Best Overall: Blue Cross Blue Shield

Blue Cross Blue Shield Association

Why We Chose It: For students looking for expansive countrywide and international coverage, range of coverage options, and low-cost premiums, Blue Cross Blue Shield was an easy pick for our best overall category.

-

Teams with various states and schools to offer plans for students

-

Expansive network providers

-

Available in all 50 states and internationally

-

Range of extra benefits

-

Some plans dont include prescription drug coverage

-

Finding information on the many BCBS websites can be difficult

About 115 million people countrywide rely on The Blue Cross Blue Shield Association for healthcare coverage. Thanks to its student-specific plans, low-cost insurance options, range of benefits, and reward system, BCBSA was an obvious choice for our best overall pick.

The BCBSA comprises 35 independent entities, most of which have an AM Best financial strength rating of A . Youll be directed to your local provider when you input your ZIP code to the BCBSA website. Depending on your location, you can choose from tiers of coverage from catastrophic through to fully comprehensive platinum. You can also customize plans with dental and vision insurance.

Catastrophic coverage has lower monthly premiums but higher deductibles and out-of-pocket maximum. The coverage doesnt max out. People of any age can join the bronze through platinum plans, but you must be under 30 to enroll in a catastrophic policy.

Keep Your Insurance Card On You

It seems obvious, but keeping your insurance card in your wallet, purse, phone case, or backpack makes sense. If youre in an accident or are unconscious, first responders or others can see that you have coverage. Some healthcare providers may offer a digital card, which you can store in your mobile phones wallet. Its also a good idea to have a photo of your card, which you can store on your phone and/or your computer.

Step 6

Best For International Students: Tokio Marine Hcc Medical Insurance Services

Tokio Marine HCC Medical Insurance Services

Why We Chose It: Tokio Marine HCC Medical Insurance Services took our top spot for international student insurance thanks to their multiple low-cost plan options with high maximum limits and low deductibles.

-

Policies meet the J-1 visa requirements

-

Get a quote and buy online

-

Emergency dental care included up to $250 per tooth and $500 maximum

-

Includes prescription drug coverage

-

Coverage for leisure activities and sports

-

Nationwide coverage

-

Variable waiting period or no coverage for pre-existing conditions

Adequate health insurance is crucial to students from other countries studying in the United States. Students may find its a requirement of their visa or the school, but even if it isnt, its a wise precaution against the prohibitive bills resulting from an accident or illness.

Tokio Marine provides low-cost, high-benefit plans for visiting students across the United States, which is why they are our best option for international students. With Tokio Marine, you can add accidental death and crisis response riders to your coverage, and personal liability coverage is included with certain policies.

Based in Houston, the Tokio Marine HCC offers health and life insurance in over 180 countries and has an A+ financial rating from A.M. Best.

Don’t Miss: Does Kroger Give Employee Discounts

Health Insurance Marketplace Plans

Cheap health insurance can be purchased through the Affordable Care Act health insurance exchange in your state if you are not eligible for Medicaid coverage. On the state exchanges, there are typically five different plan tiers that are offered: Catastrophic, Bronze, Silver, Gold and Platinum. The best plan tier will depend on your income and how healthy you are.

If you are a single young adult and are looking for an individual plan, then the best health insurance could be a lower-tier plan like Catastrophic or Bronze. These policies can work well for most young adults or young couples who have not started a family and only need basic health insurance coverage. Both of these health policies have cheap premiums but also a high deductible, which makes them ideal if you expect low to zero medical costs. Additionally, Catastrophic health plans are only available if you are under 30 years old.

Silver health insurance policies have modest premiums and deductibles, and they would be better suited for young couples who may have just started a family. The lower deductibles would allow you to get access to coinsurance and copays more quickly, as you may be facing additional medical expenses due to a newborn or having a dependent. If you can afford higher premiums, a Gold or Platinum policy could be a good choice, as these policies have the lowest deductibles.

What Does The Student Health Insurance Plan Cover

The Student Health Insurance Plan is comprehensive and covers most medical and mental health services, x-rays, labs, procedures and prevention services. The plan benefits include only a $10 co-payment for generic prescription drugs, and covers mental health, dental and vision care. For more information got to

You May Like: How Long After Quitting Job Health Insurance

Buy Student Health Insurance Online

One of the easiest ways to buy student health insurance is online. There are several websites that allow you to compare different plans and choose the one that best meets your needs. When you buy health insurance online, you can usually get a discount on your premium.

Additionally, you may be able to find a plan that has a lower deductible or copayment. You can also usually enroll in a plan and start coverage immediately. When you buy student health insurance online, be sure to compare several different plans before deciding.

Health Insurance Covers 100% Of My Medical Bills

Having health insurance doesnt mean that all of your medical bills are covered. Youre likely to pay a portion of each visit or procedure you receive.

ACA-approved plans available in the state or federal marketplaces cover essential health benefits, which include outpatient care, lab tests, prescriptions, wellness services and preventative care, emergency room visits, hospitalization, pre-natal and baby care, mental health and substance abuse treatment, medical devices for disabilities or chronic conditions, and dental and vision care for kids.

What health insurance usually doesnt cover at all includes elective surgeries, cosmetic procedures, and experimental treatments. Check with your insurance provider regarding costs and your obligations before receiving treatment.

Misconception

Don’t Miss: Health Insurance Starbucks

The Best Health Insurance For College Students 2021

Most colleges and universities require students to have active health coverage during each semester they attend school. Many schools will automatically enroll you in their health plans, but you may be able to opt out if you would like to seek coverage elsewhere, such as through a parentâs plan or marketplace plan.

If you are looking for health coverage, Mira is a great option. For only $45 a month, Mira members get access to low-cost care at any time and facility near you. Mira works as a stand-alone solution or as a supplement to catastrophic coverage to help pay for your weekly health needs.

Do The Student Insurance Plans Above Cover The Requirements Of The F1 And J1 Visa

Yes, all the plans above meet the visa requirements for the J1 visa.

But F1 visas do not always require you to show proof of health insurance. Check with your school or university in the US to find out if you need insurance or not and what kind they accept.

Either way, its recommended that you have at least a travel insurance to avoid being completely without medical coverage.

Recommended Reading: Kroger Employee Discount Card

International Health Insurance For International Students

Do international students need health insurance? Do f1 students need health insurance?

Without doubt, all students should have health insurance while they are in the US. The US health care costs are the highest in the world and a minor injury or accident could set you back tens of thousands of dollars. Being healthy and taking care of yourself is, of course, highly recommended, but accidents happen to us all and when we least expect. Students should have proper insurance before anything emergency situation arises so that you do not find yourself in serious debt.

Can international students get health insurance?

Yes, International students can definitely get student medical insurance, we offer many student insurance options on American Visitor Insurance. Quite often, the universities themselves offer student insurance, however this can be expensive. At student insurance plans that we offer are considerably more affordable than the University insurance plans, while providing similar coverage benefits. However, students should confirm if the University allows students to but insurance outside the University, and if they can get the required insurance waiver for this student insurance.

Can international students get medicare?

No. International students are not eligible for Medicare. Medicare is a US government program only available to US citizens or US permanent residents who have paid into the US system.

What is international student health insurance?

What Are The Drawbacks Of Student Health Insurance

There are a few drawbacks to student health insurance. One drawback is that it can be expensive.

Another drawback is that it may not cover everything you need. For example, some plans may not cover dental or vision care.

Finally, if you already have health insurance through your parents, you may not need to buy a separate policy.

Also Check: Is Umr Good Insurance

What Is The Cheapest Health Insurance For College Students

Getting health insurance is always expensive. So even if you do not meet the necessary amount of money needed to secure insurance for your health, then the nearest alternative is to opt-in for low-cost insurance.

But if you have tried but still cant afford to secure a health insurance plan because of lack of capital, then apply for Medicaid. Medicaid gets you all health coverage at a very low price.

Can College Students Qualify For Medicaid

Yes, students from low-income families can consider this option. You can find out if you are qualified for Medicaid or Childrens Health Insurance Program when you apply for coverage through the Marketplace. Some factors that determine your ability to qualify for Medicaid will depend on whether youre a dependent , live with your parents, and your income. Signing up for this plan is easy, simply log into your state marketplace website or the federal government site

Also Check: How Much Does Starbucks Health Insurance Cost

What Are The Most Important Things That Students Should Keep In Mind When Getting Insurance

They should keep in mind that they are required to have coverage, have many options for obtaining coverage, and should use any the free services offered to them.

If buying a plan, think about your monthly premium and your out-of-pocket expenses. Your premium is the amount you pay for insurance every month and your out-of-pocket is the amount you have to pay when you go to see your doctor, caregiver, or go to the hospital. Often the higher the premium, the lower the out-of-pocket costs you have and vice versa. Think about how often you use care or the cost of prescription drugs you will be taking and pick a plan that covers your needs.

When using care, check if the provider you are seeing accepts your insurance. There is a price difference between in-network and out-of -network health care providers. If the doctor, hospital, or health care facility you visit is part of your insurance companys network, you will get your health care at lower prices.

The Cheapest Policy Is The Best Policy

The cheapest health insurance plan is not always the best policy.

For example, a high-deductible plan with a low monthly premium might cost you when you need care the most. With just one medical incident, your out-of-pocket deductible costs could exceed the price of a plan with a higher premium and a lower deductible. Copays for low-cost plans can be higher at the time of service, and many bargain plans dont cover prescription drugs.

Look closely at the total costs youre likely to pay based on how many times you think youll need medical care over the year. A bargain isnt a bargain if the numbers dont add up.

Misconception

Don’t Miss: Insurance Lapse Between Jobs

What Are The Benefits Of Health Insurance For College Students

Many benefits come with having health insurance as a college student.

One of the most significant benefits is having access to preventive care. This means that you can get routine check-ups and screenings, which can help you catch any problems early on.

Additionally, having health insurance can help you save money on your medical bills. If you need to see a doctor or go to the hospital, your insurance will help cover the cost of your care.

Finally, having health insurance can give you peace of mind. Knowing that you have coverage can help you relax and focus on your studies, knowing that you are covered in case of an emergency.

Related Reading: International Student Health Insurance

Student Health Plans And Parent Health Plans

For a Covered California health plan, as long as students are a tax dependent of their parent or under the age of 26, their eligibility for student health coverage does not make them ineligible to be covered on their parents family health plan.

When making this decision, students should consider their parents insurance coverage network. If students attend a school that is far away from their parents home, their parents health insurance may not cover medical services provided to them while they are away at school. Students should speak with their parents health insurance plan for more information. If the student is going to school outside the state of California, only emergency services may be covered by a Covered California health insurance plan. Non-emergency services received outside the state of California will not be covered.

If students are claimed as a dependent on their parents taxes and choose to opt out of their student health coverage, their parents Covered California family plan would still be eligible for tax credits. Additionally, if students choose to stay or accept their student health plan, their parents would still be eligible for tax credits through Covered California, if otherwise eligible. However, parents must correctly state on their application that although their child is a tax dependent, they are not seeking health coverage through their Covered California health plan.

arrow_back

You May Like: Evolve Health Products

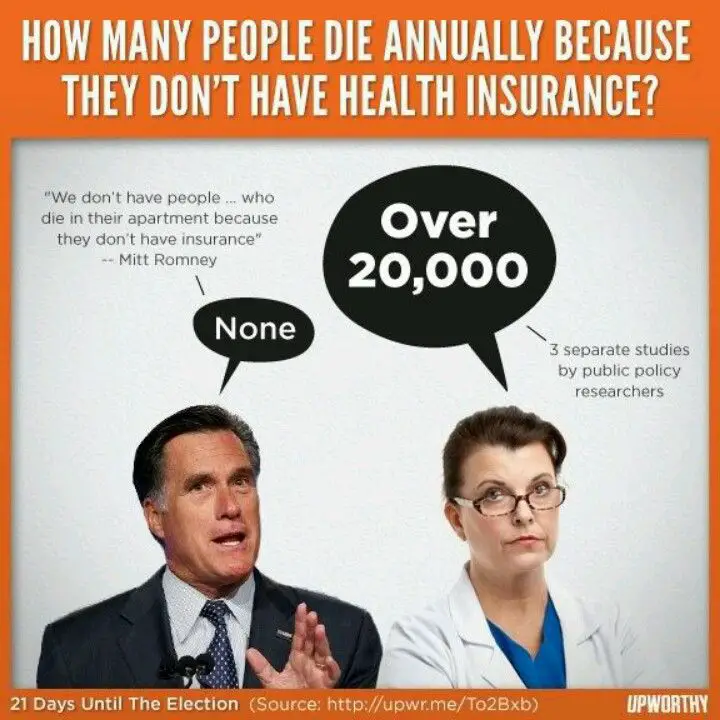

Im Young And Healthy So Health Insurance Isnt Necessary

Many young peoplecollege students includedthink that theyre invincible. And while your body may be resilient when it comes to minor scrapes and bruises or colds and flu, you cant fix something like a broken bone, a disease, or a chronic condition with just R& R.

The average doctor visit costs about $171 without insurance, and treatment for even simple issues can run into the hundreds or thousands of dollars. A major accident could be a financial and medical setback with years-long implications. Thats why everyone should be covered, no matter their agebecause taking the risk just isnt worth it.

Misconception

Is Health Insurance Required When Going To College

Many private colleges and even public universities require students to have health insurance. Colleges usually encourage students to purchase their sponsored health insurance, and many will automatically enroll incoming students unless they opt out.

If you cannot enroll on a parentsâ plan, school health insurance plans can be cheaper than purchasing an individual plan through the healthcare marketplace and may include more coverage. However, many of these plans might have more care than you need, so you may be able to save money elsewhere.

Recommended Reading: Kroger Part Time Health Insurance

Will You Attend School In State Or Out Of State

If you live in North Carolina, you shouldnt have a problem finding a doctor who accepts your existing insurance plan. But if you come from out of state, its important to find out if there are providers near your school that accept your current health insurance. If you see a healthcare provider or go to a hospital that doesnt accept your health insurance, you might get stuck owing the whole bill even though you have coverage.

Going Out of State for School?

If you attend college out of state, find out if doctors near your school that accept your current health insurance

Essential Steps Young Adults Should Take To Manage Their Health

|

Insurance Basics & Your Health

|

As fall approaches, millions of college students are heading off to school. Theyre pondering if theyll get along with new roommates, thinking about finding classes, and wondering how far their dorm room is from the cafeteria. Not on their minds? Health insurance, or where to go for health care.

We put together a quick three-step guide to cover the basics, so you can focus on the more pressing matters of the new school year . You will need to:

Recommended Reading: How To Keep Health Insurance Between Jobs

Cheapest Health Insurance For International Students In Usa

In the United States, there is very limited government-funded healthcare, most of which is not accessible to international students or better put, none of which is accessible to international students and this is why you should take a look at the cheapest health insurance for international students in usa.

With a health insurance you would be sure to get a medical attention whenever needed in the US and to be honest with you, life would be very hard for you as an international student without a health insurance.

Many international students have several student insurance plans to help them cope with issues and this is a very good idea if I am to say. You can think that too.

If you are an international student studying in the United States, you may be required to have health insurance coverage for the entire time you are abroad for your own benefit. Some schools make it madatory for international students to present their medical insurance prove before they are being enrolled.

You May Like: How To Understand Health Insurance Plans