Minnesota And Wisconsin Residents

| Plans available only if first eligible for Medicare before 20204 | |

|---|---|

| Benefits | |

|

Medicare Part A Coinsurance and Coverage for Hospital Benefits |

check |

|

Skilled Nursing Facility Care Coinsurance |

check |

|

Hospice Care Coinsurance or Copayment |

check |

|

Medicare Part B Coinsurance or Copayment |

check |

|

Medicare Part B Excess Charges |

check |

|

Foreign Travel Emergency |

check |

|

Additional Programs and Savings offered by Cigna6 |

check |

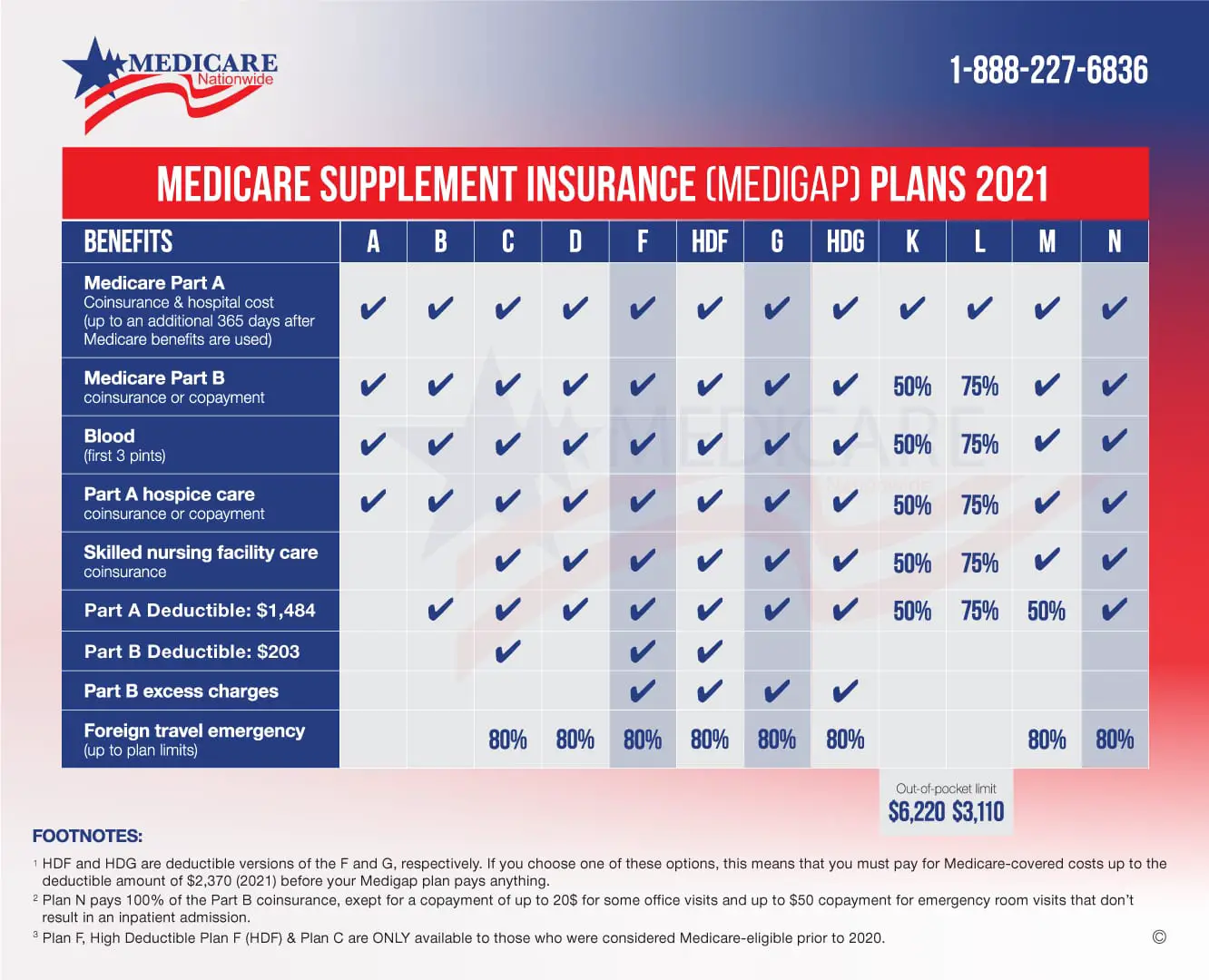

The Type Of Medicare Supplement Insurance Plan Type You Select

The benefit coverage of the Medicare Supplement insurance plan you choose usually also affects the premium you will pay. For example, you might be able to enroll in a high-deductible option for Medicare Supplement insurance Plan F. If so, the premium for the high-deductible plan will typically be lower than the premium for the standard Plan F. However, Beneficiaries who became eligible for Medicare January 1, 2020 or later cant buy Medicare Supplement Plan F or Plan C, since they cover the Part B deductible. However, if you already have Medicare Supplement Plan C or F, you can keep it. Also, you may be able to pay a lower premium from a Medicare SELECT plan because it requires you to use certain providers contracted with the insurance company.

Its important to consider how much coverage you need from a Medicare Supplement insurance plan before you make a selection, because some Medicare Supplement insurance plans tend to have higher premiums than others. You can compare Medicare Supplement insurance plans that are available where you live and their coverage and costs by entering your zip code in the box on this page.

Do I Really Need Supplemental Insurance With Medicare

Lets start our discussion by addressing the elephant in the room. Is a Medicare supplement plan really necessary, and, if so, why?

As you may already be aware, Original Medicare only covers about 80% of your major medical costs. The remaining 20% of all Medicare-approved costs are the beneficiarys responsibility. These costs, which include deductibles, copayments, and coinsurance on the healthcare services you use can be paid in several different ways, including:

These are the most common ways people cover their major medical costs when they have Medicare. If you dont qualify for one of the benefits listed above, then you self-pay out of pocket, or you buy a Medigap plan.

If youre thinking about the self-pay option, think twice. This is a very risky proposition. While you can probably swing the cost of regular doctor visits, the cost of advanced diagnostic or hospitalization due to a critical illness or injury, is enough to send most people to bankruptcy court. Compare how much is Medigap per month vs. self-pay and it wont be difficult to see which costs less.

Think about it. Could you afford to pay 20% of the cost of cancer treatment or a hip replacement? A 2013 cost-effectiveness study reported a total cost of $40,102 for first-line mesothelioma treatment. Thats just the treatment, which does not include your inpatient care. The average cost of a hip replacement in the United States is almost as costly at $32,000.

Don’t Miss: What Is The Average Monthly Cost Of Health Insurance

What About Cancer Chemotherapy How Much Will That Cost You

The cost of cancer chemotherapy is probably one of the most expensive treatments a Medicare recipient could face. This is, in part, because medical oncologists are paid more if they give more expensive chemotherapy agents. Oncologists in the US get an average 6% commission on the price of any medications they administer in their office. This commission creates a major conflict of interest for these doctors that has dramatically increased cancer chemotherapy costs in recent years.

Still, Medicare Part B covers IV therapy, including cancer chemotherapy, when administered either in a nursing home or an infusion center. If you receive chemotherapy during a hospitalization, then the cost of your chemotherapy is covered by your Part A deductible.

How much will the chemotherapy cost you? As with everything else in health care, the cost of cancer chemotherapy varies dramatically depending on the treatment. Most of the basic chemotherapeutic drugs have been around for decades so they arent very expensive. Heres a statement showing Medicares approved fee for a basic chemotherapy infusion:

Figure 4: Chemotherapy bill

This patient received IV carboplatin and gemcitabine and fosaprepitant for nausea. For this, medicare was billed over $7,700. It doesnt show how much Medicare approved for this treatment but, her 20% portion of the approved fee was $269.97. That means that Medicare approved a total of $1350 for this treatment or about 17% of what was billed.

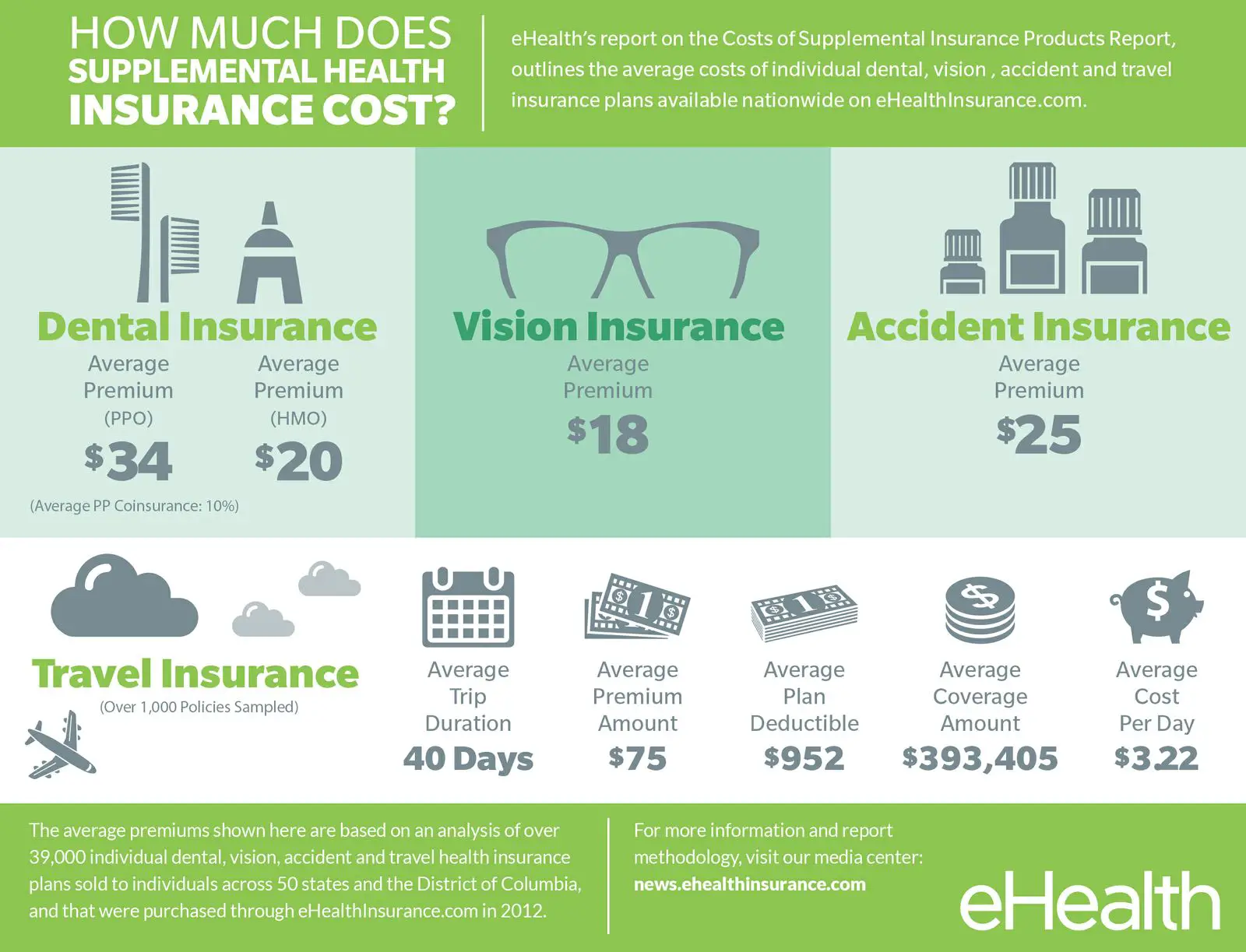

What Is The Average Cost Of Medicare Supplement Insurance

The average premium a Medicare Supplement Insurance plan beneficiary paid in 2018 was $125.93.1 But the average cost of each type of Medigap plan can vary quite a bit from one plan type to another.

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Recommended Reading: What Type Of Health Insurance Do I Need

Best For Comparison Shopping: Aarp

AARP

AARP offers the easiest way to compare prices. Just enter your ZIP code and youll be redirected to a page where you can view all the plans available to you. Whether it’s Medicare Advantage or Supplemental Medicare Plans like Plan G or Part D, you can view offerings without having to re-enter your information every time. However, to view the list of available Supplemental Plans, you will need to enter additional data like your date of birth, effective dates of Medicare Plans A and B, and the date you want your Supplemental Medicare Plan to start.

-

Information collected in one place, without being overwhelming

-

Easy-to-navigate website

-

Offers rates for various locations

-

Difficult to get customer service on the phone

-

No added benefits

AARP breaks down each different area of Medicare, allowing you to select precisely the coverage you want. AARP is not itself an insurance company, but it is a great resource and offers its plans through insurance giant UnitedHealthcare.

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

You May Like: How Much Is Private Health Insurance In Spain

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2021 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Most enrollees in individual Medicare Advantage plans are in plans that provide access to eye exams and/or glasses , hearing exams/and or aids , telehealth services , dental care , and a fitness benefit . Similarly, most enrollees in SNPs are in plans that provide access to these benefits. This analysis excludes employer-group health plans because employer plans do not submit bids, and data on supplemental benefits may not be reflective of what employer plans actually offer.

Do You Really Need Medicare Supplemental Insurance

Dont just focus on the premium cost of a Supplemental Medicare plan. The least expensive plan may not offer all of the gap coverage you expect. Before deciding on a plan simply because of the average cost of supplemental Medicare insurance, make sure you are comparing the benefits each plan offers, too.

Don’t Miss: What Is Temporary Health Insurance

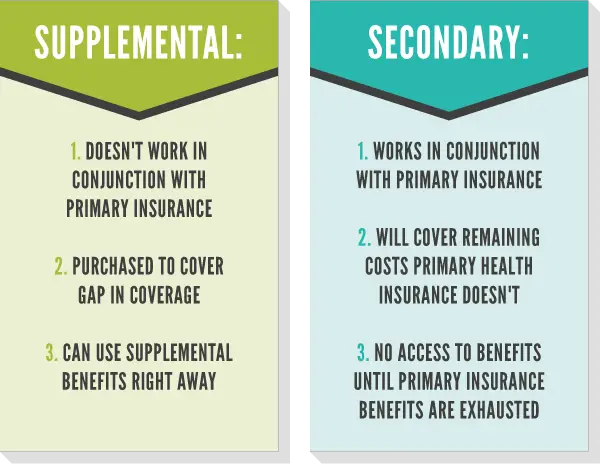

How Do Medicare Supplement Insurance Plans Work With Original Medicare

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as “Medigap”, are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A .

Medicare Advantage In : Premiums Cost Sharing Out

Medicare beneficiaries have the option of receiving their Part A and Part B Medicare benefits through a private Medicare Advantage plan. Since 2011, the federal government has required Medicare Advantage plans to cap out-of-pocket spending, and these plans may provide additional benefits or reduced cost sharing compared to traditional Medicare. They are also permitted to limit provider networks, may require prior authorization for certain services, and sometimes carry an additional premium on top of the monthly Part B premium all Medicare beneficiaries pay. This brief provides current information about Medicare Advantage premiums, cost sharing, out-of-pocket limits, and supplemental benefits, as well as trends over time. Two companion analyses examine trends in Medicare Advantage enrollment and Medicare Advantage plans star ratings and federal spending under the quality bonus program.

You May Like: Can I Buy Health Insurance After An Accident

How Much Does Medigap Insurance Cost On Average

The average cost of Medigap insurance is very hard to pin down because there are so many variables. For starters, there are 11 different Medigap plans to choose from, each with different levels of coverage, and of course, different costs.

Secondly, there are individual factors that will ultimately affect how much you pay for your plan, which include:

Letâs take a look at how these variables will affect the average cost of a Medicare Supplement, and weâll go through some sample quotes to give you a feel for the price of Medicare Supplement insurance.

What Is A Medicare Supplement Deductible

You may know the word deductible from other types of insurance you already have, such as auto insurance. A deductible is an amount you pay before your insurance plan begins to pay. Some Medicare Supplement plans pay the Medicare Part A hospital deductible, but make you pay the Medicare Part B medical deductible. Some plans cover neither the Part A nor the Part B deductible and you will be responsible for those costs out of pocket.

Medicare Supplement high deductible plan F* may charge a lower monthly premium than other plans. However, this low premium may be attached to a high deductible, meaning you must pay a significant amount out of pocket before your Medicare Supplement plan pays anything.

Read Also: Will Health Insurance Cover A Breast Reduction

How Much Does Supplemental Insurance For Medicare Cost On Average

Medicare is the federal health insurance program that covers some medical expenses for people age 65 or older and younger people with disabilities. Yet, the program doesnt cover all medical costs of most long-term care.

Medicare has four main federal components that offer healthcare benefits to retired people or people with disabilities, including Part A, B, C, and D. Whats more, the program also has the Medicare Supplement option, which is private insurance, meant to help with covering out-of-pocket costs such as copays, coinsurance, and deductibles.

Now, if youre enrolled in Medicare, or youve just found out that youll soon be eligible for the program, you may be considering buying a Medicare Supplement Insurance plan as well to help cover your major healthcare costs alongside your Part A and B coverage.

Naturally, you want to find out more about Medicare Supplement insurance and how much you should expect to pay for it. Keep reading below to find out more!

What Determines The Medicare Supplement Plan Premium

Factors that can influence the Medicare Supplement plan price are:

- Which plan you want: there are up to ten Medicare Supplement plans available labeled A, B, C, D, F, G, K, L, M and N. Medicare Supplement plan A doesnt cover everything that Medicare Supplement plan F covers, for example. Plans with more coverage may cost more.

- Which insurance company offers the plan

- The geographic area the plan covers

- How the plan is rated which is how they factor your age into your cost. Some plans charge the same monthly premium to everyone, regardless of age. Some plans charge according to the age you are when you buy the plan, and some plans charge according to your current age so your premium may increase yearly.

You May Like: How To Sign Up For Aarp Health Insurance

Whats The Average Cost Of Supplemental Insurance For Medicare

The benefits of a Medicare Supplement plan will be the same across carriers. However, the premiums will vary by the beneficiary.

Were here to help you understand why this is, and pinpoint the average cost of some of the most popular Medigap plans. Three of the significant factors that impact your Medigap rates are your location, age, and gender.

To help you understand how the cost of the same plan varies per individual, well include examples of rate quotes from three ZIP Codes, for people of different ages and both gender options. Please note that all of our examples are for non-tobacco users. If you use tobacco, you can expect to see premiums that are 10% higher.

Medicare Part A: How Much Will A Hospitalization Cost You

Lets say youre hospitalized and all you have is Medicare Part A. How much do you owe the hospital?

If the hospitalization lasts 60 days or less, the answer is $1,484 nothing more. This is an important point: For any hospitalization lasting 60 days or less, you will only owe the hospital $1,484 even if your hospital bill exceeds one million dollars! The doctor who see you in the hospital will bill you separately, but those bills are covered by your Part B benefits .

As an example, below you can see a copy of a bill that a patient of mine gave me a few years ago. This bill is for someone who was hospitalized for about four weeks. As you can see, the total amount billed was over $700 thousand and, yet, the patient still only has to pay $1,260 which was the Medicare Part A deductible in 2015.

Figure 1: Hospital Bill

Should you expect to ever be hospitalized for more than 60 days? No!

The average hospital stay in the US is 5-6 days and that number has been going down each year for more than a decade. Even people who need major surgery like a liver transplant or open heart surgery are usually home in about 7 days. I cant say that 60-day hospitalizations never occur in the U.S., but theyre about as rare as jackpot lottery winners.

Recommended Reading: Can I Have Dental Insurance Without Health Insurance

What Is Supplemental Health Care And What Does It Mean To Me

Supplemental health insurance can come in handy if you’re short of cash and facing mounting health care bills. That’s the case even if you have health insurance, like Medicare.

A Harvard University study noted that excessive health care expenses comprised 62% of all U.S. personal bankruptcies. What’s worse, 72% of Americans who declared bankruptcy over severe health care costs had health insurance when they fell into financial decline.

Consequently, if you’re concerned you don’t have enough cash and coverage for high-volume medical care costs, adding supplemental insurance to your health care payment arsenal may just be a game-changer for you.

Manulife Health Insurance Plans

We are also pleased to offer insurance options from Manulife in British Columbia, including the Flexcare®, FollowMe and Association programs. With this suite of products, you can select options to add to your insurance plan to ensure youre getting exactly the coverage you want for your specific needs. Added features include

Read Also: How To Stop Health Insurance

A Great Idea For Some But Not For Others

Supplemental insurance is extra or additional insurance that you can purchase to help you pay for services and out-of-pocket expenses that your regular insurance doesn’t cover.

Some supplemental insurance plans will pay for the out-of-pocket cost-sharing that goes along with your health insurance plan , or for medical services that your health plan doesn’t cover at all, such as dental and vision costs.

Other supplemental plans may provide you with a cash benefit paid out over a period of time or given to you in one lump sum. The cash can be used for:

- Covering lost wages

- Transportation related to your health condition

- Food, medication, and other unexpected expenses you have due to an illness or injury

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

Read Also: How Do I Know If I Have Private Health Insurance