Health Insurance Companies In Florida

You have access to 2021 individual and family health insurance from nine companies that sell plans both on and off the exchange. You can also buy these plans if youre a self- employed entrepreneur with no employees.

Cigna left the Florida Health Insurance Marketplace to sell plans off the exchange starting in the 2016 open enrollment period 9but has returned to the Florida exchange for the 2020 plan year. Bright Health Insurance Company joins Cigna for the 2020 OEP.

Below are Florida health insurance companies offering 2021 ACA plans in the individual market:

Comprehensive Long Term Care

Sunshine Health is the largest Comprehensive Long Term Care managed care organization in Florida. We offer comprehensive physical and behavioral health services and programs to support our members ability to age in place and remain independent for as long as possible. Long Term Care is for Medicaid enrollees 18 years and older who require a Nursing Facility level of care. This doesnt mean members must reside in nursing homes. We help members stay in the community whenever possible with long-term services and supports. We help can help members transition from nursing facilities into a home setting of their choice.

Get The Fl Health Insurance You Need Today

Though economic times are trying, there is no reason to go without health insurance. There are many options available for people in different situations, of varying income levels, for children, and for senior citizens. The Government of Florida, along with several insurance companies, has worked hard to make sure Floridians can get coverage. Now that you know some of the options available to you, you can find coverage. Use our free health insurance quote finder on this page to start comparing Florida health insurance rates and quotes right now!

Read Also: Do Children Need Health Insurance

How Do I Get Health Insurance In Florida

If you do not have Florida health insurance benefits through an employer, you have options for where you can purchase health coverage:

How To Get Enrolled

Whether you live in a state with an individual mandate or not, you can get the coverage you need during Open Enrollment. The annual Open Enrollment Period is the time when all eligible Americans can shop the Health Insurance Marketplace. There, you can pick an Affordable Care Act-compliant health plan for 2020. Getting an Obamacare health insurance plan means knows you are getting care that meets certain standards. And this is in terms of both level of coverage and consumer protections. Also, when you shop the Marketplace for health insurance, youll also see what kinds of subsidies you qualify for to make that coverage more affordable. These subsidies are based on household income, and they can be very significantpeople who enroll on HealthSherpa pay an average of $47/month, and 94% of people qualified for subsidies during 2020s Open Enrollment. You can also see if you qualify for Medicaid or Medicare on HealthSherpa.

Ready to get started? Shopping the Marketplace with HealthSherpa is streamlined and straightforward. Plus our Consumer Advocate Team is on-hand to help each step along the way at .

Don’t Miss: How Much Do I Have To Pay For Health Insurance

Tips For Entering A Detox Center Without Insurance

In addition to looking for state-funded programs, someone who wishes to enter rehab can do some research to find out which detox programs in Florida are the most affordable to suit their budget. If a rapid detox program is avoided and they decide to go with a traditional approach, they will find that the fees will most likely be lower.

Outpatient treatments will also be cheaper than inpatient facilities, as certain individuals may be allowed to detox at home with regular appointments with their physicians to keep the cost down.

Government funding, non-profit organizations, and financing can be helpful as well. In the end, each individual needs to weigh the benefits of achieving freedom from addiction over any costs. No price should be put on addiction recovery.

Washington Dc Individual Mandate

- Effective date: January 1, 2019

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides exemptions to the tax penalty for circumstances such as financial hardship, pregnancy, or eviction

Individuals who go without qualifying health coverage for a full year and dont file for an exemption may owe a tax penalty. The penalty amount is either 2.5% of the gross family household income or $695 per individual and $347.50 per child youll pay whichever amount is greater.

According to dchealthlink.com, the maximum penalty for not having coverage in DC is based on the average premiums for bronze level health plans available on DC Health Link. In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without coverage up to a maximum of five household members. So, potentially, a household of five or more that went the entire year without health coverage would have a penalty cap of $17,240 in 2020.

Recommended Reading: How To Sign Up For Free Health Insurance

Pip Insurance Covers More Than Medical Expenses

Even if you use your own health insurance to cover medical bills where PIPs coverage ends, you can still benefit from other protections offered by PIP. You might need PIP coverage if you have health insurance just to pursue the additional benefits PIP offers, like:

- PIPs disability benefits will pay to cover some of your lost income and reasonable expenses for help in your house that you might require while you recuperate. Coverage of this kind can prove invaluable for your peace of mind and for the smooth operation of your household.

- PIPs death benefits will pay up to $5,000 in death benefits that can help your family in a time of need. If you lost a loved one in a car collision, PIP insurance will help you pay for their funeral and burial expenses, relieving your family of a huge financial burden.

Speak to a lawyer in your area to understand the full range of benefits Florida PIP insurance can provide.

What To Expect With Medical Detoxification

Medical detox is a process used by our licensed physicians to slowly rid the body of the unwanted substance that an individual has become addicted to. Depending on the severity of the addiction and type of substance, this process can last anywhere from a couple of days to a couple of weeks.

During this process, an individual will experience withdrawal symptoms that can be extremely painful. Although the effects of every drug are different, there is a trend that follows with most symptoms an addict can experience during detox. Some of these can include:

- Shortness of breath

- Insomnia or interrupted sleep patterns

- Development of coexisting disorders like anxiety and depression

In certain cases, withdrawal symptoms can even become deadly. Seizures, strokes and even heart attacks are possible when going through the detox process.

Although this part of recovery is very uncomfortable, our staff will do everything possible to ensure each of our patients are well taken care of. We want to make the process easier for each party involved, so they have a higher chance of avoiding relapsing after detox is finished.

You May Like: How To Find Personal Health Insurance

Is Insurance Necessary To Enter A Detox Facility In Florida

A lack of insurance is a common concern that many individuals face across the nation. In each state, there is an office that is devoted to offering health services, including a division that covers mental health and any services related to substance abuse.

State-funded programs are offered in various rehabilitation and detox centers throughout the state of Florida. The state office can provide a listing of eligible facilities. If a preferred facility is not on the list of state-funded programs, financing options are available. Some addiction recovery centers and detoxification facilities offer sliding fee scales. There are options available that can open the door to recovery.

If you believe you are suffering from an addiction disorder in Florida, our staff is here to help. Whether or not you have insurance, we want to encourage you to take charge and accept the help that you need and deserve. Our treatments will allow you to overcome your disorder with the assistance of our medical professionals and therapists.

New Jersey Individual Mandate

- Effective date: January 1, 2019

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on New Jersey residents who go without health insurance but can afford it

- Provides state subsidies to help lower income residents afford health insurance

The New Jersey penalty, otherwise known as the Shared Responsibility Payment, is based on household income as well as family size. However, the penalty is capped at the cost of the average statewide premium for bronze health insurance plans.

According to NJ.gov, the minimum tax penalty for individuals is $695 and the maximum is $3,012 for the 2020 tax year. For a family of five with a household income of $200,000 or below, the minimum tax penalty in 2020 is $2,351 and the maximum is $5,074. If you are not required to file a tax return for 2020 in New Jersey, then you are exempt from paying this fine.

New Jersey law has exemptions in certain situations. For example, if you cant afford the health plans available to you through the Marketplace or your employer, you may be eligible for an exemption. Plan premiums must be more than 8.05% of your household income for that year. There may also be exemptions for religious belief or hardship.

You May Like: Does Health Insurance Cover Birth Control Pills

What Qualifies As Minimum Essential Coverage

The Affordable Care Act requires you to have whatâs called âminimum essential coverageâ or MEC. The following types of health coverage meet the ACAâs guidelines:

- any health plan bought through Healthcare.gov

- individual health plans purchased outside Healthcare.gov, if they meet the standards for qualified health plans

- any âgrandfatheredâ individual insurance plan youâve had since March 23, 2010, or earlier

- any job-based plan, including retiree plans and COBRA coverage

- Medicare Part A or Part C

- most Medicaid coverage, except for limited coverage plans

- coverage under the Childrenâs Health Insurance Program

- coverage under a parentâs plan

- most student health plans

- health coverage for Peace Corps volunteers

- certain types of veterans health coverage through the Department of Veterans Affairsmost TRICARE plans

Seeking Coverage Through Pip And Health Insurance

If you have both PIP and health insurance in Florida, you will have to make a claim for medical bills or lost wages against your PIP policy first. When your PIP coverage is exhausted, your healthcare provider will bill your health insurance .

PIP insurance requires you to visit a medical professional within 14 days of your injury. This requirement can be tricky, especially if you did not seek medical attention right away. Often, people feel fine following a car crash even if they were injured. Some car accident injuries can take days or weeks to manifest themselves.

For this reason, it is important to seek medical attention immediately after your car crash, even if you think that you feel fine. Seeing a doctor right away will not only help you recover faster but is also vital in order to be eligible to file a claim against your PIP policy within 14 days after the accident.

Contact our personal injury lawyers at Ged Lawyers, LLP, to discuss how you can seek coverage for your car accident injuries in Florida. Call at 561-995-1966 to receive a consultation.

Recommended Reading: What’s The Penalty For Not Having Health Insurance In California

The Future Of Individual Health Insurance Mandates

Over the past year, a few additional states have considered or are considering individual mandates, including:

- Connecticut

- Washington

However, so far, none of these states havemanaged to ultimately pass state individual mandates.

Lawmakers who push for individual mandate laws argue that its needed to incentivize people to get health insurance. The argument is that if not enough healthy people sign up for coverage, the pool of insured individuals will be made up mostly of sick people, and health premiums will rise for everyone. However, many states have attempted and failed to pass individual mandate legislation, and these laws remain politically controversial.

According to Forbes.com, the new Biden administration is expected to bring back the federal tax penalty for going without ACA-compliant health coverage. Its unclear yet whether he would do this through an executive order or legislative reform.

Available Programs That Offer Comprehensive Services

If you are serious about recovery from addiction, you need to look at the big picture. This stage may take a few days or could stretch into weeks. It depends on what type of drug is being used if it is being used in combination with any other drug, and how much of the drug is being used daily. If other mental health issues are a concern, this can have an impact on the rate of treatment, as well. This is when the support system of a recovery facility is essential.

Our team of caring professionals is working toward the same goal as every victim of substance abuse. We will work with clients in our facilities to discover why addiction has become a problem, what trigger factors are that may contribute to substance abuse, and healthy strategies that will make it possible to avoid a drug of choice in the future.

Also Check: How Much Is Health Insurance Usually

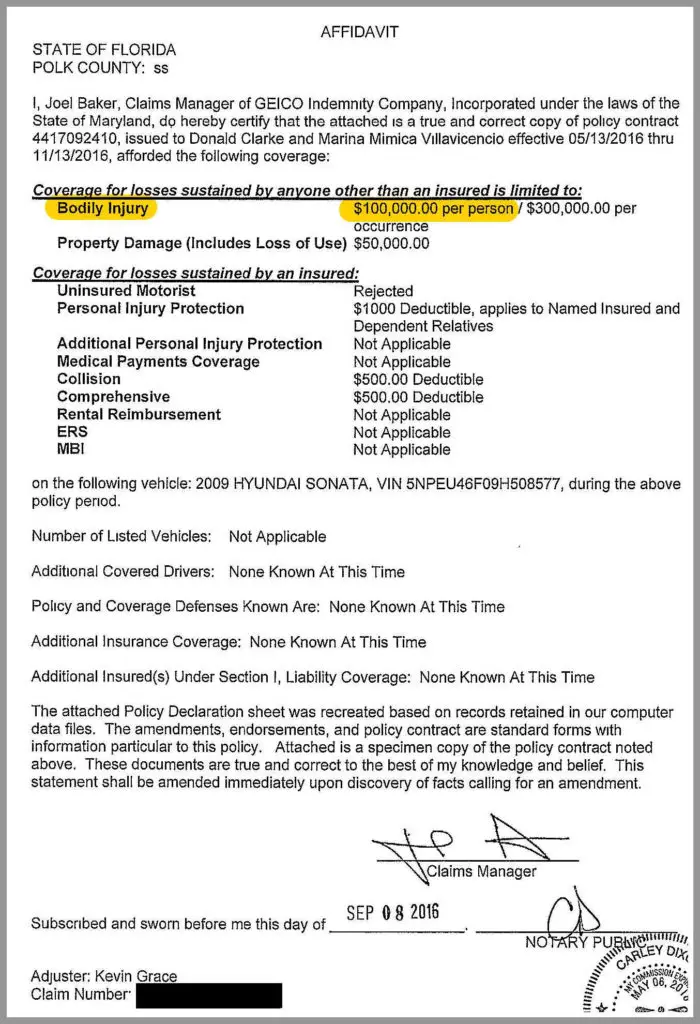

What Happens If You Reject Uninsured Motorist Coverage

If you reject uninsured motorist coverage, you will need to use another type of coverage or pay out of pocket in the event that you are hit by an uninsured driver. If you already have collision insurance and medical coverage of some sort, rejecting uninsured motorist coverage might be a good way to lower your premium. Otherwise, paying for uninsured motorist coverage is generally an inexpensive way to add extra protection.

Do You Have To Have Health Insurance To Go To A Detox Center In Florida

The reason a lot of individuals affected by addiction dont seek treatment is that they are worried they will be denied access or wont be able to afford it. Although insurance is helpful when paying for treatment, it is not necessary to be admitted into most facilities like ours at Coastal Detox.

Before an addiction spirals out of control, its important to get help from professionals who understand how to properly treat it. The first step towards recovery is always recognizing that addiction has occurred. It sounds easy, but this is often one of the most difficult things to do because its hard to walk away from substance abuse.

Also Check: Can Aflac Replace Health Insurance

Medicare Enrollment In Florida

Most people know Medicare as government health insurance for people 65 and older. But people under 65 with a disability or chronic illness can also get Medicare.5

With the Sunshine State being a top retirement destination, it may be no surprise to know that Florida has the second highest number of Medicare enrollees of any state. As of 2020, more than 4.6 million Floridians are enrolled in Medicare.

Among Floridas Medicare enrollees, more than 2.4 million get benefits directly through the federal governments Original Medicare program. Another 2.2 million get coverage through private Medicare Advantage plans, which offer benefits not included with Original Medicare such as prescription drug coverage.6 Since 2018, a separate 1.5 million Florida residents are enrolled in standalone Medicare Prescription Drug Plans.7

As of 2019, Aetna, Anthem, Florida Blue, Humana, and UnitedHealthcare are the largest Medicare Advantage providers in Florida by number of enrollees.8

Word of Advice

Review all your options. See what makes sense for your needs and your budget.

Which Insurers Offer Coverage In The Florida Marketplace

As of 2022, there will be 14 insurers offering plans in Floridas marketplace, including four new insurers . As is the case in most states, insurer participation varies from one area of the state to another:

- AvMed

- Florida Blue HMO

- Sunshine State Health Plan

- UnitedHealthcare

For 2021, Cigna expanded its coverage area again, adding Leon, Lake, Seminole, Orange, Osceola, Broward, Indian River, Martin, and St. Lucie counties to its Florida service area.

Recommended Reading: Where To Find Health Insurance

When You Can Buy Florida Aca Health Insurance

If you are a U.S. citizen living in the state, you can purchase a Florida Affordable Care Act plan during the Open Enrollment Period,3 which runs from November 1 through December 15.4

But, there is some flexibility when you can enroll depending on certain circumstances. You can enroll in a plan anytime if you have a qualifying event, which includes but is not limited to:5

- Getting married or divorced

- Becoming a U.S. citizen

Freeway Is Here To Help

Were here to help you meet your health insurance needs. Our experienced agents can help you:

- Work through the federal governments healthcare exchange at HealthCare.gov to connect Floridians with the right health insurance for their needs.

- Compare plans available for residents of Florida.

- Identify if you are eligible for any free or low-cost programs.

- Know exactly what your premiums will be and what coverage youll receive.

- Apply for government financial assistance for help with both the cost of care and health insurance premiums.

- Meet enrollment deadlines and avoid penalties.

- We are not an exclusive agent. We aim to connect you with the best healthcare insurance amongst all the providers.

- Get outstanding service all year round: before, during, and after the enrollment period. Were here to help!

Also Check: Is It Required For Employers To Offer Health Insurance