Sbis Makes Choosing Health Insurance Easy

The biggest barrier to having health insurance isnt a pre-existing health condition because at SBIS we offer a wide range of guaranteed issue no medical plans. The hurdle is selecting the plan best suited to your needs and budget. Often, youve never had to purchase individual health coverage before and may find the terminology, options, and process very confusing.

Thats why you can talk with one of our professionals to get valuable help, for free. Or you can go online and get as many free health insurance quotes as you want. You will find full online plan details for the plan you choose, and we offer secure, online enrolment so you can get the health insurance you need, now.

Health Insurance Discount Cards

Health insurance discount cards give members access to negotiated low-cost healthcare. They’re not insurance plans but rather an option you might want to explore as a last resort.

You’ll pay a small monthly fee and get a discounted rate on your services when you go to a doctor or hospital. You’ll still end up paying all your medical costs, but at least you’ll pay less.

Health Marketplace: Buying Your Own Health Insurance

Insurance you buy from a company or the marketplace is individual insurance. Itâs sold to individuals, not to members of a certain group.

You can buy individual coverage through:

- An insurance company or health maintenance organization

- A licensed health insurance agent who has a relationship with one or more insurance companies

- Healthcare.gov, the online federal health insurance Marketplace

- Theâ¯Plan Finderâ¯on Healthcare.gov for individuals and small businesses

- Aâ¯Navigatorâ¯approved to help with Marketplace enrollment

Read Also: How Long Do I Have Insurance After I Quit

How To Get Health Insurance Without Medical Questions For You And Your Loved Ones

If youre thinking about no medical exam health insurance, read this information to understand what it is, and whether or not its the right decision for you.

Lets start talking first about life insurance instead of health insurance. Youve heard about no medical life insurance. Its a life insurance option that needs to exist. If you dont have a choice and cant get life insurance any other way because of your medical history, you shouldnt feel badly about choosing it. No medical life insurance policies have higher premiums they cost more because the premiums accommodate people who have pre-existing health conditions. But if you are healthy? It may seem easier and less time-consuming to buy no medical life insurance, but medically underwritten life insurance gives you more options for coverage at a lower cost.

Now lets talk about health insurance. No medical health insurance also known as guaranteed issue health insurance can be a very smart choice . Heres what you need to know.

Health Insurance Open Enrollment: If You Need Health Insurance Coverage In Michigan Help Is Here

This site contains everything you need to know about health insurance, how to get covered, and how to use your coverage to keep yourself and your family healthy.

Open Enrollment for 2022 health insurance ran between November 1, 2021 and January 15, 2022.

Consumers who missed the January 15 deadline for 2022 coverage may still qualify for a Special Enrollment Period if they experience a qualifying life event, such as a birth, job loss, or divorce. In addition, Michiganders who qualify for the state’s Medicaid or MIChild programs can apply at any time. For help getting started, and to figure out for which programs they qualify, consumers should visit Healthcare.gov/lower-costs.

Your local agent or assister can help with the application or answer your questions. Find Marketplace help near you by visiting LocalHelp.HealthCare.gov.

Read Also: Umr Insurance Arizona

I Buy My Own Insurance And Have Trouble Paying For It Will It Be More Affordable Now

It may be. You may be able to get tax credits to lower your premiums and other costs of health insurance. To be eligible, you must:

- Be a citizen or legal resident

- Buy your coverage through your state’s new health insurance , also called an Exchange

- Make about $12,760 to $51,040 a year if you are single or $26,200 to $104,800 a year if you are in a family of four

If you make less than about $17,600 if you are single, or less than about $36,150 as a family of four, you may be eligible for Medicaid. Medicaid will cost you less than a plan on the .

Unfortunately, not all states are expanding Medicaid. If thatâs the case and your income is less than $12,760, you may not be able to get a tax credit.

In general, you’re not eligible for the tax credits if you could get coverage through a workplace. However, the coverage offered by your employer must be considered affordable. If your company offers a plan that costs more than 9.8678n through your state’s Marketplace and may receive tax credits to lower your costs.

Consolidated Omnibus Budget Reconciliation Act

These plans are available if you’ve been laid off or had your work hours cut. You may be able to remain on your former employer’s health plan through COBRA. College students may be able to remain on their parents’ plans with this option.

You might be eligible for COBRA due to include voluntary or involuntary job loss, having your hours cut, if you’re moving between jobs, or if there have been changes in your family such as death or divorce.

COBRA is an option for people who may have lost their jobs while they’re still receiving treatment for medical problems.

COBRA may not be the cheapest health insurance option, but it can provide good coverage, depending on your needs.

You May Like: Starbucks Insurance Enrollment

Health Insurance Without Phone Calls

Online health insurance quote tools let you compare health insurance companies and costs for individual health plans. Shopping for health insurance requires you to be truthful. Otherwise, you could wind up not benefiting from the best rates.

To get accurate quotes, youll have to provide personal information, including your ZIP code, phone number, your household income and your family size. You must provide accurate income and family size information especially if youre looking for an ACA plan. ACA plan members are eligible for subsidies, but you need to enter the right information in order for the tool to provide accurate quotes that takes into account subsidies.

You could provide an incorrect phone number to avoid getting potential phone calls. However, youll likely have to provide an accurate number in order to complete choosing a plan.

I’m About To Turn 65 And I’m Realizing That Even With Medicare My Health Care Costs Are Going To Be Hard To Afford Can I Get Any Help

Maybe. It depends on how much you make each year. How much money you have in bank accounts and stocks is also considered. If your income is below a certain level, you may be eligible for one or more Medicare Savings plans in your state.

There are several types of savings programs. One helps pay premiums for Medicare Part A and Medicare Part B . You may also be eligible to get Extra Help with your Prescription Drugs.

There are also savings plans to help pay deductibles, coinsurance, and copays. To find out about Medicare Savings Programs, go to Medicare.gov and go to the ‘Your Medicare Costs’ tab.

Also Check: Starbucks Open Enrollment 2020

Getting Health Insurance Through An Employer

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Read Also: Part Time Starbucks Benefits

How Much Does It Cost To Buy Health Insurance On Your Own

Generally, the less you pay out of pocket for the deductible, copays and coinsurance, the more you spend on premiums.

Platinum plans charge harmer premiums than the other three plans, but you wont pay as much if you need health care services. Bronze, meanwhile, has the lowest premiums but the highest out-of-pocket costs.

When deciding on the level, consider the medical services you used over the past year and what you expect next year. For instance, if you plan on starting a family, consider how much out-of-pocket costs youll have to pay if you go with a Bronze plan.

eHealth reported the average monthly premium by metal level:

- Bronze — $448

- Gold — $569

- Platinum — $732

Bronze and Silver are the most popular plans — 39% have Silver plans and 36% have Bronze plans. Only 17% have Gold plans and 1% have Platinum plans.

What To Do When Your Insurance Company Ends Your Coverage

Your insurance company may not renew your policy because of:

- your claims history

- non-payment of premiums

If your insurance company tells you that it won’t renew your policy, ask the company to explain the reason for its decision. Ask for the explanation in writing.

You may also want to shop around for another insurance provider.

Also Check: Health Insurance For Substitute Teachers

Q Do I Need To Do Anything With A Deceased Person’s Health Card Or Health Coverage

The health card of a deceased person must be returned to the Ministry of Health and Long-Term Care. You will need to complete a Change of Information and then mail it with the health card of the deceased person to the ministry. You should include a copy of the death certificate. Copies of this form are available by :

- Visiting your local ServiceOntario centre.

- Printing a copy of the form through Forms Online.

- Contact ServiceOntario INFOline at toll-free: 1-888-376-5197 or 416-314-5518

Alternately, you can send a letter to your local ServiceOntario centre providing the deceased person’s name, date of birth, sex and health number. Enclose a photocopy of the death certificate and the actual health card.

Individual And Affordable Care Act Plans

Many uninsured individuals are eligible for generous subsidies, but either don’t realize it or do not take advantage of them.

Individual health plans are available in the ACA marketplace and outside the marketplace.

The ACA created exchanges to compare and purchase an individual health plan. The plans on the exchanges must meet specified criteria, such as covering ten essential health benefits, including prescription drugs, outpatient, hospitalization, and mental health.

The federal government also offers tax credits and subsidies for people who qualify based on their income as part of an ACA plan. Suppose your household income is between 100-400% of the federal poverty level, you are likely eligible for subsidies to reduce an ACA plan’s cost. Thats about $12,880 to $51,520 for an individual and $26,500 to $106,000 for a family of four.

According to Dr. Kevin Griffith, an assistant professor at Vanderbilt University’s Department of Health Policy, people too often fail to take advantage of this kind of government assistance. He notes that “Many uninsured individuals are eligible for generous subsidies, but either don’t realize it or do not take advantage of them.”

You’ll be asked to submit your household income information when shopping on the ACA exchanges website. The tool provides options that consider subsidies, so you youll know what to expect to pay in premiums.

The ACA marketplace classifies plans by metal tiers:

- Bronze

- Gold

- Platinum

Read Also: Starbucks Health Insurance Benefits

Using An Insurance Agent Or Broker

An insurance agent is someone who represents an insurance company and sells its insurance products.

An insurance broker is a person or company who sells the products of several different insurance companies. However, in some cases, a life insurance agent may also represent several different insurance companies.

Dealing with a licensed agent or registered broker will help to ensure that they:

- are properly trained

- have the resources to provide you with the insurance services you may need

Agents and brokers must usually be licensed in the province or territory in which they do business. Confirm that your insurance company is licensed or registered to do business in your province or territory.

Go Through Your Employer

This choice is a no-brainer for anyone who works for a sizable company.

If your employer subsidizes the cost of health insurance, youll usually get better coverage and pay less than if you were to try and purchase insurance on your own.

In most cases, employers will allow you to buy insurance for not just yourself, but your immediate family.

Employers will often give you a choice between a more robust plan with higher premiums and a lower-cost plan with less coverage or more restrictions.

Companies often will offer dental insurance and vision plans as well.

The Kaiser Family Foundation reported that about 156 million people receive employer-sponsored insurance.

On average, most workers contribute between 0% and 25% of the premium cost to get health insurance.

And workers who received employer-sponsored insurance contributed an average of $5,588 in premiums in 2020, while employers contributed $15,754 .

Also Check: Is Umr Good Insurance

Option : Buy Through A Membership Organization

If you belong to a union, alumni association, professional organization, or any other large group, you may be able to purchase health insurance through it at group rates. Freelancers Union, for example, offers health insurance through its subsidiary, Freelancers Insurance Agency, and through one of its partners, HealthPlanServices.

When looking for health insurance through an association or membership organization, make sure you will actually be purchasing insurance and not just a health services discount plan. Discount plans might save you money on prescriptions or eyeglasses, but they wont help you if you get cancer. Also be aware that even if the association itself is a not-for-profit organization, it may be tied to or even established by a for-profit insurance agency through which it sells policies to association members.

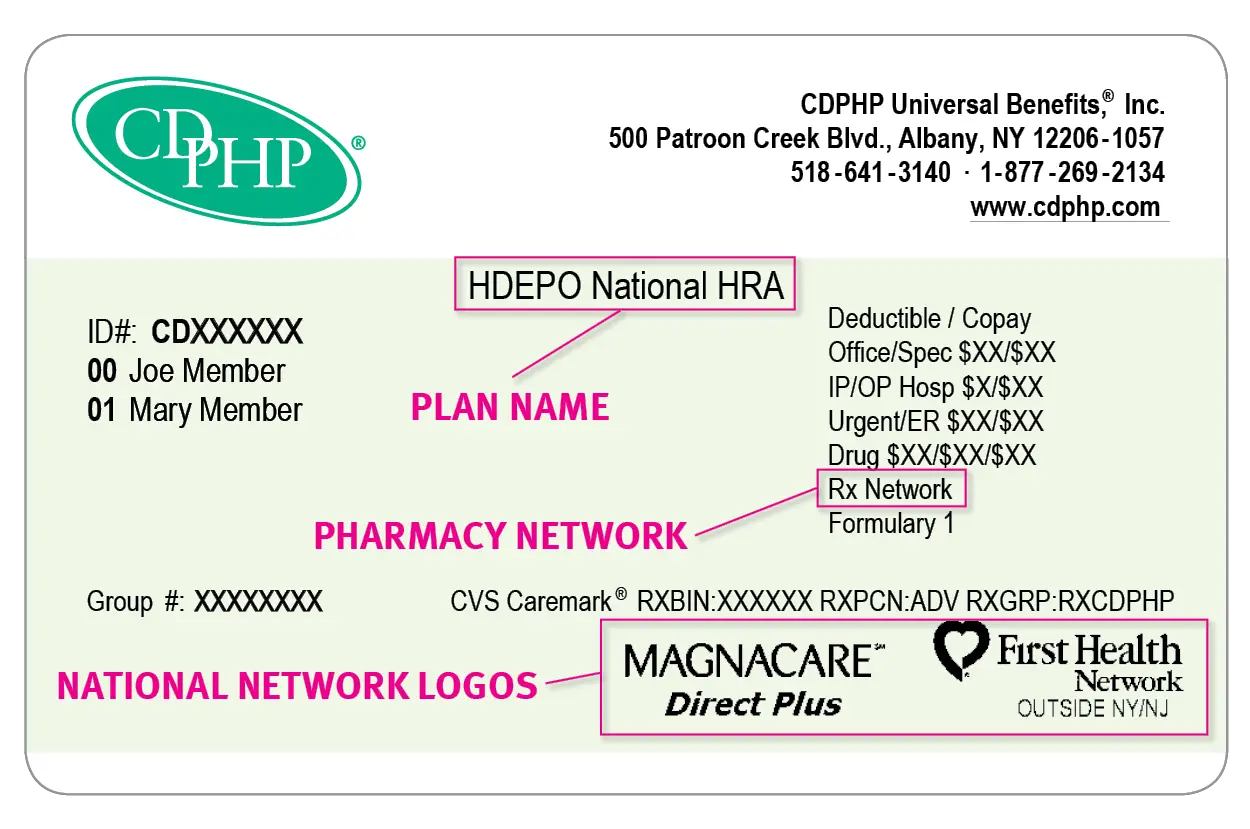

Applying For Health Insurance Doesn’t Have To Be Confusing Here’s A Handy Glossary

Whether you’re aging out of your parent’s plan and picking one for the first time, or you’re in a plan that no longer works for you and you’re ready to switch things up, or you’re uninsured and want to see if you have any workable options, there’s good news. Asking yourself a few simple questions can help you zero in on the right plan from all those on the market.

Here are some tips on where to look and how to get trustworthy advice and help if you need it.

Recommended Reading: How To Cancel Evolve Health Insurance

Qualifying For Public Insurance

How To Buy Health Insurance On Your Own

Most Americans get health insurance through their employer or Medicare. However, you can buy health insurance on your own.

The Affordable Care Act created exchanges that allow people to compare individual plans in their area. You can see each plans design and what you would pay in premiums and out-of-pocket costs. There are also individual insurance plans outside of the exchanges that offer even more choices.

Buying your own health insurance can seem daunting, but it can also open up more possibilities. Lets take a look at how to get your own health insurance.

Don’t Miss: Does Starbucks Have Health Insurance