When Is The Open Enrollment Period

If you get your health benefits through your job, your annual open enrollment period may last a few weeks or often a month. The open enrollment period typically occurs sometime in the fall, but employers have flexibility in terms of scheduling open enrollment and their plan year, so it doesn’t have to correspond with the calendar year.

Your company should notify you about your open enrollment period. Contact your Human Resources department if you are unsure or seek further information about your companys healthcare plans and policies.

If you buy your own health insurance and have an ACA-compliant planas opposed to something like a short-term health insurance policy or a limited benefit planyou are also subject to open enrollment, as coverage is only available for purchase during that time .

If that’s the case, your open enrollment period is determined by the U.S. Department of Health and Human Services, under regulations pertaining to the Affordable Care Act.

The open enrollment window for ACA-compliant plans in most states now runs from November 1 to December 15, with coverage effective the following January. But there are some state-run exchanges that have extended enrollment windows.

States that run their own exchanges have the option to extend open enrollment by adding a special enrollment period, available to all residents, before or after the regularly scheduled enrollment period. California, Colorado, and DC have permanently extended open enrollment.

Medicare Special Enrollment Periods

There are for people with Medicare.

- Initial enrollment period: Sign up for Medicare Part A and/or Part B within seven months of the time you first become eligible for Medicare through age or disability.

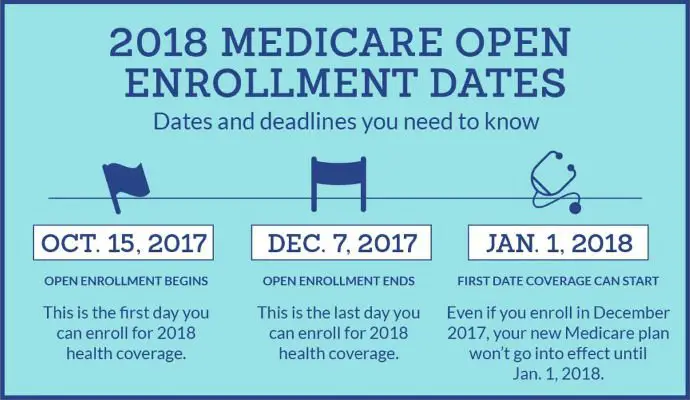

- Fall open enrollment period: Reevaluate and make changes to your Medicare or Medicare Advantage coverage, or your Part D coverage, from Oct. 15 to Dec. 7.

- General enrollment period: The time period between Jan. 1 and Mar. 31 of every year is when you can enroll in Medicare Part B for the first time. You may be eligible to enroll in a Medicare Advantage or a prescription drug plan in Apr. 1 to Jun. 30 of the same year with coverage starting on Jul. 1.

Similar to Marketplace plans, Medicare also has Special Enrollment Periods. You may qualify for a Medicare Special Enrollment Period if you meet any of these eligibility requirements, which includes losing coverage through no fault of your own, moving to or from institutional facilities, and experiencing changes in your eligibility for certain programs.

How Much Are Aca Plan Premiums

Premiums for individual coverage for a single person increased by $6 to $456 in 2020.

eHealth said the average premiums for individual coverage were:

- Bronze — $448

- Silver — $483

- Gold — $596

- Platinum — $732

For family coverage, the average premiums were:

- Bronze — $1,041

- Silver — $1,212

- Gold — $1,437

- Platinum — $1,610

For 2021, the Centers for Medicare and Medicaid Services estimated that the average ACA federal exchange plans premiums in the second lowest cost Silver plan will decrease by 2% for a 27-year-old in 2021. Many states will see even larger premium decreases.

Meanwhile, ACA plan deductibles will continue to climb. Deductibles are what you have to pay before your health plan starts paying for health care services.

Here are the median individual deductibles for 2021:

- Bronze — $6,992

- Silver — $4,879

- Gold — $1,533

CMS didn’t provide deductible estimates for Platinum plans.

What does the health insurance plan cover?

Under the Affordable Care Act, plans must provide at least 10 essential benefits:

- Outpatient care including chronic disease management

- Emergency care

- Mental health and substance abuse services

- Prescription drugs

- Preventive and wellness services

- Dental and vision care for children

Insurance plans can offer benefits in addition to the required benefits. The best way to find out what benefits each plan covers is to go to its website and compare.

Also Check: How Do I Get A Health Insurance Card

Medicaid And The Childrens Health Insurance Program

In all states, Medicaid provides coverage for some low-income people, families and children, pregnant women, the elderly, and people with disabilities. Likewise, CHIP provides low-cost health coverage to children in families that earn too much to qualify for Medicaid. CHIP also covers pregnant women in some states, and some states have expanded their Medicaid programs to cover anyone who falls below certain income levels.

If your state has expanded Medicaid, income is the only requirement. In states without expanded Medicaid, qualifications vary and may consider income, household size, disability, age, and more. Qualifications for CHIP vary from state to state. To find out if you qualify and apply for Medicaid or CHIP, go to the Health Insurance Marketplace or your states Medicaid agency.

Short-term health insurance is temporary health insurance that can help fill in the gaps in health care coverage. It can be a solution if youre between jobs, have started a new job and are waiting for new coverage to begin, are waiting to become eligible for Medicare, or dont have health insurance because you missed open enrollment. Its not right for everyone, however, and benefits can be quite limited. Consider these pros and cons.

Which The Other States Can Still Extend Their Health Insurance Open Enrollment Period

Health insurance open enrollment extensions for Obamacare could be seen as a partisan issue, with Democrats in favor of longer enrollment periods and Republicans against them. However, open enrollment benefits are popular enough for very fine folks on all sides to have embraced them in the past.

Not every state can change the dates for the upcoming open enrollment for health insurance. These four states run their own exchange and can push back open enrollment:

States can extend open enrollment at any time, even once its already underway. For instance, Maryland waited until the last day it could to extend its open enrollment.

You May Like: How Much Do You Pay For Health Insurance

Individual Plan Renewing Outside Of The Regular Open Enrollment

HHS issued a regulation in late May 2014 that included a provision to allow a special open enrollment for people whose health plan is renewing but not terminating outside of regular open enrollment. Although ACA-compliant plans run on a calendar-year schedule, that is not always the case for grandmothered and grandfathered plans, nor is it always the case for employer-sponsored plans.

Insureds with these plans may accept the renewal but are not obligated to do so. Instead, they can select a new ACA-compliant plan during the 60 days prior to the renewal date and 60 days following the renewal date. Initially, this special enrollment period was intended to be used only in 2014, but in February 2015 HHS issued a final regulation that confirms this special enrollment period would be on-going. So it continues to apply to people who have grandfathered or grandmothered plans that renew outside of open enrollment each year. And HHS also confirmed that this SEP applies to people who have a non-calendar year group plan thats renewing they can keep that plan or switch to an individual market plan using an SEP.

When Can I Enroll In Private Health Plan Coverage Through The Marketplace

In general, you can only enroll in non-group health plan coverage during the Open Enrollment period.

However, in 2021, HealthCare.gov and all state-run Marketplaces have extended the enrollment period to make it easier for people to sign up for coverage during the COVID-19 pandemic. During this extended enrollment period, uninsured people can sign up, and people already enrolled in the Marketplace have an opportunity to change plans. Even though this extended COVID enrollment period is sometimes referred to as a special enrollment period, you do not need to have a qualifying event to sign up during this time.

Dates for the extended COVID enrollment period are as follows:

HealthCare.gov states February 15 August 15, 2021

California February 1 December 31, 2021

Colorado February 8 August 15, 2021

Connecticut May 1, 2021 October 31, 2021

District of Columbia February 1 December 31, 2021

Idaho March 1 April 30, 2021

February 1 August 15, 2021

Massachusetts February 1 July 23, 2021

Minnesota February 16 July 16, 2021

Nevada February 15 August 15, 2021

New Jersey February 1 December 31, 2021

New York February 1 December 31, 2021

Pennsylvania February 15 August 15, 2021

Rhode Island February 1 August 15, 2021

Vermont February 16 October 1, 2021

Washington February 15 August 15, 2021

The extended COVID enrollment period does not apply to plans sold outside of the Marketplace in HealthCare.gov states.

Recommended Reading: How Does Health Insurance Work Through Employer

A Qualifying Event At Any Time Of The Year Will Likely Allow You To Enroll

Applicants who experience a qualifying event gain access to a special enrollment period to shop for plans in the exchange with premium subsidies available in the exchange for eligible enrollees.

HHS stepped up enforcement of special enrollment period eligibility verification in 2016, and further increased the eligibility verification process in 2017. So if you experience a qualifying event, be prepared to provide proof of it when you enroll.

And in most cases, the current rules limit SEP plan changes to plans at the same metal level the person already has. The state-run exchanges can use their own discretion on this, but in general, if youre enrolling mid-year, be prepared to provide proof of the qualifying event that triggered your special enrollment period, and know that you might not be able to switch to a more robust or less robust plan during your SEP. And understand that in most but not all cases, the current SEP rules allow you to change your coverage but not necessarily go from being uninsured to insured. So you may be asked to provide proof of your prior coverage in addition to proof of the qualifying event.

And without a qualifying event, major medical health insurance is not available outside of general open enrollment, on or off-exchange. This is very different from the pre-2014 individual health insurance market, where people could apply for coverage at any time. But of course, approval used to be contingent on health status, which is no longer the case.

Option : Check If You Qualify For Special Enrollment

Certain life events qualify you for a special enrollment period. A special enrollment period is a period of time during which you can buy coverage, even if its outside the normal Open Enrollment Period. The events which make you eligible for a special enrollment period are known as qualifying life events.

| Qualifying Life Event |

You May Like: How To Get Temporary Health Insurance

Having A Baby: Javier Adopts A Little Girl

Javier, 38, and his husband live in Miami, Florida. They just adopted a three-month-old girl, Lucía, and want to give their daughter the best of everything. Right now, Javiers high-deductible health plan only covers him and his spouse. But he can easily change that. When you welcome a child to your family through birth or adoption, thats considered a qualifying life event. After he brings Lucía home, Javier contacts his health plan to inform them of the event and chooses a lower deductible plan suitable for his entire family.

Missed Open Enrollment You May Be Able To Apply Now During The Special Enrollment Period

What happens if I miss Open Enrollment? Am I doomed to be without health insurance for the rest of the year? Am I going to get a penalty? Can you even get insurance outside of Open Enrollment?

See the options below and find out how to get healthcare after open enrollment. There still are opportunities to buy health insurance.

Also Check: How Much Health Insurance Do You Need

The Closest Thing To Real Insurance If You Missed Open Enrollment

For people who didnt enroll in coverage during open enrollment or the COVID-related enrollment window, arent eligible for employer-sponsored coverage or Medicaid/CHIP, and arent expecting a qualifying event later in the year, the options for 2021 coverage are limited to policies that are not regulated by the ACA and are thus not considered minimum essential coverage.

And most of these plans are designed to be supplemental coverage, rather than a persons only health coverage. This includes things like limited-benefit plans, accident supplements, critical/specific-illness policies, dental/vision plans, and medical discount plans.

But there are a few types of coverage that are available year-round , and that can serve as stand-alone coverage in a pinch:

Farm Bureau plans in a few states

In Kansas, Tennessee, Indiana, and Iowa, members of Farm Bureau who are healthy enough to get through medical underwriting can enroll in Farm Bureau plans that are technically not considered insurance and thus dont have to comply with insurance regulations but that are available for purchase year-round. Similar plans will soon be available in South Dakota and Texas as well.

Farm Bureau plans are also available in Nebraska, without medical underwriting, for people who are actively engaged in agriculture, but these plans use the same November 1 December 15 open enrollment period that applies to ACA-compliant plans in Nebraska.

Health care sharing ministry plans

Short-term health plans

Need Coverage At The End Of The Year

If you find yourself without health insurance towards the end of the year, you might want to consider a short-term policy instead of an ACA-compliant policy. There are pros and cons to short-term insurance, and its not the right choice for everyone. But for some, its an affordable solution to a temporary problem.

Short-term insurance doesnt cover pre-existing conditions, so its really only an appropriate solution for healthy applicants. And for applicants who qualify for premium subsidies in the exchange, an ACA-compliant plan is also likely to be the best value, since there are no subsidies available to offset the cost of short-term insurance.

But if youre healthy, dont qualify for premium subsidies, and you find yourself without coverage for a month or two at the end of the year, a short-term plan is worth considering. You can enroll in a short-term plan for the remainder of the year, and sign up for ACA-compliant coverage during open enrollment with an effective date of January 1. The temporary health plan would certainly be better than going without coverage for the last several weeks of the year, and it would be considerably less expensive than an ACA-compliant plan for people who dont get premium subsidies.

Don’t Miss: How Much Does Health Insurance Cost In Ct

Affordable Care Act Open Enrollment Is Usually Nov1

Open enrollment for plans through the Affordable Care Act starts Nov. 1 and goes through Dec. 15, 2019. In order to get coverage to start on Jan. 1, you’ll need to select a plan by Dec. 15

Some states have longer open enrollment periods:

- California Nov. 1, 2020-Jan. 31, 2021

- Colorado Nov. 1, 2020-Jan. 15, 2021

- D.C. Nov. 1, 2020-Jan. 31, 2021

- Massachusetts Nov. 1, 2020-Jan. 23, 2021

- Minnesota Nov. 1, 2020-Dec. 22, 2020

- Nevada Nov. 1, 2020-Jan.15, 2021

- New Jersey — Nov. 1, 2020-Jan. 31, 2021

- New York Nov. 1, 2020-Jan. 31, 2021

- Rhode Island Nov. 1, 2020-Dec. 15, 2021

And This Year Isnt Just Shorter

Several other changes were made over the past few years that will magnify the impact of a shorter health insurance Open Enrollment Period.

No More Individual Mandate: The tax penalty for going without health insurance no longer exists starting in 2019. This will remove one incentive to get health insurance in a timely manner, as stragglers can now rely on short-term insurance plans to fill coverage gaps instead. To date, only 4 states have added a local individual mandate.

Stricter Special Enrollment Requirements: Previously, the federal government would take your word for it if you tried to join a plan outside of open enrollment due to a special circumstance. As of this year, there are strict verification standards that involve sending the documents in a short period of time.

Removal of Non-Payment Loophole: Some consumers had also learned to stop paying their premiums in the months leading up to open enrollment. They bet that it would take a while for their coverage to be canceled, or even decided to lose coverage since they no longer needed it. This five-finger discount loophole was closed for 2018. Now, youll only be able to switch to new coverage if your old coverage is paid in full. Consumers especially those who are behind on payments by accident may not be able to learn about the issue, reconcile their bills, and sign up in time.

Also Check: Where Can You Get Affordable Health Insurance