Will Disciplinary Action Hurt My Chances For Credentialing

It is not a good thing, but it can happen. There are a number of different reasons this can happen. This is not necessarily going to be a problem for credentialing, but there will more than likely be a delay.

The insurance company will want a written explanation of what caused the action, what the allegations were, and the results of the action. This information has to be submitted directly to the insurance company.

Instead of going through the regular process, they have to go through a special committee to pass the provider along or not. The special committee that decides on credentialing is the reason for the delay.

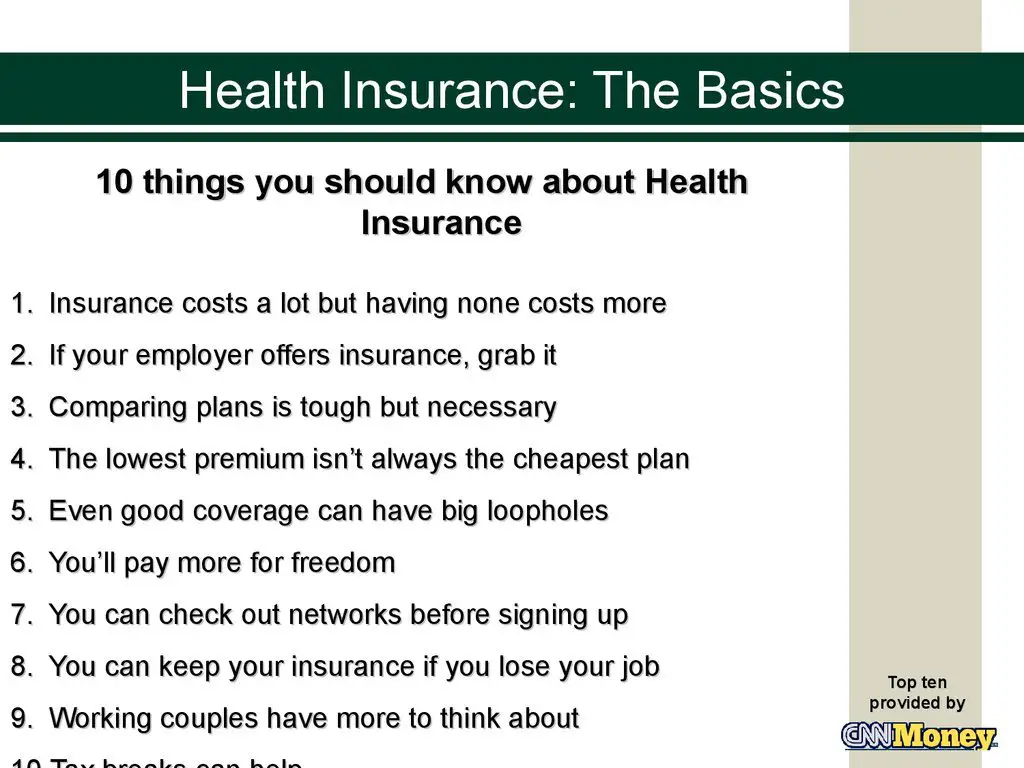

What You Need To Know

The word “private” is used to describe any health insurance plan that is not run by the federal or state government. Private insurance can be purchased from a variety of sources: your employer, a state or federal marketplace, or a private marketplace.

There are a wide variety of options when it comes to private health insurance plans. All private health insurance plans are designed to split the cost between you and the insurer, making medical care more affordable for you. These cost-sharing methods come in the form of deductibles, copays, and coinsurance. When shopping for a plan, look for the right balance between the monthly cost of the plan and the cost sharing methods.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

The opposite of a private insurance plan is a public insurance plan. There are a few government-run health insurance plans you may be aware of. Medicaid is a state-run insurance that helps people with low incomes pay for health care services. Medicare is a similar program for people age 65 and older. Another popular government-run program is CHIP, the Children’s Health Insurance Program, which provides free or low-cost health insurance to children who otherwise are not covered by a private plan or Medicare.

Public Health Insurance Programs

Medicare

Medicare is a federally-funded health benefit. Most people qualify for Medicare by turning 65 but some are eligible to enroll prior to age 65 if they meet certain conditions. Medicare is complex and your selection of a particular Medicare Part or Plan can have significant implications for your access to care.

Medicaid/HUSKY

Medicaid is a comprehensive health benefit program for individuals who qualify for it due to their income level, disability status, or other qualifications. Connecticuts Medicaid program is called HUSKY and is managed by the Connecticut Department of Social Services. OHA can assist you with issues you may encounter enrolling in HUSKY or securing necessary benefits. HUSKY is funded through a combination of state and federal funding, and is managed as a partnership between the state and the U.S. Government.

Read Also: Can Aflac Replace Health Insurance

Switching Private Health Insurance Funds Heres What You Need To Know

We answer the biggest questions you have about switching

When it comes to your health insurance, things with your current fund might not be working out the way you thought they would.

At nib, weâre focussed on giving our members the best value for money, so if youâre not getting the service you were hoping for, it may be time to consider switching. But, before you call your current health fund to say âitâs not you, itâs meâ, read up on some of the biggest questions you might have when it comes to transferring your health insurance.

Related: A guide to saving money on your health insurance cover

Q What Should I Do If I Move

It is important that ServiceOntario has your current address to ensure your coverage remains active and for any direct communication with you.

There are three ways to update your address:

For more information refer to , fact sheets .

Northern Health Travel Grant :

You may be eligible for a to help pay transportation costs if you live in northern Ontario and must travel long distances for specialty medical care.

Services in Other Canadian Provinces and Territories :

Most of your Ontario health coverage benefits can be used across Canada. The province or territory you are visiting will usually bill Ontario directly. If you have to pay for health services you receive in another part of Canada, you can submit your receipts to your local to be considered for reimbursement. Prescription drugs from pharmacies, home care services, ambulance services and long-term care services provided in other provinces and territories are not covered.

Services Outside Canada :

For people , the ministry pays a set rate for emergency health services. Emergency health services are those given in connection with an acute, unexpected condition, illness, disease or injury that arises outside Canada and requires immediate treatment. are not covered. Ontario residents are encouraged to purchase supplementary insurance when traveling outside Canada as many emergency health services provided outside the country cost much more than OHIP may pay.

Also Check: How Much Does Health Insurance Cost In Ct

You Have Private Insurance Coverage Through Your Employer Or A Spouses Employer

When youre eligible for Medicare, you can still have private insurance coverage provided by an employer. Generally speaking, youre eligible for Medicare when you:

- have a qualifying disability

- receive a diagnosis of ESRD or ALS

How Medicare works with your group plans coverage depends on your particular situation, such as:

- If youre age 65 or older. In companies with 20 or more employees, your group health plan pays first. In companies with fewer than 20 employees, Medicare pays first.

- If you have a disability or ALS. In companies with 100 or more employees, your group health plan pays first. When a company has fewer than 100 employees, Medicare pays first.

- If you have ESRD. Your group health plan pays first during a 30-month coordination period. This is regardless of the number of employees your company has or whether youre retired.

Its possible that your company may offer you coverage under a group plan after you retire. This is called retiree coverage. In this case, Medicare pays first and your retiree coverage pays second.

Some health insurance plans, such as Health Maintenance Organization and Preferred Provider Organization plans, require you to use in-network providers. If this is the case with your group health plan and it pays first, you may not be covered by Medicare if you choose to use an out-of-network provider.

More About How Va Health Care Works With Medicare And Other Insurance

This is your decision. You can save money if you drop your private health insurance, but there are risks. We encourage you to keep your insurance because:

- We dont normally provide care for Veterans family members. So, if you drop your private insurance plan, your family may not have health coverage.

- We dont know if Congress will provide enough funding in future years for us to care for all Veterans who are signed up for VA health care. If youre in one of the lower priority groups, you could lose your VA health care benefits in the future. If you dont keep your private insurance, this would leave you without health coverage.

- If you have Medicare Part B and you cancel it, you wont be able to get it back until January of the following year. You may also have to pay a penalty to get your coverage back .

Yes. We encourage you to sign up for Medicare as soon as you can. This is because:

Youll need to choose which benefits to use each time you receive care.

To use VA benefits, youll need to get care at a VA medical center or other VA location. Well also cover your care if we pre-authorize you to get services in a non-VA hospital or other care setting. Keep in mind that you may need to pay a VA copayment for non-service-connected care.

Read Also: Does Amazon Have Health Insurance

Q What Immigration Documents Must I Present To Confirm My Immigration Status As An Applicant For Permanent Residence When Applying For Ontario Health Insurance Coverage

If you are applying for Ontario health insurance coverage as an Applicant for Permanent Residence, you are required to present written confirmation from Citizenship and Immigration Canada that you are eligible to apply for permanent residence in Canada, which may be one of the following :

- CIC Confirmation Letter letter on CIC letterhead addressed to the Applicant for Permanent Residence that confirms that the applicant is eligible to apply for permanent residency in Canada

- CIC Immigration document such as a Work Permit, Visitor Record, Temporary Resident Permit or Study Permit with note in the “Remarks Section” that indicates that you have applied for permanent residence and the CIC has confirmed that you meet the eligibility requirements to apply for permanent residence in Canada.

Types Of Health Insurance Plans

When purchasing health insurance, your choices typically fall into one of three categories:

- Traditional fee-for-service health insurance plans are usually the most expensive choice. They offer the most flexibility in choosing health care providers.

- Health maintenance organizations offer lower co-payments and cover the costs of more preventive care. Your choice of health care providers is limited to those who are part of the plan.

- Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider.

Read Also: How Much Does Family Health Insurance Cost Per Month

Private Health Insurance Tips

It is mandatory for everyone living in Germany, even temporarily, to have valid health insurance for the entire time they are in the country. If you will opt for private health insurance, try to organize this online and with the help of provider support before you arrive.

One way to lower your monthly private insurance contributions is by opting to increase the excess that you will pay yourself each year for certain treatments this is known as Selbstbehalt. Remember to budget for paying for your doctors visits and treatments as you will have to do this before being reimbursed.

If you have private health care cover in your home country, you may be able to move to Germany and still be covered by the terms of your insurer to use private doctors and hospitals in Germany, but its really important that you check this first.

If you have public healthcare insurance then your children are covered under your plan. This may not always be the case for private healthcare. Make sure you choose a provider that covers your family.

Overseas Student Health Cover

If youre in Australia on a temporary visa, you should consider buying insurance to cover the costs of medical treatment. Find out more about health cover for overseas visitors and overseas students.

International students who havent been able to return to Australia due to COVID-19 should contact their private health insurer to find out about options for extending, or suspending, their cover. Some may offer a period of suspension, but they are not required to do so.

Read our collection of resources for international students.

A collection of resources about overseas student health cover for the general public and private health insurers.

Don’t Miss: What Is A Gap Plan Health Insurance

Current Role Of Private Health Insurance In The Us

Today, the majority of the U.S. population have some form of coverage delivered by a private health insurer. This includes: non-elderly people with employer-sponsored coverage or individually purchased health insurance plans low-income Medicaid enrollees covered by managed care organizations people age 65 and older and younger adults with disabilities in Medicare Advantage plans and people in traditional Medicare who also have private insurance, such as Medicare part D stand-alone prescription drug plans, supplemental policies, or employer-sponsored retiree health coverage.

The following coverage estimates are the most current data available for each category of private insurance. These data points cannot be summed because they derive from different sources, from different years, and because some people have private insurance from multiple sources.

Do You Need Private Health Insurance

Its very much a personal choice. UK residents get free treatment on the NHS, so you only really need private medical insurance if:

- you would prefer not to wait for NHS treatment

- you dont want to use the NHS, and would prefer private hospitals where possible

- you want to be covered for drugs and treatment you cant get on the NHS, such as specialist surgery for sports-related injuries check the treatment is included in your policy before you buy.

Recommended Reading: How To Get Health Insurance For My Small Business

The Benefit Of Someone Else Doing The Process For You

With years of experience, expert credentialers knows how to work with the insurance companies to get you credentialed, and takes the hassle of credentialing away from you.

Insurance companies are not great about telling you if there is a problem with your application or if something gets lost. Because they have so many providers, the insurance will not be the one to follow up. It relies on the provider to be the one to follow up with the process and applications.

Sometimes the insurance companies need a little push. Sometime companies will say, I dont have this, or I am missing this part of the application, but really they have not looked into it.

They just need a little push to show that you have completed the application and the process.

Q Are Open Work Permit Holders And/or Participants In Citizenship And Immigration Canada’s Post

Open work permit holders may be eligible for Ontario health insurance coverage provided they are employed full-time for an employer in Ontario for a minimum of six months, have a valid work permit during this time, and they:

- maintain their primary place of residence in Ontario and are

- physically present in Ontario for at least 153 days in any 12-month period and are

- physically present in Ontario for 153 of the first 183 days immediately after establishing residency in the province.

Further information on the changes concerning Temporary Foreign Workers can be found on a fact sheet entitled .

You May Like: Is Cigna Health Insurance Any Good

When Can I Buy Private Health Insurance

Most types of health insurance have an open enrollment period during which you can sign up for private health insurance. This is true whether you are buying insurance via the Affordable Care Act health insurance exchange in your state, sign up directly through the insurer, enroll in the plan your employer offers, or sign up for Medicare.

Certain life events can trigger a special enrollment period, which will allow you to change your health insurance coverage outside of the normal enrollment period. These events include getting married or divorced, having a baby, losing your job-based health insurance, or moving out of your health plans service area.

Q My Photo Health Card Has Expired How Do I Renew My Health Card

Your photo health card has an expiry date that is linked to your date of birth. The first time you apply for a photo health card, the expiry date can be anywhere from two to seven years in the future. When your photo health card is renewed, the renewal date will always be five years in the future and linked to your date of birth.

Renewal notices for photo health cards are mailed approximately two months prior to the expiry date shown on the front of the photo health card however, if it is more convenient, you can renew up to six months prior to the date of expiry.

To learn more about renewing your Ontario photo health card, refer to the fact sheet .

Read Also: How Does Health Insurance Work Through Employer

What Does It Cover

Like all insurance, the cover you get from private medical insurance depends on the policy you buy and who you buy it from.

The more basic policies usually pick up the costs of most in-patient treatments such as tests and surgery and day-care surgery.

Some policies extend to out-patient treatments such as specialists and consultants and might pay you a small fixed amount for each night you spend in an NHS hospital.

Important Insurance Terms And Concepts:

The terms ‘covered benefit’ and ‘covered’ are used regularly in the insurance industry, but can be confusing. A ‘covered benefit’ generally refers to a health service that is included under the premium for a given health insurance policy that is paid by, or on behalf of, the enrolled patient. ‘Covered’ means that some portion of the allowable cost of a health service will be considered for payment by the insurance company. It does not mean that the service will be paid at 100%.

For example, in a plan under which ‘urgent care’ is ‘covered’, a copay might apply. The copay os an out-of-pocket expense for the patient. If the copay is $100, the patient has to pay this amount and then the insurance plan ‘covers’ the rest of the allowed cost for the urgent care service.

In some instances, an insurance company might not pay anything toward a ‘covered benefit’. For example, if a patient has not yet met an annual deductible of $1,000, and the cost of the covered health service provided is $400, the patient will need to pay the $400 . What makes this service ‘covered’ is that the cost counts toward the annual deductible, so only $600 would remain to be paid by the patient for future services before the insurance company starts to pay its share.

Recommended Reading: How To Get Cheap Health Insurance In Texas

Verification Of Patient Insurance Coverage

Why is this important, how does it affect the daily job of the medical biller, and how do you do it?

The majority of patients that come into the medical office have medical insurance. That means that they may have to pay a small portion of their medical bills, while their health insurance pays for the rest.