What Is The Platinum Health Plan

Platinum is the highest of the four metal levels: these are Bronze, Silver, Gold and Platinum health plans. While a Platinum health plan offers the lowest out of pocket costs when medical services are needed, it also comes with a premium that is significantly higher than those associated with other plans.

General Differences In The Metal Levels

- Gold or platinum plans: these plans generally have higher monthly premiums but pay more of your costs when you need care.

- Silver or bronze plans: these plans cost you less per month, but pay less of your costs when you need care.

- Catastrophic plans: these plans have high deductibles and cost you less per month than a bronze plan, but pay the least when you need care. You must be under 30 years old or have a hardship exemption to purchase a catastrophic plan.

Bronze Silver Gold: Which Health Insurance Tier Best Buy For You

If you buy health insurance on a state or federal marketplace, the arrival of fall means its almost time to pick a health plan. The Affordable Care Act, also called Obamacare, requires most Americans to buy health insurance. This years open enrollment period lasts from Nov. 1 to Jan. 31 for anyone buying health insurance on their own, whether for one person or a family.

Health plans sold through the marketplaces are sorted into tiers bronze, silver, gold or platinum based on how much they will help pay your medical bills, on average.

Heres how to decide which tier is right for you.

Tiers give an estimate of how much a plan will pay

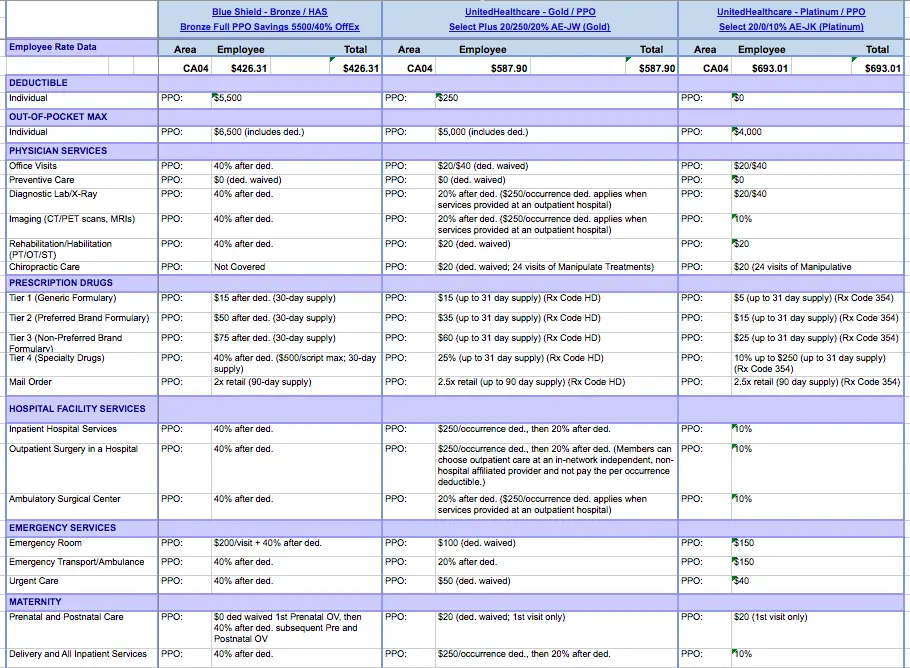

Each tier is meant to estimate the percentage of medical costs the plans will cover, based on an average across all buyers of plans within the tier:

- Bronze plans: 60%

- Gold plans: 80%

- Platinum plans: 90%

Health plans within every tier must pay for 10 essential health benefits, which are defined by federal law things such as trips to the emergency room, pediatric care, prescription drugs and preventive care such as physicals and immunizations. Plans can also pay for treatment beyond these 10 fundamentals, and the overall estimated payments for services determine the tier.

This year, Simple Choice plans will be available on the exchanges for some consumers. Deductibles, copayments and coinsurance are the same within each metal tier in these plans to make them easier to compare.

Silver and gold are a good middle ground

Read Also: How To Get Cheap Health Insurance In Texas

Vitality Level Term Assurance

Vitality level term assurance is a term life insurance policy where the amount insured remains constant throughout the policy term and the policy only pays out if one of the lives assured dies during the policy term. This type of policy is often used to cover an interest-only mortgage or to provide a lump sum for your dependents in the event of your death .

How Actuarial Value Works

The distinction between the metal levels is based on the actuarial value of the plan. AV is calculated based on the average percentage of medical costs that the plan would pay, across all of its enrollees. That includes some enrollees who have barely any medical costs, as well as others who may run up millions of dollars in spending.

In the case of insureds with very high claims, the insurance company is obviously paying a huge percentage of their costs, since the bulk of the claim would be above the patients maximum out-of-pocket limit. But for insureds who have very low claims costs, the insured might be paying all or nearly all of the bill if the total cost is less than the deductible. So you cant look at AV from an individual basis its spread across a plans entire pool of insureds.

A Bronze plan has an AV of roughly 60%, which means that the insurance company pays 60% of their insureds average costs. A Silver plan has an AV of roughly 70%, a Gold plan has an AV of roughly 80%, and a Platinum plan has an AV of roughly 90%. Within those constraints, the actual plan design can vary considerably, so its possible to find a Gold plan that has a higher deductible than a Silver plan. But you can expect that your overall out-of-pocket costs throughout the year will generally be lower with a plan thats higher up the metal level scale .

Recommended Reading: Can I Have Two Health Insurance

What Does Travel Insurance Cover

Travel insurance covers a number of travel-related risks, from flight cancellations to lost bags to medical emergencies. The dollar amount of your coverage depends on the policy you bought and where and when you bought it. Most travel insurance providers offer several different policies to choose from, with higher or lower levels of coverage and higher or lower prices to match.

You can buy policies that cover a single trip, multiple trips or a full year. You can buy an individual policy or one that covers your entire family. There are many companies that offer policies, with Allianz and Travel Guard among the best-known. Here is a chart showing the benefits and coverage levels available on some Allianz policies.

|

OneTrip Basic |

|||

|---|---|---|---|

|

Covered if certain criteria are met |

Covered if certain criteria are met |

Covered if certain criteria are met |

As part of NerdWallet’s Best-Of Awards, we analyzed various travel insurance policies to help you choose the plan that best aligns with your travel goals. Check out our results here: Best Travel Insurance of 2021.

Vitality Decreasing Term Assurance

Vitality decreasing term assurance is a type of term life insurance policy that works in the same way as a level term assurance policy except the amount of life insurance decreases to mirror the reducing balance of a repayment mortgage over the term of the policy. This makes the monthly premium cheaper.

Also Check: How Much To Employers Pay For Health Insurance

Amex Business Platinum Benefits

| Complimentary Marriott Bonvoy Gold Elite status | Variable | You will receive complimentary Gold Elite status benefits when you book directly at Marriott properties. Gold status includes: upgrades when available, late checkout and enhanced Wi-Fi. | No |

With over $4,100 in value during the first year, it is simple to justify the annual fee. After the first year you won’t be able to count the welcome bonus, the perks could be worth $1,430. And neither of these figures account for the value of the robust airport lounge access and hotel elite status with Marriott and Hilton.

However, many of the above values are estimates. And with several credits for expenses like Indeed, Adobe and Dell, you must ask yourself if you can take advantage of these benefits without forcing yourself to spend more than you normally would. Are these services you already use, or are you just signing up because you can get a discount with a credit card?

Additionally, it’s worth considering how much you’ll actually use the airport lounge and hotel elite status benefits. They are extremely valuable perks as a single airport lounge membership can easily cost hundreds of dollars, but if you don’t fly regularly, the benefits may not be worth as much to you. The same applies to the hotel elite status if you don’t use it, it probably isn’t worth a whole lot.

How Much Will It Cost

For any plan, your monthly premium will be based on several factors including:

- Your age

- Whether or not you smoke

- Where you live

- How many people are enrolling with you

- Your insurance company

Since your states Marketplace allows various private insurers to offer plans, a Silver plan from one company may cost more or less than the same plan offered by a different insurer. Plans offered by the same company, however, will increase in price as the actuarial value and the amount the plan pays go up.

As discussed above, the federal limit for annual out-of-pocket expenses for individuals is $8,550 the family cap is $17,100. Certain plans may have even lower out-of-pocket caps.

Also Check: Are You Required To Have Health Insurance In California

The Affordable Care Act’s Standardized Value Levels

To make it easy for you to compare the value youre getting for the money you spend on health insurance premiums, the Affordable Care Act standardized value levels for health plans in the individual and small group markets. These levels, or tiers, are:

- Bronze

In addition, in the individual market, catastrophic plans are available to people under the age of 30 and to people who qualify for a hardship exemption from the ACA’s individual mandate.

This classification system applies to plans sold in each state’s health insurance exchange, but they also apply to all individual and small group major medical health insurance sold anywhere in the US, including outside the exchanges. Major medical plans that aren’t ACA-compliant can no longer be sold in the individual major medical market, even outside the exchange.

Excepted benefit plans, however, are not subject to ACA regulations and the metal level classifications do not apply to these types of coverage. Examples of excepted benefits include vision and dental plans, short-term health insurance plans, fixed indemnity plans, critical illness plans, and accident supplements. There are also other types of coverage that are not subject to ACA regulations, including disability insurance, Medicare Supplement insurance, and long-term care insurance. Metal level classifications also do not apply to large group health plans, even though some of the ACA’s regulations do apply to large group plans.

What Is The Income Limit For Marketplace Insurance

Strictly speaking, there is no income limit for Marketplace insuranceanyone can purchase it. What is limited by income is the amount of the subsidy, or premium tax credit, you might qualify for to help pay for that insurance. In 2021, you qualify for subsidies if you pay more than 8.5% of your household income toward health insurance premiumsspecifically, the cost of the Silver benchmark plan .

You May Like: Can I Have Health Insurance In Two Different States

Covered California Platinum 90 Plan: Top Of The Line

Think the Rolls-Royce of the Covered California Metal Plan Portfolio. The Platinum plan offers a much smaller out of pocket expense when it comes time for doctors visits, labs, prescriptions, etc. in exchange for a higher premium per month. This plan features an attractive $0 deductible with minimal copays of $15-$30 for common services. And to top it off, if the worst should happen, the most you would have to pay in a year for covered services would be $4,500 for an individual or $9,000 for a family. This is the best of any plan offered on the Covered California Exchange. The only exception to this would be if you qualify for the Silver 87 or Silver 94 plans.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Is It Required By Law To Have Health Insurance

What Kind Of Healthcare System Does Thailand Have

The Department of Medical Services at the Ministry of Public Health funds public health services and government hospitals. These public facilities offer good medical service, but hospitals are sometimes overcrowded, which can mean long waiting times.

If youre moving to Thailand for work, youll be covered to use the public hospitals through social security payments. If youre not working in Thailand, youll need to pay for medical services out-of-pocket or use private health insurance, which will grant you access to private facilities as well as public ones. The public medical sector in Thailand has four times as many hospital beds as the private sector.

Many people prefer the private hospitals because they usually have shorter waiting times. Thailands private hospitals offer world-class care Bangkok is home to one of the top 10 hospitals in the world – Bumrungrad International. Many of these private hospitals like Bumrungrad International have special private wings with English speaking doctors and staff for foreigners.

If you get private medical insurance you’ll most likely be given several options for deductibles, coinsurance and copays. The deductible is the amount of money the policyholder will be required to pay before insurance kicks in. Coinsurance and copays are a pre-determined percentage of costs that the policyholder must pay per treatment. Each plan is different so you should check with your insurance provider for more details.

How Does Vitality Health Insurance Work

Generous customer incentives such as up to half price Virgin Gym membership, free Amazon Prime and free cinema tickets make Vitality Health insurance a hugely appealing product, however it has one unfortunate drawback. By creating a product that provides activity-based rewards they have made an already complex product even more difficult to understand.

The job of this article is to cut through the jargon and explain in simple terms exactly what you get with Vitality Health, as well as the best way to apply for it . So, first things first. What cover do you get?

Don’t Miss: Can You Have 2 Health Insurance Policies

Custom Select Coverage Options

If some of the coverages in the package plan are not important to you, you can select only the coverage you want and pay accordingly. Perhaps, for example, you have a need for just medical coverage while traveling abroad. You have the option to select just that coverage.

This example shows the levels of coverage available and the associated premium costs. The Gold Plan selected offers up to $100,000 in emergency medical, up to $750 in emergency dental, and up to $100,000 in emergency evacuation/repatriation. The price of this plan would be $32 for the entire trip.

Bottom Line: Having the option to select only the coverages you want allows you to save money by not paying for coverages you dont need. This is a key benefit of purchasing travel insurance through American Express Travel Insurance. Few travel insurance companies offer the option to purchase stand-alone travel medical coverage.

Explainer: Platinum Versus Gold Health

Among the central proposals of the reforms is shifting to a less expensive health insurance package from the current platinum level to gold coverage a proposal that supporters said could save taxpayers some $1.4 billion in costs over the next four years.

These types of changes have been discussed in the past, including by a group convened by former Gov. Chris Christie, a Republican, which in February 2016 issued a reform package with some similar proposals many of which were never implemented.

New Jerseys public workers roughly 700,000 state employees, plus county, local and school-district staff have the richest government benefits in the nation, according to the Sweeney panel in the current fiscal year, $3.4 billion in taxpayer dollars are allocated to these costs. The new report, Path to Progress, says these costs are expected to grow at nearly 5 percent a year, or $700 million over four years.

The cost of these benefits, and New Jerseys grossly underfunded pension system, have long been top concerns for public officials. But cutting these costs usually involves clashes with the states strong public labor unions, including the New Jersey Education Association, which is locked in a battle with Sweeney , the states most powerful lawmaker. As a result, major changes have been hard to implement.

Read Also: Does Health Insurance Cover Baby Formula

But Gold Plans Are Less Expensive Than Silver Plans In Some Areas

Prior to 2018, pricing on individual market health plans tended to be fairly straightforward, with Bronze plans having the lowest premiums, Silver plans having mid-range premiums, and Gold plans having the highest premiums. But in the fall of 2017, the Trump administration stopped reimbursing insurers for the cost of cost-sharing subsidies. As a result, insurers began adding that cost to the premiums for Silver plans .

That resulted in disproportionately high prices for Silver plans, and much larger premium subsidies . And in some places, Gold plans are less expensive than Silver plans. So it pays to closely compare your options, and keep in mind that the pricing might not be what youd logically expect.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Vitality Whole Of Life Plan

Vitality’s whole of life plan is where the policy is set up to pay out in the event of the life assured’s death whenever that occurs. As you can imagine this is the most expensive option.

So far none of this is unique to Vitality, as I said at its core it works the same as other life insurance policies. You can choose to set up a Vitality life insurance policy on a single life basis, joint life first death or joint life second death . Again, all very standard.

You May Like: How To Add Dependent To Health Insurance