Q: If An Agent Holds A Full Lines License Can They Offer Limited Lines Credit Insurance Under A Full Lines License Without The Addition Of A Credit License Is There A Regulation That Outlines This

A: If a producer holds full L& H authority, that producer can sell credit insurance related to that line . If a producer holds full P& C authority, that producer is able to sell credit insurance related to that line . If a producer with P& C authority wishes to sell credit insurance related to life and health, that individual would need to obtain either 1) limited lines credit authority or 2) full L& H authority.

Thinking About A Career In Insurance Download This Free Launching Your Insurance Career Ebook

What is the difference between a life insurance license and a life and health insurance license?

A life insurance license permits you to sell annuities, term, and cash value life insurance. A life and health insurance license enables you to sell these life insurance products, plus policies that provide protection for medical expenses, loss of income due to a disability, and the need for long-term care.

Some states, like Alabama and Florida, offer the options of earning a life insurance license, a health insurance license, and a life and health insurance license. Each of the three types require passing a separate exam. Others, like North Carolina, have separate licenses for life and health but not a combination, and each requires passing a separate exam. Still others, like Missouri, have a combined life and health insurance license only.

Factors That Affect Premiums

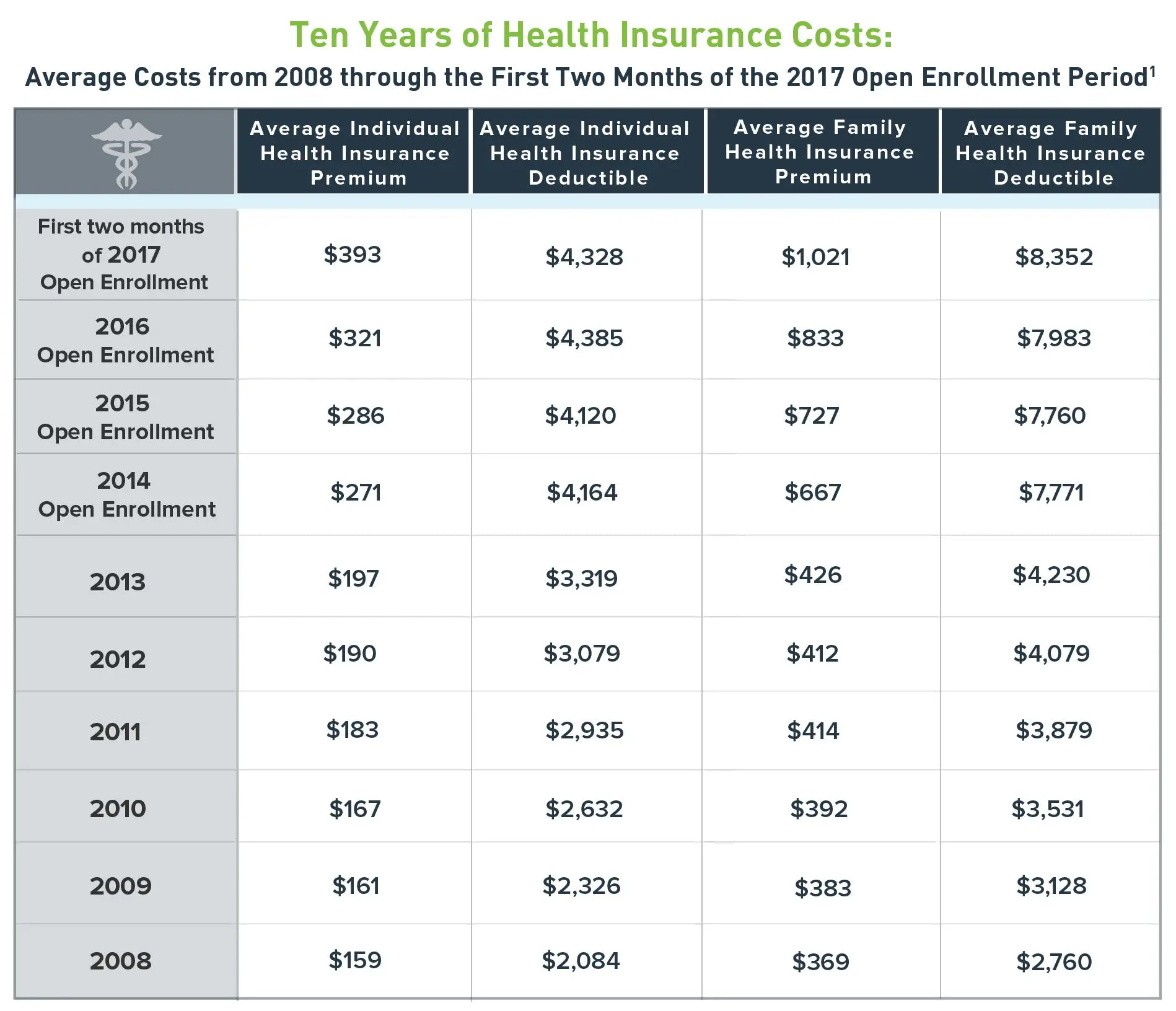

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

Read Also: Which State Has The Cheapest Health Insurance

Complete An Indiana Pre

To qualify for the Indiana insurance license exam, you must complete a pre-licensing insurance course that is certified by the Indiana Department of Insurance. Upon passing the pre-licensing course final exam, you will be awarded a Certificate of Course Completion.

Our Indiana pre-licensing insurance courses cover the various insurance concepts, definitions, insurance laws and agent regulations listed on the Indiana Examination Content Outlines. Courses are presented in a clear and concise format and include instructional videos, interactive illustrations, practice exams, and student support.

National Online Insurance School is certified by the Indiana Department of Insurance to offer the following courses:

| Pre-Licensing Course |

|---|

Insurance Exam Fee: $69.00

About the state exam

- You are required to provide a copy of your pre-licensing Certificate of Course Completion and a current federal or state ID with a photo at the testing center

- You should arrive at least 30 minutes before your scheduled appointment to allow time for check-in procedures. If you arrive late you will not be allowed to take your exam and will forfeit your exam fee.

- Applicants with disabilities that require special accommodations or applicants whose primary language is not English who are requesting additional time should indicate this during your online exam registration. You can contact the testing administrator at 895-0496 for additional information.

- Passing score is 70%

| 15 | 95 |

Step 3

How To Get Your Insurance License

If youre interested in becoming a health insurance agent, one of the first things you need to do is take the licensing exam required by your state regulator. In California, thats the California Department of Insurance . In Nevada, its the Nevada Division of Insurance .

Below are six steps that put you well on way to your new career.

Also Check: How To Become A Health Insurance Broker In California

What Is On The Life And Health Insurance Exam

The content of your exam is contingent on the states specific regulations and the line of products you are looking to sell. There are examination content outlines available per state, and while there will be some variation, there is a shared basic structure.

You are asked to understand the concept of the insurance, how it can vary or become customized with policy riders or tax considerations, and how it is fulfilled to the insured.

For this example, we are looking at life insurance.

First, you will be expected to understand and differentiate the types of life insurance policies, such as:

Traditional Whole Life Insurance

- Limited-pay and single-premium whole life

- Return of premium

Next, you will also be expected to understand the types of policy riders, provisions, options and exclusions that can modify a policy.

Variables like accidental death, certain beneficiary designations, and dividend options require agents to get flexible about their understanding of the product.

Lastly, prospective producers will have to demonstrate an understanding of the application and the underwriting practices needed to deliver the policy.

What Is The Best Insurance License To Get

A property and casualty insurance license provides one of the best opportunities for maximizing at bats. Most people need to carry some type of property and casualty insurance, whether for their homes or vehicles. A property and casualty license qualifies agents to sell a diverse set of policy types: Auto insurance.

Don’t Miss: How To Get Health Insurance For My Small Business

The Two Most Common License Types Are:

- Property and casualty license, for agents who plan to serve clients who need auto, home, and business insurance.

- Life, health, and accident license, for agents who plan to serve individuals who need insurance related to life events, such as life insurance, accidents, or health insurance.

Your career plan may require you to obtain multiple licenses. You will need to get the specifics from your state licensing department or the company you plan to represent.

Purchase Errors & Omissions Insurance

Errors & Omissions insurance is intended to protect an insurance agent from legal action should they unintentionally provide misleading or incorrect information to a client. While E & O insurance is not required to become an insurance agent, most insurance carriers require it in order to sell their products. A typical E & O policy can cost around $300-$700 a year.

Estimated Cost of Errors & Omissions Service: $500/year

Read Also: Does Golden Rule Insurance Cover Mental Health

If I Fail The Life Insurance Exam What Is The Wait Time Before I Can Retake It

You will find out if you passed or failed the exam at the testing center. However, you cannot register to take it again at that time. Instead, you must wait 24 hours before you can register again. You can take the exam three times in one year. If you fail it all three times, you will have to complete prelicensing education again before you can take it for a fourth time the following year.

Step : Prepare For Your Insurance Licensing Test

California requires a minimum of 20 hours of approved pre-licensing study. A new resident applicant who had a current Accident and Health license in another state within the last 90 days and has a current non-resident license in California or an applicant holding a Life Underwriter Training Council Fellowship , Chartered Life Underwriter , Certified Insurance Counselor , Certified Employee Benefit Specialist , Fellow, Life Management Institute , Health Insurance Associate , Registered Employee Benefits Consultant or Registered Health Underwriter designation is exempt from the 20 hours of pre-licensing education.

California also requires 12 hours of approved pre-licensing on code and ethics.

Nevada has a similar requirement. Candidates must satisfactorily complete an approved course of education in each field of insurance for which they plan to be licensed.

Also Check: Can I Get Health Insurance In Another State

How To Apply For A License:

Register and Study for an Exam

Within one year prior to applying for a license, register for an examination through Pearson VUE. The Candidate Handbook contains the course content outline and is an essential tool for studying for the examination. The Candidate Handbook published online by Pearson VUE.

Individuals may choose to prepare for their prelicensing examination by taking a course of education in the fields of insurance for which they apply. To find approved prelicensing courses, conduct a search on Sircon.

Submit an Application

Resident individuals applying for a producer license should apply electronically throughSircon. The State licensing fee is $185. The vendor may charge transaction fees in addition to the state fee.

Be Fingerprinted for a Criminal History Background Check

Upload to the application the Fingerprint Background Waiver, the fingerprint receipt and any other required supporting documentation. The waiver must be received by the Division prior to submitting your fingerprints.

Make a reservation for digital fingerprinting through IdentoGo. Fingerprints are valid for six months.

Applicant for Variable Annuities

A producer applying to sell variable annuities or variable life insurance must be registered with the Financial Industry Regulatory Authority and must hold an active producer license with life line of authority.

Appointment Requirements:

How to Print Your License

Renewal Information

Continuing Education Requirements

CE Exemptions for Producers

How Do I Get My Life And Health Insurance License

Each state has different qualifications to successfully earn insurance licenses, but the most common first stage is preparing for the states examination.

For example, to begin the process in Michigan, you must apply for a license with the National Insurance Producer Registry. This can be online or in-person and costs $15 for each type of business you plan to sell. The application lasts for six months.

During this time, prospective agents will enroll in specific education courses, tailored to the content expected on the exam. Each pre-licensing course will be worth a set amount of credit hours. In Michigan, completion of Life, Accident, and Health coursework requires forty hours and is awarded a certificate necessary for taking the exam.

Recommended Course

For pre-license education products and courses , StateRequirement recommends:Kaplan Education Company

From there, prospective life and health insurance agents in Michigan can attempt the exam for a fee of $40 per attempt.

Don’t Miss: Does Amazon Have Health Insurance

Texas Insurance License Application

Once you have completed your exams and fingerprinting, you are now ready to apply for your license. If you have more than one line of authority that you have passed the exam for, be sure to apply for all of those lines.

The fee for an online application is $50 per line plus a small transaction fee. You must also upload the fingerprint receipt from MorphoTrust with your application.

Any supporting documentation that needs to be sent with the paper application should be directed to .

Resident Producer Licensing Application & Requirements

To quality as a Missouri resident insurance producer, you must:

- Be 18 years old

- Pass any necessary examination. Missouri requires an examination for the following lines: Life, Accident and Health or Sickness Property Casualty Personal Lines Crop Title and Surplus Lines

- Submit an application and pay the $100 fee

Are you a veteran?

Veterans taking a state licensing examination required by the department can be reimbursed for the cost of the examination. Click here to learn more about examination reimbursement for veterans.

Read Also: Can A Child Have 2 Health Insurance Plans

After Getting Your Washington Insurance License

Once youve passed your exams and completed the licensing application, you are now a licensed insurance agent in Washington. A common question we hear is, I have my insurance license, now what? Here are a few things you can do or need to know:

- Get a job in the insurance field. Check out StateRequirements Insurance Jobs board.

- If youre going to sell advanced life insurance products, youll need to have the proper securities licenses. Series 6, Series 7, and Series 63 are the most common among insurance agents, but youll need to begin with the SIE exam. Find out which licenses you need with our Securities Licensing Guide.

- Every two years, youll need to renew your insurance license. Check out our guides on Washington Insurance License Renewal and Washington Insurance Continuing Education for more details.

Take Your Exam And Receive Your Results

Read Also: Can I Be On My Parents Health Insurance

What To Expect During Your Insurance License Exam

The exam process usually is not difficult, especially if you have completed pre-exam requirements and come prepared. Youll arrive at your scheduled time and be placed at a computer. Test questions are usually in multiple-choice format. When the exam is complete, youll immediately find out if you passed. If you dont pass on the first try, you can reschedule and take it again.

Consent Under 18 Usc 1033 Federal Violent Crime Control And Law Enforcement Act

To apply for the Consent Under 18 U.S.C. 1033 Federal Violent Crime Control and Law Enforcement Act o 1994 waiver you must submit a completed to the IDOI Enforcement Division.

Once the 1033 waiver application is filed:

Also Check: Is It Required By Law To Have Health Insurance

Digging Deeper For Pricing Information

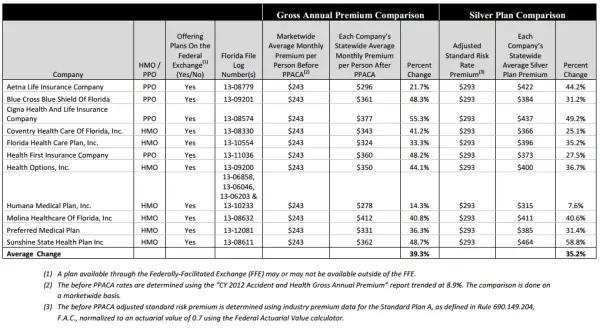

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.9

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”10

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.7

Gather What You Need To Take Your Exam

On the day of your exam, you must bring two forms of identification deemed acceptable to the test center . If you dont, you will not be allowed to take the examination and will forfeit the examination fee.

Recommended Reading: How To Get Cheap Health Insurance In Texas