Are Health Insurance Deductibles The Same For All Coverages

Health Insurance deductibles are not the same for all the coverages in your health insurance plan. Every plan is different, which is why understanding how the different kinds of deductibles work will help you.

Some coverages and medical expenses have lower deductibles than your overall plan, some covered medical expenses may have no deductible. It depends on the plan you have chosen and the kind of deductible your plan offers. To understand how much money you will end up paying out-of-pocket, you should ask your plan provider three questions.

You Pay First Insurance Pays Later Plans

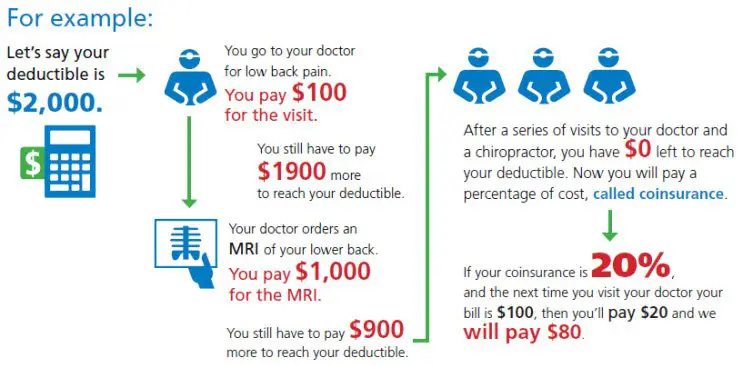

Your health insurance might not pay a dime toward anything but preventive care until youve met your deductible for the year. Before the deductible has been met, you pay for 100% of your medical bills.

After the deductible has been met, you pay only coinsurance until you meet your plan’s out-of-pocket maximum your health insurance will pick up the rest of the tab.

In these plans, usually any money you spend toward medically-necessary care counts toward your health insurance deductible as long as its a covered benefit of your health plan and you followed your health plan’s rules regarding referrals, prior authorization, and using an in-network provider if required.

Although you’re paying 100% of your bills until you reach the deductible, that doesn’t mean you’re paying 100% of what the hospital and doctors bill for their services.

As long as you’re using medical providers who are part of your insurance plan’s network, you’ll only have to pay the amount that your insurer has negotiated with the providers as part of their network agreement.

Although your doctor might bill $200 for an office visit, if your insurer has a network agreement with your doctor that calls for office visits to be $120, you’ll only have to pay $120 and it will count as paying 100% of the charges .

Q How Do I Change My Name On My Health Card Upon Dissolution Of My Marriage

To change your name on your photo health card to reflect your birth name or a previous married name, you must visit a ServiceOntario centre, complete a Change of Information and present the original of one of the following:

- A divorce certificate which includes your previous name and the requested name

- A marriage certificate which includes your previous name and the requested name

- Birth certificate

- Change of name certificate

If you do not already have a photo health card, you must also provide three original documents to prove citizenship, Ontario residence and identity.

If you have any questions regarding your own specific situation, call the ServiceOntario, INFOline at 1-866-532-3161.

You May Like: How To Cancel Oscar Health Insurance

What Is The Difference Between A Deductible And A Copay

Depending on your health plan, you may have a deductible and copays.

A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. If your plan includes copays, you pay the copay flat fee at the time of service . Depending on how your plan works, what you pay in copays may count toward meeting your deductible.

How To Choose A Deductible Level

The two primary considerations when selecting a deductible are your ability to withstand risk and the amount you expect to spend annually on health care coverage. For example, if you have recurring medical expenses each month, such as prescription drugs, then you may want to select a lower deductible plan that allows you to quickly reach that deductible.

On the other hand, if you are relatively young and do not get sick often, selecting a plan with higher deductibles may make the most sense. As a result, higher-deductible plans generally have lower premiums. Until these deductibles are met, you are effectively not receiving any of the cost-sharing benefits of having coverage.

For those people with low expected health care expenses, a more affordable health insurance plan with a higher deductible may make more sense. This lowers your guaranteed out-of-pocket costs by reducing the premiums you pay on a monthly basis. The only thing to consider when selecting a plan is whether or not you have the financial means to cover the required deductible should an incident occur.

Understanding this tradeoff is vital in how you choose a plan and find the best health insurance for your needs. The deductible structure of a health insurance plan is important in deciding which plan you choose since it dictates when the carrier actually begins to pay.

Also Check: How To Switch Your Health Insurance

Deductible Is Waived For Some Services Plans

In this plan type, your health insurance picks up part of the tab for some non-preventive services even before youve met your deductible. The services that are exempted from the deductible are usually services that require copayments. Whether or not the deductible has been met, you pay only the copayment for those services. Your health insurance pays the remainder of the service cost.

For services that require coinsurance rather than a copayment, you pay the full cost of the service until your deductible has been met . After the deductible has been met, you pay only the coinsurance amount your health plan pays the rest.

Examples of plans like this include what you might think of as a “typical” health insurance plan, with copays for office visits and prescriptions, but a deductible that applies to larger expenses such as hospitalizations or surgeries.

In these plans, the money you spend toward services for which the deductible has been waived usually isn’t credited toward your deductible. For example, if you have a $35 copayment to see a specialist whether or not you’ve met the deductible, that $35 copayment probably won’t count toward your deductible.

However, this varies from health plan to health plan so, read your Summary of Benefits and Coverage carefully, and call your health plan if youre not sure.

How Do They Work Together

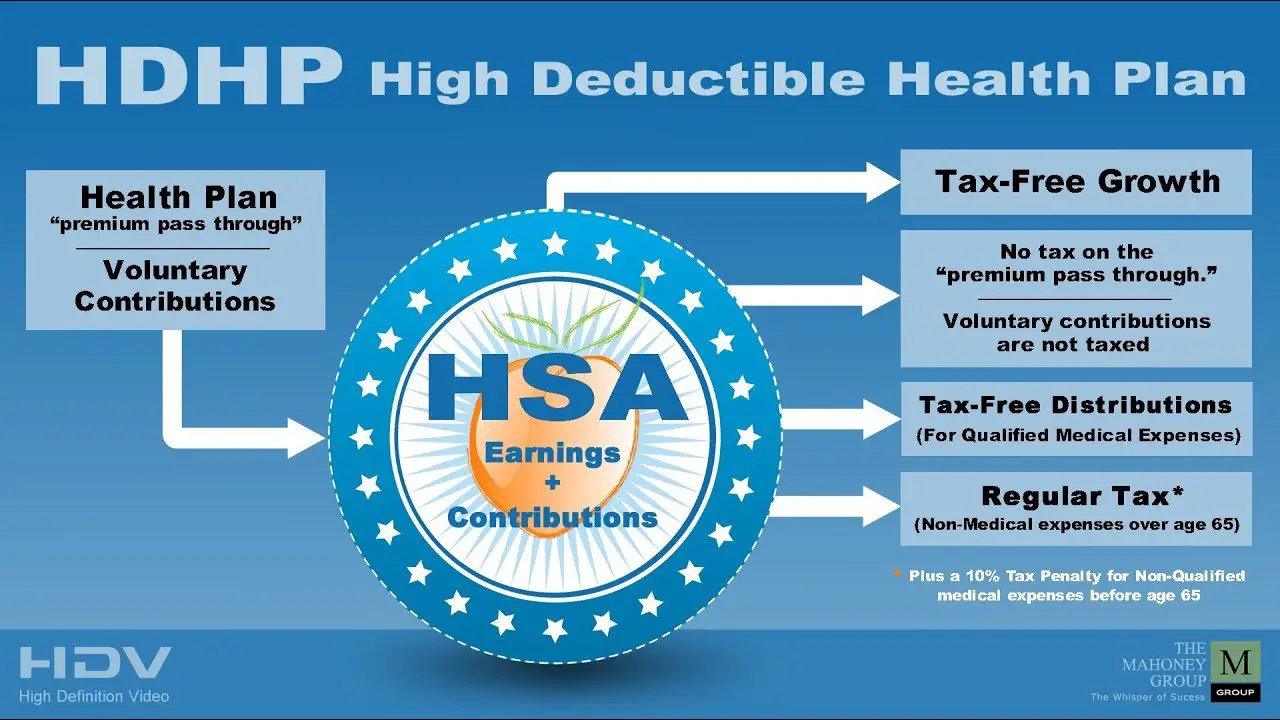

An HSA can help pay for qualified medical expenses such as copays, deductibles, coinsurance, and dental and vision costs. Once you meet your deductible, your HDHP starts to cover your medical expenses as outlined in your plan. You can continue to use your HSA funds to cover copays and coinsurance. If you prefer, you can let funds build up in your account for future use.

If your healthcare is generally limited to annual checkups, screenings and immunizations, having access to an HSA can make your insurance coverage affordable. However, if you have children or a chronic illness, need pricey medications or otherwise routinely need medical care beyond preventive services, this may not be an affordable option and you might consider different coverage.

Also Check: What Is Temporary Health Insurance

Is College In Canada Free

Simply put, there are no tuition-free universities in Canada for international students as stated before. There are no tuition-free universities even for Canadian students. However, you can study without paying the tuition fee by getting a full-tuition scholarship or even fully-funded scholarships.16 jan. 2020

What Is A Good Deductible

Despite the cost of deductibles, health insurance can lower your medical costs. The role of the health insurance company is to negotiate rates with medical providers to ensure that you, the policyholder, can pay a lower rate on healthcare.

When it comes to deductibles, there is one key difference between health insurance and other forms of insurance. With health insurance, you can still get some of your services met before you pay the deductible entirely. With auto insurance and homeowners insurance, you generally have to pay the deductible in full before you can receive any of the benefits.

When you are looking for a health insurance policy, think of the deductible vs. premium issue as a balancing act. The more you pay for one, the less youll pay on the other, and vice versa. Therefore, your deductible rate should be based on your health needs and current financial situation.

If you currently earn a modest income but have already built a large savings account, your best bet would likely be low premiums and high deductibles, especially if you do not foresee any health issues in the near future. If you are currently in a higher-earning bracket, yet you face certain health issues, it might be better to opt for higher premiums and lower deductibles.

You May Like: How Do I Know Which Health Insurance I Have

Factors Impact The Deductible Amount In Health Insurance Policy

The insurance deductible can be decided on the basis of the following factors:

o Any pre-existing health conditions before you buy a health plan, such as diabetes, asthma, etc. o Your current health statuso Your ageo Any past medical conditions or concernso Your present lifestyle and habits like smoking and drinking

When You Dont Pay The Deductible

As part of the Affordable Care Act in the United States, you dont have to pay a deductible for certain preventive care services from an in-network doctor, as long as your health plan isn’t grandfathered.

A grandfathered plan is one that was in effect prior to the Affordable Care Act that’s allowed to continue without follow all of the ACA’s regulations. If your employer has a grandfathered plan, you may have costs for some preventive care.

Read Also: Do I Need Pet Health Insurance

Q Do I Need To Notify The Ministry If My Baby And I Are Leaving The Province

You should contact the Ministry of Health and Long-Term Care with any change of address for both you and your baby. If you move to a location outside Ontario, you should inform the ministry of your new address and the date of the move as soon as possible. To inform the ministry of your move, you can either :

- Obtain a for you and your baby. Complete and sign the form and return it by mail. Forms are available from your local ServiceOntario Centre or from .

- Send a letter to your local ServiceOntario centre. You must include your names, health numbers, telephone number, current address, new address including postal code, and the effective date of the move for yourself and child.

What If I Can’t Afford My Deductible

Some insurance plans have very high deductibles, and paying this amount may be a challenge. Your therapist might offer affordable payment plans to allow you to pay over a longer time period. Communicate with your therapist, and ask for information about these options.

Maybe you cannot afford your deductible even with a flexible payment plan. In this case, you might choose not to use your insurance and instead find a therapist who offers sliding scale fees based on your income and ability to pay. Since your therapist will not bill your insurance, these payments will not go towards your deductible for the year, but they can make therapy services more affordable.

Sliding scales are also an excellent resource for individuals who do not have health insurance.

Read Also: What Is Amazon Health Insurance

How To Pick A Health Plan That’s Right For Your Budget

When shopping for health insurance plans, look at the “total cost of a plan when you’re trying to make a decision,” Buckey says. There are a number of calculators that can help run the numbers on some of the biggest costs when comparing plans, including the monthly premium, the deductible and coinsurance rates.

“It’s definitely worth sitting down for a half an hour and doing a rough calculation on the back of the envelope around what your expenses are and what your employer is offering you,” Buckley says.

Being admitted to the hospital is like buying a house.Jonathan WiikTransUnion Health

If you can’t swing a more expensive monthly premium, or if your employer doesn’t offer a plan with a low deductible, consider setting up a health savings fund using a health savings account or flexible spending account that can be used to pay for out-of-pocket expenses.

HSAs, which are designed to be used with a high-deductible plan, allow you to contribute up to $3,550 per year for self coverage and up to $7,100 for family coverage in 2020. These may be offered through your employer, or you can sign up for one independently.

FSAs are offered through your employer and allow you to contribute up to $2,700 in tax-free funds in 2019, with limits expected to increase to $2,750 in 2020. You don’t need to have a high-deductible plan in order to be eligible for an FSA.

“Just take five, 10 minutes to eyeball those , they may have some surprises that change your mind,” she says.

Find The Right Insurance For Your Needs

Health insurance is a very personal type of insurance protection for you and your family. Its important to know that the coverage you have are working in your best interests!

Thats why you need a top-notch independent insurance agent on your side to guide you through finding the best health insurance for you. We have the folks for the job, and you can find them through our Endorsed Local Providers program.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

You May Like: Does Health Insurance Cover Transplants

Benefits Of High Deductible Plans

True to its name, a high deductible health plan , has a higher deductible than a low deductible health plan, or traditional health plan. There may be other benefits to these types of plans, including:

- Members may spend less per month on their premium, or amount deducted from each paycheck. Spending less up front tends to appeal to generally healthy members who dont anticipate upcoming medical expenses. The trade-off for spending less on the monthly premium is that youre responsible for 100% of out-of-pocket costs until the deductible is met.

- As a way to offset the out-of-pocket costs, certain qualified high deductible health plans can be paired with a savings tool called a health savings account, or HSA. Employees can contribute pretax money into a special account designed for qualified medical expenses. If the funds arent spent, they roll over year to year.

How Many Types Of Health Deductibles Are There

There are three different types of health deductibles. You can choose any one of the following:

Voluntary deductible: A voluntary deductible is when the insured person can choose the deductible amount themselves. So, if you opt for this type, you will be able to select an insurance deductible amount that you can afford and are comfortable with. The decision can be made according to your income capacity and insurance needs. However, as explained above, the higher the premium amount, the lower can be your premium.

Compulsory deductible: A compulsory insurance deductible is fixed by the insurance company. You do not have a say in the insurance amount and have to abide by the rules set by the insurance provider. Since the compulsory deductible is fixed, it has no impact on the premium of your policy.

Cumulative deductible: A cumulative deductible is only applicable on family floater health insurance plans. Family floater plans cover all members of the family, such as the spouse, children, mother, and father. In such policies, the insurance cover is shared by all the people insured. The cumulative deductible is applied to such plans when an insurance claim is made by any person insured under the plan.

Don’t Miss: How Much Does It Cost For Health Insurance

Limitations Of An Hdhp

While an HDHP can offer some tax benefits, they arent necessarily an appropriate healthcare solution for everyone. If you have a pre-existing medical condition or expect to incur significant healthcare expenses in the year ahead, you may want to select a plan that offers more comprehensive coverage.

Because of the features of an HDHP, they are typically only recommended for individuals who dont expect to need healthcare coverage except in the face of a serious health emergency. You should carefully weigh your options during the open enrollment period in order to find the plan that best meets your needs.

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

Recommended Reading: Will My Dental Insurance Cover Veneers

You May Like: How Much Is Health Insurance For Seniors

Pros And Cons Of High Deductible Health Insurance

Choosing a health plan depends on your choices, finances, providers and what you want from your plan. An HDHP can be the right plan if you dont expect to need much health care over the next year. However, if you have a growing family or expect to need medical services, you may want to find a plan with lower out-of-pocket costs.

Here are the pros and cons of HDHPs:

Recommended Reading: Do Parking Tickets Affect Car Insurance

How Should I Choose A Health Insurance Deductible

Every persons situation is different, and what works for your needs will depend on your health needs, budget, and more. As youre considering your options, its important to take the time to shop around and compare costs. As mentioned, deductibles and other out-of-pocket costs may vary quite a bit from plan to plan. Comparing costs is easy and could save you money.

If youre interested, an eHealth licensed insurance agent would be happy to walk you through your options to find a health plan that might fit your needs. You can also start shopping on eHealth at your own convenience and compare all health insurance options in your state!

Related Articles

Also Check: What Is The Best Health Insurance In Alabama