Do I Qualify For Cost Assistance Through Covered California

If you make between 138 and 400% of the FPL areeligible for premium tax credits. In addition to qualifying for a subsidy, youwill also qualify for a California Silver Plan.

- If you make > 138to 150% of the FPL, you will qualify for the Silver Enhanced 94 Plan, which covers 94% of the average annualcost of health care.

- If you make > 150to 200% of the FPL, you will qualify for the Silver Enhanced 87 Plan, which covers 87% of the average annual cost of health care.

- If you make > 200to 250% of the FPL, you will qualify for the Silver Enhanced 73 Plan, which covers 73% of the average annual cost of health care.

The California Silver Plans are a popular choice because they tend to have affordable monthly premiums and mid-sized deductibles. They also have discounted fees for common medical services. The California Silver Plans may be best suited for those who are relatively healthy, mainly receive routine care during doctor visits, and take generic drugs.

You can compare the benefits and costs of the California Silver plans through e-Health, by checking out Individual and Family Health Insurance plans, selecting Affordable Care Plans, answering a few questions about yourself and your coverage aims, and letting us help you find the most affordable plans that match your needs.

How Can I Get Plan B For Free Is It Covered By Insurance

The price of Plan B typically ranges from $40 to $50, but you can order some generic brands for less. The brand shouldn’t matter Planned Parenthood notes that all brand-name and generic levonorgestrel morning-after pills are equally effective.

Still, “cost is the big barrier,” Shah said, adding that it’s important to know options to help with the price if needed.

Health insurance may aid with the cost. You can get morning-after pills for free with many insurance plans, including Medicaid in some states. But if you’re using insurance, it’s important to note that you will need a prescription by doctor or nurse so that the pill will be covered. Call your provider to confirm.

Some health centers, including Planned Parenthood, also offer morning-after pills for free or at lower costs.

Shah recommends buying one or two morning-after pills or getting a prescription in advance, that way you are prepared when you need it. Still, it’s important to note that these pills can expire, so check the information on the side of the box.

Undocumented Individuals Can Apply For Coverage On Behalf Of Documented Family Members

Immigrants who are not legally present may apply for medical coverage through Covered California on behalf of their lawfully present family members .

Additionally, Covered California encourages anyone who is lawfully present to apply for health insurance, even if some of their family members are undocumented. Families with mixed immigration status are encouraged to apply with the entire household on the application. Those that are undocumented need to mark no that they are not applying.

Recommended Reading: Does Starbucks Offer Health Insurance To Part Time Employees

Whats Covered California What Are My Options

Covered California was created to provide California residents with branded insurance under the Patient Protection and Affordable Care Act.

This exclusive and free service provides financial help to people who buy insurance from the most reputable American companies. At the time of your application, you can:

- Receive a discount on a health plan under Covered California

- Get insurance through the state Medi-Cal program

Whatever your situation, the health coverage youll get will be excellent.

What Is Plan B

A morning-after pill is an oral emergency contraception that you can take up to five days after unprotected sex to reduce risk of pregnancy.

There are two types of morning-after pills: levonorgestrel pills and the ulipristal acetate-based Ella pill. Plan B One-Step, or Plan B, is arguably the most well-known levonorgestrel pill in the U.S.

According to Planned Parenthood, taking a levonorgestrel morning-after pill within three days of unprotected sex can lower your chance of getting pregnant by 75-89%. In addition to Plan B One-Step, common brands include Take Action, Preventeza, AfterPill, Aftera, My Choice, My Way, Option 2 and EContra One-Step.

Recommended Reading: Starbucks Insurance Enrollment

Am I Eligible For The Northern Patient Transportation Program

You may be eligible for northern transportation subsidy to help pay for transportation costs if you live north of the 53rd parallel in Manitoba and are required to travel long distances for specialty medical care.

The Northern Patient Transportation Program subsidizes medical transportation costs for eligible Manitoba residents in the north to obtain medical or hospital care not available in their home community. Subsidies may include costs for an essential escort .

Program eligibility is limited to Manitoba residents who live:

- north of the 53rd parallel from the Saskatchewan boundary to the west side of Lake Winnipeg

- north of the 51st parallel from the east side of Lake Winnipeg to the Ontario boundary

- on Matheson Island, when ground travel is not possible by winter road or ferry

Travel must be approved a physician and meet program eligibility. Patients who have coverage from an insurer or funder are not eligible for this medical travel subsidy. Examples include:

- Employers

To process a transport request or for questions about the program, please contact your local office:

Thompson NPTP office

When And Where To Apply For Covered California Health Insurance

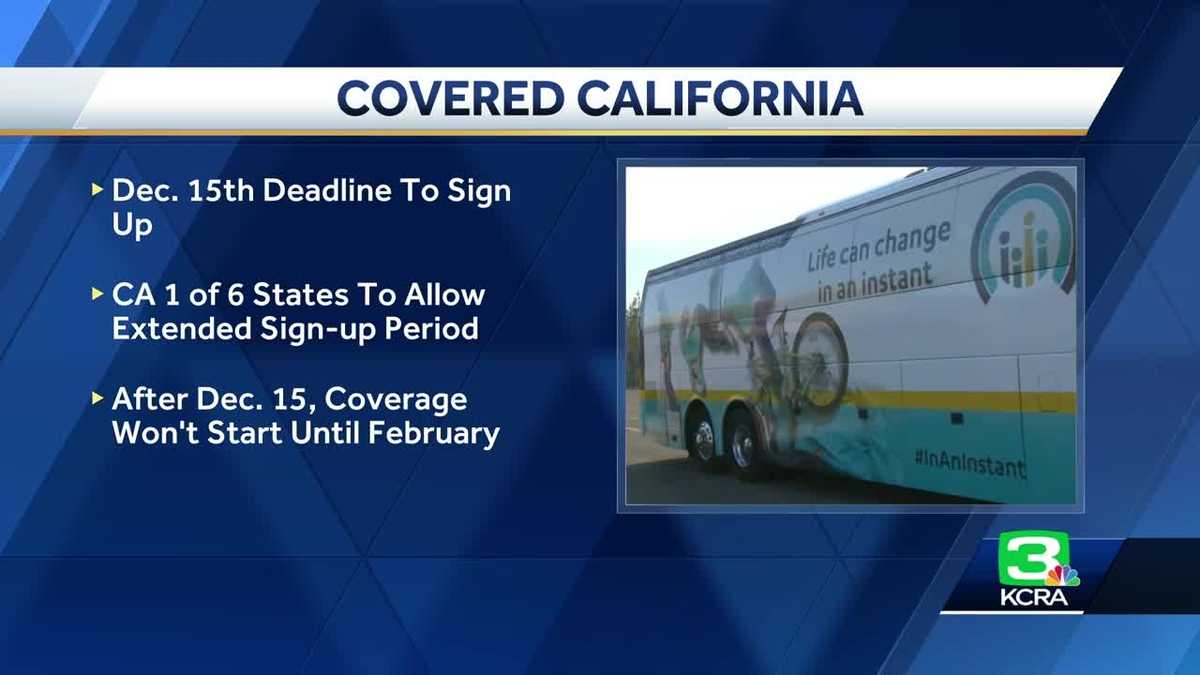

California will accept applications for 2019 from October 15, 2018 to January 15, 2019 through CoveredCA.com, eHealth.com, or any other broker or insurer in the state. The states open enrollment period is longer than the federal open enrollment period available to citizens in most other states. Medi-Cal applications are accepted at any time.You may also apply for ACA plans at any time if you experience certain life events that will qualify you for a Special Enrollment Period. These qualifying life events include:Loss of health coverage

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

- Turning 26 and losing coverage through a parents plan

Changes in household

- Having a baby or adopting a child

- Death in the family

- Moving to a different ZIP code or county

- A student moving to or from the place they attend school

- A seasonal worker moving to or from the place they both live and work

- Moving to or from a shelter or other transitional housing

Other qualifying events

- Changes in your income that affect the coverage you qualify for

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act Corporation shareholder

- Becoming a U.S. citizen

- Leaving incarceration

- AmeriCorps members starting or ending their service

You can browse previous articles on Covered California Open Enrollment to learn more about the open enrollment period.

Read Also: Starbucks Health Insurance Plan

Income Limits For Medi

Adults qualify for Medi-Cal with a household income of less than 138% of FPL. However, according to the Covered California income guide, children who enroll on Obama Care California plans may qualify for Medi-Cal when the family has a household income of 266% or less. The children must be under 19 years of age to qualify. Also, C-CHIP, the County Childrens Health Initiative Program, offers health care coverage for children when the family income is greater than 266% and up to 322% of FPL.

Special Enrollment For Californians Affected By Covid

During this time of national crisis, we know that thousands of people are affected by income and job loss, leaving many Californians without health insurance.

If youve recently been affected by COVID-19, you may qualify for Special Enrollment. Call our Certified Enrollment Counselors today at to see if you qualify.

Don’t Miss: Minnesotacare Premium Estimator

Am I Covered For Emergency Care Outside Of Canada

Doctor Bills Manitoba Health and Seniors Care will pay for emergency doctors services outside of Canada at a rate equal to what a Manitoba doctor would receive for a similar service.

Hospital Bills Emergency hospital care is paid on an average daily rate established by Manitoba Health and Seniors Care.

You may be charged more than the amount paid by Manitoba Health and Seniors Care for services provided outside Canada.

The difference above the covered amount may be substantial and is your responsibility.

Bring or mail your original bill to the Out-of-Province Claim Section at Manitoba Health and Seniors Care within 6 months of receiving care. If you have made payments on your bills, Manitoba Health and Seniors Care requires a receipt showing the amount paid. If you do not include your receipt, Manitoba Health and Seniors Care will pay the hospital or doctor directly.

For more information contact:

Manitoba Health and Seniors Care300 Carlton Street Business hours: Monday to Friday 8:30 to 16:30 For more information call: 204-786-7303Toll free: 1-800-392-1207 Ext. 7303TDD/TTY: 204-774-8618TDD/TTY Relay Service outside Winnipeg: 711 or 1-800-855-0511

NOTE: The in-person Registration and Client Services Office at 300 Carlton St., Winnipeg will be temporarily closed to the public to support social distancing efforts. Services will be available by telephone or email. More information can be obtained here.

Californias Health Insurance Scenario: Then Vs Now

The California health insurance exchange is also popularly known as Covered California. From their official website, collect more information about Covered California Plans.

As of February 2021, more than 1.5 million Californians have enrolled their name in ACA coverage. The estimate states, between 2013 and 2019, the percentage of Californians who went uninsured decreases from 17.2% to 7.7%.

However, the people who cannot enroll their names in Covered California plans are:

Therefore, the Covered California health insurance policy is the best and most successful state exchange out there.

You May Like: How To Keep Health Insurance Between Jobs

Did You Know Health Insurance Is Mandatory

If youre unaware, health insurance is required. If you fail to comply and purchase minimum essential coverage, there is a fee called the individual shared responsibility payment.

The fee is calculated a couple of different ways a percentage of household income or on a per person basis. YOU PAY THE HIGHER AMOUNT!

Percentage of Income

- 2.5% of household income

- The maximum is the total yearly premium for the national average price of a Bronze plan.

Per Person

- $347.5 per child under 18

- Maximum is $2,085

What Is Minimum Essential Coverage ?

This is the type of medical coverage Americans need to have in order to avoid the fees mentioned above.

Heres a list of the types of health insurance included in MEC:

- Employer-sponsored coverage

- Coverage purchased in the individual market, including qualified health plans offered by Affordable Insurance Exchange.

- Medicare Part A and Medicare Advantage plans.

- Most Medicaid coverage

- Childrens Health Insurance Program

- Certain types of veterans health coverage administered by the VA

- TRICARE

- Coverage provided to Peace Corps volunteers

- Coverage under the Non-appropriated Fund Health Benefit Program

- Refugee Medical Assistance supported by the Administration of Children and Families

Penalty For No Health Insurance

Just what are the tax penalties for not having health insurance in 2020? At the federal level, you wont be required to pay a dime. However, if you live in any of the following states, here are the penalties you may be facing:

California Health Insurance Penaltyâ

If you are a resident of the state of California, and dont have health insurance in 2020, you can expect a tax penalty of $695 per adult and $347.50 per child, or 2.5% of your annual income. Whichever is higher.

Massachusetts Health Insurance Penaltyâ

If you are a resident of the state of Massachusetts, and dont have health insurance in 2020, you can expect a tax penalty anywhere between $264 to $1,524. If you make under $18,210 a year, you will be exempt.

New Jersey Health Insurance Penaltyâ

If you are a resident of the state of New Jersey, and dont have health insurance in 2020, you can expect a tax penalty anywhere between $695 and $4,500. The amount you owe will depend on the size of your family and tax bracket you fall under.

Rhode Island Health Insurance Penaltyâ

If you are a resident of the state of Rhode Island, and dont have health insurance in 2020, you can expect a tax penalty of $695 per adult and $347.50 per child, or 2.5% of your annual income. Whichever is higher.

Vermont Health Insurance Penaltyâ

Washington DC Health Insurance Penaltyâ

Read Also: Does Burger King Offer Health Insurance

Who Qualifies For Help With Covered California Premiums

Several types of financial assistance that may dramatically reduce your health insurance cost are available with Covered California/ACA health insurance:

- Premium assistance: Premium assistance in the form of income credits can be applied immediately to reduce your health insurance premiums.

- Cost-sharing reductions: Purchasers with modest family incomes may qualify for reductions in deductibles for specific plans.

- Medi-Cal: Your application process may alternatively qualify you or your family members for Medi-Cal, Californias Medicaid program.

Qualifying for financial assistance is determined primarily by how your familys modified adjusted gross income, or MAGI, compares to guidelines presented in the Federal Poverty Level Chart. For example, you may qualify for a premium subsidy if your income is between one and four times the federal poverty level for a similar-sized household. In addition to income, the purchasers age, household size and zip code are used to determine premium costs and subsidies. Covered California also has special rules for children, the disabled, and pregnant women. To learn more about ACA subsidies, .

Penalty For No Health Insurance 2020 In California

When Obamacare passed, it came with a tax penalty for those who could afford health insurance but didnt get it. The tax penalty was eliminated in 2017 by the Trump administration, but the state of California has reinstated it for 2020. California residents who do not have health insurance in 2020, will have to pay a tax penalty in 2021. Read our blog to learn more.

Also Check: Starbucks Health Insurance Eligibility

Qualifying Life Events For Special Enrollment

People who experience a qualifying life event can newly enroll in a health plan through Covered California even outside the open enrollment period. Currently enrolled members who experience a qualifying life event can change their coverage or choose a new plan.

Qualifying life events include:

- Lost or will soon lose your health insurance

- Permanently moved to/within California

- Had a baby or adopted a child

- Got married or entered into a domestic partnership

- Returned from active duty military service

- Released from jail or prison

- Gained citizenship/lawful presence

The Obama Care Mandate: What Is Required

The mandate refers to the federal law that requires all American citizens and legal residents to have qualified medical insurance. This medical coverage may be acquired off-exchange or through Covered California. The mandate is also known as the Affordable Care Act, or Obama Care. For more information, visit Obama Care California. Under the mandate, Americans and legal residents are required to do one of the following:

* You can be uninsured for part of the calendar year and not be subject to a penalty so long as you are uninsured for less than three consecutive months.

Don’t Miss: Starbucks Dental Coverage

What Income Level Qualifies For Covered California Coverage

Covered California recipients are entitled to financial help that reduces their premiums if their household income is less than 400% of the Federal Poverty Level . It is more commonly known as a Subsidy.

CSRs

If their household income is between 138% and 250% of the FPL, Covered CA recipients are also eligible for more discounts, otherwise known as Cost Sharing Reductions.

The 10 States With The Highest Health Insurance Costs

To find the states with the highest costs, GOBankingRates compared the lowest-cost plan at the ACAs silver tier in each state. Comparing monthly premiums, deductibles and copays based on a single, 40-year-old, non-smoking male with an annual income of $40,000, the study highlighted the 10 states with the highest health insurance costs.

If you live in one of these states, you should expect to pay more each month for your insurance. Unfortunately, youll also be paying more for each doctor or emergency room visit, as the worst plans charge higher co-insurance rates and copays. Starting with the 10th-worst to the No. 1 worst state for health insurance costs, these are the states where residents pay more for coverage.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

You May Like: What Insurance Does Starbucks Offer

Obamacare Income Guidelines Chart Based On The Federal Poverty Level

According to Covered California income guidelines and salary restrictions, if an individual makes less than $47,520 per year or if a family of four earns wages less than $97,200 per year, then they qualify for government assistance based on their income. If the family has a lower household net income, then a greater amount of government assistance is available to the family. Tax deductions can lower your income level. View the Covered California income limits chart below.

Immigrants Can Apply For Medical Coverage Through Covered California

Those who are undocumented have two options:

They can check to see if they are eligible for free or low-cost Medi-Cal, which is coverage through the state of California, though benefits may be limited. The other option would be to purchase a health plan privately by enrolling through an insurance agency like Health for California Insurance Center. You would have a variety of insurance companies to select a plan through such as Kaiser, Blue Shield, Anthem Blue Cross, Health Net, etc. Keep in mind that undocumented individuals are not subject to a penalty.

Deferred Action for Childhood Arrivals individuals are not considered legally present in the U.S. As such, they are not eligible for Covered California. These individuals may be eligible for Medi-Cal and can apply for Medi-Cal coverage through Covered California or at any Medi-Cal office.

You May Like: Starbucks Benefits Package