How Many Employees Do You Need To Qualify For Group Health Insurance

Group health insurance is a cost-effective way for small businesses to offer health insurance, as its cheaper than buying individual plans.

A company has to have fewer than 50 employees to qualify for group health insurance. You also have to have an office of some sort in the state where youre applying for coverage, and you need to enroll at least 70% of your uninsured employees.

If youre a family-run business, you need to check your eligibility for group health insurance, as you need to have workers who are not related to or the spouse of the owner of the company. If you only employ family members, youll need to apply for a family health insurance plan instead. Sole proprietors also cannot apply for group health insurance.

Part-time employees and seasonal workers do not count as part of the group, but you can still choose to offer them group health insurance. You can also provide individual health insurance to specific workers alongside your group plan.

Update: The New Qsehra May Allowemployers To Pay Up To $5k Annually Towards Employee’s Individual/family Plans Ask Us How It Works

Many California employers still contribute to employee’s individual planswithout the QSEHRA andthey’re running a risk by doing so.

It’s highly valued by employees

Even if a company is only paying 50% toward the Bronze level plan, theemployee feel taken care of.

The cost to vet, hire, and train employees is a significant cost.

More sothan the health insurance premium paid.

And here’s what I heard from one of our clients about offering insurance:

Do Small Businesses Have To Offer Health Insurance A Guide To Employee Health Benefits

The health insurance mandates of the Affordable Care Act have changed since President Donald Trump took office. Many small business owners are confused and have questions about whether or not they have to offer health insurance to their employees. In 2018, small businesses with fewer than fifty full-time equivalent employees are not required by law to provide health insurance to their workers.

These topics will show you how to determine if you need to provide health insurance and walk you through your health benefits options:

Also Check: How Much Is Health Insurance For Seniors

Fine They Can Go Up To The Silver Gold Or Even Platinum Level Coverage

The employer’s contribution remains based on the Bronze and the employee pays the difference with pre-tax money.

Of course, they’re only going to do this if it makes sense financially tothem.

This is the best of both worlds.

Employer caps exposure for health care costs while the employee can pickaccording to his/her health care needs and budget.

If an employer has to offer health insurance, this is the way to do it!

We can offer this mini-cafeteria plan for small and large companies.

Who Is Required To Offer Health Insurance

Health insurance requirements are based on the type of business and the number of employees it has. For businesses that are smaller, with under 50 full-time equivalent employees, benefit plans are not required to be offered by the employer. They are offered on a voluntary basis.

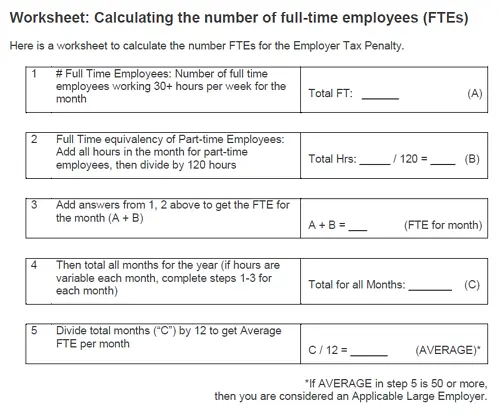

Technically, no business has to offer health insurance to their employees. However, under the Affordable Care Act , larger businesses with 50+ FTE employees will receive a tax penalty of $3,860 per employee if they do not offer health insurance.

According to attorney Sachi Barreiro, there are a few reasons a business might actually be required to offer health insurance to their employees:

- If their employment contract or union agreement guarantees it.

- If they offer group health insurance, they must offer it to similarly situated employees.

- If theyre being discriminatory about it.

Recommended Reading: How To Extend Health Insurance

Are Employers Required To Offer Health Insurance To Employee Dependents

Health insurance plans generally allow qualified dependents to be added to any plan. However, for group health insurance plans, it is optional for employers to pay for the health insurance coverage of employee dependents. In most cases, employees can still add qualified dependents to their health plan, regardless of whether their employer decides to contribute to dependents premiums.

Do You Have To Offer Health Insurance In 2020

Well, yes and no.

Legally speaking, if youre operating a business that has less than 50 active full-time employees, then youre not required by the IRS to provide health insurance to your employees. You wont be penalized if you dont offer health benefits. However, now that were in 2020, youll find that you most probably have to provide it anyway.

Despite all the banners and the opportunities, encouraging new startups to join the entrepreneurial ecosystem, making it through the world of business is not an easy feat.

As if competing with large businesses in every aspect wasnt hard enough, startups always struggle to find good talent. When youre one of the best, the equation becomes: why join a startup with low compensation and limited benefits, when they can work for large companies and get the best offers? This leaves startups with one of two options to be able to acquire these talents: offer higher compensation or attract them with more benefits. This is where health insurance comes to play, as its one of the best benefits an employee can get.

You May Like: What Is A Good Cheap Health Insurance

How Can Employers Save Money On Small Business Health Insurance Premiums

Smallbusinesses can still purchase group health insurance even if they do notqualify for a health care tax credit. For instance, small employers may stillbe able to deduct the cost of contributing to monthly employeepremiums from their federal taxes as a business expense.

Since group health insurance is employer-sponsored coverage, small businesses can also ask employees to pay for a portion of monthly premiums from their paychecks while still fulfilling employer cost-sharing requirements and ACA health insurance requirements. Browse affordable small business health insurance plans with eHealth to find the best options for your business.

You may also be able to offset some of the expense of providing group health insurance if you can capitalize on some of the small business incentives available from the American Rescue Plan Act of 2021, enacted to provide economic relief during the coronavirus pandemic. A variety of grants and loans, collectively valued at more than $22 billion, are set aside to assist small businesses struggling to recover from the economic effects of the pandemic.

Best For Health Expense Fund Options: Aetna

Aetna

- No. Policy Types: Varies by state

- No. States Available: 50

Small businesses may appreciate the high-deductible health insurance plans available from Aetna. It’s also recognized for its customer service and tax-advantaged savings options that may better fit some employee needs.

-

High levels of customer satisfaction

-

Not available in every state

-

Less informative website info for decision making

-

Costs variable, hard to determine without sales rep help

Aetna is an insurance company with a long history in the business. The company has been around since 1853 and has earned an A rating with AM Best. Aetna scores from 2.5 to 4 on a scale of 1 to 5 with NCQA. The company shows mixed rankings on the J.D. Power’s 2021 Commercial Member Health Plan Study.

Aetna isn’t available in every state, but the company has a large global footprint, with more than 700,000 primary care doctors and over 5,700 hospitals. Depending on your state, the company may have one, two, or all three of these plans as well as others the costs may vary:

Four health expense fund options for small businesses are unique to Aetna. These give employees tax-advantaged savings opportunities:

- HealthFund Health Reimbursement Arrangement

- HealthFund Flexible Spending Account

- Retirement Reimbursement Arrangement

Read Also: What Type Of Insurance Is Health Partners

What Is An Applicable Large Employer

For the majority of organizations, this is a simple calculation. However, for employers with many part-time or seasonal employees, the calculation is more in-depth. In general, if your organization employed an average of 50 or more full-time equivalent employees during the previous calendar year, you are considered an applicable large employer for the current year.

Your organization is defined as an applicable large employer on a calendar year basis. For example, you could be an applicable large employer in 2021, but not in 2020. Did your organization employ 50 or more full-time employees on average during the preceding calendar year? If yes, then you are an applicable large employer for the current calendar year.

Your organization is NOT an applicable large employer if:

- You employed fewer than 50 full-time employees on average during the previous calendar year, or

- You employed more than 50 full-time employees no more than 120 days during the previous calendar year due to a seasonal workforce.

How Can Employers Qualify For The Small Business Health Insurance Tax Credit

A small business owner can usually qualify for the two-year tax credit if the following ACA requirements are met:

Smaller businesses can generally be eligible for a higher health care tax credit. For instance, a business with fewer than 10 employees and an average salary lower than $26,000 would qualify for the highest tax credit. Overall, the health care tax credit may help make the purchase of group health insurance more affordable for small businesses while ensuring that their coverage meets ACA insurance requirements. If you decide to offer a group health plan to your employees, you can calculate and claim the credit using IRS Form 8941.

Read Also: How Much Does Private Health Insurance Cost In California

Does Small Business Have To Provide Health Insurance

Given the ongoing decline in employer-sponsored health coverage and soaring healthcare costs, many cash-strapped small business owners ask, “Do small businesses have to provide health insurance?”

Read on to learn whether or not you’re legally required to provide healthcare coverage for your employees. Plus, why you might want to offer it if you have the budget.

Technology Advancements Make It Easier To Customize Plans To An Individuals Unique Needs

Technology has unlimited potential to bridge the gap between supply and demand in new and creative ways. Its happening everywhere. Netflix has changed the way we think about TV and movies. Amazon has changed the way we think about shopping. The list goes on and on, with new names being added every day.

Healthcare will be no exception traditional healthcare experiences will also face disruption. There are consumer pain points everywhere you look in healthcare. And where there are pain points, there is demand for new solutions. Technology has great potential to help improve healthcare experiences, build fluency, and guide consumers through healthcare decisions, delivering personalized recommendations to help consumers save money on coverage and care.

But we have only scratched the surface of what is possible.

You May Like: Is It Legal To Marry For Health Insurance

Learn The Basics Of Small Business Health Coverage

Just getting started with your research? Here are the most important things to know about choosing a small business health insurance plan.

- You can buy business coverage any time.

- Theres no special enrollment period for business health insurance.

- You can request a quote online and from as many companies as you like. Theres no need to make contact or provide any more information than youre willing to share until youre ready to talk.

- Finally, its easy to compare plans online. Most business health insurance providers offer interactive tools and calculators to help you compare the plans they offer.

Selecting A Health Insurance Policy That Works For You

Once you have a good idea of what type of coverage to purchase and from whom, the next step is to apply for a policy. Work closely with the insurance company to gather data on the next steps. This generally will include providing all employee names and personal information.

Most often, the insurance provider will set up a time to come to the place of employment to enroll employees and educate them on their options. Others handle this through a set of forms each employee must complete.

Most of the time, a benefits package is issued, which contains all of the terms and features of the policy and instructs employees on their next steps. It’s common to see a booklet outlining information. There may be resources for setting up online accounts and how to start using the policy within this. Some companies have mobile apps, too.

The insurance company will then mail health insurance cards to the covered employees once the policy is active. They will also provide insight into available features, including preventative care services. Employees can then start using their policies as they want and need to do so.

Recommended Reading: Can A Child Have 2 Health Insurance Plans

Should I Offer Health Insurance To My Employees

There are a few things to consider before making a decision. Remember, if youre a larger business, you will receive a tax penalty if you dont offer health insurance to your employees. This is referred to as the employer mandate under the ACA.

Some employers may find it more affordable to offer an alternative solution, like a Health Reimbursement Arrangement , instead. However, If you have less than 50 FTE employees, then you are not legally required to provide health insurance and you will not face a tax penalty.

One thing to consider is how you view your employees and what impression you want to make on them. Providing health insurance shows your team that you respect them and shows them that you want them to remain loyal to you. Additionally, if youre a smaller business offering such benefits, you might be eligible for tax breaks.

Providing health insurance shows your team that you respect them and shows them that you want them to remain loyal to you.

What Health Benefit Options Are Available For Small Businesses

Although small businesses dont need to offer health insurance, many opt to do so to keep their employees happy and healthy and to attract new workers. Here are some of the most popular health benefits options available to small businesses:

- Traditional group health insurance: The federal government offers SHOP, the Small Business Health Options Program, which gives small employers the option to provide health and dental coverage to their employees. SHOP is available to businesses with one to fifty employees you can apply online.

- QSEHRA: The Qualified Small Employer Health Reimbursement Arrangement is a health benefit plan funded by employers that reimburses employees for their health care expenses from a monthly tax-free health care allowance. It allows businesses to set their own budgets but still offer coverage.

- Integrated HRA: With an integrated HRA, small businesses offer employees a group plan in combination with a monthly allowance for health care expenses. The group plan for an integrated HRA usually involves a high-deductible policy.

- Health insurance purchasing co-op: Health insurance purchasing co-ops are regulated at the state or local level. These co-ops allow small businesses to come together and collectively purchase health insurance for their employees. The regulation and availability of purchasing co-ops varies from state to state.

Read Also: How Much Is Temporary Health Insurance

Beware Of Alternative Types Of Health Insurance Or Outright Fakes

Medical discount plans are not insurance

These plans claim to offer discounts for members who use certain doctors, pharmacies and hospitals. Verify these claims with those providers before buying.

While these plans are not insurance, they are regulated by the department. Call our Insurance Consumer Hotline to verify the plan is registered as required by Missouri law.

Bogus health plans

You may see ads on late-night TV, in spam or in junk faxes offering unbeatable low prices on group health coverage. Many of these are unlicensed, illegal operations. You can find out if these companies are legitimate with a quick phone call to our department. As with most products, if a deal sounds too good to be true, it probably is.

Health Insurance Options You Can Provide

Youll find out that there are many options when it comes to providing health insurance as a startup or a small business. Here are some of the options you have:

1. Group Insurance

Group insurance is the most traditional type of insurance known to both employers and employees alike. Senior employees on this plan can even postpone being enrolled in Medicare without any penalty. They can take their time to understand the different supplemental plans, as explained on this URL, and then choose according to their preferences. While there are many options in group insurance, PPO and HMO are the two most popular plans to choose from: the first costing more, but offering greater network coverage, while the second costing less but with limited network coverage.

2. Self-Funded Health Insurance

Group insurance can be really costly for an employer, thats why many businesses opt for self-funded health insurance. Instead of paying premiums to insurance companies, self-funded insurance allows companies to pay for their employees health care costs as they arise out of the companys own pocket. While this option is cost-effective for large companies, it can break the bank for startups if theyre faced with a high medical bill that they werent expecting.

3. Health Savings Account

4. Qualified Small Employer Health Reimbursement Accounts

5. Individual Coverage Health Reimbursement Arrangements

6. Informal Wage Increase

Recommended Reading: How Much Is Health Insurance Usually