Health Insurance For Qualifying Adults

Based on income eligibility, some adults qualify for Medicaid or the Healthy Indiana Plan. These are insurance programs to make healthcare more accessible.

Medicaid is a jointly funded, Federal-State health insurance program for low-income people. It covers children, the aged, blind, and/or disabled and other people who are eligible to receive federally assisted income maintenance payments.

The Healthy Indiana Plan known as HIP 2.0 is a health-insurance program for qualified adults offered by the State of Indiana. It covers medical costs and in some cases vision and dental costs. It also offers incentives to members for taking better care of their health.

Application assistance is available at the following locations in North Central Indiana:

Now That You’re Signed Up We’ll Send You Deadline Reminders Plus Tips About How To Get Enrolled Stay Enrolled And Get The

To find information on how to apply visit the fssa benefits portal. Instantly compare free 2021 online quotes from. Indiana health plans is a privately operated, independent marketing website, and is not part of or directly associated with any health insurance company or provider. Hip plus is a premier plan type that includes dental and vision coverage, and no copays except for how much does health insurance cost in indiana. Comparing health insurance plans starts with learning how companies determine their rates in different parts of the state. If you are approved for hip, your health plan will mail you a welcome packet. Now that you’re signed up, we’ll send you deadline reminders, plus tips about how to get enrolled, stay enrolled, and get the. You cannot have one health insurance policy that meets all of your requirements. Compare indiana health insurance plans with free quotes from ehealth! Indiana’s exchange is also where you can apply for subsidized coverage depending on your income. By erik martin posted : Indiana has two levels of medicaid coverage: The healthy indiana plan is a health insurance program for qualified adults.

Health insurance rates vary based on location. How to find affordable health insurance in the state of indiana. It is indiana’s medicaid program, and income limitations apply. Healthy indiana plan member quick links. The plan is offered by the state of indiana.

Once I Make A Fast Track Payment Can I Change My Mce/health Plan

No. Once you pay your Fast Track invoice you may not change your MCE/health plan. You may change your health plan selection before paying your Fast Track invoice by calling 1-877-GET-HIP-9. You can pay your Fast Track invoice or POWER account contribution to your new health plan and your coverage will start the month in which your payment is received and processed. Only make a payment to the health plan that you want to be your HIP coverage provider. You will not have the opportunity to change your health plan until Health Plan Selection in the fall.

Don’t Miss: Can You Have Health Insurance And Medicaid

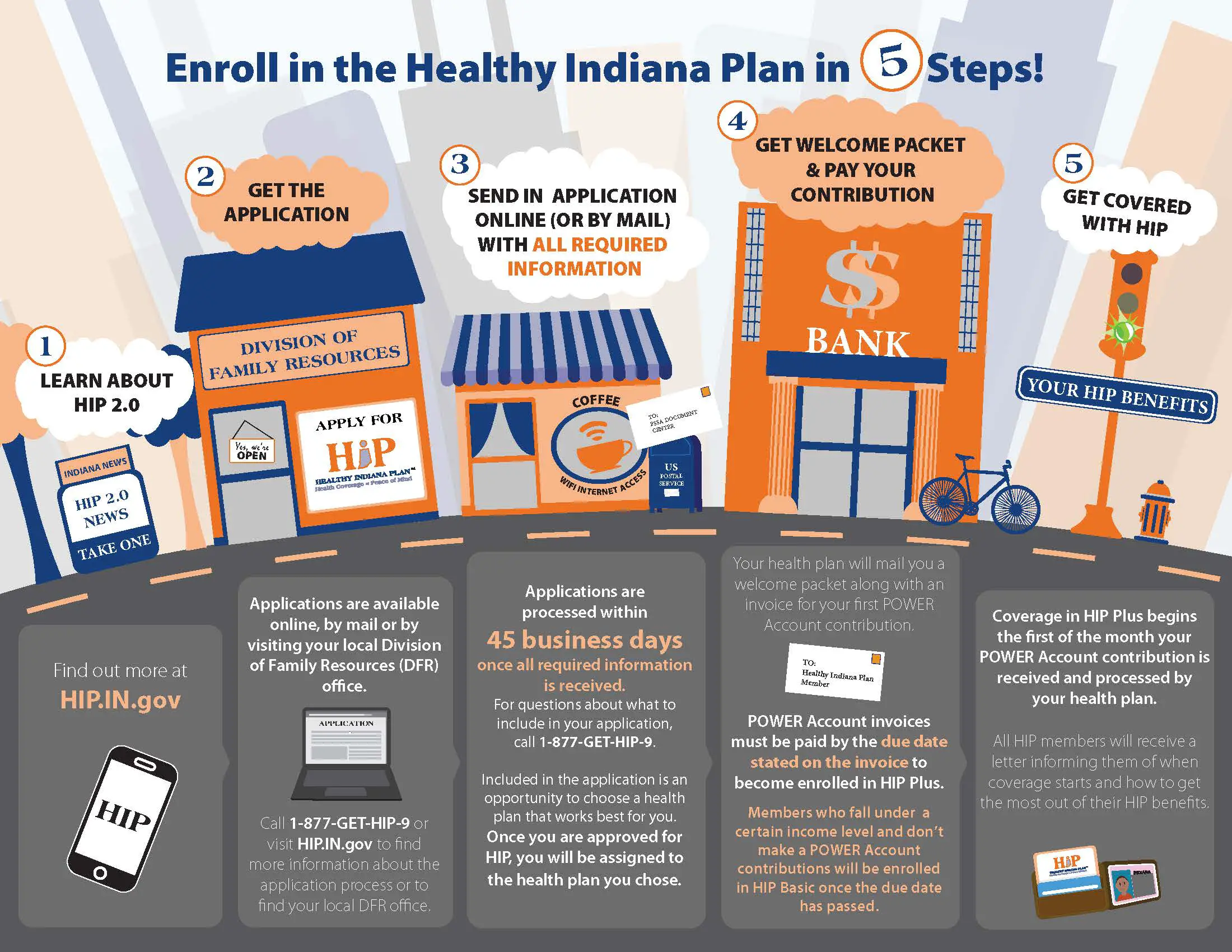

How To Enroll In Hip

Get an application

Applications are available online, by mail or by visiting your local Division of Family Resources office. Call 1-877-GET-HIP-9 to find more information about the application process or to find your .

Send in the application with all required information.

Applications are processed within 45 business days once all required information is received. For questions about what to include in your application, call 1-877-GET-HIP-9.

After your application is processed, you will receive a letter by mail telling you if you qualify for the program.

Once you are approved for HIP, you will be assigned to the health plan you chose on your application. . If you do not choose a health plan, one will be selected for you.

Approved applications

If you are approved for HIP, your health plan will mail you a welcome packet.

All HIP members will receive an invoice for their POWER account contribution. HIP POWER account contributions must be paid by the due date stated on the invoice to become enrolled in HIP Plus.

If you selected a health plan on your application, you will also receive an invoice for a Fast Track payment while your application is being processed. Making a Fast Track payment can expedite your enrollment in HIP Plus. To find out more about Fast Track payments, .

Get HIP benefits

All HIP members will receive a letter informing them when coverage starts and how to get the most out of their HIP benefits.

How Do I Apply For Indiana Hoosier Healthwise

It also rewards members for taking better care of their health. To find the right health insurance plan in indiana, you first need to consider your medical needs. Comparing health insurance plans starts with learning how companies determine their rates in different parts of the state. Check indiana health insurance plans, laws, regulations and requirements. Find low cost indiana health insurance rates, get covered easily and quickly, and apply for a policy today.

Recommended Reading: How Much Does It Cost To Get Health Insurance License

Getting Coverage Outside Of Open Enrollment

Open enrollment for the Federal Health Insurance Marketplace is now over, but you may still have options to get health coverage. Click here to learn more about your options.

Certified navigators can also help you through the options still available to you through ClaimAid, which you can learn about at www.claimaid.com. The local representative for ClaimAid is Betty Fagg, who can be reached at 812-238-7967. Betty’s office is located at Union Hospital, so you will be able to meet with her in person should you choose to do so.

If you qualify for the special enrollment period, please remember Union Hospital and UAP Clinic have partnered with the MDwise Marketplace insurance plan, and is the exclusive provider for MDwise in Vigo and Vermillion counties. MDwise is an Indiana health insurance company that includes Indiana’s top ranked doctors and hospitals that no other plan covers in-network, and close to home. This means that if you choose the MDwise Marketplace plan, you will have the ability to utilize Union Hospital services. MDwise is available to Vigo County residents through the Marketplace . Residents of Park and Vermillion counties who wish to select MDwise for their insurance coverage can log on directly to the MDwise website at MDwiseMarketplace.org, or call 1-855-832-5937 to select the MDwise Marketplace insurance.

For our Illinois patients, Union Hospital will accept Blue Cross Blue Shield and Coventry insurance purchased from the Illinois Marketplace.

Having Health Insurance In Indiana Gives You Access To Some Important Medical Benefits That You May Not If You Don’t Have Health Insurance Here’s How To Find The Best Coverage Options In Indiana

How do i apply for indiana hoosier healthwise? Indiana’s exchange is also where you can apply for subsidized coverage depending on your income. You cannot have one health insurance policy that meets all of your requirements. The plan is offered by the state of indiana. Now that you’re signed up, we’ll send you deadline reminders, plus tips about how to get enrolled, stay enrolled, and get the. Applicants falling within a specific medicaid program will have to meet its criteria in order to receive medical. Indiana health insurance how to find an affordable plan. The cheapest health insurance in indiana for most people is the caresource marketplace low premium silver plan, which was the most affordable plan in 89% of the state’s learn how we conducted this analysis in our: Hip plus includes dental and vision coverage, and no copays unless enrollees use the emergency room. Learn how to sign in to your member site. Apply for coverage and learn more about health plans in indiana. Health care is provided at little or no cost to indiana families enrolled in the program. Health insurance rates vary based on location.

Read Also: How To Cancel Health Net Insurance

Transferring To Or From Other Health Coverage

The federal Health Insurance Marketplace holds an annual open enrollment period, usually from November through January. During this time, you can apply to buy health insurance coverage on the Marketplace and see if you qualify for financial assistance programs. Indiana also has health coverage called the Healthy Indiana Plan , and you can apply any time during the year. Both Marketplace and HIP coverage have eligibility requirements you must meet before you can get coverage.

Learn more about your options based on your current health coverage:

You have health insurance through the Marketplace

If you have health insurance through the federal Health Insurance Marketplace, you will get a letter from the Marketplace requesting that you come back to the Marketplace during open enrollment and update your information. If you go back to the Marketplace to update your information, the Marketplace will reassess and confirm your eligibility. If the Marketplace thinks you may be eligible for HIP, it will forward your information to Indiana to determine your eligibility for Indiana Health Coverage Programs like the Healthy Indiana Plan.

If you get a notice from the Indiana Family and Social Services Administration that says you are eligible for HIP, there are several actions you will need to take.

You have health coverage through the Healthy Indiana Plan

Could You Qualify For The Healthy Indiana Plan Find Out

Could you or someone you know benefit from HIP 2.0? This program could provide health coverage for up to 10,000 eligible residents in Reid’s service area.

Of the estimated more than 25,000 uninsured people in the Reid service area, up to half or more of them could be eligible for HIP 2.0. The plan pays for medical expenses and provides incentives for members to be more health conscious, according to the state HIP web site. Generally, coverage is for qualified low-income Hoosiers ages 19 to 64 with incomes of up to $17,443 a year for an individual, $23,615 for a couple or $35,960 for a family of four.

HIP participants also need to be up-to-date on the new Gateway to Work program. Gateway to Work is a part of the Healthy Indiana Plan that connects HIP members with ways to look for work, train for jobs, finish school and volunteer. Starting in 2019, some HIP members are required to do Gateway to Work activities to keep HIP benefits.

Signups for HIP can be done with the help of Reid’s ClaimAid team and benefit specialists, including:

The documents needed to sign up include a birth certificate, photo ID, and the last 30 days of income verification for everyone in the household. Once signed up, coverage begins in from 40 to 60 days.

| Household size |

|---|

Don’t Miss: Which Is The Best Health Insurance Company In Texas

One Plan Always Covered

MHS offers affordable individual and family health insurance plans that fit your unique needs. Program eligibility depends on your:

- Age

- Any special health needs you may have

Medicaid: To find out if you are eligible for Medicaid, visit the FSSA website.

Marketplace: To find out more about the Health Insurance Marketplace, visit HealthCare.gov.

Medicare: To find out more about Medicare options, visit Medicare.gov.

Learn more about the plans MHS offers by selecting a program below. If you have a question or need help, please call us at 1-877-647-4848. We are here to help!

Do I Have To Make A Fast Track Payment

While making a Fast Track payment can help ensure you get enrolled in HIP Plus as quickly as possible, you are NOT required to make a Fast Track payment. From the date you receive your initial Fast Track invoice you will have 60 days to make a payment to start your HIP Plus coverage. You can pay either the $10 Fast Track payment or your POWER account contribution amount. If you do not make your contribution or Fast Track payment within 60 days and your income is less than the federal poverty level you will be enrolled in HIP Basic where you will have copayments for all services and you will not have dental, vision or chiropractic. If you wait more than 60 days to make a payment and your income is more than the federal poverty level, then your application will be denied and you will have to reapply for HIP coverage.

You May Like: How To Get Health Insurance For My Parents

I Have Insurance Through My Employer Does This Affect Me

No. If you are eligible for employer-sponsored health coverage, you will not be affected.

Whether you qualify for the Marketplace will depend on what kind of coverage your employer offers. If your job-based coverage is considered “affordable” and meets minimum value, you won’t be able to get lower costs on premiums or out-of-pocket costs in the Marketplace. This is true no matter what your income and family size are. Employer coverage is considered affordable if the employee’s share of the annual premium for self-only coverage is no greater than 9.5% of annual household income.

How Does The Power Account Work

In the HIP program, the first $2,500 of covered medical expenses is paid for out of a special savings account called a Personal Wellness and Responsibility Account. The state will pay most of the expenses, but members are also required to make a small contribution each month. These POWER Account contributions can be made by a member’s employer or a not-for-profit organization. HIP members get to choose a health plan that will manage and track the POWER account and collect the member’s portion each month.

Read Also: How Much Does Usps Health Insurance Cost

Payments Made While Your Application Is Being Processed

If you do not apply online, or choose not to make a Fast Track payment when you apply, you will still have the opportunity to make a Fast Track payment while your application is being processed. You will receive a Fast Track invoice from the Managed Care Entity you selected to provide your health coverage. If you did not select an MCE you will be automatically assigned to one. If you pay the Fast Track invoice and are determined to be eligible for HIP then your HIP Plus coverage will begin the first of the month that your payment was received and processed.

What Is Fast Track

Fast Track is a payment option that allows eligible Hoosiers to expedite the start of their coverage in the HIP Plus program. Fast Track allows you to make a $10 payment while your application is being processed. The $10 payment goes toward your first POWER account contribution. If you make a Fast Track payment and are eligible for HIP, your HIP Plus coverage will begin the first of the month in which you made your Fast Track payment.

Don’t Miss: What Is The Self Employed Health Insurance Deduction

How Will Hoosiers Be Healthier Under The Healthy Indiana Plan

The indiana children’s health insurance program is a type of health insurance provided by the government. Hip plus includes dental and vision coverage, and no copays unless enrollees use the emergency room. How will hoosiers be healthier under the healthy indiana plan? Now that you’re signed up, we’ll send you deadline reminders, plus tips about how to get enrolled, stay enrolled, and get the. Finding the best health insurance plan from so many different health insurance companies can get confusing for many people. Anyone who applies for indiana health coverage programs online will have the opportunity to make. Learn how to sign in to your member site. Five different levels of coverage are available covers those who earn up to $44,000 for a family of four, for example, been without insurance. Indiana offers a range of health insurance options. How to select best health insurance policy. There are a number of health insurance. This page will help you understand everything you need to know about purchasing affordable health insurance in indiana, understanding the benefits of purchasing health insurance, how to obtain an accurate health insurance quote, and. Health insurance is a requirement.

How to apply for medicaid.

We are able to forward inquires to licensed health insurance agencies and their agents who are qualified to discuss the health.

How do i apply for indiana hoosier healthwise?

How much does health insurance cost in indiana?

If You Already Have Health Coverage But Need Help Using And Keeping It We Can Help With That Too

Covering Kids and Families of Brightpoint can help you with:

- Finding a primary care doctor

- Reporting changes such as a new address, new job, birth of a baby, etc.

- Completing Eligibility Review and Re-enrollment paperwork

- Knowing where and how to make monthly payments

- Filing appeals

- Dealing with any other questions or problems you may have with your health coverage

Read Also: How To Sign Up For Aarp Health Insurance

Presumptive Eligibility For Pregnant Women

PEPW is for pregnant women who are not currently receiving Indiana health coverage. PEPW offers temporary coverage for prenatal care services while an Indiana health coverage application is pending. If you have not already applied for Medicaid, Brightpoint Navigators will help you apply at the time a PEPW application is submitted. PEPW can be used as a secondary insurance and enrollment is year-round.

What If My Power Account Contribution Is Not $10

If you are found eligible for HIP and you make your $10 Fast Track payment, this payment will be applied toward your POWER account contribution. Your monthly POWER Account contribution will be based on your income. This may be more or less than $10 per month. If your POWER account contribution amount is less than $10 per month, your $10 payment will be applied to your initial coverage month with the remaining amount applied to future months.

For example if your POWER account contribution is $4, then your first two months of coverage will be paid in full, you will owe a balance of $2 in the third month, and then $4 for every following month to maintain HIP Plus enrollment. If your POWER account contribution is more than $10, then you will owe the balance in the first coverage month. For example if your POWER account is $15, then your $10 payment will be applied to your first months coverage. You will owe an additional $5 for that month of coverage and $15 for each following month.

You May Like: What Is The Best Travel Health Insurance