Some States Now Have Health Insurance Mandates

That said, a handful of states have passed their own health insurance requirements. If you live in one of these states — California, the District of Columbia, Massachusetts, New Jersey, or Rhode Island — you may owe a state tax penalty unless you are exempt from the state’s law.

To learn more, select your state from the list on this page.

What Is The Health Insurance Penalty

The penalty for no health insurance increases each year:

- In 2015, the penalty is the greater of $325 per adult and $162.50 per child, or 2% of your taxable household income minus the federal tax-filing threshold, which is the minimum income required by the IRS for someone to file an income tax return.

- In 2016, the penalty goes up to the greater of $695 per adult and $347.50 per child, or 2.5% of your taxable household income minus the federal tax-filing threshold.

- In 2017 and 2018, the penalty increases to the greater of $695 per adult and $347.50 per child, plus COLA , or 2.5% of your taxable household income minus the federal tax-filing threshold.

- In 2019, there will be no more penalty.

See chart below.

Why Have An Individual Mandate

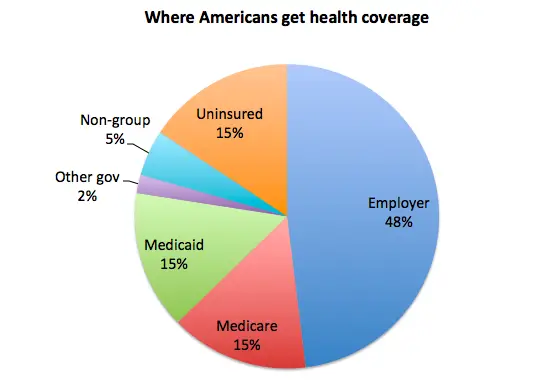

These states have an individual mandate for the same reason the ACA originally did. Without an individual mandate, people would only buy insurance if they knew they were going to need it. Most often, this means the elderly and people with pre-existing conditions.

But those who use their health insurance the most are also the most expensive to insure. Before the Affordable Care Act, insurance companies would evaluate all applicants before enrolling them. Based on peoples age and medical history, the insurance companies would then deny them health care coverage, or charge them more for it. But the ACA made that kind of discrimination illegal. And then it took things one step further. An individual mandate is an incentive for everyone to get health insurance, even healthy people. That meant there was now a larger pool of people applying for health insurance. And with more healthy people getting health insurance, health insurance companies could lower premiums for everyone.

In other words, the individual mandate was meant to be one of the of cost-savings and consumer protections we associate with the ACA. It allows more people to be insured at a lesser rate per person. Even though there is no national individual mandate anymore, some states have passed their own mandates to help keep more people insured at lower costs per person. If the mandates help more people get insured, taxpayers in these states will have lower monthly premiums on average.

Recommended Reading: What Health Insurance Does Walmart Offer

Saving Money On Prescriptions When You Are Uninsured Or Underinsured

Most people who go without health insurance do so because of the cost, according to theKaiser Family Foundation. SingleCare can help you save money on your prescriptions. Many times, usingSingleCare provides you with lower prices than if you used your insurance.

It is easy to find out if you can save money this way. Use either theSingleCare website orapp and search for your medication to receive a list of pharmacies and digital coupons for the drug. These prices are based on partnerships between the pharmacies and SingleCare. You often can find your prescriptions for a lower cost than if you walked into the pharmacy without checking or through your insurance.

Aca Goal: Insure Most Americans And Keep Them Insured

The overarching goal of the Affordable Care Act was to extend health insurance coverage to as many Americans as possible. In that regard, it’s had significant success. From 2010 through 2016, the number of people with health insurance in the U.S. increased by roughly 20 million. And although the uninsured rate has been increasing since 2017, it has been below 10% since 2015.

But while access to health insurance is important, it’s also important that people maintain their coverage going forward. Keeping as many people as possible in the risk poolespecially when they’re healthy and not in need of immediate carekeeps premiums affordable. And while health insurance coverage is certainly not cheap, it would be far more expensive if people could just wait to purchase coverage until they were in need of medical care.

Recommended Reading: How To Cancel Oscar Health Insurance

How Do I Avoid The Individual Mandate Tax

To avoid this penalty and protect yourself from the potential financial burden of unexpected medical expenses, you can enroll in a health insurance plan during the open enrollment period. For 2021 coverage, the national open enrollment period will take place from November 1st 2020 through December 15th 2020. Some states have extended this period. To learn about your states open enrollment period, read our article, 2021 Obamacare Open Enrollment Dates by State.

If you lose your insurance in the middle of the year, you may qualify for a special enrollment period to purchase an ACA-compliant plan on the public exchange. You may buy an ACA-compliant plan outside the public exchange anytime. Depending on which state you live in, you may be able to enroll in short-term health insurance to help fill any coverage gaps you may experience throughout the year.

Your health and financial well-being are important to us. As the largest online health insurance broker, eHealth offers a variety of health insurance plans to fulfill your coverage needs, wherever you live in the United States. These include on and off exchange ACA-compliant plans, major medical insurance, and short-term health insurance. Let us help you explore your coverage options now. Simply click Individual & Family Health Insurance to find affordable insurance. Our licensed insurance agents are here to help you and share their expertise as you consider your choices.

Individual Mandate Penalty Repeal

Former President Trump campaigned on a promise to repeal the ACA and replace it with something else. Republicans in the House passed the American Health Care Act in 2017 but the legislation failed in the Senate, despite repeated attempts by GOP Senators to pass it.

Ultimately, Republican lawmakers passed the Tax Cuts and Jobs Act and President Trump signed it into law in December 2017. Although the tax bill left the rest of the ACA intact, it repealed the individual mandate penalty, as of 2019 .

Although Congress did not repeal anything other than the mandate penalty , a lawsuit was soon filed by a group of GOP-led states, arguing that without the penalty, the mandate itself was unconstitutional.

They also argued that the mandate was not severable from the rest of the ACA, and so the entire ACA should be declared unconstitutional. A federal judge agreed with them in late 2018.

An appeals court panel agreed in late 2019 that the individual mandate is not constitutional, but sent the case back to the lower court for them to decide which provisions of the ACA should be overturned.

The case ultimately ended up at the Supreme Court, where the justices ruled in favor of the ACA. So although there is still no federal penalty for being uninsured, the rest of the ACA has been upheld by the Supreme Court .

You May Like: Is Cigna Health Insurance Any Good

What If I Have Concerns About Affording Health Insurance

Health insurance can be expensive, but the good news is there are quality health insurance plans available at an affordable rate. The even better news is that you may qualify for a new subsidy program for low and middle income California residents.

In the past, individuals that earned between 138% and 400% of the federal poverty level were eligible for federal tax credits through Obamacare. The new California program will extend premium tax credits for taxpayers who make between 400% and 600% of the federal poverty level. This means individuals who make between $50,000 and $75,000 per year will qualify for subsidies and families who make between approximately $103,000 and $154,500 per year will qualify as well. The state subsidies will be offered in addition to any federal tax credits in which an individual is eligible.

Take advantage of the current open enrollment season to research your potential health insurance options and avoid tax penalties in the future. Freeway Insurance can determine if you qualify for a health care subsidy to cover some of your health insurance costs. Give us a call at or request a free California health insurance quote online.

Health Insurance Financial Assistance

California will become the first state to offer financial assistance to middle-income residents who make between 400% and 600% of the federal poverty level. Thats about $50,000 and $75,000 a year for an individual and about $103,000 and $154,500 for a family of four.

The state-funded subsidy will help residents who have previously struggled to pay their health insurance premiums because they were not eligible for assistance.

Covered California estimates that the new subsidy, in conjunction with the new state tax penalty, will result in 229,000 newly insured Californians.

The revenue from the health insurance penalty, in addition to other state funds, will help pay for the subsidies for roughly 922,000 people who purchase insurance through Covered California. The new state financial assistance will be in addition to federal financial aid that some will receive through Covered California.

State residents whose annual household income is less than 138% of the federal poverty level will see premiums for specific plans lowered to just $1 per person, per month. The 2020 earnings cutoff for this level is $17,237 for an individual and $35,535 for a family of four.

Recommended Reading: What Type Of Health Insurance Do I Need

I Just Cant Afford Insurance Options What Can I Do

Find out if you qualify for Medicaid. Medicaid is a state-based assistance program for people under the age of 65. Patients usually pay no part of costs for covered medical expenses, although a small copayment may be required.

Each state sets its own guidelines regarding eligibility and services so you should contact your local Medicaid office directly.

Is There A Fine For Not Having Health Insurance

The Affordable Care Act, also called ObamaCare, went into effect in 2010. In the law, there was an Individual Mandate written in, which made it a requirement for all Americans to carry a health insurance plan or else theyd be penalized by the federal government during that years tax season. In December 2017, the new tax legislation repealed the tax penalty so that for the year 2019, there was no federal tax penalty. However, a few states had their own Individual Mandate in place and plan to have it in place next year too.

Read Also: Is Priority Health Good Insurance

No Longer A Question On Federal Tax Return About Health Coverage

From 2014 through 2018, the federal Form 1040 included a line where filers had to indicate whether they had health insurance for the full year .

But since 2019, Form 1040 has no longer included that question, as theres no longer a penalty for being without coverage.

But state tax returns for DC, Massachusetts, New Jersey, California, and Rhode Island do include a question about health coverage. , in order to try to connect uninsured residents with affordable coverage. Colorados tax return will have a similar feature as of early 2022 .

In addition, nothing has changed about premium subsidy reconciliation on the federal tax return. People who receive a premium subsidy will continue to use Form 8962 to reconcile their subsidy. Exchanges, insurers, and employers will continue to use Forms 1095-A, B, and C to report coverage details to enrollees and the IRS.

Exemptions From Health Insurance Requirement

There are a number of exemption provisions under which you may avoid the requirement to have health insurance. These provisions include:

- Unaffordable careif minimum coverage would cost more than 8 percent of your household income, you may qualify for an exemption.

- No tax filing requirementhaving an income below the Internal Revenue Service’s filing threshold exempts you from the coverage requirement.

- Hardshipif you experience a hardship that prevents you from getting coverage, the Health Insurance Marketplace may certify your exemption. Situations include those whose pre-existing health coverage was canceled due to the ACA.

- Short coverage gapsif your coverage lapses for less than three consecutive months, you will not be charged a fee for the uninsured time.

- Membership in an exempt groupNative American tribes, prisoners, undocumented immigrants, members of health care sharing ministries and those whose religious beliefs prevent them from having insurance are exempt from the requirement to be insured.

Not sure if you are exempt from the tax penalty or from the requirement to purchase health insurance? See “Are You Exempt From Health Care Coverage?” to help determine whether you might be eligible to waive the tax penalty entirely and apply for a health care exemption.

You May Like: How Much Are Employers Required To Pay For Health Insurance

Similarities & Differences Between Traditional Ira Roth Ira &

In 2006, the Massachusetts legislature passed the Health Care Reform Act, requiring almost all of its citizens to obtain minimum levels of health insurance or face penalties. The law requires the majority of state residents over age 18 who meet minimum income standards to purchase health care coverage or pay penalties when filing state tax returns. The state requires enrollment in plans meeting its minimum creditable coverage levels. If you don’t enroll, you’ll face monthly penalties.

Individual Mandate Exemptions: Still Important If You Want A Catastrophic Plan

Although there is no longer a federal penalty for being uninsured, the process of obtaining a hardship exemption from the individual mandate is still important for some enrollees. If you’re 30 or older and want to buy a catastrophic health plan, you need a hardship exemption.

You can obtain the hardship exemption from the health insurance exchange , and you’ll need the exemption certificate in order to enroll in a catastrophic health plan. These plans are less expensive than bronze plans, although you can’t use premium subsidies to offset their cost, so they’re really only a good choice for people who don’t qualify for premium subsidies.

Although there is no longer a federal penalty associated with the individual mandate, you still need to obtain a hardship exemption from the mandate if you’re 30 or older and you want to buy a catastrophic health plan.

Recommended Reading: What To Do When You Lose Your Health Insurance

What Is The Individual Mandate

The health insurance marketplacesestablished by the AffordableCare Act provide coverage to 11.41 million consumers, according to anApril 2020 report from the Centers for Medicare & Medicaid Services .

Prior to 2020, if you went without Affordable Care Act compliant health insurance for more than two consecutive months, you would pay a penalty. This requirement was commonly known as the Obamacare individual mandate. The purpose of the penalty was to encourage everyone to purchase health insurance if they werent covered through their employment or a government-sponsored program. According to Kaiser Health News, the federal ACA penalty for going without health insurance in 2018 was $695 per uninsured adult or 2.5% of your income, whichever amount was higher.

In response to concerns about the affordability of marketplace ACA plans, congress passed the Tax Cuts and Jobs Act at the end of 2017. The law reduced the individual penalty of the Obamacare individual mandate to zero dollars, starting in 2019. Now that the individual mandate tax penalty has been removed, there is not a tax penalty at the federal level.

Do You Have To Get Health Insurance

Learn whether you must have health coverage under the Affordable Care Act in your state.

As we head into open enrollment for 2021 insurance plans, the Affordable Care Act is still the law of the land. And, technically speaking, the law still says that you must have health insurance. But — and this is a big but — the tax penalty for going without health insurance has been reduced to zero.

Read Also: Does Short Term Health Insurance Cover Pre Existing Conditions

Preventative Care And Early Intervention

When you don’t have insurance, you may avoid getting treated for minor issues which can escalate into bigger problems quickly. Preventive medicine and quick treatment are the best ways to avoid expensive hospital stays.

If you have insurance, then you won’t need to worry about this as much. Additionally, if you put off going in for treatment and wind up developing a serious medical condition, you may have a difficult time finding health insurance after you have not had any for so long.

The Importance Of Health Insurance

Health insurance provides regular, preventive care for you and your family to stay healthy and prevent illness. Medical bills are the number one cause of bankruptcy and can reach into the millions of dollars. Having quality health coverage gives you peace of mind knowing that if an accident or illness strikes you and your family are protected from a lifetime of financial burden.

Also Check: What Is The Most Affordable Health Insurance

When Is California Open Enrollment

The open enrollment period to sign up for health care coverage with Covered California is Oct. 15, 2019, through Jan. 15, 2020. If you dont have health insurance, this is the time to sign up to avoid having to pay the health insurance penalty.

If you are currently uninsured, you can use Covered California to compare plans and enroll in a plan that meets your needs.

If you already have health insurance, you will be automatically re-enrolled in your existing plan if it is still available. If your plan is discontinued, you will be enrolled in a plan deemed similar by Covered California. Open enrollment is a time for you to review your coverage, compare plans, and switch to a new health insurance plan if you find a better option.