Informed Choices Confident Decisions

Choosing the right health insurance for you and your family is an important decision. We understand, and we want you to feel confident in your choice. Let us help you find the insurance plan thats right for you.

Were Here to Help

Sometimes talking over the phone is easier. Were here to listen to your questions and help you get answers. Call us at 888.630.2583.

You May Like: Does Medical Insurance Cover Chiropractic

How Do Health Insurance Companies Rip You Off

Insurers are well aware that they have you over a barrel. They may say things to scare you into accepting their low-ball offer. They may claim that they have proof that you are to blame for the mishap. Adjustors have been known to intimidate victims by pointing out particular medical expenses as fake.

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.

Don’t Miss: How Much Does Starbucks Health Insurance Cost

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

Florida Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.4 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Miami to Orlando, Tampa to Jacksonville, explore these Florida health insurance options and more that may be available now.

Read Also: Starbucks Insurance For Part Time Employees

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

- $534

Are Your Providers In Network

Check the health plan’s network to make sure it has a good selection of hospitals, doctors and specialists. Look for your providers in the plans network.

This is especially true if you get an HMO. HMOs have a restricted network and wont pay for the care you receive outside of the network.

If you get a PPO, youll likely be able to get out-of-network care, but it can come at a higher price tag.

Read Also: Starbucks Medical Insurance

Where Can Consumers Buy Individual Health Insurance Coverage

Individual health insurance is available via the exchange/marketplace in every state . There are 36 states that use HealthCare.gov as their marketplace in 2021, while DC and the other 14 states run their own exchange platforms .

Individual health insurance is also available outside the marketplace nationwide, with the exception of the District of Columbia . But premium subsidies and cost-sharing reductions are only available if the plan is purchased through the marketplace.

In both cases on-exchange or off-exchange individual health insurance is only available during the annual open enrollment period or during a special enrollment period triggered by a qualifying event. In most states, the annual open enrollment period runs from November 1 to December 15, with coverage effective January 1. But the majority of the states that run their own exchange platforms tend to offer extended enrollment periods, some of which continue well into January.

Plan availability and coverage options vary considerably from one area to another. Some parts of the country have only a single insurer that sells individual health insurance, while other areas have several different insurers and dozens of healthcare plans from which to choose.

Five Factors That Shape Health Insurance Premiums And Health Insurance Cost For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

- State laws these can dictate what health insurance must cover and affect competition. For instance, a 2017 Maine law instructs insurers to compensate customers who find a better deal on certain services. On the flipside, some states have certificate-of-need laws that may decrease competition.

- Your employers size larger employers tend to have access to cheaper cover. Those who dont have access through their employer will often pay more.

- Geography health insurance can be cheaper in cities than in remote locations.

- Plan type preferred provider organizations tend to cost the most, while high-deductible health plans cost the least.

- Personal factors such as age.

What are the best places for American expats to live abroad?

Find out more here

Don’t Miss: Does Kroger Give Employee Discounts

What Do Individual Health Plans Cover

Individual health insurance plans offer comprehensive coverage.

Before the ACA, individual health plans courage varied widely. Insurance companies could deny applications for insurance or set exorbitant premiums if you had a health condition.

Now, a health insurance company has to cover you regardless of your health history. You qualify for individual health insurance even if youre pregnant, have a long-term condition like diabetes or a serious illness, such as cancer.

Health insurance plans additionally cant cap the amount of benefits you receive. Theyre further limited on how much out-of-pocket costs you have to pay in a year.

In addition, all individual health plans must cover a standard set of 10 essential health benefits:

- Outpatient care, including doctors visits

- Emergency room visits

- Mental health and substance abuse treatment

- Prescription drugs

- Services and devices for recovery after an injury or due to a disability or chronic condition

- Lab tests

- Preventive services, including health screenings, immunizations and birth control. You pay nothing out of pocket for preventive care when you see health care providers in your plans network.

- Pediatric services, including dental and vision care for kids.

What Are The Disadvantages Of Private Health Insurance

Private health insurances potential downsides The price. Private health insurance is costly depending on the coverage, a person, couple, or family might spend thousands of dollars in premiums each year, with rates rising yearly. Products that are complicated. Treatments that are not allowed. Out-of-pocket expenses.

Recommended Reading: 8448679890

Where To Buy Private Health Insurance

You can purchase an ACA plan at Healthcare.gov through Aug. 15, 2021, in most states, or beginning again Nov. 1 each year.

You can buy a private marketplace plan directly from an insurance company or insurance broker at any time. Search online for carriers and brokers, and compare several different plans and premium costs to find the right product for you.

How Much Does Average Health Insurance Cost In The Usa

Health insurance means different things to people across the world the USAs system is known for several distinguishing features, including a high relative cost to the individual and a lack of universal coverage.

You may be wondering why the cost of healthcare insurance seems to be rising and how the picture compares to other nations. In a country that spends nearly $4 trillion on healthcare yet finds coverage varies widely, theres a lot to weigh up. How much does health insurance cost? is one of the most important questions to Americans.

Across the United States, Americans pay wildly different premiums monthly for health insurance. The average annual cost of health insurance in the USA is $7,470 for an individual and $21,342 for a family as of July 2020, according to the Kaiser Family Foundation a bill employers typically fund roughly three quarters of.The cost to each person can vary a lot, however, based on factors such as age, geography, employer size and the type of plan theyre enrolled in. While these premiums are not determined by gender or pre-existing health conditions, thanks to the Affordable Care Act, a number of other factors impact what you pay.

Of course, not all companies offer health benefits to employees 44% of firms did not offer insurance to staff in 2020.

Insurance costs are rising globally.

Find out what’s driving up prices

You May Like: Umr Insurance Arizona

What Is Private Health Insurance

Private health insurance is insurance coverage available to an individual and family purchased either through the federal health insurance marketplace or individual health insurance from private insurance companies on the private marketplace.

“Policyholders purchase this type of coverage directly from the insurer rather than through a plan sponsored by an employer, trade association, union, or other group that solicits multiple potential policyholders, says Brian Martucci, the Minneapolis-based finance editor for Money Crashers.

Many employees and people who work for themselves but don’t qualify for government-run insurance like Medicare or Medicaid turn to private health insurance as their only opportunity to get health coverage.

Unless the plan is subsidized by the government, as with some ACA/Obamacare plans, “private health insurance plans are paid out of pocket by a person or family using a personal bank account with post-tax income. You can choose and customize a private health insurance plan based on your needs,” says John Bartleson, owner of Health Benefits Connect.

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

Read Also: Sidecar Health Dental

When Can I Buy Private Health Insurance

Most types of health insurance have an open enrollment period during which you can sign up for private health insurance. This is true whether you buy insurance via the Affordable Care Act health insurance exchange in your state, sign up directly through the insurer, enroll in the plan that your employer offers, or sign up for Medicare.

Certain life events can trigger a special enrollment period, which will allow you to change your health insurance coverage outside of the normal enrollment period. These events include getting married or divorced, having a baby, losing your job-based health insurance, or moving out of your health plans service area.

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

Read Also: Starbucks Health Insurance Deductible

Find Cheap Health Insurance Quotes In Your Area

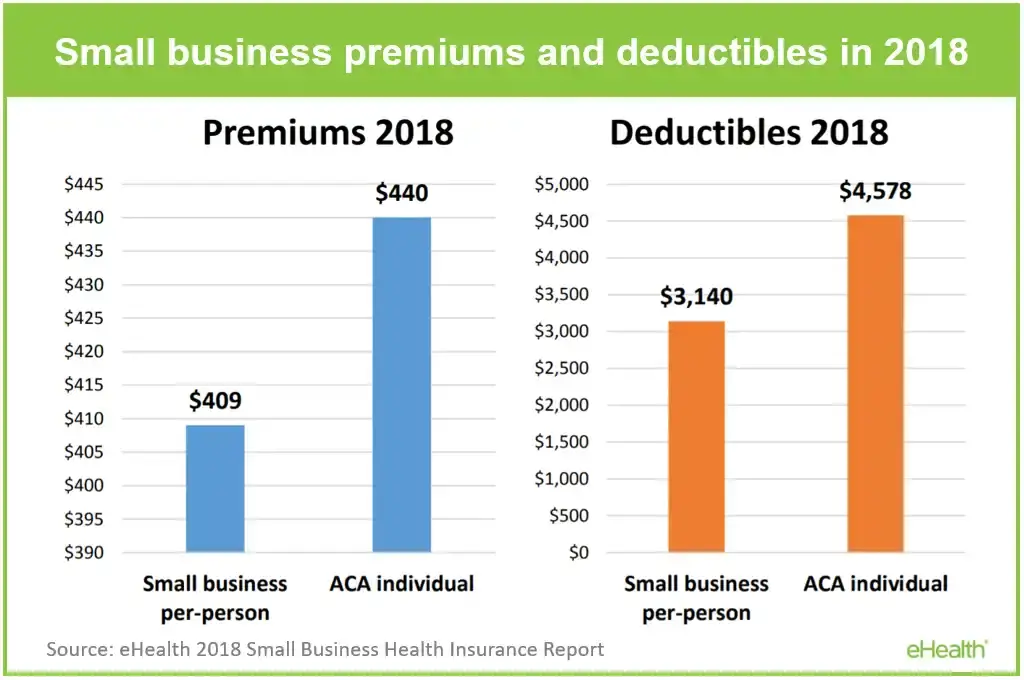

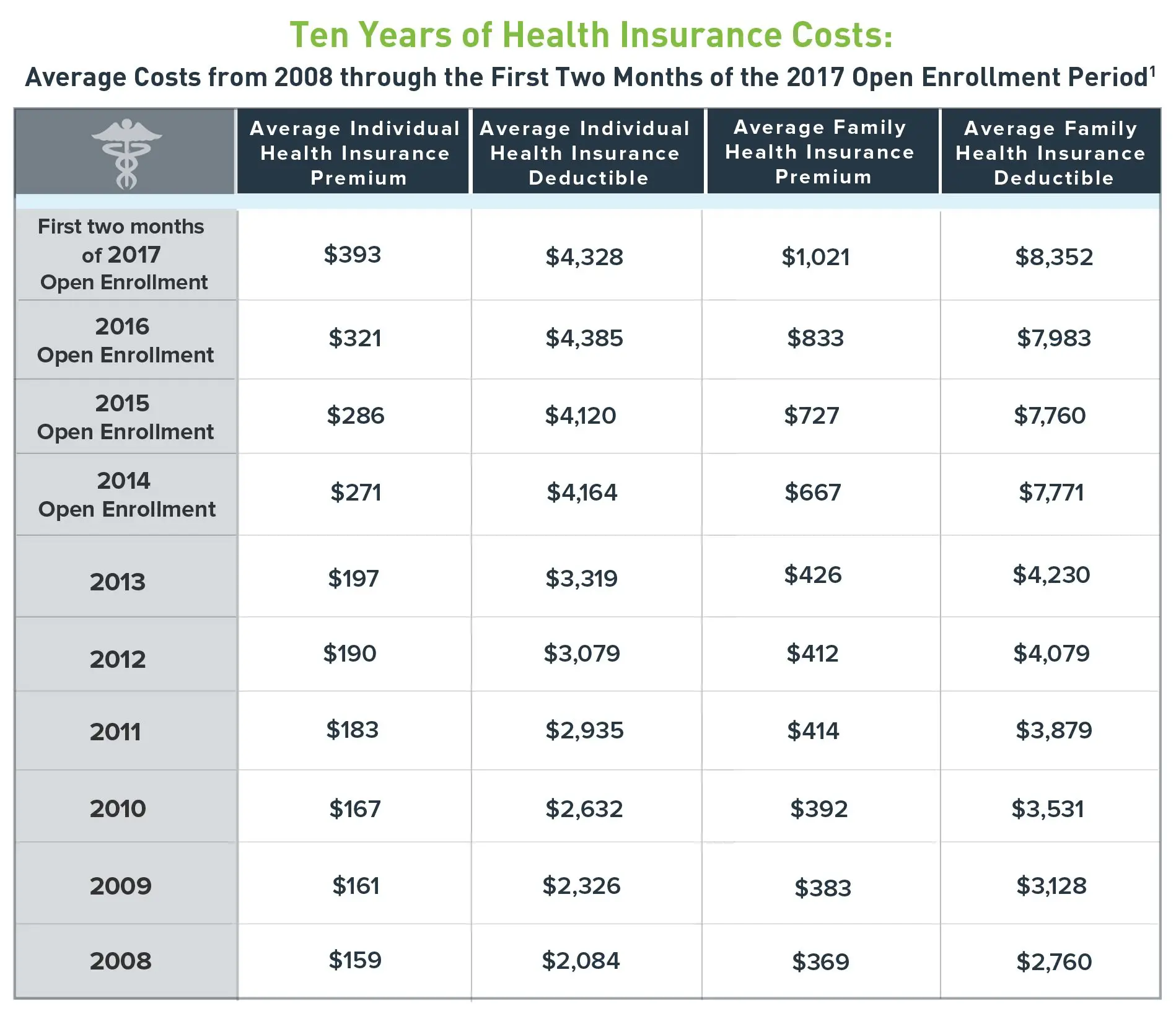

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county in which you live. In this first table, we look at health insurance premiums for 2022 and how they differ by state.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

Also Check: When Does Health Insurance Stop After Quitting Job

How Do I Choose The Best Health Insurance For My Family

How to Select Best Health Insurance Policy Choose Adequate Sum Insured Amount. Choose the Right Coverage Type. Check the Flexibility to Increase the Total Amount You Are Insured For. Check the Pre-existing Disease Waiting Period. Check the Maximum Renewal Age. Insurer with High Claim-settlement Ratio.

Also Check: Starbucks Benefits For Part Time Employees

Making Health Insurance More Affordable For Middle

The Affordable Care Act has extended health coverage to over 20 million people and has lowered the cost of coverage or care for millions more. But a frequent criticism of the law is that it has not done enough to make coverage affordable for middle-income individual market consumers. The solution to this problem is straightforward. Increasing or eliminating the income cap on the ACAs premium tax credits would ensure that nearly all consumers have coverage options that cost less than 10 percent of their incomes.

About 6 million people purchase individual market plans without premium tax credits, and another 4 to 5 million people with incomes too high to qualify for subsidies are uninsured. Discussions about how to help these consumers are often unduly focused on sticker price premiums. A common assumption is that premiums in the ACA individual market are exceptionally high relative to other health insurance markets, and that solving this problem requires structural change to the ACA.

Expanding eligibility for premium tax credits is better for both consumers and the individual market as a whole than other commonly discussed approaches to making coverage more affordable for middle-income people.

Read Also: Kroger Health Insurance Benefits

Countries With High Cost Of Medical Care

The United States has the highest cost of healthcare in the world, as the country spends significantly more per capita for its medical welfare than anywhere else in the world.

In Europe, Switzerland leads the way in terms of cost of care with the Netherlands and Germany close behind.

In Asia, Japan, China, Singapore, Hong Kong, and Korea have higher than average costs to treat medical conditions.

Check out the OECD website to know which countries spend high on health care. You can see how other countries in this list, including Iceland and Australia fare, compared to others.

Is there an underwriting process when applying for expatriate healthcare?

Medical underwriting, which pertains to the review of your medical history, is required by international healthcare companies when you apply for one of their global medical insurance plans.

If you are apply for an international family health insurance plan, all family members will have to provide their medical history.

For US citizens familiar with the benefits and protections provided by the Affordable Care Act , take note that it does not apply here. You can be turned down or denied coverage.

The underwriting process is generally done to obtain and review your medical history. It is not overly burdensome to do as most providers can complete the underwriting process in 3 to 5 business days. However, the process may take longer in case some unusual circumstances arise.

Theres A Plandirect Insurance Plan For Everyone Whats Your Current Situation

You can tailor your coverage to include a range of healthcare needs, such as:

Your monthly premium will depend on the plan you choose. To get a quote and explore all our plans have to offer take our questionnaire.

With health and dental insurance, you pay a monthly premium which covers either entirely or to a certain percentage or annual maximum eligible costs that you would have otherwise paid out-of-pocket.Heres how costs could compare if youre paying for some common things without insurance vs how much you would pay for eligible out-of-pocket if you were covered by our popular CorePlus plan, for example.Note: For dental, this assumes the $25 person per calendar year deductible has been satisfied.

| Without coverage |

|---|

Also Check: How Long Do Health Benefits Last After Quitting