How To Cancel Health Insurance

- Post author

How to cancel health insurance? Health insurance offers a way to reduce the costs to more reasonable, affordable amounts.

Generally, it works in a way that the consumer pays an advance premium to a health insurance company. This payment allows the consumer to share risk with lots of other consumers who are making similar payments.

As new insurance options become available so you may need to cancel or alter your current individual health insurance policy. But with the right way, canceling your individual health insurance policy will protect yourself financially and your future coverage.

This article will provide you a detailed guideline on how to cancel your health insurance policy. So if you are interested to know the right way then keep reading this article till the end.

When Your Health Insurance Company Can Cancel Your Policy

Insurance companies are businesses dealing with risks, and being able to assess risks and avoid losses is part of how they operate. Their insurance policies are usually contractual agreements bound by certain rules, so they could terminate your coverage if you veer from the conditions set forth in your policy.

Luckily, current law also limits what an insurer can include as reasons for canceling your health insurance policy. For instance, an insurer typically isnt allowed to cancel a policy midway through its term and before its expiration or renewal date. Your health insurance company can legally terminate your policy on these grounds:

- You fail to pay premiums by the due date.

- You voluntarily or mutually agree to end the coverage.

- You intentionally falsify information or provide incomplete information thats crucial to the coverage on your insurance application.

- You commit fraud in obtaining insurance benefits.

- Youre no longer eligible for coverage through termination from employment or death.

While an insurance company may terminate your policy for nonpayment of premiums, you may qualify for premium payment relief or a grace period during which you can settle any premiums due. The grace period for health insurance policies is as follows:

- At least seven days for weekly premium policies.

- At least 10 days for monthly premium policies.

- At least 31 days for all other policies.

Buy Another Plan From Your Insurer

You can still apply for another health insurance plan through your current insurer as long as youre eligible. The insurance company shouldnt lock you out of purchasingeither directly or through an agentany of its other plans for which you qualify. Inquire with the insurance company which plans may be available to you.

Read Also: How Long Does It Take To Enroll In Health Insurance

How To Cancel Group Health Insurance Plan

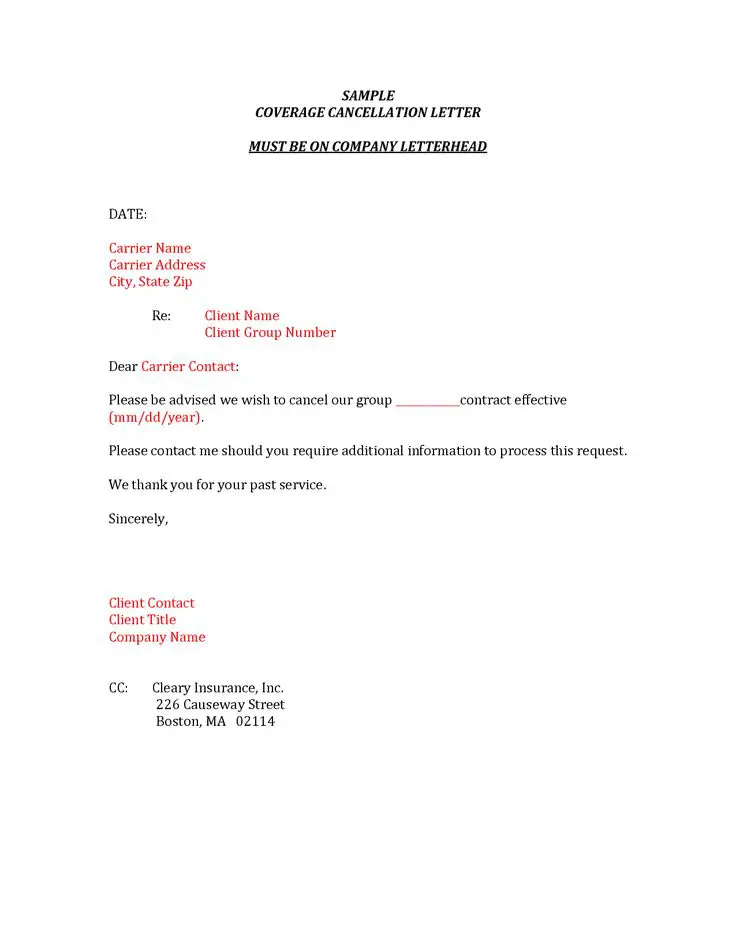

Want to know how to cancel your Group Health Insurance Policy? Then you need this guide! Inside youâll find 3 simple ways to help you cancel your GHI plan.

There are several reasons to cancel a group health insurance plan. Perhaps you just turned 65 and want to change your coverage or maybe youâre going to start a new job. Either way, canceling a health insurance policy without a new one or alternative coverage isnât the best idea.

Plus, for organizations, now group health insurance is mandatory, so canceling it will leave you open to a fine. Hence, before you cancel your existing policy, the smart move is to line up a new health insurance policy. This way, thereâs no gap in your coverage.

The method of cancellation is slightly different. It entails different aspects as compared to how you purchase group health insurance. Itâs important you understand the different ways to cancel group health insurance plan and their outcomes. This ensures you make a calculated, informed decision.

Canceling Anthem Insurance Via Companys Website

If youre trying to cancel your insurance cover, you can use the Anthem Insurance website. Download and fill out the Member Change Form with your contact details, and tick the relevant boxes to signify that you want to cancel.

You need to submit the termination details within 60 days of the desired date of cancellation. This will stop Anthem from billing you for an additional month while the company processes your termination.

If you continue to be billed after that period, contact the company on the Ask Customer Service page or the General Assistance Live Chat.

Any of these methods should enable you to cancel your membership with Anthem Insurance, but why go through all the trouble of doing it yourself when DoNotPay can do the job for you?

Recommended Reading: Do You Get Fine For Not Having Health Insurance

Can You Get Insurance Through The Marketplace If Your Employer Offers Coverage

You can purchase a plan from the health insurance marketplace, but this will forfeit any employer contribution you may receive with a group plan. You may also not be able to receive any premium tax credits or other incentives because an employer-provided policy is available.

If you cancel coverage and dont replace it, you could face a penalty, in addition to the health risks.

Does My Health Insurance Plan Include Prescription Drug Benefits

Most health plans help pay the cost of covered prescription drugs. Insurers often use a formulary that lists what medicines will be covered and how much of the cost youll pay. If you need a specific prescription, you should review your plans formulary, which is a listing of what medications are covered, to learn if the drug is covered. A formulary usually has different tiers based on the type of covered medicine. Prescription medicines listed in one tier may cost you more than those in another tier .You may have to pay the full cost of prescription medicines until you reach your plans deductible for the year. Prescriptions that you pay for will count toward your annual out-of-pocket maximum.

You can ask your insurance company for an exception if a drug you need is not on your plans formulary. If the insurance company denies your request, you may be able to file a medical necessity appeal to the Office of Patent Protection.

Many drug manufacturers also offer discounts if you are having difficulty paying for your prescription.

Also Check: Does Starbucks Offer Health Insurance To Part Time Employees

Recommended Reading: How Much Is Individual Health Insurance

The Refund Process In Health Insurance

The refund process in health insurance involves the following important points.

-

Depending on how long it has been since you initiated your policy, your insurer will subtract the charges and credit the refund.

-

Post the initiation of the refund, an email or letter with the details of the cancellation will be sent to you.

How To Cancel Health Insurance Coverage

There are times when its necessary to cancel a health care plan, such as when you start a new job or age out of your parents coverage. In some cases, terminating health insurance is as easy as making a phone call or accessing your online account. But policy rules can vary, depending on who provides your coverage.

Going without coverage, even for a short period, could lead to financial issues or serious health problems. So if you need to cancel your existing health insurance, you should know exactly when a new policy will go into effect.

Read Also: How Much Is Health Insurance For A 60 Year Old

Replacing A Photo Health Card

How you replace a photo health card depends on whether it is expired or not and whether your personal information has changed or not.

You must visit a ServiceOntario centre to replace an unexpired photo health card if your name or address has changed.

If your name and address has not changed, you can replace an unexpired lost, stolen or damaged photo health card by calling ServiceOntario at .

To replace an expired photo health card after the renewal date, you must visit a ServiceOntario centre.

Bring two separate identification documents from the list of qualifying identification documents :

If your Canadian Citizenship or immigration status has changed since you got your current health card, you also need to bring your most recent Citizenship or immigration document

Special Enrollment Periods For Health Insurance

Special enrollment periods are so named because thats exactly what they are: special. During a special enrollment period, only you and your family have the chance to decide on new coverage options.

Special enrollment periods are triggered by specific events, including:

- Getting married, divorced or legally separated

- Giving birth or adopting

- Starting, ending or losing a job

- Losing other health insurance coverage

- A death in the family

- Moving to a new ZIP code or county

- Certain other qualifying events

If one of these events applies to you, youll usually have 60 days to switch to a new plan or make changes to your existing one.

Just like with open enrollment, you can shop around and compare plans by talking to your existing health insurance provider, your broker or visiting your states health insurance marketplace. In some cases, youll need to provide evidence of your qualifying life event before enrollment is complete.

You May Like: How Much Can Health Insurance Cost

Changing Health Insurance During The Yearly Open Enrollment Period

Open Enrollment is the time of year when anyone can change their health insurance plan, for any reason. It typically runs from November 1 to December 15, yet is sometimes extended. Medicare Open Enrollment periods may vary.

This is the time when you can accept your current plans health insurance renewal, or you can shop around to find a better fit for you and your family. The plan you choose will begin January 1, or February 1, depending on when you enroll.

Want to shop around? Here are a couple ways to make the experience a little simpler:

- If you want to look at new plans with your same insurance provider, you can usually compare plans online or call their team. At HealthPartners, its easy to review health insurance plans online or get personal help by calling .

- If you want to see options from different health insurance providers, you can either contact them directly, call your broker or use the health insurance marketplace.

On the health insurance marketplace, you can see plan information from many different companies all at once. You can also find out if you qualify for financial assistance. In Minnesota, get started at MNsure.org. In Wisconsin, go to healthcare.gov.

Can You Drop Health Insurance At Any Time

Yes, you can drop health insurance at any time. If you need to cancel your health insurance policy, contact your HealthMarkets agent, or give us a call at and we can help you with your options. We can also help you compare plans if you need coverage to help hold you over until the Open Enrollment Period. Additionally, you can also review your options now for coverage that may be available.

47809-HM-0721

Also Check: How Much Is Health Insurance In Florida

Cancellation Of Health Insurance

Cancelling your Dutch health insurance

You can cancel your and change insurer up to 31 December each year. If you indicate your wish to cancel your Dutch health insurance before 31 December, the contract will end as at 1 January. In some situations, you can also cancel your Dutch health insurance in the course of a year.

What if you no longer work in the Netherlands? In that case you are no longer obliged to take out insurance. Your public healthcare insurance terminates on the day following that on which you cease to be obliged to take out insurance. You must inform us of that fact as soon as possible.

When Can My Health Insurance Coverage Be Terminated

Your coverage can only be terminated because:

- Premiums are not paid by the due date. Coverage is also waived when the employee portion of the premium is not deducted for 12 consecutive months.

- Coverage is voluntarily canceled.

- Death of the .

- Fraud is committed in obtaining benefits or there is an inability to establish a physician/patient relationship. Termination of coverage for this reason requires Group Insurance Board approval.

State and Grad only: Your coverage can be terminated because your eligibility for coverage ceases .

Retirees only: Your coverage can be terminated because you:

- Became ineligible for coverage as an annuitant because of becoming an active Wisconsin Retirement System employee.

- IYC Medicare Advantage enrollees only: Dropped Medicare Part B. Your coverage will change to IYC Medicare Plus. You may also change health plans.

The Medicare enrollment requirement is deferred while you or your spouse are employed and covered under a group health insurance plan from that employment. Active employees should contact their benefits/payroll/personnel office for the date coverage will end.

Don’t Miss: Is It Illegal To Go Without Health Insurance

Involuntary Loss Of Other Coverage

The coverage youre losing has to be minimum essential coverage, and the loss has to be involuntary. Cancelling the plan or failing to pay the premiums does not count as involuntary loss, but voluntarily leaving a job and thus losing employer-sponsored health coverage does count as an involuntary loss of coverage. In most cases, loss of coverage that isnt minimum essential coverage does not trigger a special open enrollment.

. And although they are not technically considered minimum essential coverage, they do count as minimum essential prior coverage in the case of special enrollment periods that require a person to have previously had coverage .)

Your special open enrollment begins 60 days before the termination date, so its possible to get a new ACA-compliant plan with no gap in coverage, as long as your prior plan doesnt end mid-month. the code of federal regulations 155.420, and the that makes advance open enrollment possible for people with individual coverage as well as employer-sponsored coverage.) You also have 60 days after your plan ends during which you can select a new ACA-compliant plan.

Apply For A Marketplace Plan

You can seek health coverage through the Marketplace or any insurer that sells insurance through the Marketplace. If you lost coverage for non-payment of premiums, you could qualify for income-based financial assistance on premiums and out-of-pocket costs. You may also be eligible for low-cost or free coverage through Medicaid or CHIP . Marketplace plans also come with their own rights and protections.

Recommended Reading: How Long Can I Get Cobra Health Insurance

Can My Employer Cancel My Health Insurance Or Require Me To Pay It While Im Off For A Work Comp Injury

There is a common concern among many Missouri workers who are off work due to a work injury. It has to do with their employers canceling their health insurance while they are off from work. Many ask, Can my employer cancel my health insurance, or require me to pay it, while Im off recovering from a work comp injury?

Answer: a company must continue your health insurance while you are on leave, but they are able to require you to pay your premium.

While most states prevent employers from retaliating against an employee that has filed a workers compensation claim, most do not address the continuation of benefits in the event of an extended absence due to a work-related disability or injury. As a result, some employers will choose to stop paying for health coverage.

However, there are two federal programs that mandate the continuation of health coverage. One is the Family and Medical Leave Act and the second is COBRA. Both of these programs can help workers who have been injured and cannot work, keep their health coverage if they are able to pay the cost themselves.

How To Cancel Health Insurance Purchased From A Private Insurer

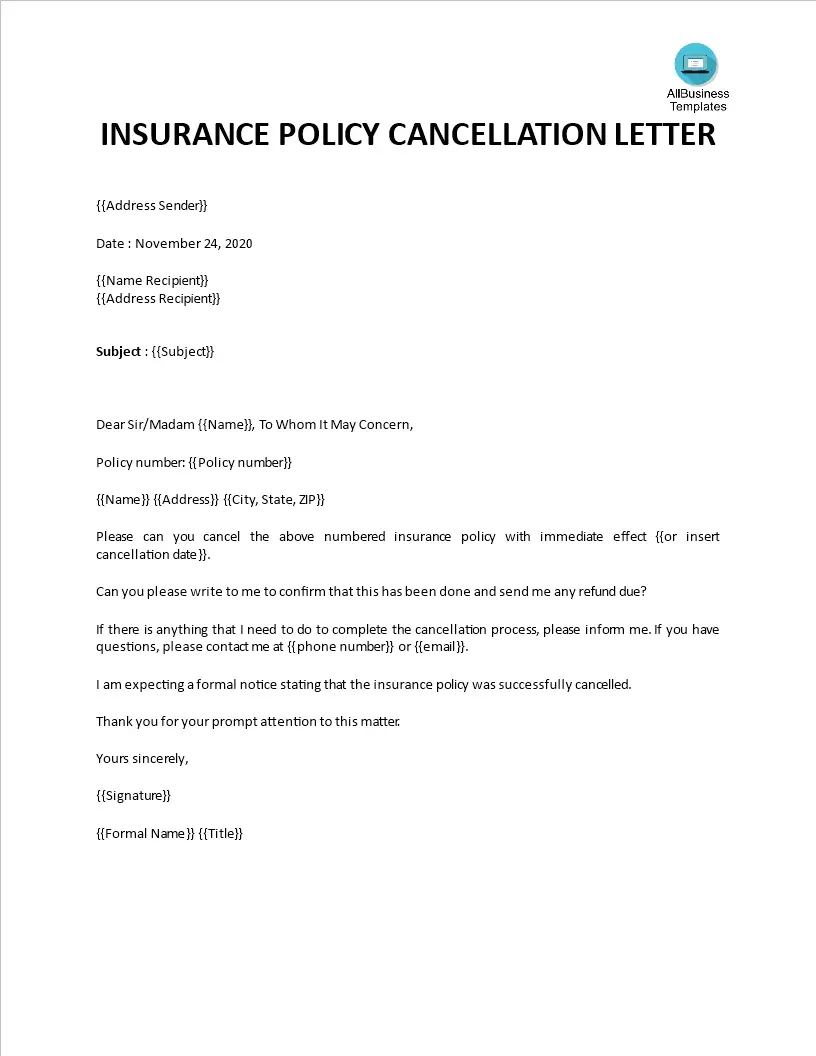

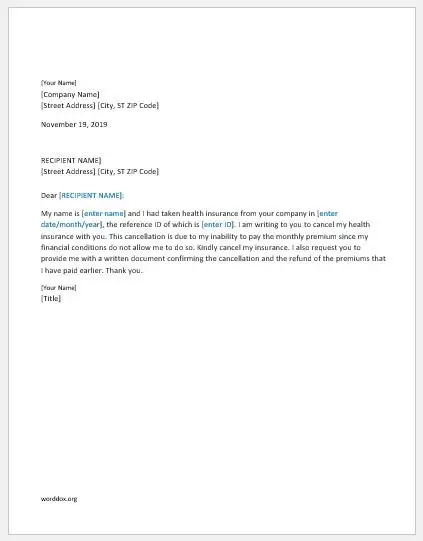

Contact Your Provider: If you want to cancel health insurance you bought from a private insurer, youll need to contact that insurer for directions. Different carriers have different cancellation protocols. Some insurers may send you a form to fill out others may want a more formal written confirmation to end coverage. Call the customer service number listed on the back of your health insurance card to get the details you need to follow.

Don’t Miss: Are Illegal Immigrants Eligible For Health Insurance

What Happens If I Want To Quit A Marketplace Health Plan During The Year

It is important that you contact both the Marketplace and the health plan and let them know you no longer need coverage. In HealthCare.gov states, you can log into your Marketplace account, select the terminate coverage option, and enter the required information.

If you have a family policy and want to remove one person from the policy but keep coverage in effect for others, in HealthCare.gov states, log in to your Marketplace account, select the reporting a life change option, and enter the required information.

If you have questions about these changes, seek help from a Navigator or other trained in-person assister.

Making these changes through your Marketplace account will create a written record that you tried to end coverage.

Do not simply stop paying the premium for your Marketplace health plan as a way to terminate coverage. Nonpayment will eventually cause your coverage to end, but in the future, if you try to enroll in coverage again with that insurer, you might be prevented from doing so until you repay the missed premium.

Cancel Insurance During The Year

You can cancel your insurance during the year if:

- You are insured with Menzis, but you are nog the policyholder. For example, in the event of a divorce or if you are goint to live independently. Have your registered with another healthcare insurer? If so, they will terminate the insurance with Menzis on your behalf on the first day of the following month.

- You are collectively insured with Menzis through your employer and wish to switch to a collective insurance of another healthcare insurer through your new employer. We must be notified within 30 days of your new employment.

- You do not want to agree to insurance terms and conditions modified by Menzis. We must receive your cancellation within 30 days after we have informed you of the change. You cannot cancel your insurance if the changes are due to changes in the law.

Don’t Miss: How Much To Buy Private Health Insurance