Where To Buy Private Health Insurance

You can purchase an ACA plan at Healthcare.gov through Aug. 15, 2021, in most states, or beginning again Nov. 1 each year.

You can buy a private marketplace plan directly from an insurance company or insurance broker at any time. Search online for carriers and brokers, and compare several different plans and premium costs to find the right product for you.

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

The silver plan falls around the middle, with moderate deductibles, copays and coinsurance. The catastrophic and bronze plans offer the smallest amount of coverage, while platinum plans offer the greatest.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with platinum plans being the most expensive and catastrophic and bronze plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on the tier. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

What Is The Cost Of Family Planning Without Insurance

If you require pre-natal care, the average cost of a doctor’s visit is between $100 and $2,000+. This adds up to a big total throughout even a single pregnancy. Should you go into labor and need assistance delivering your baby, this will cost anything from $2,700 up to and over $40,100.

Surgery in the form of a cesarean section costs between $10,600 and $50,500+. A postpartum check-up costs between $100 and $3,100+. If you have any birth complications, this tends to cost $3,000+ per day. And the average length of stay in the NICU is 20 days, meaning that you could potentially face a $60,000+ bill at the end of all your troubles.

Also Check: Does Coldwell Banker Offer Health Insurance

Core Provisional Plan Coverage

They are also required to provide medically required physician services rendered by medical practitioners. There is no legal provision that the services all be rendered by a doctor. In fact, practitioners make up the majority of caregivers.

The law also requires that the provinces and territories extend medically necessary hospital and physician coverage to eligible residents traveling through reciprocal agreements with other provinces. These agreements protect Canadians from being presented with a bill for services in case of an accident or illness.

What Influences Aca Plan Costs

Individual health plans and plans on the Affordable Care Acts Health Insurance Marketplace request key information from people when determining health insurance costs.

“Health insurance costs will vary significantly depending on your age, geography, family status and tobacco use,” notes Brian Martucci, a Minneapolis-based personal finance expert with Money Crashers.

Plans cant reject you or charge higher rates because of pre-existing conditions. The ACA ended that practice.

“Generally speaking, young, healthy non-smokers enjoy the lowest health insurance premiums, while older adults pay more — especially on the individual market,” says Martucci.

Chris Orestis, the president of Life Care Xchange and a nationally recognized health care expert, echoes those thoughts.

“Our current system rewards people for being younger and healthier in both group or individual coverage. But the differences are much starker for individual coverage,” says Orestis.

The ones who tend to pay the most overall are older folks who don’t yet qualify for Medicare – such as 64-year-olds, Darr says.

Franke says individual plan insurers can only charge an older person three times what it charges a younger person.

“For instance, in Seattle, a 64-year-old will pay 300% more than a 21-year-old for a Silver plan. That could mean the difference between paying about $900 per month versus $300 per month, respectively,” Franke adds.

Also Check: How Do You Get Health Insurance

Types Of Individual Health Insurance

When shopping for a private health insurance policy, you can pick from two main sources offering plans:

- The federal marketplace

- Directly from a health insurance company

The federal marketplace offers Affordable Care Act -compliant plans available on the federal health exchange at Healthcare.gov. These are often referred to as “Obamacare” plans.

These health plans offer comprehensive covered benefits, including the 10 essential health benefits, such as mental health, prescription drug, outpatient and preventive care. No pre-existing condition exclusions apply, which means you cant get denied because of your health. The Department of Health and Human Services has a marketplace exchange website where you can compare plans. About a dozen states have their own marketplace exchange and site.

“ACA plan premiums are usually very low if you qualify for a payment discount or tax credit based on your household’s annual income,” Bartleson says. “But if you don’t qualify for a subsidy discount, your premiums may be more expensive than other health care options. Also, many of the plans’ networks are local HMO plans with limited options, and you are usually limited to apply only during the open enrollment period — unless you have a life-changing event like moving, getting married, or losing an employer-sponsored health plan.”

The ACA marketplace offers several different types of plans, including:

- Platinum

- Silver

- Bronze

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

Read Also: Does State Farm Offer Health Insurance For Employees

The Average Cost Of Health Insurance In 2022

Everyone knows that health care is expensive, but just how much is health insurance for one person? The average health insurance cost per month for a 40-year-old individual is $477, or nearly $6,000 per year. However, keep in mind that premiums vary widely based on where you live, along with your age, family size and type of insurance plan.

This national average is for private health insurance you buy on the governments Health Insurance Marketplace created by the Affordable Care Act, often called Obamacare.

MoneyGeek researched national data and analyzed how health insurance rates change based on the type of insurance plan, the number of people covered and the location of that coverage, among other factors.

Many Americans qualify for subsidies that make buying health insurance on the Marketplace more affordable. You may also have lower-cost options if your employer offers health benefits or you’re eligible for government insurance programs such as Medicaid or Medicare, which offer comprehensive plans like Medicare Advantage for affordable prices.

Key Takeaways

The average health insurance premium for a 40-year-old is $477 per month.

Age, location, family size and plan type are all influential factors in the cost of health insurance.

How We Conducted This Study

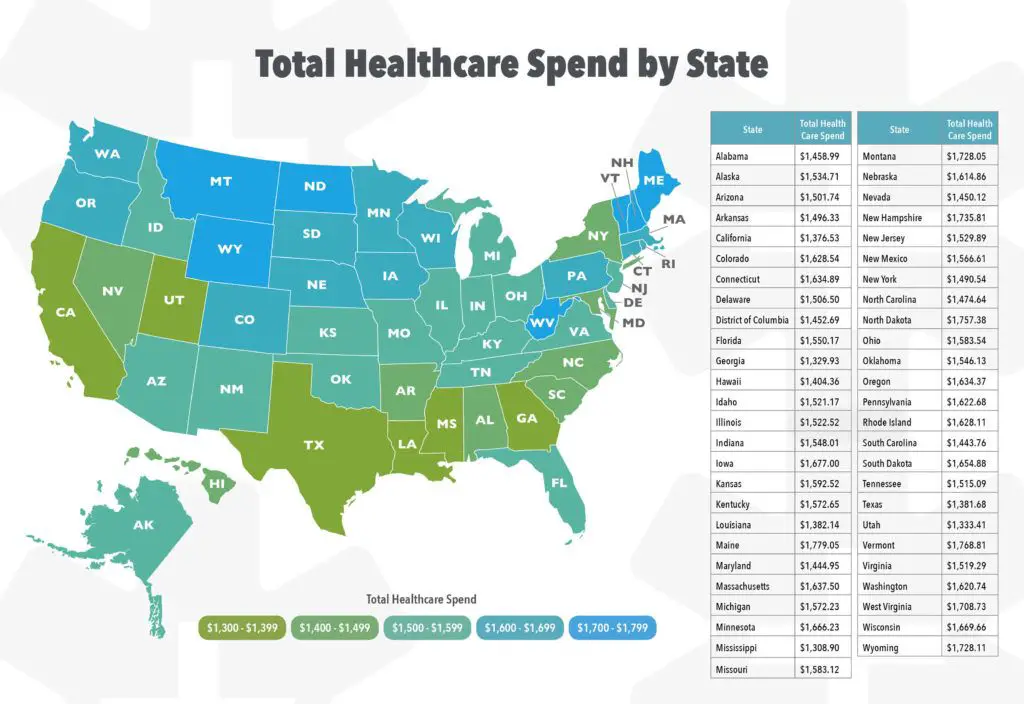

This Commonwealth Fund report uses data from the federal Medical Expenditure Panel SurveyInsurance Component to look at two trends in employer coverage over the last decade: how much workers are paying, on average, in premiums and deductibles, and the size of these costs relative to median income in each state. The MEPSIC is the most comprehensive national survey of U.S. employer health plans, surveying more than 40,000 private sector employers in 2020 with an overall response rate of 56.1 percent.

Total premium and deductibles are compared with median household incomes for the under-65 population in each state. Income data come from the U.S. Census Bureaus Current Population Survey of households analysis of CPS data performed by Mikaela Springsteen and Sherry Glied of New York University for the Commonwealth Fund.

Publication Details

Also Check: Does My Health Insurance Cover Eye Exam

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

- $170$3,501

Tips For Reducing Health Insurance Costs

Shopping and doing the research to find the best health insurance are important, because your situation and medical expenses play large roles in what you get out of your health insurance plan.

- A health savings account may help you save money on your medical spending if you have a qualifying high-deductible plan to go with it.

- Compare the out-of-pocket costs for different plans. Out-of-pocket costs may include deductibles, copays, and coinsurance.

- Create a checklist of what is important for you or your family, and compare how each plan fits with what you are looking for.

- Make sure your plan allows you access to the providers you want. If you choose a plan with a limited provider network, you may find it harder not to rack up additional costs for using out-of-network providers.

- If both you and your spouse have access to health insurance, consider using coordination of benefits to leverage your coverage and potentially reduce costs.

- If you foresee costs, such as those related to mental health needs or pregnancy in the near future, review your health insurance options with your family’s needs and plans in mind. Some health insurance plans may have better coverage for pregnancy and childbirth than others.

Recommended Reading: Does Health Insurance Cover Personal Training

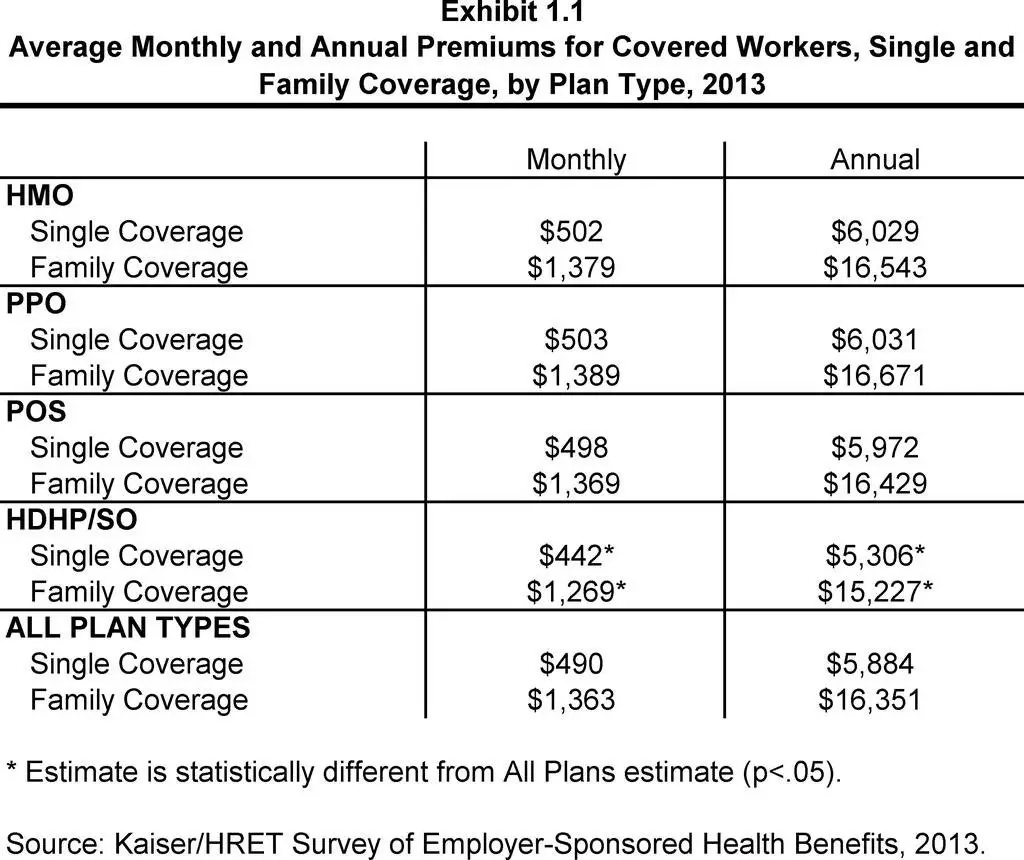

Section : Cost Of Health Insurance

The average annual premiums in 2021, are $7,739 for single coverage and $22,221 for family coverage. Over the last year, the average premium for single coverage increased by 4% and the average premium for family coverage increased by 4%. The average family premium has increased 47% since 2011 and 22% since 2016.

This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time:

PREMIUMS FOR SINGLE AND FAMILY COVERAGE

Figure 1.1: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Plan Type, 2021

Figure 1.2: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Firm Size, 2021

Figure 1.3: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Firm Size, 2021

Figure 1.4: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Region, 2021

Figure 1.5: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Industry, 2021

Figure 1.6: Average Annual Premiums for Covered Workers With Single Coverage, by Firm Characteristics, 2021

Figure 1.7: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Characteristics, 2021

Figure 1.8: Average Annual Premiums for Covered Workers, by Firm Characteristics and Firm Size, 2021

PREMIUM DISTRIBUTION

PREMIUM CHANGES OVER TIME

What Could Prescription Drugs Cost

American healthcare prices are also high when it comes to prescription medication. If you have diabetes and need insulin, you could be facing a cost of $530 to more than $1,100+. A years worth of allergy shots will set you back $600 to $2,000+. If you require cholesterol medication, you could see a $30 to $130 bill. Asthma inhalers cost between $60 and $70+. Prescription drugs can become a big part of a patient’s budget.

You May Like: How Much Is Kaiser Health Insurance In California

Plans Available Directly From Health Insurance Companies

The ACA marketplace isn’t the only place to turn for health insurance. You can also price out individual health insurance coverage options directly from health insurers like Aetna, Cigna, and Blue Cross Blue Shield.

“With direct private plans, your premiums may be less expensive than for an unsubsidized ACA plan. You can typically apply for coverage outside of the open enrollment period, doctor and hospital networks are usually PPOs available nationwide, and there’s a wide array of options you can choose from to tailor coverage that best suits the needs of you and your family,” notes Bartleson.

Overall, private policies usually offer more choices when it comes to providers and plan types.

“Plans off the ACA marketplace tend to have less strict rules. They can often be a little cheaper and tend to be curated offerings to particular subsets of the population,” says Marshall Darr, vice president of marketing for Decent. “Realize that you may have to pass medical underwriting requirements to qualify for a private plan, however.”

Be aware, as well, that many of these private marketplace plans may not cover all health/medical conditions or provide the same level of built-in protections as Obamacare plans.

As with federal marketplace plans, private marketplace policies usually come in different flavors — like PPO, HMO, or POS — and tiers such as Platinum, Gold, Silver, and Bronze.

Plus Potential Ways To Reduce Your Premium

Open enrollment for health insurance planswhether it’s an employer-sponsored plan or an Obamacare plan you buy through a federal or state healthcare exchangegenerally takes place in the last two or three months of the year. Unless you have a qualifying life event such as getting married or losing your job at a different time of the year, open enrollment is the time to shop around to ensure that youre paying the best price for the right coverage.

It helps to first understand what average premiums are, how the rates have changed over the past few years, and ways you can reduce your monthly premium.

Recommended Reading: Can I Pay For My Employees Individual Health Insurance

What Health Insurance Plan Is Best For International Students In Ontario

As an international or exchange student, you are not eligible for the Ontario Health Insurance Plan . This means you will need to purchase health care. Your school may mandate that you purchase coverage under the University Health Insurance Plan .

Schools that require students to have UHIP insurance include:

- Carleton University

What Is The Average Cost Of Health Insurance For A Family Of 4

Consumers buying for a family of 4 pay an average monthly premium of $1,437 for non-subsidized health insurance. This monthly premium cost reflects a modest increase from $1,403 in 2019.

Plan selection can affect monthly premiums. Usually the more coverage the plan offers, the higher your monthly premium. For family coverage , only the Bronze family plan premiums decreased between 2019 and 2020.

| Metallic Plans |

Read Also: What To Do If You Lost Your Health Insurance

Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

How Much Does Health Insurance Cost In The Usa

Date Published:

How much does health insurance cost? The cost of health insurance in the USA is a major talking point for Americans and visitors alike here, we explore the averages of health insurance costs and factors impacting policy fees. The USAs healthcare system is unlike many others, so we look at why the cost of average American healthcare insurance seems to be rising and how other nations compare.

Key takeaways:

- Age, geography, employer size and plan type all influence the cost

- Healthcare costs in the USA are partly due to administrative factors

- Fees are going up, with plan trends contributing

- Almost half of American adults were underinsured in 2020

- Voluntary health payments are higher in Switzerland than the USA, though Americas costs are among the worlds highest

- On the flipside, American expats abroad often find they pay less for insurance overseas

Read Also: Can A Daca Recipient Get Health Insurance

For Visitors To Canada

If you are an international traveler visiting Canada for a short trip or a stay of less than one year, a less comprehensive and more affordable travel insurance plan may be the best option. These travel medical insurance plans cover the costs of medical treatment for emergencies and illnesses that occur while traveling. They also offer additional benefits such as coverage for adventure sports, trip interruption, medical evacuation and transportation, and more.

If you also want to cover the cost of your trip, consider a trip cancellation plan.