Does The Affordable Care Act Cover Individuals With Mental Health Problems

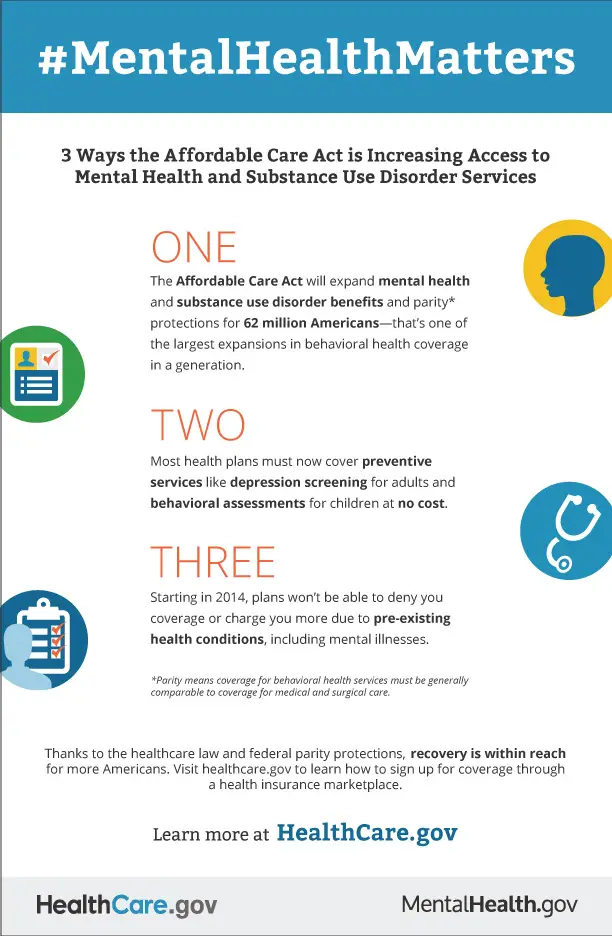

Yes. The Affordable Care Act provides one of the largest expansions of mental health and substance use disorder coverage. The law requires that most individual and small employer health insurance plans, including all plans offered through the Health Insurance Marketplace cover mental health and substance use disorder services. Also required are rehabilitative and habilitative services that can help support people with behavioral health challenges.

Still Work To Be Done

The ACA has dramatically increased coverage for behavioral health treatment. But the National Alliance on Mental Illness continues to bring attention to the challenges people face in obtaining mental health care, despite the changes that the ACA imposed.

Although insurance coverage with behavioral health benefits is much more widespread than it used to be, access to care is still limited in some circumstances. In many states, theres a shortage of mental health providers, which is magnified in rural areas. Shel Gross noted that two- to three-month wait times are not uncommon when new patients are seeking an appointment with a psychiatrist.

A 2017 Milliman study found that mental health care is much more likely than other medical care to be provided out-of-network, and insurers tend to reimburse mental health providers less than they reimburse primary care providers. Largely as a result of what the providers see as low reimbursement rates, nearly half of private psychiatrists in the US dont accept any health insurance at all theyre out-of-network no matter what insurance the patient has. When Milliman revisited this issue in 2019, they found that the out-of-network problem was persisting, and appeared to be worse than ever.

The mental illness with the highest mortality rate is anorexia nervosa. And yet patients continue to face insurance-related barriers that prevent them from receiving residential treatment for anorexia.

Do Any Health Insurance Plans Cover Marriage Counseling Or Couples Therapy

The short answer here is that some health plans cover marriage counseling, but most do not.

Many health plans that say they cover couples therapy actually cover something quite different from marriage counseling. What they usually cover is a procedural code that allows a spouse to be present in therapy.

There is a procedural code for Counseling for Marital and Partner Problems. But insurance companies tend to reject it for not being medically necessary.

Make sure to contact your insurer before you schedule a couples therapy session. Do this even if it seems obvious your health plan covers such treatment. If you dont, you may have to pay the resulting bill out of your own pocket.

Don’t Miss: Do Veterans Get Free Health Insurance

Are All Mental Health Diagnoses Covered By The Parity Law

Unlike some state parity laws, the federal parity law applies to all mental health and substance-use disorder diagnoses covered by a health plan. However, a health plan is allowed to specifically exclude certain diagnoseswhether those diagnoses are considered to be in the physical/medical realm or behavioral/mental health. Any exclusions should be made clear to you in your plans description of mental health benefits. If you are uncertain ask your insurance company.

Mental Health Coverage In California

Since 2010, mental health coverage has been considered essential, and all California and federal health care plans cover mental health and substance use disorders. Thanks to the ACA, you cant be denied insurance coverage due to pre-existing mental health conditions or be charged a higher rate than those without. Under the ACA mandate, you must:

- Be enrolled in a qualified health plan.

- File an exemption mandate when filing taxes.

- Pay a penalty for being uninsured .

Each health care coverage plan has a different open enrollment period for new patients. Plans under the Affordable Care Act have Open Enrollment Periods from November 1 through January 15 annually. To have coverage for the beginning of the year, you must enroll in a plan before December 15th. Medicare enrollment has its Open Enrollment Period every year from October 15 to December 7.

You May Like: How Do I Choose The Best Health Insurance Plan

Find The Right Mental Health Treatment Provider

Depending on your insurance coverage, youll have different in-network options available. When you find a behavioral health provider, make a preliminary appointment and see whether this treatment provider is right for you. When making an appointment, be sure to ask the following questions:

- Does the practice accept your insurance, or is it out of network?

- Are there limits on coverage due to specific diagnoses?

- How many sessions does the practice allow per year?

- Is the practice currently accepting new patients?

- Do the mental health care providers specialize in the help you need?

- Do the practice hours work with your schedule?

- Do you feel like your needs are being addressed and you are receiving a therapeutic outcome?

- Is your provider respectful of your experiences and cultures?

- Does the provider pay attention to you and speak in accessible terms you can understand?

- Do they lay out treatment options clearly and listen to your input?

- Does your provider give you in-depth information and expectations about your prescriptions?

- Does your provider give you a concrete follow-up plan?

Can You Be Denied Coverage For Health Reasons

If you choose health insurance covered by the Affordable Care Act, you cannot be denied coverage for pre-existing medical conditions.

However, if you opt for short-term health insurance or any policy offered outside of the government Marketplace, different rules apply, and you can be denied coverage for health reasons.

Recommended Reading: What Is The Deadline For Health Insurance Open Enrollment

The Roadmap To Better Mental Health

Its essential to remember that behavioral health conditions are common and can affect people of all ages, races and genders. The first step to treating mental issues is to remember they arent your fault and are an illness just like any other. By understanding your options and reaching out to a provider, you can start on the path to improving your mental health.

If you dont know where to begin, use the following steps as a roadmap to better behavioral health:

How Do I Find An In

Many therapists list on their website which insurances they accept. Directory websites list providers by location and allow you to filter by your presenting concern to help you find a therapist who takes your insurance and is trained to help you with your unique challenges.

You can also call your insurance company or visit the company’s website and ask for the names of therapists in their network. Although the company typically will not have information on the therapist’s specialization, this is a good starting point.

Is the therapist that specializes in your issue out-of-network? Sometimes, insurance companies limit how many therapists they will accept on their panel at a time, and therapists who want to accept your plan are unable to. You can call the company and ask them to panel more therapists.

You May Like: What Job Has The Best Health Insurance

Why Your Health Insurance Doesnt Cover Mental Health Services

This post is dedicated to the lovely Alison, my die-hard Batman buddy and good friend. She was asking me the other day about why health insurance doesnt cover mental health services .

I confessed that I didnt know too much about it, so Im writing this blog post as an answer to her question. I found out all I could about mental health related services and why they dont seem to be covered by most insurances.

First off, there has been legislation passed to ensure mental health and addiction services are covered as equally as other health services. Its called the Mental Health Parity and Addiction Equity Act, and it was passed in 2008. This act is meant to force insurance companies and healthcare providers to treat mental illness without discrimination in terms of coverage and importance. Unfortunately, it hasnt been implemented.

With the Affordable Care Act passed, those insured through both online marketplaces and private insurance were supposed to receive more coverage for mental health services, yet they didnt. The final rules of the act remain undefined, as well as the definition of what exactly a parity for mental health care is.

There are also issues with claims being denied, such as this instance noted by USNews.com:

Using Your Mental Health Coverage

Check with your human resources department or insurance company for specific details about your coverage. Here are some important points to consider:

The full text of articles from APA Help Center may be reproduced and distributed for noncommercial purposes with credit given to the American Psychological Association. Any electronic reproductions must link to the original article on the APA Help Center. Any exceptions to this, including excerpting, paraphrasing or reproduction in a commercial work, must be presented in writing to the APA. Images from the APA Help Center may not be reproduced.

Recommended Reading: Where To Get Short Term Health Insurance

Q: Does The Affordable Care Act Require Insurance Plans To Cover Mental Health Benefits

Answer: As of 2014, most individual and small group health insurance plans, including plans sold on the Marketplace are required to cover mental health and substance use disorder services. Medicaid Alternative Benefit Plans also must cover mental health and substance use disorder services. These plans must have coverage of essential health benefits, which include 10 categories of benefits as defined under the health care law. One of those categories is mental health and substance use disorder services. Another is rehabilitative and habilitative services. Additionally, these plans must comply with mental health and substance use parity requirements, as set forth in MHPAEA, meaning coverage for mental health and substance abuse services generally cannot be more restrictive than coverage for medical and surgical services.

Huge Challenges Of Covering Mental Health

In 2013, a person with a bipolar diagnosis was unable to obtain private individual health insurance in most states. The same was true for people with schizophrenia and other psychotic disorders, anorexia, alcoholism, and a variety of other serious mental or behavioral illnesses.

Even for people with relatively minor mental health diagnoses, health plans were allowed to increase premiums during the initial underwriting process, and some would still reject these applicants.

The underwriting rules that applied to mental health treatment often trapped people in the health plan they had when they were diagnosed, with no realistic opportunity to shop around when annual rate increases were announced. And for people who were uninsured at the time of their diagnosis, securing coverage was challenging and expensive or impossible, depending on where they lived.

For those who had insurance, it often didnt cover mental health care. According to a 2013 analysis conducted by HealthPocket, only 54 percent of individual health plans in the United State included coverage for substance abuse treatment, and 61 percent covered mental health treatment.

Read Also: Is It Cheaper Not To Have Health Insurance

What Needs To Be Done About Mental Health:

Mental health should not be overlooked you should ask your insurance broker about it when looking for a new plan. It is often the case that in times of great distress we tend to focus on the physical and neglect the mental aspects of our health. The assumption is always made that the priority must lie with the physical health, while mental health is almost regarded as almost extra-curricular in a sense it is often perceived as being a bonus and often left unaddressed until major problems begin to arise, and even then those are often left unchecked.

There is an intense amount of psychological strain being put on the average person during periods of quarantine. From the anxiety of worrying about the safety of yourself and your loved ones, to the intense feeling of isolation when forced to distance yourself from society, to the potential degradation of preexisting conditions due to the strain of an uncertain future.

Reem Shaheen, Counseling Psychologist, Founder and Director of BE Psychology Center for Emotional wellbeing DMCC, said, It is unfortunate and sad that individuals today have to jump through hoops to get mental health coverage. In my practice, I see lots of people withdraw from therapy, or dont even engage in therapy because of lack of coverage.

Which Plans Cover Therapy

Whether you have insurance or are looking for insurance, below are the types of health insurance that are affected by the parity law.

Employer-sponsored health coverage. If you have insurance from your company, and there are more than 50 employees, your health insurance is required to provide equal mental health services to you.

Health insurance purchased under the Affordable Care Act. By purchasing health insurance through an exchange under the health care reform law, you have greater access to mental health services.

The Affordable Care Act helped more than 21 million Americans get access to health coverage. This included classifying mental health services as an essential health benefit.

Childrenâs Health Insurance Program . This insurance program is designed specifically for families with children who donât qualify for Medicaid.

Medicaid programs. Most Medicaid programs are required to give you equal access to mental health care. These requirements could change depending on your program.

Read Also: Where Can I Find Cheap Health Insurance

Health Insurance: Behavioral Health Services

Your insurance plan may offer behavioral health benefits. In New York State, most insurance plans must follow State and Federal laws that protect your right to equal access and coverage of behavioral health services compared with other medical services.

If your insurance plan is covered by those laws, then any treatment for mental health and substance use disorders should be covered at the same level as other medical services. This is called behavioral health parity.

Need For Health Insurance In Psychiatry

According to the recently concluded NMHS 20152016, common mental disorders including depression, anxiety disorders, severe mental disorders, and substance use disorders are a huge burden affecting 11% of the population anytime. Despite the availability of effective treatment for these disorders, a huge treatment gap exists for common mental disorders, the highest being 86.3% for alcohol use disorders. Treatment gaps for major depression and neurosis were identified to be 85.2% and 83.2%, respectively. Among the various factors thought to have an impact on treatment gap, affordability of care was identified as one critical factor influencing treatment utilization.

In this context, the inclusion of psychiatric disorders under the ambit of insurance will no doubt contribute toward reducing the treatment gap by covering for the financial risks that families need to endure. Although traditionally psychiatric disorders have been kept out of the health insurance schemes, the enactment of MHCA 2017 has brought in a welcome change in the scenario. Over the next few paragraphs, we would give a glimpse of the positive developments in this area.

Read Also: What Is The Best Hmo Health Insurance

Does Depression Disqualify You From Life Insurance

Life insurance companies may decline policies to people suffering from a range of mental health conditions. As is always the case with just about any kind of health condition, criteria vary from insurance company to insurance company. Consequently, there is no general rule when it comes to depression and anxiety.

Check Your Insurance Account Online

If you havent already done so, register your online account. Most insurance plans have websites with information about coverage and any related costs you should be aware of. Because there are dozens, if not hundreds of plans out there, its important to make sure that youre looking at your exact insurance plan.

Take note of whether you should be looking for a therapist or provider who is in your plans network, or if there are additional fees if you go out of network.

Pro tip: Call the therapist or doctor youre considering seeing and ask them for the Tax ID number that they bill with. This will help your insurance provider find them in their system so you can make absolutely sure theyre in-network.

Don’t Miss: What Happens If I Don T Have Health Insurance

Q: What Is The Health Insurance Marketplace

The Health Insurance Marketplace is designed to make buying health coverage easier and more affordable. The Marketplace allows individuals to compare health plans, get answers to questions, find out if they are eligible for tax credits to help pay for private insurance or health programs like the Childrens Health Insurance Program , and enroll in a health plan that meets their needs. The Marketplace Can Help You:

- Look for and compare private health plans.

- Get answers to questions about your health coverage options.

- Get reduced costs, if youre eligible.

- Enroll in a health plan that meets your needs.

Learn more at HealthCare.gov.

Mandatory As Per The Law

One of the primary benefits of health insurance for mental disorders is that it is compulsory to be included in the health insurance coverage as per the Mental Health Act, 2017. Insurers must offer coverage to persons diagnosed with mental illness. There are provisions in the policy to offer coverage for patients suffering from mental health disorders.

Read Also: What Health Insurance Covers Viagra

Who Should I Talk To If I Think My Insurance Company Is Violating The Parity Law

If you have concerns that your plan isnt complying with the parity law, ask your human resources department for a summary of benefits to better understand your coverage, or contact your insurance company directly. Your human resource department can provide you with information about your coverage and may be able to put you in touch with a health care advocate who can assist in making an appeal. If other employees are having similar issues, your HR department may wish to keep track of the problems and work with the insurance company to ensure that benefits are meeting employee needs.

If you do not have an HR department or if your insurance is not provided by your employer, you may wish to speak with the insurance company directly. To reach out to your insurance company, check for a customer service number on the back of your insurance card. If you obtained your insurance through an insurance exchange, you may be able to get help from your state insurance commissioner.

If you still have unanswered questions or wish to file a parity complaint, visit the U.S. Department of Health and Human Services to find the appropriate agency to assist. You can also call the EBSA toll-free consumer assistance line at 444-3272. The federal governments Consumer Assistance Program website is another good resource.