Health Insurance In The Usa: Whats The Cost

Avin Talabani

Transformation Manager

The cost of health insurance in the USA is a major talking point for Americans and visitors alike here, we explore the averages and factors impacting policy fees. The USAs healthcare system is unlike many others, so we look at why the cost of average American healthcare insurance seems to be rising and how other nations compare.

Key takeaways:

- Age, geography, employer size and plan type all influence the cost.

- Healthcare costs in the USA are partly due to administrative factors.

- Fees are going up, with plan trends contributing.

- Almost half of American adults were underinsured in 2020.

- Voluntary health payments are higher in Switzerland than the USA, though Americas costs are among the worlds highest.

- On the flipside, American expats abroad often find they pay less for insurance overseas.

Ways To Get A Health Plan

There are many different ways that you can buy a health plan in Massachusetts. Many people get their health plan through their place of employment. For people that can’t do this, there are several other ways to get a health plan.

Through Your Employer or Union

In Massachusetts over 70% of all employers offer health insurance as a benefit to their employees. Most of these employers pay part of the premium and also offer a choice of several health plans. You can choose the health plan that is best for you from the choices offered.

Qualified Student Health Insurance Plan

If you are enrolled as a student in a Massachusetts college or university, you can buy a health plan through your school. This SHIP id designed for students and is only available while you are enrolled.

Directly from an Insurance Company

Massachusetts residents can buy health plans directly from an insurance company. And the company can’t turn you down if you have a health condition. Sometimes the company will direct you to purchase their health plan through an intermediary. An intermediary is a company that takes care of the enrollment and premiums.

MassHealth

If you meet certain income requirements, you may be eligible for MassHealth. This is a Medicaid program paid for by the state and federal taxes for eligible persons. You can learn more at or call 1-800-841-2900

Through the Connector

Medicare

Other Government Health Plans

International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Does My Us Health Insurance Cover Me Abroad

Most of the time, your domestic health insurance plan doesnt provide cover abroad, but there are some cases it will for instance, for emergencies, medical evacuations or during short trips. Contacting your provider is usually the best way to find out. Sometimes, even if your insurer will cover care in such cases, you may need to pay out-of-pocket and apply for reimbursement.

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county where you live. In this first table, we look at health insurance premiums for 2021 and how they differ based upon the state you reside in.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

Don’t Miss: Starbucks Insurance Benefits

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

How To Choose Your Premium And Deductible

Premiums and deductibles work together. Plans with higher deductibles usually have lower premiums, while plans with lower deductibles often have higher premiums. One thing to consider when choosing a plan is how much you think you will use your insurance.

- I will use my insurance often: Do you have small children? Or do you or a family member get sick often or have an ongoing illness or disability? If you think you’ll need to see doctors regularly, you may want to consider a plan with a higher premium and lower deductible. You’ll pay more each month, but you’ll also meet your deductible faster which means lower total out-of-pocket costs.

- I will not use my insurance often: If you’re healthy and don’t go to the doctor often, you may want to consider a plan with a lower monthly premium and higher deductible. If you don’t think you will meet your deductible with the amount of health care services you may use, a lower premium may be the best way to keep your overall annual costs down.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Factors That Affect Premiums

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

Medical Expense Deductions For The Self

There is an exception made to the 7.5% rule for individuals who run their own businesses. Among the many other tax deductions and benefits that self-employed individuals can claim, youre allowed to deduct the entirety of your premium payments from your adjusted gross income, regardless of if you itemize your deductions. However, you may be precluded from this deduction if you are:

- Eligible to participate in another employers plan and elect not to

- Self-employed, but you have another job that offers a health plan

- Eligible to receive coverage through a spouse’s employer-sponsored plan.

There are also limitations imposed on self-employed individuals based on the amount of their business income. In any given year, a self-employed person cannot deduct more than the amount of income they generate through their business operations.

Individuals who operate more than one business can designate only one of them as the health insurance plan sponsor you cannot add up the income generated by multiple companies in order to claim the maximum deduction. In the case of self-employed persons, it may be in their best interest to choose their most profitable business as the plan sponsor in order to increase their potential amount of tax relief.

Also Check: Starbucks Health Care Benefits

Five Factors That Shape Health Insurance Premiums For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

- State laws these can dictate what health insurance must cover and affect competition. For instance, a 2017 Maine law instructs insurers to compensate customers who find a better deal on certain services. On the flipside, some states have certificate-of-need laws that may decrease competition.

- Your employers size larger employers tend to have access to cheaper cover. Those who dont have access through their employer will often pay more.

- Geography health insurance can be cheaper in cities than in remote locations.

- Plan type preferred provider organizations tend to cost the most, while high-deductible health plans cost the least.

- Personal factors such as age.

What are the best places for American expats to live abroad?

Find out more here

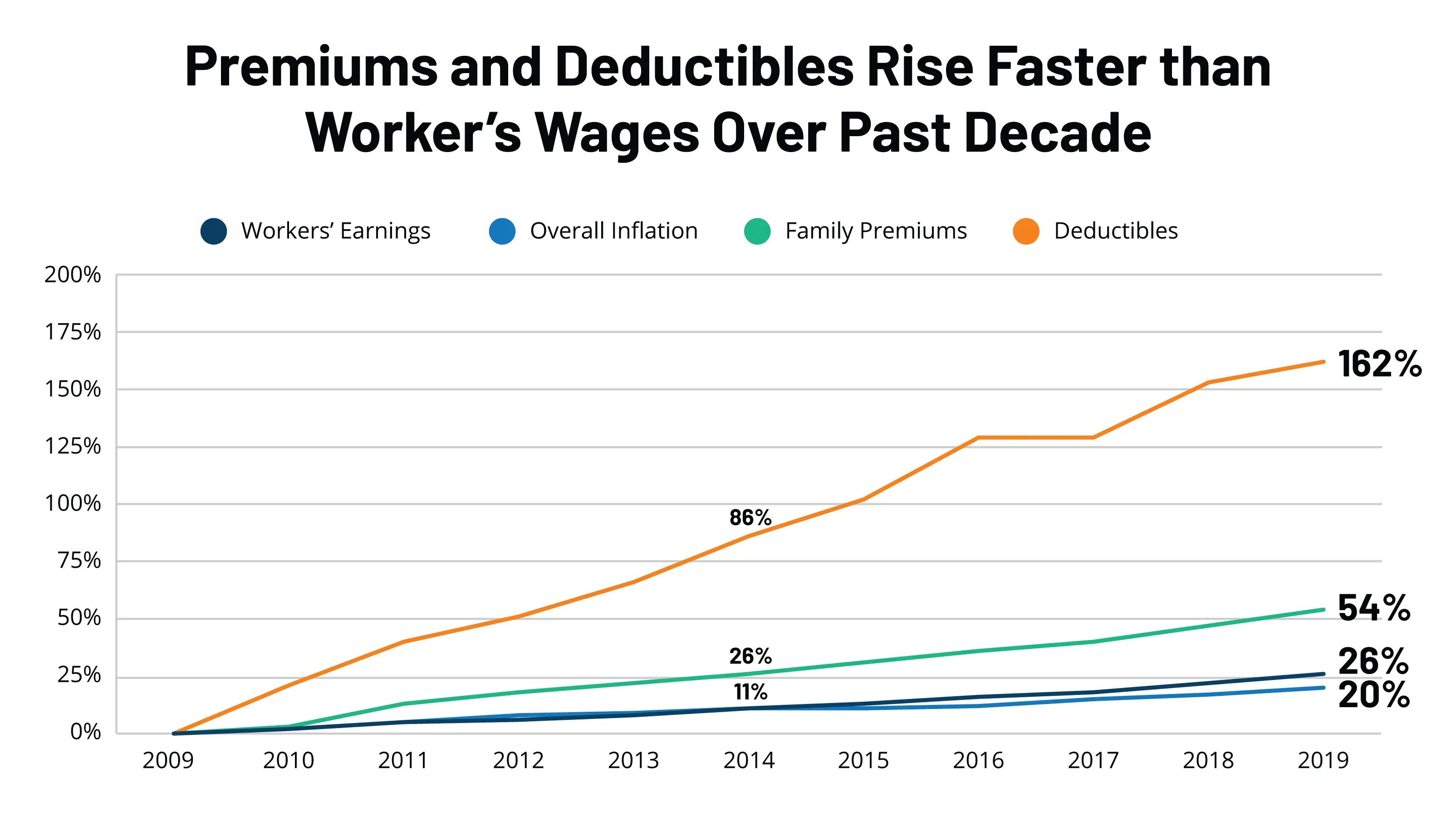

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2019:

- $1,655: Average general annual deductible for a single worker, employer plan

- $2,271: Average annual deductible if that single worker was employed by a small firm

- $1,412: Average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from Healthcare.gov., Plan Year 2020 |

|---|

| Bronze |

| $1,430 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Also Check: What Health Insurance Does Starbucks Offer

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

How Much Do You Pay For Health Insurance

How much are your health benefits?

Monster Contributing WriterPrivate Health Insurance

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Is The Premium Paid

You pay the health premium if you are a resident of Ontario and your employment or pension income is more than $20,000 a year. In most cases the premium is automatically deducted from your pay or pension. It is included as part of the income taxes deduction on your pay stub.

If you dont have taxes automatically deducted from your pay or pension, the premium is paid when you file your annual personal income tax and benefit return with the Canada Revenue Agency .

If your income is $20,000 or less, you dont need to pay the health premium.

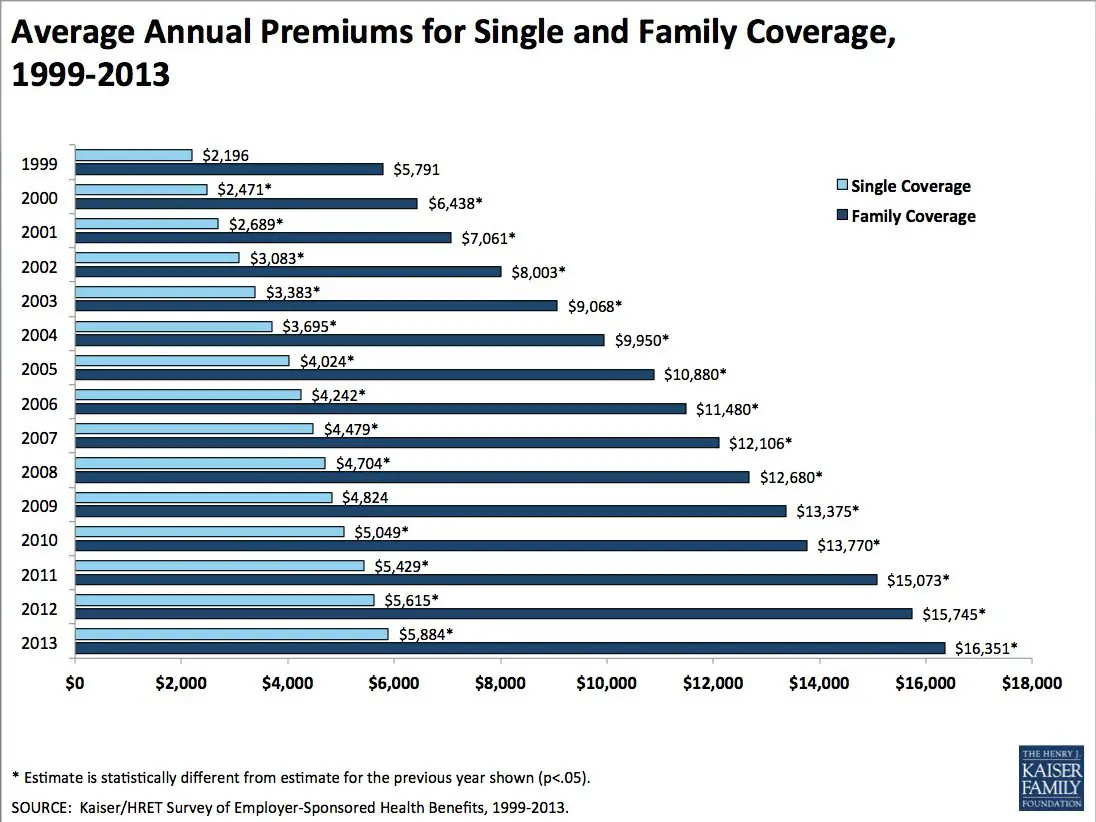

Premium Growth In Employer Health Plans Has Ticked Up

Following a slowdown between 2012 and 2016, average annual growth in employer premiums rose at a faster pace between 2016 and 2018, rising by 4.9 percent for single plans and 5.1 percent for family plans . The average annual growth rate from 201618 was 7 percent or higher in seven states for single-person plans and in eight states and the District of Columbia for family plans . In 2018, average premiums for single-person plans ranged from a low of $5,971 in Tennessee to a high of $8,432 in Alaska. In family plans, the lowest average premium was $17,337 in North Dakota and the highest was $22,294 in New Jersey.

Recommended Reading: How To Enroll In Starbucks Health Insurance

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Health Insurance Premiums And Rate Increases

Health insurance premiums are the monthly amount you or your employer pay to an insurance company. The insurance company collects premiums from all of its policyholders and uses that money to pay for their medical claims. The insurance company can also use premiums to pay for its administrative expenses and to earn profit.

Also Check: Do Starbucks Employees Get Health Insurance

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Deductibles Copays And Coinsurance

Premiums are set fees that must be paid monthly. If your premiums are up to date, you are insured. The fact that you are insured, however, does not necessarily mean that all your healthcare expenses are paid for by your insurance plan.

- Deductibles. Deductibles, according to Healthcare.gov, are “the amount you pay for covered healthcare services before your insurance plan starts to pay.” But it’s important to understand that some services can be fully or partially covered before you meet the deductible, depending on how the plan is designed.ACA-compliant plans, including employer-sponsored plans and individual/family plans, cover certain preventive services at no cost to the enrollee, even if the deductible has not been met. And it’s quite common to see plans that partially cover certain servicesincluding office visits, urgent care visits, and prescriptionsbefore the deductible is met.Instead of having the enrollee pay the full cost of these visits, the insurance plan may require the member to only pay a copay, with the health plan picking up the remainder of the bill. But other health plans are designed so that all servicesother than the mandated preventive care benefitsare applied towards the deductible and the health plan doesn’t start to pay for any of them until after the deductible is met. The cost of premiums is often closely tied to deductibles: you will generally pay more for an insurance policy that has lower deductibles, and vice versa.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for “cost-sharing reductions” : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees