Mapped: Healthcare Costs In All 50 States

The average cost of health insurance for a typical 40-year-old applicant is about $495 per month, a price that has gone down over 2% from last year. However, health insurance might cost a lot more depending on where you live.

- West Virginia is the most expensive state in the country for health insurance, costing on average $712 per month.

- The cheapest place is New Hampshire, where insurance only costs about $335 per month for a typical 40-year-old applicant.

- Prices are wildly fluctuating from last year depending on where you live, declining some -19.56% in Iowa but rising +9.92% in Indiana.

- Taken together, health insurance premiums decreased over 2% from last year and cost on average $495.

We got the data for our map thanks to ValuePenguin. First we color-coded each state based on the average monthly cost of health insurance premiums for a 40-year-old applicant. The rates come from Public Use Files at the Centers for Medicare & Medicaid Services. Then, we added a circle corresponding to the percentage of change from 2020 to 2021, with green indicating a net reduction in cost, and red an increase. The result is an intuitive snapshot of the national market for health insurance.

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county where you live. In this first table, we look at health insurance premiums for 2021 and how they differ based upon the state you reside in.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

Medicare Part C In California

Medicare Part C, also known as Medicare Advantage, helps merge medical services coverage such as doctor visits and hospital care into a single plan. Since most Medicare Advantage plans are standardized throughout the country, youâll get the same coverage in California as anywhere else in the country. However, depending on your provider, there may be additional benefits such as gym and fitness memberships. Medicare Part C plans such as HMO and PPO offer a comprehensive list of health coverages.

Read Also: Starbucks Insurance For Part Time Employees

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

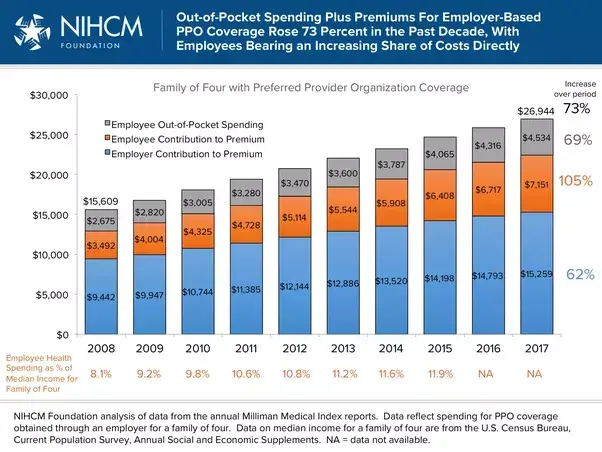

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2020:

- $1,644: average general annual deductible for a single worker, employer plan

- $2,295: average annual deductible if that single worker was employed by a small firm

- $1,418: average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from HealthCare.gov., Plan Year 2020 |

|---|

| Bronze |

| $95 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Recommended Reading: Substitute Teacher Health Insurance

The Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars by their company. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

California Health Insurance: Find Affordable Plans

See how you can get cheap health insurance in CA, including marketplace plans, Medicare, and Medicaid.

- IX.

Residents of California have many options for affordable health insurance coverage. While group coverage through an employer is common, you can purchase California health plans from Covered California, enroll in Medicare or Medi-Cal, or purchase a plan directly from an insurance company.

This guide provides detailed information about your options as a California resident.

Read Also: How To Keep Health Insurance Between Jobs

Is Health Insurance Expensive In California

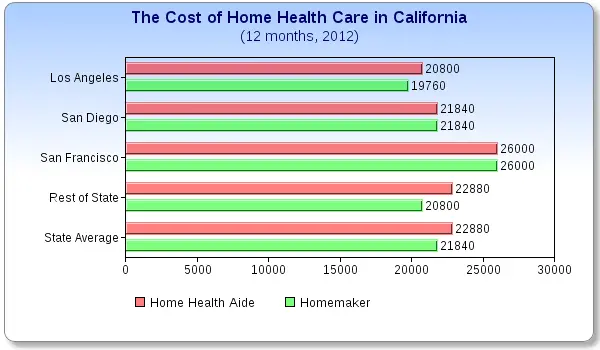

The average cost of health insurance in California is $537 per month for a 40-year-old purchasing a Silver plan. In California, cheap health insurance can be purchased through the online state insurance exchange or acquired through Medicaid if your household income is at or below 138% of the federal poverty level.

Student Health Insurance In California

If you are a student, you can purchase individual health insurance through the Covered California portal. But students in California have other options for obtaining health insurance, including:

- Stay on your parents’ plan: You have the option to stay covered under your parents’ health insurance policy until the age of 26.

- School-sponsored plan: Some colleges offer their own health insurance plans, although they may not cover off-campus services, and you could lose your coverage if you become a part-time student or transfer schools.

- Student health plan: These health insurance plans are designed for full-time students between the ages of 17 and 29. Policies can be purchased through the same insurance providers that offer marketplace coverage. Student health plans are paid through an annual or semiannual premium and can be a good option because they travel with you wherever you study in the U.S.

Also Check: Starbucks Open Enrollment

Compare Health Insurance Plans In California

Wednesday, February 3 2021By Lee Prindle

In addition to sandy beaches and sunny weather, California also has good health insurance options for residents. In a US News study, the Golden State was ranked as the eleventh best state regarding health care access, health care quality, and good public health.

You May Like: How To Enroll In Health Insurance

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

You May Like: Shoprite Employee Benefits

Will California Be The First State To Implement Single

No U.S. states have single-payer health care systems, although some have tried to implement single-payer. Vermont was working towards single-payer under a 1332 waiver, but pulled the plug at the end of 2014, amid concerns that the costs would be higher than expected. In Colorado, single-payer advocates pushed for reform in 2016, but voters defeated Amendment 69 by a wide margin.

Will California eventually succeed where others have failed? Perhaps, but it wont be in the immediate future.

On February 17, 2017, State Senators Ricardo Lara and Toni G. Atkins introduced S.B.562, the Californians for a Healthy California Act.

S.B.562 was sponsored by the California Nurses Association, and would have transitioned California to a single-payer system at a not-yet-determined future date . The program, which would be overseen by a nine-member board of directors, would not have deductibles, copays, or coinsurance, and would cover all medical care determined to be medically appropriate by the members health care provider on a fee-for-service basis.

On April 26, the Senate Health Committee passed the measure, sending it on to the Senate Appropriations Committee. And on June 1, the legislation passed the full Senate, by a vote of 23-14.

On May 22, the California Senate Appropriations Committee :

What Are The Most Common Types Of Commercial Insurance

The most common types of commercial insurance are property, liability and workers compensation. In general, property insurance covers damages to your business property liability insurance covers damages to third parties and workers compensation insurance covers on-the-job injuries to your employees. Feb 16, 2018

Don’t Miss: Kroger Health Insurance Part-time

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than $1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth $2,745 per capita. Check out how much medical treatment can cost abroad.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

How Much Does Health Insurance Cost Average Health Insurance Costs By Us State

Health insurance costs vary a lot between states. According to a 2019 report by the Commonwealth Fund:

- Hawaii has the cheapest individual health insurance contributions of any US state, at $755 annually.

- Texas, Tennessee, South Carolina and Michigan all see personal health insurance costs close to the US national average $1,427.

- Massachusetts was the most expensive state for health insurance. Here, individual contributions stood at $1,903.

Recommended Reading: Asares Advanced Fingerprint Solutions

Does My Us Health Insurance Cover Me Abroad

Most of the time, your domestic health insurance plan doesnt provide cover abroad, but there are some cases it will for instance, for emergencies, medical evacuations or during short trips. Contacting your provider is usually the best way to find out. Sometimes, even if your insurer will cover care in such cases, you may need to pay out-of-pocket and apply for reimbursement.

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

We have a full guide on how much expat health insurance can cost in different countries, together with a list of most expensive and cheapest countries for health insurance.

Don’t Miss: Proof Of Va Health Insurance For Taxes

How Much Is Health Insurance By State

Wondering how much private health insurance costs? The answer is that monthly premiums can vary significantly depending on where you live.

Variation in rates stems from factors like how much competition there is in a given state, forcing insurers to offer attractive rates. Expenses may also vary because of the expected health costs of a population. For example, in states where people tend to be less healthy or where doctors and hospitals charge more, insurance companies set higher rates to cover those costs.

Average Health Insurance Premiums by State for 40-Year-Olds

Scroll for more

- $7,646

Average health insurance rates are only part of the story. Your actual plan may cost you much more or less than the typical person pays.

Thanks to federal subsidies, many people find their premiums are much more affordable. More than 50% of people can find a Silver plan for less than $10 per month with federal cost-sharing adjustments.

Another way to save money on premiums is to opt for higher-deductible plans. You may pay less each month, but you are on the hook for more of the bill if you use health care services until you reach your deductible. If you dont use many services, this kind of trade-off may save you money in the long run.

Do I Need Individual Health Insurance

The Obamacare mandate requires that most people obtain medical insurance coverage. If you are not already enrolled in a health plan that meets the Affordable Care Act minimum essential benefits requirements, you may need to switch plans.

The mandate requires that most Americans and legal residents obtain health insurance that meets the standards set by the Covered California Exchange. Those who do not get covered for health insurance may face a penalty.

You may also need to get Individual Health Insurance in California if:

- You are self-employed.

- Your employer does not offer group plans.

- You are enrolled in a group plan, but it does not cover your spouse or dependents.

- You are enrolled in a health plan, but the premiums are too high.

- You are enrolled in a health plan, but your benefit needs have changed.

Don’t Miss: Does Medicare Pay For Maintenance Chiropractic Care

Average Rate Increase Of 18% For 2022 Bright Health Joining Marketplace And Three Insurers Are Expanding Coverage Areas

Covered California announced in July 2021 that the preliminary individual market rate changes for 2022 amount to a 1.8% increase. As of October 2021, residents can window-shop on Covered CA to see rates and plans for 2022.

The rate changes for 2022 are higher than the rate changes have been for the past two years , but the average rate increase across the three-year window amounts to just 1.1%, indicating significant stability in the states individual insurance market.

Anthem Blue Cross of California, Blue Shield of California, and Valley Health Plan are all expanding their coverage areas for 2022, and Bright Health is newly joining the exchange.

The following rate changes apply in Californias individual market:

- Anthem Blue Cross of California : 2.5% .

- Blue Shield of California : 1.3% increase.

- Bright HealthCare: New for 2022, offering plans in Contra Costa County.

- Chinese Community Health Plan: 1.7% increase.

- Health Net: 4.5% increase.

- Oscar Health Plan of California: 8.6% increase.

- Sharp Health Plan: 0.7% .

- Valley Health Plan: : 5.5% increase.

- Western Health Advantage: 3% increase.

But as is always the case, weighted average rate increases dont paint a full picture:

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

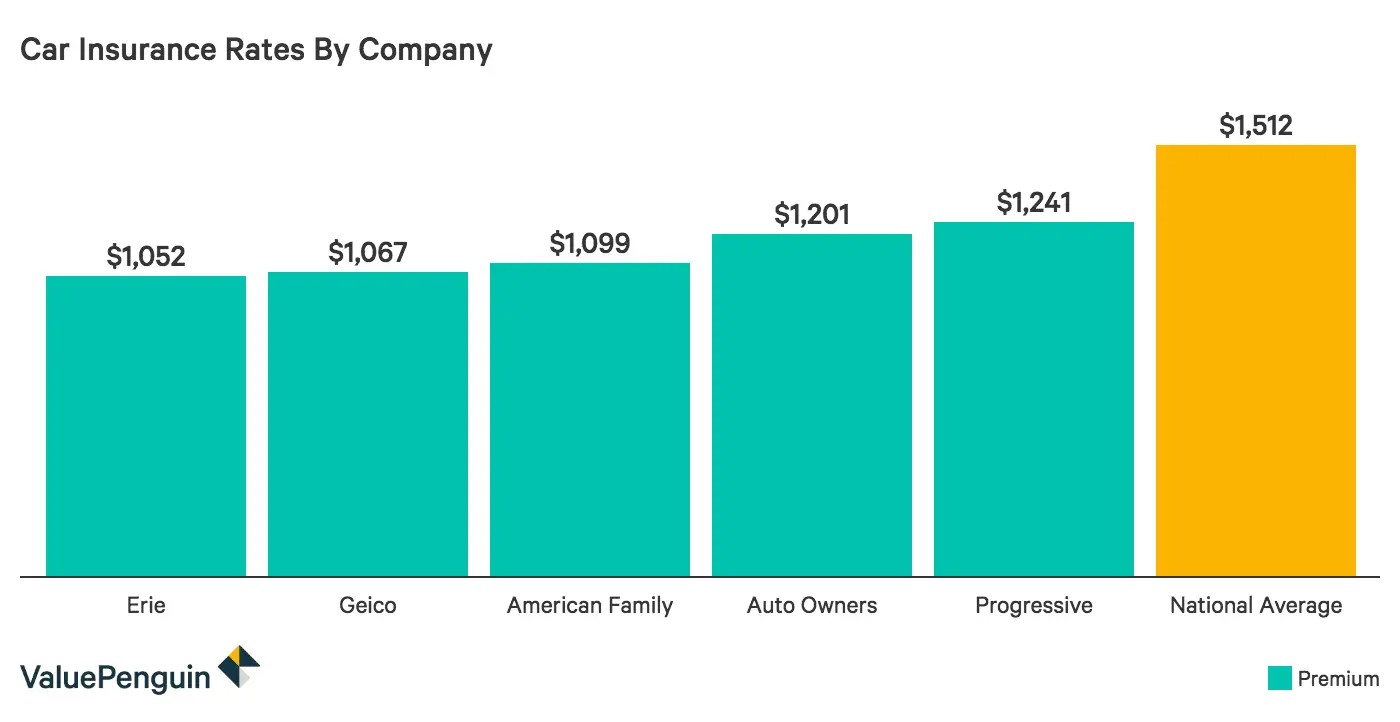

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

- $534

Recommended Reading: Uber Driver Health Insurance

Pros And Cons Of Self

One change enacted by the Affordable Care Act is that monthly premiums can now be a deductible line item on a tax return for someone that is self-employed. Self-employed insurance also is beneficial because it gives you the flexibility to adjust your income level throughout the year, which may qualify you for subsidies to help with the cost of coverage. This is very helpful in the event that your insurance dips lower than you had originally expected. This can, however, have some disadvantages if you dont update your income on your application as you will risk paying a higher amount in monthly premiums if you dont update any increases in your income.

Five Factors That Shape Health Insurance Premiums And Health Insurance Cost For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

- State laws these can dictate what health insurance must cover and affect competition. For instance, a 2017 Maine law instructs insurers to compensate customers who find a better deal on certain services. On the flipside, some states have certificate-of-need laws that may decrease competition.

- Your employers size larger employers tend to have access to cheaper cover. Those who dont have access through their employer will often pay more.

- Geography health insurance can be cheaper in cities than in remote locations.

- Plan type preferred provider organizations tend to cost the most, while high-deductible health plans cost the least.

- Personal factors such as age.

What are the best places for American expats to live abroad?

Find out more here

Read Also: How To Cancel Evolve Health Insurance