Medicare Advantage Plan Benefits

Private insurance companies have a bit more flexibility in designing Medicare Advantage plans, so youll find more differences between plans. This means you need to be more careful comparing plan options to make sure you dont overlook anything.

As mentioned, Medicare Advantage plans give you the opportunity to get coverage for benefits beyond Original Medicare. This may include routine vision and dental, hearing, and health wellness programs. Normally, under Original Medicare, youd pay for these services out of pocket unless you have other insurance.

Another benefit of Medicare Part C is that many of these plans also include Medicare Part D prescription drug coverage as part of the plan coverage. Also known as Medicare Advantage Prescription Drug plans, these plans give you the convenience of having all of your Medicare benefits administered through a single plan.

If you enroll in a Medicare Advantage Prescription Drug plan, you will not need to enroll in an additional Medicare Prescription Drug Plan. In fact, if you are enrolled in a Medicare Advantage plan that includes prescription coverage and also enroll in a stand-alone Medicare Prescription Drug Plan, you could be automatically disenrolled from your Medicare Advantage plan.

What Is Our Methodology

We selected the health insurance companies with the highest market share and reviewed them by financial strength, customer satisfaction, and other factors, such as what makes these plans so popular.

We also offer information on the companies, including financials, customer satisfaction, complaints, geographic reach, and pricing.

Best For Medicare Pa Dual Eligible Subscribers: Allwell

Allwell offers a Special Needs Plan for those enrolled in Medicare and Medicaid. It includes prescription coverage and care coordination. You dont pay a copay to see your primary doctor or specialists.

Allwells Dual Medicare plan also includes comprehensive dental coverage, eyewear for coverage and hearing aids. It also provides and over-the-counter benefit and transportation to medical appointments.

Recommended Reading: Where To Go To Apply For Health Insurance

What Determines The Monthly Premium On A Medicare Supplement Plan

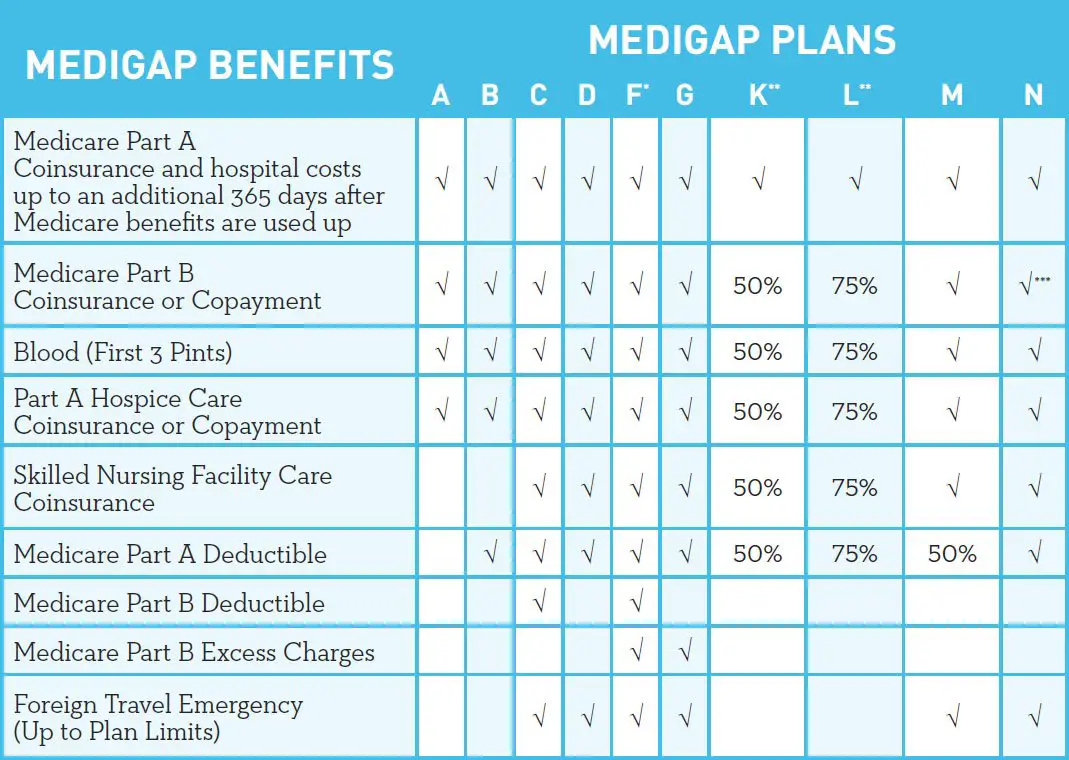

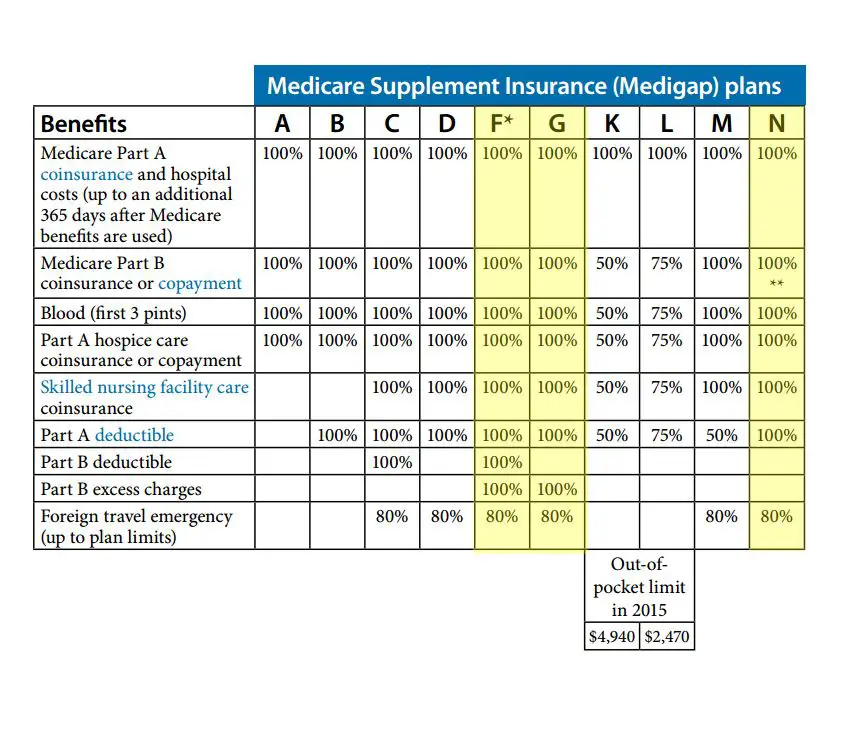

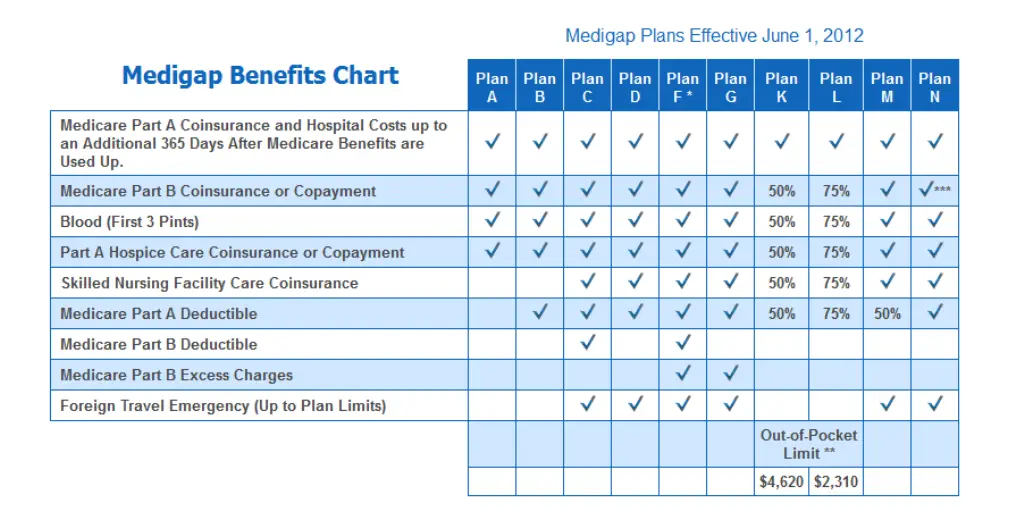

In most states, there are ten standardized Medicare Supplement plans. Each plan is identified by the letters A, B, C, D, F, G, K, L, M, and N.

Medicare Supplement plans A and B, as an example, do not cover everything that plans F and G cover. However, all policies with the same letter offer the exact same benefits, no matter which insurance company you buy from. This makes plans easier to choose. Simply look at the comparison chart, find the plan with the coverage you want, then go price shopping.

Here are the most common factors that affect premiums:

- Plans with more coverage most often cost more.

- The insurance company .

- Where you live

- How the plan is rated

Tip: Some companies charge the same monthly premium to everyone, regardless of age. Some companies charge according to your age when you buy the plan, and some companies charge according to your current age so your premium may increase yearly. Your insurance agent can help you make the right choice.

Selecting A Medicare Supplement Insurance Company That Works For You

After youve researched and compared companies, you will select a supplemental insurance company that works best for you. You will want to consider things like the reputation and reviews of the insurance company as well as how easy it is to navigate their website and apply for coverage. Additional factors to consider include types of plans available, pricing, and deductibles. You may also want to select a company that has an app so you can manage your policy on the go.

You May Like: How Much Health Insurance Do You Need

How Does Medigap Serve Or Help Me

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs.

Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs. You decide how much you want to be covered and what premium you want to pay.

Gerber Life Medicare Supplements

Best known for its line of baby food, the Gerber name in the insurance business surprises many people. But, the fact is, Gerber Life is a major player in both life insurance and Medicare supplements.

Gerber Life is a financially stable insurance carrier and offers a variety of insurance products, including a good line of Medigap plans. Its their diversity of insurance products that makes us pro Gerber.

Founded in 1967, Gerber Life Insurance Company is now owned by the Nestle Company, it has a solid A rating from A.M. Best, which is considered excellent.

Don’t Miss: How Much Is Health Insurance Usually

What Is Medicare Part C

Medicare Part C, also known as Medicare Advantage, is not Medigap insurance, nor is it the same as Original Medicare. Instead, its a sort of hybrid of Medicare Part A and Part B and supplemental insurance. If you have Original Medicare from the federal government, you have the option of enrolling in Part C. However, enrolling in Part C takes away the option of enrolling in a supplemental Medigap plan.

Medicare Advantage plans are offered by private insurance companies. They bundle the services of Medicare Part A, Part B and often Part D with other insurance coverage, such as dental insurance and vision insurance. Instead of paying your Medicare Part A and Part B premiums to the federal government and your Medigap premiums to a private insurer, under a Medicare Advantage plan, all your premiums are paid to the private insurer.

The insurance companies that offer Medicare Advantage plans need to be approved by the federal government. Medicare pays the insurance companies a set amount each month for your health care. To continue to offer Medicare Part C plans, the insurance company needs to follow the regulations and rules set forth by Medicare.

The cost of a Medicare Advantage plan depends on a range of factors. Some plans charge a monthly premium, but not all do. Some also have a deductible, but not all. The plan might also charge a copayment or coinsurance each time you see a doctor or receive treatment.

Medicare Plan N Is The Best Medicare Supplement Because

Speaking of being healthy, if youre super healthy and want to save a bunch on your supplemental Medicare insurance premiumsA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. …, be sure to discuss Medicare Plan NMedicare Supplemental Plan N is one of the ten standardized Medigap plans. Although it is one of the newest plans available, Medicare Plan N is quickly becoming a favorite with Baby Boomers aging into their… with your agent. This is not only the newest of the 10 Medigap plans, but its also one of the most innovative and most economical.

With a Medigap Plan N policy, you pay a small copayA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…. when you see your doctor or use the emergency room . And, unlike Plan G, you dont get coverage on Medicare excess chargesA Medicare Part B excess charge is the difference between a health care providers actual charge and Medicares approved amount for payment….. These are costs above what Medicare regularly pays doctors for medical services. In trade for you paying these small costs out-of-pocket you pay much less for your Medicare supplement coverage.

Recommended Reading: Does Short Term Health Insurance Cover Pre Existing Conditions

How Does Medigap Work

In order to buy a Medigap policy, you must sign up for Medicare Part A and B.

Medicare coordinates the billing and claims between Original Medicare and your Medicare Supplement plan.

The provider bills Medicare first, then bills your Medigap plan. Depending on the plan, the provider then bills you for what remains, such as the Part B deductible, and your check goes to the provider.

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

State-by-state differences exist in some guarantees and limitations.

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Also Check: Is It Legal To Marry For Health Insurance

Best User Experience: Humana

-

Some of the deductibles run higher than other plans

-

Lack of detailed educational information about each plan’s coverage

-

Not available in all 50 states

Humana’s website offers easy-to-use, self-explanatory content that makes the process of finding the best Medicare Supplement policy simple and straightforward. Each plans coverage details are clearly displayed by ZIP code, without needing to enter your personal information into the site. You can also request an in-person appointment with a Humana Medicare agent.

You can compare specific plans if you enter your personal data, and Humana also provides a PDF with detailed plan information by state. Deductibles for some Humana plans are a little higher than other carriers. Humana covers every state with the same basic plans, including Parts A, B, C, F, G, K, L, and N. Plan F has an additional high-deductible option.

Humana earns an A- with AM Best for financial health. The MyHumana app is available from both Google Play and Apple’s App Store.

Humana is waiving out-of-pocket costs for in-network primary care, outpatient behavioral health, and telehealth visits effective May 1 through the end of 2020.

Usaa Medicare Supplement Insurance: Our Thoughts

Medigap plans sold by any company must provide a standard set of benefits. USAA offers a solid set of coverage options, including plans F, G and N, which are the most popular Medigap plans sold. In most states where USAA sells Medigap, choices are limited to plans A, F, G and N. Additional options are available in Michigan and Pennsylvania.

Members have not reported any issues that we could find with customer service for their USAA Medigap plans, and USAA has received high marks from the Better Business Bureau and other third-party review entities such as NAIC and AM Best. Customer service is limited to normal business hours Monday through Friday, but members can access a wealth of information on the USAA website or mobile app at any time.

USAA rate information is not available publicly, but Medigap plans are typically affordable compared to other companies. Eligible members can review Medigap prices through an online account or by contacting USAA directly.

Don’t Miss: How To Apply For Health Insurance As A College Student

Find The Best Medicare Supplement Plan For Your Budget

Once youve listed Medicare Supplement Insurance plans that cover your health care needs, a great way to narrow down your options is to choose the best Medicare Supplement Insurance plan for your budget.

Medicare Supplement Insurance plans typically come with a monthly premium. However, insurance companies that sell Medicare Supplement Insurance coverage may price their plans differently.

As youre deciding on the best Medicare Supplement Insurance plan for your financial situation, keep in mind that insurance companies may use three types of premium-pricing methods:

- Issue-age rated: premiums are based on your age when you enroll and dont go up as you get older.

- Community-rated: all plan members pay the same premium, regardless of their age.

- Attained-age rated: premiums are based on your current age, so your premium costs rise as you get older.

Please note that premiums may go up because of inflation, regardless of the pricing method.

Find An Available Medicare Supplement Plan F In Your State

Medicare makes this easy by virtue of its Medigap Find a Plan database. Enter your ZIP code for a list of available plans in your area and select View Policies on the right of the screen for a list of companies offering Plan F or High-Deductible Plan F. To narrow the pricing window, there is an option to enter age, gender, and tobacco use on the Main Search page.

Don’t Miss: What Are Some Good Health Insurance Plans

How Does Medicare Supplement Insurance Work With Medicare

Medicare Supplement Insurance works with Original Medicare Parts A and B. If you choose to buy a standalone Part D Prescription Drug plan, Medicare Supplement works with that, too.

Medicare Supplement Insurance is different from Medicare Advantage. You can have either a Medicare Advantage Plan or a Medicare Supplement Plan, but not both at the same time.

What Is Supplemental Medicare And Supplemental Insurance

When you become eligible for Medicare, you might find the out-of-pocket costs are more than you can comfortably afford based on the medical conditions you have and the treatments you need. Medicare also doesnt cover everything you might need or want coverage for. Supplemental insurance or Medigap coverage can fill in gaps in your coverage or pay for costs Medicare doesnt pay for.

Just as there are multiple types of Medicare available, there are multiple supplemental insurance options out there. Like Original Medicare, Medigap plans are lettered, starting with A and running through N, although certain plans, such E, I and J are no longer available. Changes in the law mean that certain Medigap plans, such as Plan F, will no longer be sold to people as of 2020. Those plans are still available to people who already have them.

Some of the benefits offered by Medigap plans include:

- Coverage of Part A coinsurance and hospital costs for up to an additional 365 days once Medicare Part A benefits are used up.

- Coverage of Part B copayments or coinsurance.

- Coverage of up to 3 pints of blood.

- Coverage of coinsurance for hospice care under Part A.

- Coverage of coinsurance for skilled nursing care under Part A.

- Coverage of Part A deductible.

- Coverage of Part B deductible .

- Coverage of excess charges for Part B.

- Foreign travel insurance coverage.

Also Check: How Much Does It Cost For Health Insurance

Do I Want Help With Part B Costs

Plan G will help pay your Part B excess charge . And while all Medicare Supplement plans offer some coverage for Part B coinsurance and copayments, Plan K only covers 50%, and Plan L covers 75%. Plan N covers these costs 100%, with the exception of a $20 office visit copay or $50 emergency room copay in certain situations.

Usaa Medigap Plan Availability

USAA Medigap policies are sold in most states, but availability may vary. Contact USAA to confirm which plans are offered in your area.

USAA Medigap plans may not be available in the states listed below. If you are seeking Medigap coverage in one of these states, talk to USAA directly or access your online account to review your options.

- Massachusetts

- Wisconsin

Also Check: Who Pays First Auto Insurance Or Health Insurance

How We Chose The Best Medicare Supplement Insurance Companies

The world of insurance is large and there are hundreds of companies across the country offering Medicare Supplement plans. So, to narrow it down and choose the best companies in the industry, we took the following factors into consideration:

Variety of Plans OfferedWhile there are countless companies offering Medicare Supplement Insurance, many only offer a couple of policies out of the 10 available. We focused our search on companies that are able to provide a majority of the available plans. These companies give potential customers the greatest amount of options to select a plan that fits their needs.

Number of States ServedThere are many insurance companies around the country that only offer Medicare Supplement Insurance in a handful of states. While its difficult to find true nationwide coverage, the companies featured on our list are able to serve a majority of the country. However, not all plans will be offered in all places.

Company IntegrityWhen purchasing something as important as health insurance, its vital to select a provider you can trust. Because of this, we focused our search on companies that are widely regarded as trustworthy and have a long history of providing customers with insurance services. To determine this, we looked at factors like awards won, Better Business Bureau ratings, and customer reviews.

Does It Matter Which Insurance Company I Purchase My Medicare Supplement Plan From

While it is true that every insurance company must provide identical coverage under each standardized plan type, the prices each charged for that same coverage can vary. Once you identify the plan type that will work best for your specific needs, it is definitely in your best interests to do a bit of shopping around to find the coverage you want at the best possible price.

Read Also: Do You Have Health Insurance

Choosing Medicare Supplement Insurance

Health care expenses can add up and be a burden, particularly if youre on a fixed retirement income. Health care and out-of-pocket costs for Medicare participants are also on the rise, making the need for supplemental insurance even greater.2

Private insurance companies like Erie Family Life offer supplemental insurance policies1 that work with Medicare Parts A and B, the federal health insurance program for people age 65 and older, people under the age of 65 with certain disabilities and people of any age with End-Stage Renal Disease .

Medicare Part A helps pay for:

- Inpatient hospital care

- Certain home health care services

Medicare Part B helps pay for:

- Physician fees

- Durable medical equipment

- Some preventive services

With Medicare Parts A and B, youre required to pay deductibles and coinsurance for Medicare-provided services. Medicare Supplement plans are designed to help pay for costs like deductibles, copayments and coinsurance that you would typically pay out of your own pocket. The costs and benefits will depend on which Medicare Supplement plan you select.

Here are a few more reasons to enroll in a Medicare Supplement plan:

- It helps pay the portion of approved expenses not covered by Medicare.

- With no network, you can choose any doctor or hospital that accepts Original Medicare.

- Coverage is guaranteed if you enroll in the first six months of Medicare Part B eligibility.3

- Coverage is guaranteed to renew each year .