance company each monthwhich is what most people do. However, if youd rather, you may choose to get your premium tax credit as a tax refund when you file your taxes instead of having it paid in advance.

This option is only available if you enrolled in a plan through the exchange. If you buy your plan directly from an insurance company, you won’t be eligible for up-front premium subsidies, and you also won’t be able to claim the subsidy on your tax return.

If your income is so low that you dont have to file taxes, you can still get the subsidy, although you won’t be eligible for a subsidy if your income is below the poverty level .

When the subsidy is paid in advance, the amount of the subsidy is based on an estimate of your income for the coming year. If the estimate is wrong, the subsidy amount will be incorrect.

If you earn less than estimated, the advanced subsidy will be lower than it should have been. Youll get the rest as a tax refund.

Regardless of whether you take your subsidy up-front throughout the year or in a lump sum on your tax return, you’ll need to file Form 8962 with your tax return. That’s the form for reconciling your premium tax credit .

Don’t Miss: What Is A Gap Plan Health Insurance

Will The Government Pay For My Health Insurance

Not all of it! The government will not pick up the entire tab, but if you enroll in a Covered California health plan, depending on how much money you make, you may qualify for a subsidy that may cover a considerable portion of your monthly premiums. If you make less than 138% of the Federal Poverty Level in California, you qualify for Medi-Cal . If you make over that amount but less than 400% of the federal poverty level based on your household income and number of dependents, then you may be eligible for an up-front subsidy 1. View Covered California income limits to determine if you quality.

Basically, the government will pay for part of the premium and you will pick up the rest. The amount the government pays initially is dependent on your estimate of what your annual income is expected to be during the year that you apply for health insurance.. If at tax time the next year, it turns out that you made less money than predicted, then you will get a tax credit. If you made more, then your taxes will increase to make up for the governments overpayment on your subsidy. Whether or not you get a subsidy from the government is based on several things: your household income, number of dependents and you being on a Covered California exchange plan.