Must Employers Provide Small Business Health Insurance In 2020

Even with the Obamacare Individual Mandate, employers never were forced to offer small business health insurance. Larger companies may have faced a fine for failing to offer group coverage, and some small businesses could have missed out on a health-care tax credit. However, the 2017 Tax Cuts and Jobs Act repealed the mandate , so employers might not face penalties in 2020 for failing to offer qualified group health plans.

Even though companies arent legally required to provide health insurance, many can still benefit. The health-care tax credit might still apply in 2020. Small business can qualify with:

- A maximum of 25 full-time employees

- An average salary of no more than $50,000

- Payment of at least half of the premiums

- Purchase of a Health Insurance Marketplace plan through a partner like eHealth or the Marketplace

Typically, smaller businesses with lower average salaries can qualify for a higher health-care tax credit. For example, businesses that employ fewer than 10 people and pay average salaries of less than $25,000 qualify for the most in credits. These credits can make the purchase of small business health insurance much more affordable, because they can be used to defray the cost of premiums in the year that theyre earned, or saved to be applied against a tax bill.

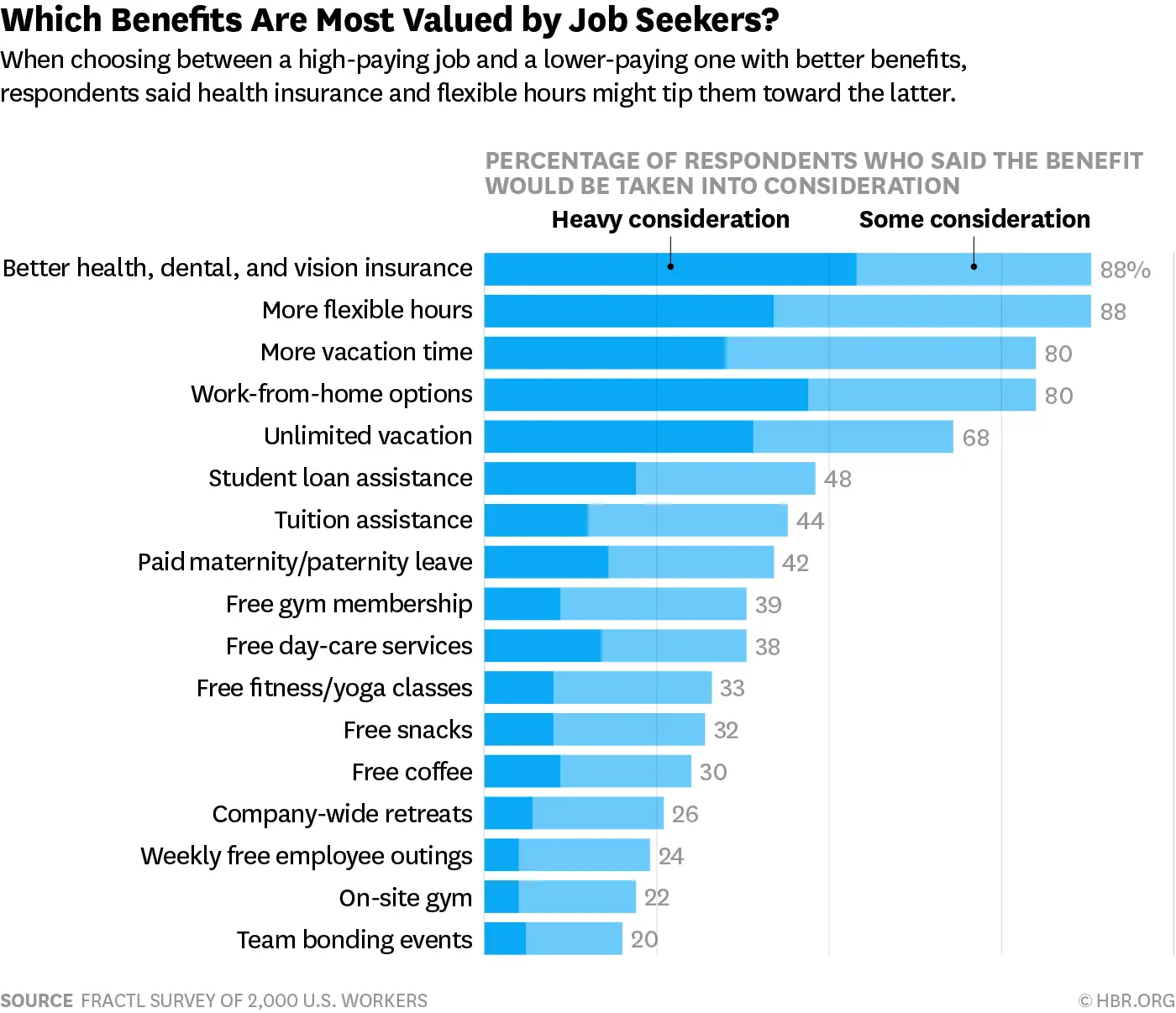

Small Business Health Insurance May Help Employers Compete For Good Employees

According to the Bureau of Labor Statistics, large employers usually provide health insurance. So do most mid-sized companies and government employers. In contrast, just about half of companies will fewer than 100 employers provide small business health insurance. When its offered, employees often sign up, even when they have to pay a portion of the premiums.

This popular benefit can help improve morale, encourage proactive health care, and boost employee retention. In these ways, some employers believe theyre making a good investment by sponsoring a small business health insurance group.

Job Security And Mobility

Health Canada provides employment security to its employees to the greatest extent possible. Should a job be declared redundant, we strive to find the affected individual alternative employment. When a spouse is relocated, Health Canada will try to find the employee a job in the same location. Because Health Canada is part of the Federal Public Service, our employees benefit from the ability to move within the department, or within various departments of the Federal Public Service.

Read Also: How To Cancel Cobra Health Insurance

The Easiest Ways To Earn Extra Cash Online

- Branded Surveys – Get paid instantly by answering simple questions. Join now!

- Survey Junkie – Earn $20 fast for taking surveys & testing new products. Join now!

- PaidViewpoint – I’ve personally earned over $5,500 with this trusted site. Pays fast via Paypal. Join Today!

The Internet is flooded with many reliable companies offering work at home jobs for those looking to make an extra dollar. Interestingly some of them even offer healthcare insurance for their online employees.

They include the following

Why Do Workers Want Employment

Workers want health insurance for themselves and their families in order to protect against the catastrophic costs of serious illnesses and to ensure access to medical care. For those without the time or income to save for it, insurance may be the only way to obtain medical care that would otherwise be unaffordable . Although it is possible for individuals to purchase insurance on their own, the high cost of private individual coverage, barriers to access to that coverage, and steep transactions costs help account for the value of group coverage to workers and thus explain why, in the absence of any viable alternative, workers demand coverage through their employers.

Employment-based coverage is far less expensive than individually purchased coverage, for several reasons. First, through pooling, employers can reduce adverse selection and administrative expenses. These cost advantages are significant, especially for large firms. Moreover, employers are able to offer relatively inexpensive health insurance because most people covered by employment-based plans are in good health. Those people who are most expensive to insurethe elderly and people with serious disabilities and chronic conditionsare typically covered by public programs such as Medicare and Medicaid, thereby reducing the cost of employment-based insurance .

Don’t Miss: How Much Is Independent Health Insurance

Government Jurisdiction Over Cobra

Several agencies of the federal government are responsible for administering COBRA coverage. Currently, the Departments of Labor and Treasury maintain jurisdiction over private-sector group health plans, while the Department of Health and Human Services is responsible for public-sector health plans. However, these agencies are not necessarily heavily involved in the process of applying for COBRA coverage or related aspects of the continued coverage program.

The Labor Department’s regulatory responsibility includes the disclosure and notification of COBRA requirements as stipulated by law. And the Center for Medicare and Medicaid Services provides information about COBRA provisions for public-sector employees.

The American Recovery and Reinvestment Act of 2009 expanded COBRA eligibility and also reduced the rates of eligible individuals by 65% for up to nine months of coverage. This coverage ended Dec. 31, 2009.

The American Rescue Plan Act of 2021, signed into law by President Biden on March 11, 2021, contains a provision that provides a 100% subsidy of COBRA premiums beginning April 1, 2021, and ending September 30, 2021. Employers recoup the premiums through Medicare tax credits.

Review Plan Choices Each Year

Whether over or under age 65, once you’ve secured health insurance in retirement, you should be proactive about evaluating it by conducting an annual review of your coverage options during open enrollment each fall.

Benefits and costs change, and it’s possible a new plan may offer you better coverage at a lower price. You wont know unless you look. Once again, you may want to talk with an experienced agent or contact your state’s SHIP to ensure your plan change will benefit you.

Don’t Miss: What Do You Need To Get Health Insurance

Health Insurance Options You Can Provide

Youll find out that there are many options when it comes to providing health insurance as a startup or a small business. Here are some of the options you have:

1. Group Insurance

Group insurance is the most traditional type of insurance known to both employers and employees alike. Senior employees on this plan can even postpone being enrolled in Medicare without any penalty. They can take their time to understand the different supplemental plans, as explained on this URL, and then choose according to their preferences. While there are many options in group insurance, PPO and HMO are the two most popular plans to choose from: the first costing more, but offering greater network coverage, while the second costing less but with limited network coverage.

2. Self-Funded Health Insurance

Group insurance can be really costly for an employer, thats why many businesses opt for self-funded health insurance. Instead of paying premiums to insurance companies, self-funded insurance allows companies to pay for their employees health care costs as they arise out of the companys own pocket. While this option is cost-effective for large companies, it can break the bank for startups if theyre faced with a high medical bill that they werent expecting.

3. Health Savings Account

4. Qualified Small Employer Health Reimbursement Accounts

5. Individual Coverage Health Reimbursement Arrangements

6. Informal Wage Increase

Health Care Sharing Ministries

A health care sharing ministry works on the same premise as the group health expense sharing plan. A group of people who share similar beliefs create a pooled fund to share the cost of health care. An HCSM is a non-profit entity, so again, it’s not health insurance and it’s not regulated in the same way. Rather, it provides an alternative to standard insurance.

These plans will often include rules that align with the beliefs of the group. This means they may not cover certain treatments or drugs that they object to on moral grounds.

Recommended Reading: What Is The Self Employed Health Insurance Deduction

Cobra Benefits And Available Coverage

For qualifying candidates, COBRA rules provide for the offering of coverage that is identical to that which the employer offers to its current employees. Any change in the plan benefits for active employees will also apply to qualified beneficiaries. All qualifying COBRA beneficiaries must be allowed to make the same choices as non-COBRA beneficiaries. Essentially, the insurance coverage for current employees/beneficiaries remains exactly the same for ex-employees/beneficiaries under COBRA. You must be given at least 60 days in which to choose whether or not to elect continuation coverage. Even if you waive coverage, you can change your mind if it is within the 60-day election period.

From the date of the qualifying event, COBRA coverage extends for a limited period of 18 or 36 months, depending upon the applicable scenarios. One can qualify to extend the 18-month maximum period of continuation coverage if any one of the qualified beneficiaries in the family is disabled and meets certain requirements, or if a second qualifying event occurspotentially including the death of a covered employee, the legal separation of a covered employee and spouse, a covered employee becoming entitled to Medicare or a loss of dependent child status under the plan.

Employers’ Benefits From Workers’ Health Insurance

Most nonelderly Americans receive their health insurance coverage through their workplace. Almost all large firms offer a health insurance plan, and even though they face greater barriers to providing coverage, so do the majority of very small firms. These employment-based plans cover two-thirds of nonelderly Americans and pay most of working families expenses for health care and about one-quarter of national health spending. Despite employers role in the health insurance market, however, very little attention has been paid to employers motivations for providing health insurance to workers. Why do employers offer health insurance to workers? Is it because workers want it? Because their unions demand it? Or do employers offer health benefits to workers because their productivity and profitability depend on it?

This article makes a case for reassessing the theory. A key flaw in the standard theory is that it ignores the benefits accruing to employers from offering health benefits. According to the conventional view, employees pay the full cost of coverage presumably because they believe that the benefits of health coverage are entirely for themselves. The alternative view that I am investigating posits a business case for employment-based health coverage, acknowledging that employers may want to offer coverage because offering a compensation package composed of both wages and health insurance is more profitable than providing wages alone.

Recommended Reading: How Much Is Health Insurance When You Retire

Employers Can Still Save Money On Small Business Health Insurance Premiums

Businesses can still buy Marketplace health insurance if they dont qualify for health-care credits. They may still have a chance to deduct the cost as a business expense and ask their employees to pay a portion of the bill out of their paychecks. Also, many employers decide to purchase non-Marketplace plans.

Companies may make this choice because they find a plan that doesnt qualify as an Obamacare plan, but costs less and suits their requirements better. In some cases, they may even want to purchase better coverage than the available Obamacare policies. For instance, some counties only have HMOs on the marketplace, and the employer may choose to buy a PPO.

High Deductible Health Plans

A high deductible health plan is one way to maintain a low-cost health plan. Since the deductible is high, this means you may have to pay a lot out of pocket before the plan helps with funds, but it can be a good safety net in case you end up needing emergency treatment or for any treatment that would result in a very high bill.

One way to offset the high costs you may need to pay to meet your deductible under an HDHP is to pair it with a health savings account . Using this account for smaller health issues can save you money in the long run.

Don’t Miss: How Much Do You Pay For Health Insurance

Applying For Cobra Coverage

In order to begin COBRA coverage, an individual must confirm that they are eligible for assistance according to the requirements listed above. Typically, an eligible individual will receive a letter from either an employer or a health insurer outlining COBRA benefits. Some individuals find this notification difficult to understand because it includes a large amount of required legal information and language. If you have any difficulty determining whether you are eligible for COBRA or how to begin coverage through this program, contact either the insurer or your former employer’s HR department.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options, such as a spouse’s health insurance plan.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options. In some cases, a spouse’s health insurance plan may be a possibility. Or you might explore your options on the federal health insurance marketplace or a state insurance marketplace. Loss of a job will open up a special enrollment period.

Companies That Offer Part

Part-time jobs with benefits typically require less than 40 hours of work per week and offer some combination of health, vision or dental insurance. Although many employers only offer benefits to full-time employees, there are some part-time jobs that offer benefits in nearly every industry. In this article, we’ll explore 10 companies with locations across the U.S. that offer benefits to part-time employees.

Read Also: How To Get Health Insurance As A Real Estate Agent

Caveats To Be Aware Of When It Comes To Part

As I wrote at the outset, everything connected with health insurance has become imperfect, and that includes part-time jobs with health insurance. If you?re applying for these jobs, please be aware of the following:

- An employer that offers part-time jobs with health insurance now may not have it a year from now.

- The employer subsidy on health insurance plans for part-timers is usually not as generous as it is for full timers. It?s even possible that there may be no subsidy at all.

- Plans may cover the employee only, and not the employee?s family.

- Watch out for employers that offer limited benefit plans. These are not true health insurance, as they will only pay a flat fee for certain health conditions. As well they will not exempt you from the Obamacare penalty for not having health insurance.

- Be sure that you?re very familiar with the details of the insurance coverage for any part-time job you accept, if getting health insurance is the primary reason for taking the job.

The whole idea of part-time jobs with health insurance worked brilliantly for my family for nearly three years. The reality is that there are all kinds of different situations with different people, but I think this offers a real solution to the healthcare dilemma in a lot of cases.

Have you had any experience with part-time jobs with health insurance? Please share your experience if you have. Also, feel free to suggest other employers who offer coverage for part-timers.

Pros And Cons Of Cobra Coverage

An individual who opts for COBRA coverage is able to continue with the same physician, health plan, and medical network providers. COBRA beneficiaries also retain existing coverage for preexisting conditions and any regular prescription drugs. The plan cost may be lower than other standard plans, and it is better than remaining uninsured as it offers protection against high medical bills to be paid for in case of any sickness.

Nonetheless, it’s important to keep in mind the downsides of COBRA. Some of the most prominent of these include the high cost of insurance when it is borne entirely by the individual, the limited period of coverage under COBRA, and the continued dependency on the employer. If the employer opts to discontinue the coverage, an ex-employee or related beneficiary will no longer have access to COBRA.

If the employer changes the health insurance plan, a COBRA beneficiary will have to accept the changes even if the changed plan doesn’t offer the best fit for the individuals needs. A new plan may change the coverage period and number of available services, for example, and it may increase or lower deductibles and co-payments.

For these reasons, individuals eligible for COBRA coverage should weigh the pros and cons of COBRA against other available individual plans to select the best possible fit.

Don’t Miss: How To Get Health Insurance Self Employed

Navy Federal Credit Union

The OutOfYourRut list reports that credit unions are common sources of part-time jobs that provide health insurance. I did some light research to see if thats true, and it absolutely is. In fact, I hit pay dirt on the first search.

Navy Federal Credit Union is the largest credit union in the country, and yes, they provide health insurance for part-timers. They list comprehensive medical coverage, catastrophic coverage and prescription drug benefits, with a choice of either a PPO or HMO, depending on location.

The website doesnt give details as to how many hours you need to work, but 20 seems to be the standard among credit unions.

Apart from Navy Federal Credit Union, check with any credit union in your area to see if they have part-time jobs that provide health insurance. Theres an excellent chance they will.

Group Insurance From Organization Memberships

Many organizations provide health insurance group plans. If you belong to any kind of membership organization, it’s worth asking if they have a health insurance plan. Some common sources include alumni groups, professional organizations, business bureaus, or independent worker associations.

Many of these groups help provide reduced health insurance premiums or other health care perks for their members. If you belong to one of these groups, it’s worth looking into what they offer as an alternative to employer-sponsored group health insurance.

Read Also: Does Health Insurance Pay For Abortions