What Are Health Insurance Deductibles

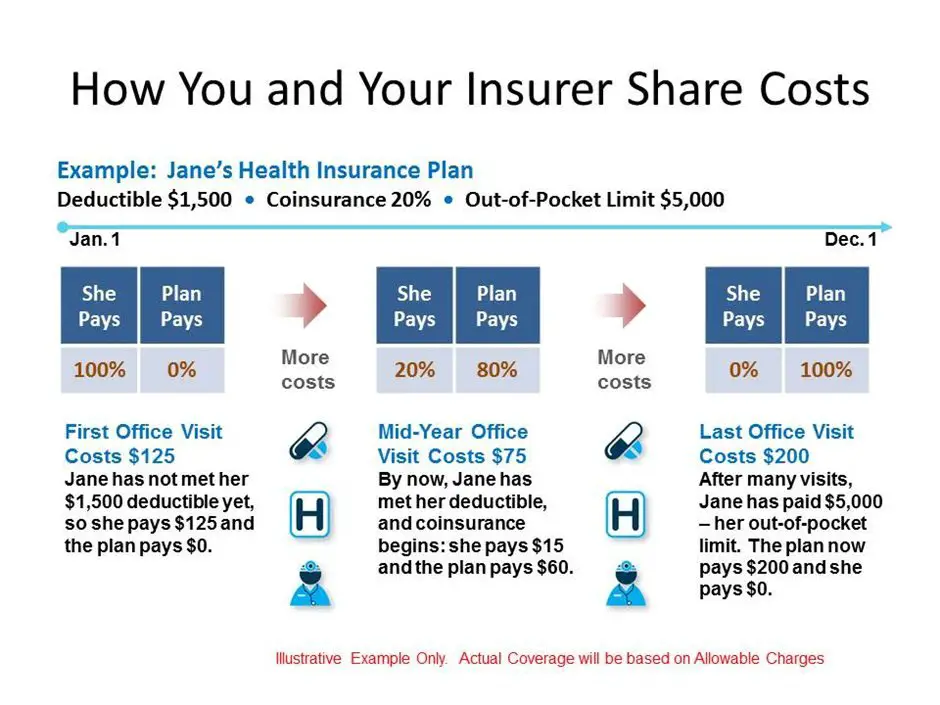

A health insurance deductible is a specified amount or capped limit you must pay first before your insurance will begin paying your medical costs.

For example, if you have a $1000 deductible, you must first pay $1000 out of pocket before your insurance will cover any of the expenses from a medical visit. It may take you several months or just one visit to reach that deductible amount.

Youll pay your deductible payment directly to the medical professional, clinic, or hospital. If you incur a $700 charge at the emergency room and a $300 charge at the dermatologist, youll pay $700 directly to the hospital and $300 directly to the dermatologist. You dont pay your deductible to your insurance company.

Now that youve paid $1000, you have met your deductible. Your insurance company will then start paying for your insurance-covered medical expenses.

Your deductible automatically resets to $0 at the beginning of your policy period. Most policy periods are 1 year long. After the new policy period starts, youll be responsible for paying your deductible until its fulfilled.

You may still be responsible for a copayment or coinsurance even after the deductible is met, but the insurance company is paying at least some amount of the charge.

Health Insurance Deductibles: How Do They Work

Health insurance can help your family avoid bankruptcy from high medical bills. Understanding how it works isnt easy, though.

The insurance plans are full of confusing terms, such as deductible, that everyday people dont understand.The complexities continue by having several other factors that impact your costs. It makes comparing policies extremely frustrating.

You can alleviate some of that frustration by understanding what youre looking at.

One of the most significant factors that impacts your costs in a health insurance plan is your deductible.

Heres how they, along with other insurance terms, work.

How Do You Reach Your Out

Your deductible is part of your out-of-pocket maximum . This is the most youll pay during a policy period for allowed amounts for covered health care services.

Other cost-sharing factors that count toward hitting your out-of-pocket maximum:

- Copayments: Fixed dollar amounts of covered health careusually when you receive the service. .) Your plan determines the price of your copay and whether its owed before or after you meet your deductible.

- Coinsurance: You likely wont pay coinsurance, calculated as a percentage of shared costs between you and your health plan, until your deductible is met. Typical coinsurance ranges from 20 to 40% for the member, with your health plan paying the rest.

Your premium and any out-of-network costs dont count toward your out-of-pocket maximum.

Once your deductible and coinsurance payments reach the amount of your out-of-pocket limit, your plan will pay 100% of allowed amounts for covered services the remainder of the plan year.

You May Like: What Is Employer Group Health Insurance

Paying Part Of The Cost When There’s No Deductible

Sometimes a plan will offer coverage for your costs on certain medical procedures or treatments without deductible.” Be careful as you read your wording to make sure you also check for the limits. Even though limits and deductibles are not the same, hitting the limit in a plan will force you to pay out-of-pocket.

For example, sometimes certain medical exams like an eye exam may not be subject to a deductible, so it will be a no deductible coverage. Yet the eye exam cost, or even the cost of the glasses you end up being able to buy, may have a limit even if they do not have a deductible.

If your eye exam costs $65 and your limit for the eye exam coverage is $50, then you will end up paying the difference, even though there is no deductible.

What Doesnt Count Toward The Deductible

Healthcare expenses that arent a covered benefit of your health plan dont count toward your deductible even though youve paid for them. For example, if your health insurance doesnt cover orthotic shoe inserts, then the $400 you paid for a pair of orthotics prescribed by your podiatrist doesnt count toward your deductible.

Similarly, if your health plan doesn’t cover out-of-network care, any amount that you pay for out-of-network care will not be counted towards your deductible.

If your health insurance requires a per-episode deductible, or a deductible each time you get a particular type of service, as well as an annual deductible, money you pay toward the per-episode deductible might not count toward your annual deductible.

If you have separate deductibles for in-network and out-of-network care, the amount youve already paid toward your in-network deductible doesnt count toward your out-of-network deductible. Depending on your health plans rules, the amount youve paid toward your out-of-network deductible likely won’t count toward your in-network deductible, either.

In most health plans, copayments don’t count toward your annual deductible, although they do count toward your total out-of-pocket costs for the year.

You May Like: What Is The Best Health Insurance Coverage

Average Deductibles And High Deductible Health Plans

In 2020, the average cost of a high-deductible health plan for an individual was $4,971 a year while the average cost for a low-deductible plan was $7,816.

This is how much the average American paid for health care premiums and deductibles as of the end of 2020:

- The average health insurance premium for a plan offered under the Affordable Care Act was $456 for an individual and $1,152 for a family. The numbers do not take into account any subsidies for coverage that were received by lower-income people.

- The average annual deductible was $4,364 for an individual and $8,439 for a family, according to the latest figures available, from 2019.

- People who were covered by company health plans paid an average deductible of $1,655.

How Can Your Deductible Vary

Your deductible varies based upon several factors. The plan that you choose is the most common reason that a deductible might vary. Different plans will have different deductible amounts. However, there are other things to be aware of as well. For example, you might have a deductible that only applies to certain types of services. For example, you may have to meet a deductible only on your prescription medication. That means that you have to pay for your own medication for a period of time until you meet the threshold, after which you may or may not have to pay an additional co-pay whenever you pick up medication.

Another factor to consider is that your deductible can vary based upon the number of people covered in your plan and the person that is using the benefit. For example, with some health insurance plans, your deductible might apply to the entire family while others will apply to each individual person within the family. This is definitely something you want to understand beforehand, prior to your signing up for that particular health insurance plan. Make sure that you get all of the information you can before you decide on which plan to have because you cant change it until the next window.

Read Also: How Much Is Health Insurance Through Work

How To Know Health Insurance Tax Deductible Per Year

6 Best Credit Cards for 2021: Your Ultimate Guide

In the form of income tax, you will find a health insurance tax deductible and can claim it if you are self-employed and have made a profit for the year. If you list your tax year deductions on Attachment A , Detailed Deductions, you will be able to deduct the costs you paid for medical and dental care for you, your spouse, and people under pressure. You can still list premiums as a detailed deduction in Appendix A when submitting your tax return for all medical expenses and premiums.

Other taxpayers can only deduct the cost of health insurance as a detailed deduction if their medical and dental expenses in 2020 exceed 7.5% of their adjusted gross income. Self-employed persons who meet certain criteria can deduct health insurance premiums even if their expenses do not exceed the 7.5% threshold.

Insurance premiums can be thought of as the service charge of a health policy excluding other payments consumers have to pay such as deductibles, copays, and other out-of-pocket costs.

According to a study by the Kaiser Family Foundation, a nonprofit health organization in the United States, about half of Americans get health insurance through an employer plan. And in almost all cases, the premiums people pay for employer coverage are deducted from their pre-tax payroll.

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

Read Also: Can You Add Your Mom To Your Health Insurance

Is There A Limit To What You Pay Out

Every year an out-of-pocket maximum is placed on both individual and family plans. This is the most you have to pay out-of-pocket for covered services during that plan year. After you spend this pre-determined amount of money on deductibles, copays, and coinsurance, your health insurance plan pays 100% of the cost of covered benefits.

Keep in mind that an out-of-pocket maximum does not include your monthly premiums. It also doesnt include any money you pay out-of-pocket for non-covered services.

What’s The Difference Between A Deductible And An Out

Your insurance deductible is relevant at the beginning of your health insurance policy, and your out-of-pocket maximum is relevant after you’ve had significant health care during a policy year.

- Deductible: You pay 100% of your health care costs until your spending totals your deductible amount.

- Coinsurance/copay: You’ll pay a portion of your health care costs until your total spending reaches your out-of-pocket limit.

- Out-of-pocket limit: You’ll pay 0% for covered health services after your out-of-pocket limit.

Recommended Reading: How To Apply For Kaiser Health Insurance

My Health Plan Has A Deductible What Does That Mean

To help keep premium costs lower, some health care plans have a deductible. A deductible is the amount of money a member pays out-of-pocket before paying a copay or coinsurance. The amount paid goes toward the out-of-pocket maximum.

- Need an explanation of health care terms we use? Visit our glossary

- Think of your health insurance deductible like your auto insurance. You pay a monthly premium for coverage, but when the time comes for a claim, you pay your deductible first. Unlike auto insurance deductibles, many health plans provide some benefits before you meet the deductible – such as free, preventive services.

When You Dont Pay The Deductible

As part of the Affordable Care Act in the United States, you dont have to pay a deductible for certain preventive care services from an in-network doctor, as long as your health plan isn’t grandfathered.

A grandfathered plan is one that was in effect prior to the Affordable Care Act that’s allowed to continue without follow all of the ACA’s regulations. If your employer has a grandfathered plan, you may have costs for some preventive care.

Read Also: Can You Buy One Month Of Health Insurance

What Other Deductibles May Apply

Keep in mind that some plans have separate deductibles for certain benefits. For example:

- You may need to reach separate, higher individual and family deductibles if you decide to seek treatment from providers outside your insurance companys network.

- Your plan may have a separate deductible you must reach before your insurance starts paying for covered prescription drugs.

After you have met your deductible, your health insurance plan will pay its portion of the cost of covered medical care and you will pay your portion, or cost-share.

How Do You Find The Right Health Insurance Plan

With these basic principles in mind, you are ready to explore your health insurance options! Whether you are looking for individual coverage or insurance to cover your family, eHealth can help you find affordable coverage designed to meet your personal needs and preferences. Learn more about individual and family coverage with eHealth and find a plan that works for you. An eHealth team of knowledgeable insurance brokers and service representatives is standing ready to help you. Also check out health insurance by state to see the best plans in your area.

This article is for general information and may not be updated after publication. Consult your own tax, accounting, or legal advisor instead of relying on this article as tax, accounting, or legal advice.

Don’t Miss: How Much Is Insurance For Health

Family Plans Have Separate Deductibles

Family health insurance deductibles are even more confusing.

You generally have two deductibles to watch out for.

The first is a per-person deductible. This must be met for each individual before health insurance starts kicking in on most services for the individual.

The second is a family deductible. This is higher than the per person deductible.

If you reach the family deductible amount, insurance automatically kicks in for all family members whether theyve reached their individual deductible or not.

Reaching the deductible for Person A without fulfilling the family deductible means Person B needs to meet their deductible.

Alternatively, the family as a whole has to meet their family deductible.

Only then will insurance start paying for Person Bs costs.

Insurance Deductibles Explained: How To Meet Your Deductible

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 12 references cited in this article, which can be found at the bottom of the page. This article has been viewed 4,048 times.Learn more…

You pay a monthly premium for insurance coverage that protects you if disaster strikes. In addition to paying your monthly premiums, you’re also responsible for paying the deductiblethat’s the amount of money you pay before your insurance company will pay. You might choose a policy with a higher deductible in exchange for a lower monthly premium, but then an unexpected illness, injury, or accident can leave you scrambling. That’s why we’ve compiled some of the best options available for you to meet your insurance deductible so you can move forward.

Also Check: How Much Is Health Insurance In Costa Rica

Other Exceptions To Deductibles

While most cost-sharing benefits only kick in once the deductibles have been met, health plans can and do make a few exceptions where copays come into effect beforehand. For instance, all plans are required to cover preventive care at zero cost to the consumer.

Other exceptions to deductibles offered by plans include:

- Copays on a set number of visits to primary care physicians.

- Many catastrophic and high-deductible plans allow patients to pay a low copay for PCP visits even before deductibles are met.

- A number of plans offer up to three visits to the PCP for a copay.

- Generic drugs are also often excluded from the deductible requirement with an established copay applying at all times.

How A Health Insurance Deductible Works

The benefit of a health plan is that it helps pay the cost of your medical expenses, but health insurance doesnât always pay for everything â oftentimes youâll have to chip in, too. Thatâs why most health insurance plans constitute a cost-sharing plan between you and the insurer you pay a portion of the costs and your insurer pays a portion of the cost. How those costs are determined depends on different aspects of your plan, including the deductible.

The deductible is the dollar amount that you must pay out of pocket before your health insurance begins paying for covered medical expenses.

When you purchase an individual plan on the health insurance marketplace, and sometimes even if youâre choosing a plan offered by your employer, you will need to choose a deductible amount for your plan. Deductible amounts typically range from $500 to $1,500 for an individual and $1,000 to $3,000 for families, but can be even higher.

When a family has coverage under one health plan, there is an individual deductible for each family member and family deductible that applies to everyone. For example, the family deductible might be $2,000 and each individual deductible might be $350.

However, certain procedures or services â like preventive care or a visit to a primary care doctor, perhaps even the example we used above â might not be subject to a deductible. That means the insurer will pay the entire cost of the visit minus a small copay, which you pay out of pocket.

Recommended Reading: What Do You Need To Get Health Insurance