Is My Employer Required To Provide Medical Benefits To My Spouse Domestic Partner Or Dependent Children

Much like employers are not required by law to provide health and welfare benefits to employees, they are equally not required to provide those benefits to spouses, domestic partners or dependent children. If, however, an employer voluntarily provides spousal benefits through an insurance provider or health maintenance organizations , the employer must also provide those same benefits to registered domestic partners of the covered employees. Thats because AB 2208 requires equal treatment of spouses and registered domestic partners in all aspects of insurance coverage.

Note: AB 2208 applies to insurance providers and HMOs who supply insurance to an employers employees, but does not apply to employers who self-insure, who are not required to provide equal domestic partner coverage to their employees.

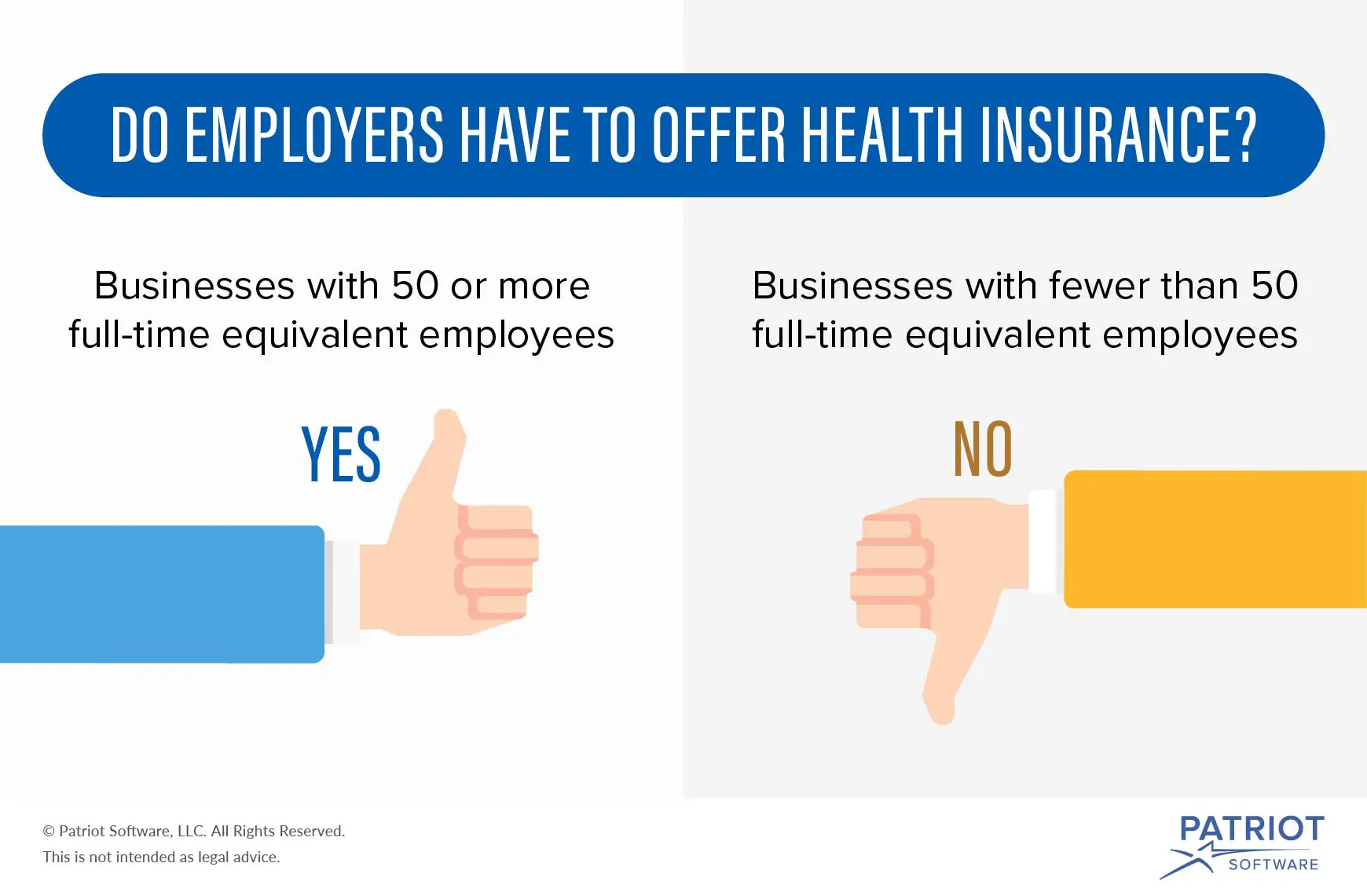

Not All Employers Are Required To Provide Health Insurance

Employers arenât necessarily required to provide health insurance in the United States if they classify as a smaller business. The requirements fall in line with the number of employees a business has, and some state laws might change the requirements, depending on where you live.

Dr. Kate Tulenko, a health workforce expert at Corvus Health, explains why employers are not required to provide health insurance for their employees

âThe Affordable Care Act does require large employers to provide health insurance to 95% of their workers or pay a fine. The health insurance provided must meet certain affordability requirements and must cover a minimum set of essential services. Whether individuals have to pay a penalty if they do not have health insurance depends on their state of residence and is in flux due to lawsuits challenging the ACAâ.

What Do Employers Gain

If workers prefer to obtain health insurance through their employers rather than on their own, why are employers willing to act as their health insurance agents? Part of the explanation undoubtedly rests with the tax incentives for employers to offer coverage to workers and their dependents. Payments for health insurance are deducted from gross revenues in calculating the employer’s taxable income, and they also are excluded from the base payroll in determining the employer’s share of the payroll tax for Medicare and Social Security. More important, however, employers may want to offer health insurance to their workers because failing to do so could harm the firm’s performance. The evolution of company-sponsored medical care plans suggests that employers have long recognized the value of providing health insurance to workers. With the rapid growth of manufacturing and unions before World War I, the provision of welfare benefits, including health insurance, was widely acknowledged to be good business: The employee plans

relieved the employer of the solicitations for aid for the destitute dependents of deceased employees also, it was not necessary for the employees to pass the hat among themselves during working hours for the same purpose the program assisted in attracting better employees and in retaining those already employed, employee morale was enhanced, job relations improved and the public relations of some firms favorably affected.

Recommended Reading: How Much Do You Pay For Health Insurance

Does My Employer Have To Provide Health Insurance

Prefer to listen? Play the audio version of this article and follow along!

A common question among employees is does my employer have to provide health insurance? The answer? Not necessarily. The health care reform law, called the Affordable Care Act , requires certain employers to purchase health insurance or else pay a tax penalty.

Consumer Expectations Have Evolved

We no longer accept one-size-fits-all solutions in other areas of our lives, so why should healthcare be any different? Consumer needs and perspectives on health insurance coverage vary widely across many dimensions, including generational differences.

As a father of four, including a son who has newly entered the workforce, I have seen first-hand how differently younger generations think about their insurance plan options and experiences.

Younger generations have only lived a digital age and therefore have high expectations for flexibility, convenience, and personalization. They are generally in good health, so they are far less likely to be dealing with chronic conditions, specialized physicians and treatments, or high-cost prescriptions. Many are single and have not yet started families, which simplifies their considerations when choosing coverage. Younger generations are great adopters and proficient users of technology, and are therefore likely to be more receptive to change, and are at the forefront of adopting new technologies and experiences.

Its inevitable that demands for more personalization in healthcare will reach a tipping point and employer plans will either have to evolve to deliver these experiences, or consumers may take matters into their own hands, re-evaluating where they get their healthcare coverage.

Also Check: Can I Buy Dental Insurance Without Health Insurance

If I Decide To Enroll In A Marketplace Plan Will I Be Eligible For Subsidies/savings

First, your employer may contribute to your health insurance costs when you enroll in an employer-sponsored plan. Sometimes they even contribute 100%. But if you opt-out of your employer-sponsored plan for an Obamacare plan, they wont. Want to opt-out of an employers plan? Youll be handling the costs of your monthly premiums on your own and paying full price.

Second, if you turn down an employer plan and enroll in an Obamacare plan, you probably wont get any subsidies/savings. The only ways you can qualify for a subsidies are:

More on these minimum standards here.

To make this process a little easier, weve created a free guide you can save and refer back to later.

Calculating Number Of Full

According to a newer IRS ruling, employers need to calculate their employees hours of service every month for a minimum 6 month period before January 1st and that a common law employee is one that averages 30+ hours of service per week for any given month. So, the key is if the full-time employees plus the common law employees that average 30+ hours of service per week for any given month is greater or less than 50. For more details on this please see this FAQ from the IRS on calculating the number of full-time equivalent employees or use Healthcare.govs FTE calculator.

Recommended Reading: How Much Does It Cost For Health Insurance

I Can’t Afford To Lose My Most Important Employeesthe Ones That Reallycare About Their Work They’re The Ones That Can Move To Another Company Forbenefitsand They Will

The goal is to attract and keep the best employees. We all know they’re hardto find.

Employer health benefits are essential to this end.

Bad healthcare can affect moral, productivity, and business success

If your employee can’t get physical therapy after a accident or needed medsto prevent a large health issue in the future, that’s going to affect your dayto day business.

Almost every employer has a story.

We won’t spend to much time on this but you can see the core reasons thatemployer offer group health insurance even when they are not required to.

Let’s look at what the law says about employers with 50+ full time employeeequivalents

Health And Worker Productivity

The existing studies found little evidence that workers with health coverage are absent less often than are workers without coverage. For example, the Rand Health Insurance Experiment found that the effect of insurance coverage on work loss days was small and insignificant . Similarly, despite years of research outside mainstream economics , there is almost no direct evidence regarding the effect of health insurance coverage on morale and worker productivity and the firm’s performance. In those fields, although the link between employment practices and productivity is widely recognized, the linkages between productive behavior and psychosocial job structure have remained unclear in the eyes of many observers . However, there is compelling research demonstrating that health insurance has a powerful influence on access to health care, the timeliness of care, the amount and quality of care received, and fundamental health . People without health insurance are less likely to seek medical care, less likely to get it, and, as a result, more likely to be in worse health and have higher death rates than are people with insurance coverage . Uninsured persons have a much greater risk of health decline and death, with several studies showing them to be 1.2 to 1.5 times more likely to die than are insured persons .

Also Check: How Can A College Student Get Health Insurance

Requirement For Individuals To Have Health Insurance

Starting in January 2014, most individuals must have health insurance that is considered “minimum essential coverage” or qualify for an exemption. Otherwise, the individual will owe a tax penalty during the following year.

Any job-based plan as well as plans purchased in the Health Insurance Marketplaces, Medicare, Medicaid, state Children’s Health Insurance Programs , most TRICARE plans and the Veterans health care program, and certain other coverage meet this requirement.

If health insurance is not considered affordable for an individual, that person will qualify for an exemption from the tax penalty. Individuals who are uninsured for less than three consecutive months of the year also will qualify for an exemption from the tax penalty. Other exemptions exist.

Learn more about the individual requirement at www.healthcare.gov.

Private Individual & Family Coverage

Private individual insurance is coverage you select and pay for yourself. You can enroll in an individual insurance plan during the annual open enrollment period. This allows you to select a health insurance plan that suits your needs. If your employer does not provide affordable minimum health coverage you may be eligible for premium subsidies.

Read Also: How To Apply For Low Cost Health Insurance

Health Insurance From An Employer

In the U.S., a majority of people under the age of 65 have health insurance coverage through an employer-sponsored health plan either from their own job or through a family member, such as a spouse or parent. However, not all employers offer health insurance to their employees. With most job-based health insurance plans, the employer pays a portion of the premiums, and an employee’s contribution is paid on a pre-tax basis.

If You Have Fewer Than 50 Full Time Equivalents As An Employer You Do Notneed To Offer Group Health Insurance

Before you breath a sign of relief, let’s at some reasons why you may WANT tooffer health insurance to employees if under 50.

The vast majority of companies that offer group health benefits do so notbecause they have to.

They see the benefit in doing so and there are tricks to keep the costs down.

Before we get into the requirements for 50+ employee companies, let’s look atthe key reasons most companies offer coverage.

It’s tax deductible!

This is a huge advantage to group health coverage. The employer can write offthe premiums paid.

With a POP 125, employees can pay with pre-tax money for their share and theemployer can save on payroll tax.

You can generally cannot deduct employer contribution towards an employee’sindividual health plans.

In fact, there can be huge penalties from the IRS for doing so.

$100/day/employee up to $36,500 per year.

It’s definitely a message from the IRS that they mean business.

You May Like: What’s The Penalty For Not Having Health Insurance In California

Update: The New Qsehra May Allowemployers To Pay Up To $5k Annually Towards Employee’s Individual/family Plans Ask Us How It Works

Many California employers still contribute to employee’s individual planswithout the QSEHRA andthey’re running a risk by doing so.

It’s highly valued by employees

Even if a company is only paying 50% toward the Bronze level plan, theemployee feel taken care of.

The cost to vet, hire, and train employees is a significant cost.

More sothan the health insurance premium paid.

And here’s what I heard from one of our clients about offering insurance:

Health Insurance Options For Small Businesses

Several health insurance options are available for small/medium businesses . Which option you choose will depend on your budget, the impact you want to have on your employees and your location. Each option ranges in cost and benefits, which makes some more cost-effective than the others. However, each offers its own strengths and can provide employees with the health care they need.

The following are a few options of health insurance for SMBs:

Choosing whether or not to provide health insurance can be a difficult task, but its important to consider what type of business you are and what you think will benefit both you and your employees in the long run.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Also Check: Is Eye Surgery Covered By Health Insurance

New Requirement For Large Employers

As a result of the ACA, in 2016, large employers will have to pay a penalty if they do not offer health coverage or offer coverage to fewer than 95% of their full-time employees and their dependent children, and have at least one full-time employee receive a tax credit to purchase coverage in the Health Insurance Marketplace.

In addition, if a large employer does not offer coverage to full-time employees that is considered to be adequate and affordable, and at least one full-time employee receives a tax credit to purchase coverage in the Health Insurance Marketplace, the employer must pay a penalty. Only employees who don’t have an offer of coverage considered to be adequate and affordable, and who meet certain income requirements, will be eligible for financial help to buy a plan in the Health Insurance Marketplace.

Learn more about large employer requirements at www.healthcare.gov.

Contact An Experienced Employment Law Attorney Today

If you believe that your employer has failed to provide required health coverage due to discrimination, your employment classification, or because an employment contract guaranteed you this right, an experienced employment law attorney can help. Legal issues surrounding employee benefits constitute an extremely complex, and constantly evolving area of law, and it is in your best interest to obtain legal counsel if you believe your rights have been violated in any way.

You May Like: Where To Go To Apply For Health Insurance

Medical Loss Ratio Rebates

Insurance companies must generally spend at least 80% of premium dollars on medical care. Insurance companies that don’t meet this requirement must provide rebates to policyholders usually an employer who provides a group health plan. Employers who get these premium rebates must allocate the rebate properly. Learn more about federal tax treatment of Medical Loss Ratio rebates from the IRS.

Should Employers Be Required By Law To Offer Health Insurance To Employees

1. Should employers be required by law to offer health insurance to employees? Should employees be required by law to participate in employers health insurance? Why or why not?

2. Should everyone be required to have health insurance, much as drivers are required to have auto insurance? Why or why not?

3. Our system of health insurance is linked to employment. Coverage is usually provided by the employer, with some contribution from the employee. We now have many people working part-time, or freelance, or working through other non-traditional arrangements. Should health insurance continue to be linked to employers ? Why or why not?

4. In our current system, insurance plans ultimately decide whether or not a health service is necessary as they are the ones who pay for it. Should they decide when a healthcare service is medically necessary? Why or why not?

RECENT ASSIGMENTS

Also Check: Are Abortions Covered By Health Insurance

Exceptions To The Rule

As with most things in life, there are some exceptions to the no legal obligation rule when it comes to employer-sponsored health insurance. Here are a few examples:

- If your employment contract specifically gave you the right to health insurance, your employer must uphold this promise.

- Union employees, who are guaranteed health care in a collective bargaining agreement, must receive these benefits.

- When all other employees in your employment classification are offered health insurance, you must receive the same offer.

- If health insurance is being offered on a discriminatory basis , you may have a workplace discrimination claim based on protections within Title VII of the Civil Rights Act.

Generally speaking, the ACA holds that if an employer offers health insurance to employees, it must offer coverage to all eligible employees as soon as they become eligible. Employers who choose to go this route are subjected to a 90-day maximum waiting period, after which insurance must be provided to all eligible employees.

In Addition To Health Insurance What Other Types Of Coverage/benefits Can I Offer My Employees

There is a plethora of additional benefits available for small groups such as: dental insurance, long-term care insurance, short-term disability, long-term disability, life insurance, flexible spending arrangements , health savings accounts , health reimbursement accounts , vision insurance, etc. The number and type of benefits offered is up to the small business owner.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Organizational Performance And Profitability

Perhaps the most important impact of health insurance is its effect on firms productivity and profitability, although these effects were not directly tested. Similarly, no studies compared the quality or ability of workers employed by firms providing health insurance with workers at firms that did not offer insurance. However, the evidence that firms offering health insurance paid their workers higher wages than did those not offering health benefits suggests that insured workers may be more productive than uninsured workers. A complementary explanation is that workers with health insurance also received a wage premium, or an efficiency wage.

Some analysts make a similar argument with regard to pensions and productivity: The strength and durability of the wage/pension relationship across different data sets and empirical procedures support the view that pensions enhance productivity . More remains to be learned about how health insurance fits into a compensation structure that enhances work effort. However, the fact that firms making a wide range of investments in workers typically start with health insurance suggests that health coverage comes to mind first when employers consider making human capital investments in their workforce.