Healthcaregov Plus 18 State

States had the option of creating their own exchanges or relying on the federal government to create an exchange for them. Some states have hybrid exchanges that are either a partnership between the state and federal government or a state-run exchange that uses the federal enrollment platform . As of 2021, there are 15 fully state-run exchanges, six state-run exchanges that use HealthCare.gov for enrollment, six state-federal partnership exchanges, and 24 federally-run exchanges.

The largest health insurance exchange, HealthCare.gov, is run by the federal government, serving health insurance shoppers in 36 states in 2021 . The other 14 states and the District of Columbia each run their own exchanges .

Three of the states that use HealthCare.gov in 2021Maine, Kentucky, and New Mexicoare transitioning to fully state-run exchanges in the fall of 2021, and will no longer use HealthCare.gov for coverage effective in 2022 and beyond. So as of the 2022 plan year, DC and 17 states will have their own exchange platforms, while the other 33 states will continue to use HealthCare.gov.

Some other states are considering a similar transition within the next few years, so the number of states relying on the federally-run exchange platform is expected to decline over time.

Finding Your Health Insurance Exchange

Your state may run its own health insurance exchange such as the one run by California, Covered California. Or, your state may have opted not to create a health insurance exchange, or to create an exchange but use the federal enrollment platform. In that case, residents use the federal government’s exchange at HealthCare.gov.

The following states have their own enrollment websites, although you can get to them by starting at HealthCare.gov and clicking on your state or entering your zip code:

How Many People Have Coverage Through The Aca’s Exchanges

At the end of open enrollment for 2021 coverage , total exchange enrollment in individual market plans stood at just over 12 million people, including enrollments conducted via HealthCare.gov and the 14 state-run exchanges.

Effectuated enrollment as of early 2021 stood at about 11.3 million people. Effectuated enrollment is always lower than the number of people who sign up during open enrollment, as there are invariably some people who don’t pay their initial premiums or who cancel their coverage shortly after enrolling.

But 2021 was an unusual year, due to the COVID/American Rescue Plan enrollment window that lasted at least six months in most states. In most of the country, this window continued through at least August 15, 2021, and allowed people to sign up for coverage without a qualifying life event, even though open enrollment had ended months earlier. More than 2.8 million people enrolled in coverage during this extended enrollment window in 2021. Many of these new enrollees were motivated to enroll due to the enhanced premium subsidies available as a result of the American Rescue Plan.

Small businesses can enroll in plans through the exchanges, but there were fewer than 200,000 people enrolled in small business exchange plans nationwide in 2017the vast majority of the ACA exchange enrollees have coverage in the individual market.

You May Like: How Much Does Usps Health Insurance Cost

Which States Use Healthcaregov

For health coverage with a 2021 effective date, the following states use the federally run exchange. This means consumers in these states enroll in health coverage by using HealthCare.gov and contact the call center by calling 1-800-318-2596:

- Alabama

- Washington

Among the 36 states that currently use HealthCare.gov, six operate whats called a state-based exchange on the federal platform, or SBE-FP. As of the 2021 plan year, these states include Arkansas, Kentucky, Maine, New Mexico, Oregon, and Virginia.

As noted above, three of those SBE-FP statesKentucky, Maine, and New Mexicowill have their own fully state-run exchanges as of the fall of 2021. These states are in the process of creating their new enrollment platforms and call centers. Kentuckys exchange will once again be called Kynect, and New Mexico will use BeWellNM.

These SBE-FPs can be thought of as a hybrid model. They use HealthCare.gov for eligibility determinations and plan enrollment, but the state oversees other aspects of the exchange, including health plan certification and consumer outreach.

How To Get A Unitedhealthcare Exchange Plan

You can buy a plan through your states insurance marketplace. Another way to get one of these plans is to contact a licensed health insurance broker.

“A broker will be able to easily navigate the federal health care marketplace and/or state-based marketplaces,” Bartleson adds. “Seeking insight from a licensed broker can save you time, and they can also make plan recommendations based on your medical needs and budget.”

You May Like: Where To Go If You Have No Health Insurance

The Choice Of A Different Network

Off-exchange plans sometimes work with different networks. Say you want to keep a particular family doctor, but none of the on-exchange plans in your price range work with her practice. You may be able to find an off-exchange plan in your price range that does include her in their network, making the off-exchange plan your best choice for keeping your preferred doctor.

Health Insurance Exchange Or Health Insurance Marketplace: Understanding The Semantics

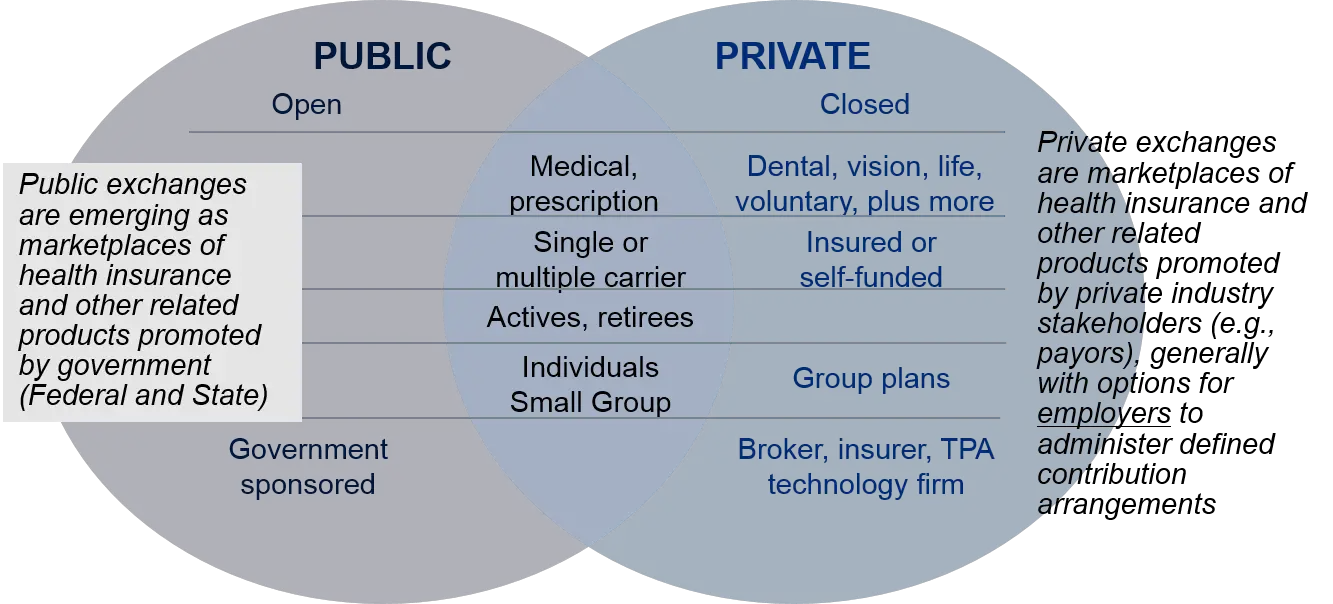

A health insurance exchange is a marketplace for purchasing health insurance. Thus we could call them exchanges or marketplaces, and we would be talking about the same thing. The official term when talking about Americans using the exchange is health insurance marketplace. However, the Affordable Care Act itself refers to them as exchanges. Each State-run exchange has its unique name.

The health insurance exchange can also be referred to as the HIX, ObamaCare Exchange, Health Benefits Exchange, Health Care Exchange, Health Insurance Marketplace and Affordable Insurance Exchanges. The terms are all interchangeable, just like ObamaCare is also called Health Care Reform, the Affordable Care Act, ACA, etc.

Read Also: Where Can I Go For Health Care Without Insurance

Failing To File Tax Returns Will Prevent Advance Payments In The Next Year

The IRS reminds taxpayers who received advance payments of the premium tax credit that they should file their tax return timely to ensure they can receive advance payments next year from their Marketplace.

If advance payments of the premium tax credit were paid on behalf of you or an individual in your family, and you do not file a tax return reconciling those payments, you will not be eligible for advance payments of the premium tax credit or cost-sharing reductions to help pay for your Marketplace health insurance coverage in the next year. This means you will be responsible for the full cost of your monthly premiums and all covered services. In addition, we may contact you to pay back some or all of the advance payments of the premium tax credit.

If you have a question about the information shown on your Form 1095-A, or about receiving Form 1095-A, or about a letter you received, contact your Marketplace as shown in the table below or visit HealthCare.gov/taxes.

The Choice Of Different Drug Coverage

Prescription drug tiers: theyâre complicated and annoying for even the most seasoned among us. If you have a specific drug that you need, you may be better off with an off-exchange plan that includes those drugs in their drug list, instead of an on-exchange plan that includes a different brand or a generic.

You May Like: How To Cancel Oscar Health Insurance

About The Plans And Benefits

Do the exchanges have a good selection of plans to choose from?

The number of plans that you can choose from varies widely. In some states, only a couple of insurers are offering policies though the marketplace, while in others there may be a dozen or more. Even within a state, there will be differences in the number of plans available in different areas. Insurers generally offer a variety of types of plans, including familiar models like PPOs and HMOs.

What health services are covered?

Each plan offered has to cover 10 “essential health benefits.” These include prescription drugs, emergency and hospital care, doctor visits, maternity and mental health services, rehabilitation and lab services, among others. In addition, recommended preventive services, such as preventive mammograms, must be covered without any out-of-pocket costs to you. It’s important to keep in mind that the insurer does have some discretion about which specific therapies they’ll cover within each category of benefit. So it’s very important to study the plans carefully to make sure it is offering any specific benefits you may need.

There’s a cap on how much you pay out-of-pocket for medical services each year. That cap is $6,350 for individual policies and $12,700 for family plans in 2014. Your regular monthly premiums do not count toward the cap.

What’s this about Bronze, Silver, Gold and Platinum plans?

I have read that the subsidy can only be applied to a Silver plan. Is that true?

Changes Under The 2022 Aca Marketplaces Rules

The final 2022 NBPP, issued in September 2021, reversed some of the changes that the Trump administration had finalized in early 2021, and also created some new rules.

But some aspects of the initial NBPP have remained in place, and other rules were finalized in the NBPP that the Biden administration issued in April 2021. So the changes described in this article stem from multiple 2022 NBPPs.

The NBPP addresses a variety of actuarial issues, including extensive guidelines related to risk adjustment and fees that insurers pay to sell coverage in the exchange. Those regulations are crucial in terms of how insurers design and price their products.

But this article will focus more on the regulations that would have a more direct impact on consumers who are seeking coverage in the health insurance exchange for 2022 and future years.

You May Like: Does Health Insurance Cover Tooth Extraction

King V Burwell: Some States Considered Sbes Before Subsidies Were Ruled Valid In Every State

For the first half of 2015, there was significant concern about the King v. Burwell lawsuit among states with federally-run exchanges and partnership exchanges. The lawsuit hinged on the argument that the ACA only allows for subsidies to be provided by exchanges established by the state. Since subsidies are a cornerstone of every states exchange, the prospect of losing those subsidies was alarming several states considered the possibility of building their own exchanges if subsidies were to be eliminated. But on June 25, 2015, the Supreme Court ruled 6 3 that subsidies are legal in every state, regardless of whether the state or federal government runs the exchange.

Arkansas, Pennsylvania, and Delaware had received conditional approval from HHS to create state-run exchanges in the lead-up to the King v. Burwell ruling. Pennsylvania and Delaware dropped those plans once the Supreme Court ruled that subsidies could continue to be provided via the federally-run exchange. But Arkansas moved forward with their plan to operate an SBE-FP, implementing it in time for the 2017 coverage year.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Health Insurance Marketplaces At A Glance:

The term health insurance exchange has become part of the mainstream conversation about health insurance and healthcare reform over the last several years. The Affordable Care Act , enacted in March 2010, called for the creation of an exchange in each state, but the practical implementation of those exchanges varies considerably from one state to another.

As a result, questions about what the exchanges are, what they offer, and how they work, are still widespread. And as with most aspects of the ACA, health insurance marketplaces became yet another battleground in the political fight over the ACA.

Twenty-seven states joined a federal lawsuit in 2010/2011 trying to overturn the ACA, but in 2012 the Supreme Court upheld all but one of the challenged provisions.

Although the Supreme Court ruled that the bulk of Obamacare was constitutional, many states continued to resist the ACA by refusing to act on health insurance marketplaces. And some states simply felt that creating their own exchanges would be too costly or administratively burdensome, and opted to leave the heavy lifting to the federal government, despite their overall support for the ACA. There have also been technical issues over the last few years that have caused some states to adjust their exchange model for logistical rather than political reasons.

Don’t Miss: Who Pays First Auto Insurance Or Health Insurance

Finding The Perfect Off

When it comes to enrolling through the exchange, everyone knows where to go. When it comes to finding a plan off of the exchange, things arent as simple. Luckily, you came to the right place.

FirstQuote Health is an industry leader in all things health insurance. Not only do we provide informative content to help readers in their pursuit of the perfect plan, but weve also partnered up with experienced agents and companies to help point you in the right direction.

Plans and pricing vary by area, down to the part of town you live in. So, in order to help everyone find a plan that fits their needs, and also their budget, FirstQuote Health has developed a powerful quoting engine. By entering your zip code, youll be able to compare health insurance quotes in your area with ease.

Popular Articles

What Is The Special Enrollment Period

There is another time when you may be able to sign for a marketplace plan. If you have a qualifying life event, you can get a health plan during a special enrollment period.

Qualifying events include getting married, losing health coverage, a spouse dying, and having a child. If you have a qualifying event, you have 60 days from that event to sign up for a marketplace plan.

Also Check: Can You Add Your Mom To Your Health Insurance

Exchanges Are Enrollment Portalsthey’re Not Your Insurer

It’s important to understand that the exchanges are just a platform for purchasing coverage. If you buy health insurance via Covered California, for example , Covered California is not your insurance company. Instead, your insurance company will be Health Net, or Blue Shield, or Anthem, or any of the other private insurers that offer coverage via Covered California.

And to clarify one other point that sometimes creates confusion, the terms “exchange” and “marketplace” are used interchangeably. But the term “market” is used more generally.

So while a health insurance exchange or marketplace refers specifically to the portal in each state that people can use to compare the various options and enroll, the term “health insurance market” applies much more broadly, and can include plans sold outside the exchange and employer-sponsored plans as well as grandmothered and grandfathered plans .

Health Insurance Exchange Example

To visit the health insurance exchange, users go to Healthcare.gov or the website for their state-operated exchange during the enrollment period. Users specify their state and ZIP code, then begin the application.

The documents and information needed to apply are Social Security numbers, income information for the entire family, policy numbers for current insurance and any other information about job-related health insurance.

After completing the application, you can browse the available plans and select the one that matches your needs and your budget. Rather than getting estimates from each company individually, the exchange lists and compares them all in one place. Once you enroll in a plan, you make payments directly to the insurance company rather than to the health insurance exchange.

Not sure if you need to browse the health insurance exchange? Learn more about Obamacare exchanges vs. employer health insurance.

Don’t Miss: What Type Of Insurance Is Health Partners

Unitedhealthcare Benefit Plans For Exchanges

Currently, UnitedHealthcare exchange plans are available in the following states:

- Arizona

Every UHC exchange plan is provided in three different metal levels: Bronze, Silver, and Gold. Marketplace plans differ by metal tier. Bronze and Silver plans have lower premiums but higher deductibles, while Gold plans have higher premiums and lower out-of-pocket costs.

In Washington state, the carrier is also offering Select Gold, Silver, and Bronze plans under its Cascade Care Program.

Many exchange plan members can count on receiving three virtual care visits with no copay due on most plans within a plan year, as well as no-cost primary care visits on at least one Silver plan and most markets within a plan year.

“As an exchange participant offering ACA-compliant plans, UnitedHealthcare can’t deny coverage due to pre-existing conditions or other circumstances prohibited by the Affordable Care Act,” says Brian Martucci, finance editor for Minneapolis-headquartered Money Crashers. “Also, be aware that UnitedHealthcare exchange plan participants generally can’t be reimbursed for out-of-network care, except for emergency services, where required.”

Qualifying Health Plans: Minimum Benefits Required By Obamacare For Plans Sold On The Health Care Exchange

Qualifying Health Plans are plans that meet the minimum standards set forth by ObamaCare. All plans sold on and off the ObamaCare Health Care Exchange must include the following ten essential health benefits to be considered a Qualifying Health Plan:

1. Ambulatory patient services4. Maternity and newborn care5. Mental health and substance use disorder services, including behavioral health treatment6. Prescription drugs7. Rehabilitative and habilitative services and devices8. Laboratory services9. Preventive and wellness services and chronic disease management10. Pediatric services, including oral and vision care

Learn more about the official health insurance regulations on our ObamaCare health insurance rules page.

Read Also: What Is The Best Health Insurance In Alabama

Silver State Health Insurance Exchange

The state agency that operates the online health insurance marketplace, Nevada Health Link.

The Silver State Health Insurance Exchange is the state agency that operates the online Marketplace known as Nevada Health Link where eligible Nevada consumers can shop for, compare, and purchase quality and affordable health insurance plans with ease. The Exchange facilitates and connects eligible Nevadans who are not insured by their employer, Medicaid, or Medicare to health insurance options. Individuals can purchase ACA certified Qualified Health Plans through the Exchange and if eligible, can receive subsidy assistance to help offset their monthly premiums and out-of-pocket costs. An intuitive web page will guide consumers through the application process with a number of useful tools including plan and rate comparison tools, prescription drug availability, and provider network.