How Big Were The Penalties

The IRS reported that for tax filers subject to the penalty in 2014, the average penalty amount was around $210. That increased substantially for 2015, when the average penalty was around $470. The IRS published preliminary data showing penalty amounts on 2016 tax returns filed by March 2, 2017. At that point, 1.8 million returns had been filed that included a penalty, and the total penalty amount was $1.2 billion an average of about $667 per filer who owed a penalty.

Although the average penalties are in the hundreds of dollars, the ACAs individual mandate penalty is a progressive tax: if a family earning $500,000 decided not to join the rest of us in the insurance pool, they would have owed a penalty of more than $16,000 for 2018. But to be clear, the vast majority of very high-income families do have health insurance.

Today, the median net family income in the United States is roughly $56,500 For 2018, the penalty for a middle-income family of four earning $60,000 was $2,085 . This is far less than the penalty a more affluent family would have paid based on a percentage of their income.

The penalty could never exceed the national average cost for a bronze plan, though. The penalty caps are readjusted annually to reflect changes in the average cost of a bronze plan:

The maximum penalties rarely applied to very many people, since most wealthy households were already insured.

I Just Cant Afford Insurance Options What Can I Do

Find out if you qualify for Medicaid. Medicaid is a state-based assistance program for people under the age of 65. Patients usually pay no part of costs for covered medical expenses, although a small copayment may be required.

Each state sets its own guidelines regarding eligibility and services so you should contact your local Medicaid office directly.

Dc’s Individual Responsibility Requirement

A DC law began in 2019 that requires residents to have qualifying health coverage, get an exemption, or pay a penalty on their DC taxes.

All DC Residents Must:

Get Covered, Stay Covered

Find a plan, see if you qualify for cost savings, and learn about what kind of coverage is required.

Find out about the penalty for not having qualifying health coverage or an exemption.

GET COVERED

Find medical coverage that meets your needs and budget. See if you also qualify for a tax credit or Medicaid.

STAY COVERED

Health coverage that provides a broad range of health services like doctor visits, hospitalization, emergency services and prescription drug coverage meets DC’s individual responsibility requirement. For every month that you have any of the following coverage, you do not need to have an exemption or pay a penalty on your taxes.

If you have a questions about a plan type not listed below, contact the insurance company and ask whether it meets the federal requirement for minimum essential coverage. If it does, it likely meets DC’s individual responsibility requirement.

Employer-sponsored coverage

- All plans purchased through DC Health Link

- Coverage you get through a parent’s plan

- Health plans purchased directly from an insurance company if the plan provides a comprehensive range of benefits

- Most student health plans

- All plans purchased through healthcare.gov or another state health insurance marketplace

Government-sponsored coverage:

PAY A TAX PENALTY

Also Check: Does Insurance Cover Chiropractic

Is Health Insurance Really That Important:

People might wonder why the U.S. government emphasizes health insurance. In summary, there are two primary reasons to have health insurance:

Health insurance supports you if you get sick Health insurance helps you avoid getting sick to begin with

Health Insurance Supports You if You Get Sick.

Most people cant pay for all their health care out-of-pocket and opt to put it on a debit or credit card. But thats just another financial burden thatll have to be addressed at some point.

Health insurance provides financial protection in case you have a serious accident or illness.

For example, a broken leg can cost up to $7,500 who has that amount of money just laying around to be used, and on a broken leg, at that? Chances are, if youve got $7,500 to put toward a broken leg, youre better off paying for monthly health coverage, as it can help protect you from those high, unexpected costs.

Read more about the benefits of having health insurance coverage here and here.

Health Insurance Helps You Avoid Getting Sick to Begin With

Does this sound familiar? Some of us have shared similar thoughts in the past, and this is especially the case with individuals who pay attention to their health, eat well, exercise on a regular basis, and simply dont get sick often.

But forgoing health insurance coverage still isnt recommended.

So, what happens if you dont have health insurance coverage? Well, your taxes will be affected.

Determine What You Need

You dont want to overpay for health insurance, thats why you need to sit down and figure out what you need before you begin your search. How often do you visit the doctor? How many people will be on the plan? Do you or someone else on the plan need prescriptions covered? Do you have any pre existing conditions? Answer all these questions so you dont get stuck with a plan that doesnt offer sufficient coverage for your situation, or a plan that covers too much.

Read Also: How To Cancel Evolve Health Insurance

Apply For An Insurance Exemption

There are some circumstances in which a person may be found exempt from having to pay a tax penalty. Some of these allowable exceptions include:

- If coverage is proven to be unaffordable.

- If a person has a short coverage gap, meaning that they are uninsured for less than three consecutive months during the year.

- If a persons income is lower than the state threshold for filing taxes, which usually means that they are not required to file taxes or pay penalties for not having health insurance coverage.

- If a person was incarcerated.

- If a person is a member of an Indian tribe.

- If a person experienced a general hardship, such as eviction, foreclosure, homelessness, unpaid medical bills, death of a close family member, or domestic violence.

- If a person is a member of a certain religious sect.

If You Had No Health Coverage

Unlike in past tax years, if you didnt have coverage during 2021, the fee no longer applies. This means you dont need an exemption in order to avoid the penalty.

Important: Some states have their own individual health insurance mandate

If you live in a state that requires you to have health coverage and you dont have coverage , youll be charged a fee when you file your 2021 state taxes. Check with your state or tax preparer.

You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2021.

Don’t Miss: Insurance Lapse Between Jobs

What Is The Fine For Not Having Health Insurance In Texas

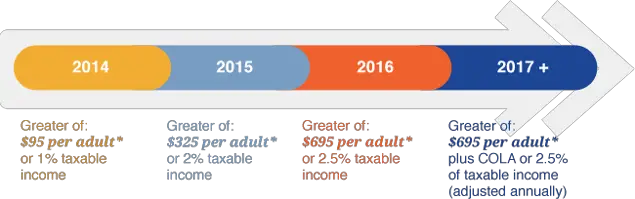

In 2015, the fines begin at $325 per adult and $162.50 per child, or 2 percent of your family income, whichever is greater. In 2016, the fines increase to as much as $695 per adult and $347 per child, or 2.5 percent of family income, whichever is greater. After 2016, the penalties will be adjusted based on inflation.

Short Term Health Insurance

During the COVID-19 pandemic, many people have gone through transitional periods and have had a lapse in health care coverage. Short-term health insurance can be a temporary option to protect you from expensive medical bills. You are eligible for short-term coverage if you:

- Change jobs

- Other specific instances

Also Check: Does Uber Have Health Insurance

Then Calculate The Penalty Based On 3 Groups

If at least one employee receives federal subsidies due to the purchase of health insurance through an exchange, an employer may be required to pay a monthly penalty based on the number of Full-Time Employees.

VERY IMPORTANT: When calculating the amount of the penalty, the employer receives a credit of 30 Full-Time Employees. .

What Are The Effects Of Repealing The Individual Mandate

Since its implementation, the individual mandate was controversial amongst the public and its repeal was equally debated. Much of the debate surrounding the individual mandate repeal was based on its effects on healthcare premiums. With less people obtaining health insurance, the premiums were expected to become higher for those who needed healthcare and had preexisting conditions. Not only was this controversial financially, but this brought up concerns over the state of health for the U.S. population. The worries about the inflation of premiums were brought to light when premiums for bronze plans increased from 3 percent to 13 percent once the tax penalty was removed. Additionally, enrollment fell from 2.8 million uninsured individuals to 13 million. For these reasons, certain states have chosen to enact their own mandates on health insurance requirements.

Also Check: Eligibility For Aarp

Washington Dc Individual Mandate

- Effective date: January 1, 2019

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides exemptions to the tax penalty for circumstances such as financial hardship, pregnancy, or eviction

Individuals who go without qualifying health coverage for a full year and dont file for an exemption may owe a tax penalty. The penalty amount is either 2.5% of the gross family household income or $695 per individual and $347.50 per child youll pay whichever amount is greater.

According to dchealthlink.com, the maximum penalty for not having coverage in DC is based on the average premiums for bronze level health plans available on DC Health Link. In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without coverage up to a maximum of five household members. So, potentially, a household of five or more that went the entire year without health coverage would have a penalty cap of $17,240 in 2020.

Examples Of The Obamacare Tax Penalty

The rules governing the Obamacare tax penalty for 2016 are as follows. If youre subject to the penalty, you will be required to pay either:

- 5% of your taxable household income

- Or $675 per adult and $347.50 per child under 18

So, for example, a 30-year-old individual who reports a taxable household income of $25,000 may be required to pay the greater of the following:

- 5% of household income = $625

- Or $675 for 1 adult

Since its higher, this persons penalty would be the second one.

Another example: a family of 3 who reports a taxable household income of $85,000 may be required to pay the greater of the following:

- 5% of taxable household income = $2,125

- Or $1697.50 for 2 adults and 1 child

In this example, the family of three would have to pay the first, since its higher.

Now, to keep things simple, weve used the term taxable income in the examples above, but technically these calculations are based on the figure referred to as your modified adjusted gross income on your federal tax return. To better understand how these rules may apply to you, speak with a tax professional.

Recommended Reading: Can You Buy Dental Insurance Anytime

Is There A Penalty For Not Having Health Insurance

Too often, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills. If you fall and break your leg, hospital and doctor bills can quickly reach $7,500for more complicated breaks that require surgery, you could owe tens of thousands of dollars. A three-day stay in the hospital might cost $30,000. More serious illnesses, such as cancer, can cost hundreds of thousands of dollars. Without health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

The Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills. While the federal health insurance coverage mandate and shared responsibility payment was in effect, from 2014 through 2018, the number of people in the United States who got health insurance increased by around 20 million.

Since 2019, there is no federal penalty for not having health insurance, says Brad Cummins, the founder and CEO of Insurance Geek. However, certain states and jurisdictions have enacted their health insurance mandates. The states with mandates and penalties in effect are:

- California

- Preventive and wellness services

- Pediatric services

There are a variety of health plans that meet these requirements, including catastrophic and high deductible plans.

Are Health Insurance Premiums Pre

Usually people are not permitted to deduct pre-tax premiums for medical coverage on their tax return. They are already receiving the tax benefit by paying the premiums with their pre-taxed earnings.

Medical insurance premiums are deducted from your pre tax pay. This implies that you are paying for your medical protection before any of the government, state, and different charges are deducted. After-tax medical costs can be deducted on the off chance that you organize your tax return, however you can only deduct the amount of your total medical expenses that exceed 10% of your adjusted gross income.

You May Like: Starbucks Health Insurance Eligibility

How Long Can You Go Without Health Coverage

Under Obamacare, you could go without coverage for a maximum of 2 consecutive months without having to pay a tax penalty. Essentially, if you had coverage for at least 10 months, you dont have to worry.

However, President Trump decided to switch up the rules just a bit. Now, you can go without health insurance for 3 consecutive months before you become liable for a tax penalty. Not a bit change, but can be significant for those who are struggling to find affordable health insurance.

Here Are A Few Examples Of The Cost Of Care Without Insurance

- Fixing a broken leg: $7,500

- The Average cost of a three-day hospital stay: $30,000

- Comprehensive cancer care: over $100,000

- Single prescription drug price: $268

Having a health insurance policy can protect you from exposure to unexpected costs. In any of the examples above, youd still save anywhere from thousands to tens of thousands of dollars after your plans cost.

Don’t Miss: Starbucks Dental Coverage

Are Health Insurance Premiums Tax Deductible For Retirees

The medical expense tax deduction covers the cost insurance of premiums, long-term care insurance premiums, and Medicare. Basically all restoratively essential costs endorsed by a doctor are charge deductible.

This implies that if your primary care physician advised you to add a humidifier to your home warming and cooling framework to alleviate your breathing issues, the gadget could be somewhat deductible. Travel costs to and from clinical medicines are deductible.

You are able to deduct 20 cents per mile for medical needs travel. The expense of in-home consideration can be deducted in case youre persistently sick and the consideration is recommended by your primary care physician.

Deductible uninsured clinical expenses can incorporate everything from an additional pair of eyeglasses, a request for contact focal points, dentures, portable amplifiers, or prosthetic limbs. Substance misuse treatment costs, for example, liquor and drug rehabilitation programs, are potential ordered derivations, as is laser vision corrective surgery.

Penalties Still Exist In Dc And Four States

The ACA’s individual mandate penalty, which used to be collected by the IRS on federal tax returns, was reduced to $0 after the end of 2018. In most states, people who have been uninsured since 2019 are no longer assessed a penalty.

But there are some areas of the country where penalties still apply if a person is uninsured and not eligible for an exemption.

As of 2021, there are penalties for being uninsured in Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia.

More than a decade after it was enacted, most parts of the Affordable Care Act are supported by the majority of Americans.

This includes guaranteed-issue coverage regardless of pre-existing conditions, premium tax credits that make coverage more affordable, coverage for essential health benefits, the elimination of annual and lifetime benefit maximums, and the expansion of Medicaid.

But the individual shared responsibility penalty, aka the individual mandate penalty, was always an unpopular provision of the law. The mandate went into effect in 2014, requiring almost all Americans to maintain health insurance coverage unless they’re eligible for an exemption.

From 2014 through 2018, there was a penalty assessed by the IRS on people who didn’t maintain coverage and who weren’t eligible for an exemption. The individual mandate itself still exists. But there is no longer a federal penalty for non-compliance.

Also Check: Kroger Employee Discount Card

What Is The Individual Mandate

The health insurance marketplacesestablished by the AffordableCare Act provide coverage to 11.41 million consumers, according to anApril 2020 report from the Centers for Medicare & Medicaid Services .

Prior to 2020, if you went without Affordable Care Act compliant health insurance for more than two consecutive months, you would pay a penalty. This requirement was commonly known as the Obamacare individual mandate. The purpose of the penalty was to encourage everyone to purchase health insurance if they werent covered through their employment or a government-sponsored program. According to Kaiser Health News, the federal ACA penalty for going without health insurance in 2018 was $695 per uninsured adult or 2.5% of your income, whichever amount was higher.

In response to concerns about the affordability of marketplace ACA plans, congress passed the Tax Cuts and Jobs Act at the end of 2017. The law reduced the individual penalty of the Obamacare individual mandate to zero dollars, starting in 2019. Now that the individual mandate tax penalty has been removed, there is not a tax penalty at the federal level.

Recommended Reading: How Much Do Health Insurance Agents Make