I Lost My Employer Coveragewhat Should I Know About Essential Health Benefits

If youve typically had employer-sponsored coverage and are new to the Marketplace and ACA plans, this might seem confusing or overwhelming. However, just think of essential health benefits as the basics that every plan must cover, just at different rates based on your plans metal tier. Because ACA plans are highly regulated, they are required to cover the 10 essential health benefits outlined above. Your employer-sponsored plan may have covered these 10 benefits, but since it wasnt required to, some of them may not have been included.

Percentage Of Firms Offering Health Benefits

Not only do small employers have tighter budgets to begin with, the rising cost of health insurance makes it even harder to offer a benefit.

The average premium for family coverage has increased 22% over the last five years and 55% over the last ten years, significantly more than either workers wages or inflation. This steady increase in costs can make it difficult for small employers with tight budgets to continue to offer employees with a health benefit that will provide enough value.

The Healthcare System And Health Insurance In Belgium

The Belgian healthcare system is one of the best in Europe. It receives generous funding through compulsory health insurance and social security contributions in Belgium.

It achieves near-universal coverage. According to OECD data, 99% of Belgian residents can access treatment through the public healthcare system.

In the 2019 Health Care Index, Belgium ranked ninth out of 89 countries on the overall quality of its healthcare system. Austria, Denmark, Spain, and France are the only European countries to rank higher.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

Public Health Insurance In Belgium

Public health insurance in Belgium receives partial funding through social security contributions. Because of this, residents of Belgium must first register with the social security office before they can access public healthcare.

Once youve registered for social security, you need to sign up for one of the various Belgian public health insurance schemes. These are known as mutuelles or ziekenfonds . Joining one of these schemes is mandatory for any resident wishing to receive health coverage.

After joining one of these schemes, patients can receive reimbursements of between 50% and 75% of their medical costs.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How Much Does It Cost To Have Health Insurance

If you work for a large employer, health insurance might cost as much as a new car, according to the 2019 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage was $20,576 in 2019, 6 which is nearly identical to the base price of a Honda Civic. 7

When Can I Purchase Cheap Health Coverage

Health insurance coverage can be purchased by anyone during the annual open enrollment period . During this period you can access your state or federal health insurance marketplace and shop around for coverage from a variety of providers. If you need coverage outside of this time, then you may qualify for a special enrollment period which allows you to still buy coverage. However, qualification usually only occurs if you have lost a job, had a child or recently gotten married.

Also Check: Does Starbucks Give Health Insurance

Is It Cheaper To Pay Insurance Monthly Or Annually

Paying your insurance premiums annually is almost always the least expensive option. Many companies give you a discount for paying in full because it costs more for the insurance company if a policyholder pays their premiums monthly since that requires manual processing each month to keep the policy active.

Is There Ever A Right Amount Or Coverage That One Needs To Look At

The right amount of coverage depends on several factors like the type of hospital you prefer, current age and health conditions of yourself and your family members, your affordability etc. Healthcare costs vary significantly by hospital and the facilities opted. For example, the cost of a knee replacement surgery nearly doubles if you opt for an imported implant instead of an indigenous one. This way, the size of your Health Insurance should be linked to your income and lifestyle.

While there is no ideal sum assured for Health Insurance policy for an individual, there are two market-broadly-accepted rules on its quantum. First, your health cover should be at least 50% of your annual income. And second, the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice. Most personal finance experts recommend a minimum health cover of Rs 5 lakh. You can have similar sum assured as a family floater to include your family members.

The rising costs of medicines and treatments may render your individual Health Insurance cover inadequate to cover all expenses. The basic Health Insurance policy may not cover expenses related to recovery phase such as extensive nursing care, counseling sessions, rehabilitation. But you can substantially enhance your health cover over and above your basic policy with tools like Riders and Top-Ups without corresponding increase in the premium.

Don’t Miss: Starbucks Insurance Benefits

More Help Before You Apply

-

Estimating your expected household income for 2021

- You can probably start with your households adjusted gross income and update it for expected changes.

- Learn more about estimating income, and see what to include.

Including the right people in your household

Comparing The Two Plans

The low-deductible plan is better if you spend more than $2,650/year at the doctor and the HDHP is better if you spend less than that. Many people see the higher deductible and out-of-pocket maximums on HDHPs and panic which, is why low-deductible plans are so popular, but the thing to keep in mind here is that the total cost of this HDHP will never be more than $1,880 above the total cost of this low-deductible plan.

Another thing to remember is that even if you do have a major injury or prolonged illness for a year or two, the cost of that will be easily balanced out by all the years where you dont have any major problems. Lets say you average $500/year in medical expenses, but once in your first five years, you get in a major accident and it costs $10,000 in hospital bills. Do you know how much money you would save with the higher deductible plan over that time frame? $4,100. Thats a whole lot of money. Obviously, the savings are even higher if you dont get in the accident.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Average Uae Medical Insurance Prices

Having health insurance in the UAE is mandatory. In case your employer does not provide a healthcare cover, you will have to buy one privately both for yourself as well as your family. The UAE medical insurance prices are exorbitant but the care provided is the best in the world. The family medical insurance cost in Dubai especially is quite expensive in comparison to the other Emirates.

- The average Health Insurance Cost in UAE is around AED 10,000 per annum.

- The premiums for comprehensive health insurance can fall in the range of AED 5,500 annually for ex-pats to AED 33,500 for a family of four members.

- The family medical insurance cost in Dubai of a basic cover for four members will cost around AED 17,000 per annum.

- The average annual cost of medical insurance for a couple having a joint policy is around AED 36,324 per annum.

Even though the UAE medical insurance prices make it the 7th most costly nation in the world but there is a reason why it ranks as the top medical tourism center in the world.

Find Cheap Health Insurance Quotes In New York

New Yorkers can purchase affordable health insurance through the state marketplace or through Medicaid if their household income falls below 138% of the federal poverty level.

The average cost of health insurance in New York is $701, which is about 1% more expensive than it was in 2020.

To help you find the best coverage, we analyzed Silver health insurance policies available across all counties and found that the Fidelis Care, Silver, was the cheapest plan available. However, there are many insurers offering health plans in New York, and where you live will determine available companies and policies.

Recommended Reading: Starbucks Healthcare Benefits

How Does The Metc Compare To A Health Spending Account

The Medical Expense Tax Credit and HSA are two competing alternatives to reduce your personal medical expense costs.How are they different? HSA vs METC.

- You might ask, “how does the medical expense deduction work?” Well, you must remember that a tax credit is different than a deduction. The METC is a non-refundable tax credit applied through your personal tax return. A non-refundable tax credit is subtracted from your tax owed, but cannot bring your tax balance above 0.

- The size of the METC is dependent on your medical expenses, net income, and province of residence. In some cases, you may receive little to no tax credit at all.

- On the other hand, an HSA can eliminate 100% of the taxes on your medical expenses . It does this by turning after-tax personal medical costs into before-tax business deductibles. This process occurs through your business, which is why the plan only works for small business owners.

Now, let’s use the same numbers above for an HSA calculation:

Note: A Health Spending Account is NOT a tax credit, it is a means to make your medical expenses tax free. Therefore, we cannot directly compare the numbers, but you can still have a general idea of which creates better savings.

Net Income = $100,000

Province = Alberta

The $4,000 medical expense is an after-tax cost, so in reality you are paying $6,250 before tax. =$4000)

Before Tax Cost = $6,250

Olympia HSA membership fee = $249

After Tax Cost = $4,249

With a Health Spending Account, you save $2,250.

Cheap Health Insurance For Students

Students often have additional health insurance options. Many universities and colleges provide free health insurance to students through a school-sponsored plan. These policies typically provide health insurance for most on-campus medical services, but you may lose the coverage if you become a part-time student or transfer schools.

Another option for some students is to purchase a student health plan. These health insurance policies are designed for full-time students between the ages of 17 and 29. Plans can be bought through most large health insurance companies and are paid either by an annual or semiannual premium. A student health plan can be a great cheap medical insurance option because you will not lose your coverage if you decide to transfer to a different school.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Get The Most Affordable Mec Plans

Keep your employees healthy and happy with our low cost Minimum Essential Coverage plans.

MEC eliminates the costly penalty that employers would otherwise have to pay for each employee under the Affordable Care Act by covering preventive and wellness-related tests and treatments.

Our MEC plans can be a good alternative for employers with 2 or more full-time employees. Since MyMEC plans are self-funded, they are exempt from state coverage mandates and state taxes, and any unused funds are returned to the business.

Cheapest Health Insurance Companies

When evaluating affordable health insurance policies, you will find that there are some companies that consistently offer cheaper rates than others. However, these providers may not offer policies with as many benefits as other plans. This is an important factor to evaluate when searching for the best policy for your family.

For example, our analysis found that in nine states, the cheapest health insurance company that offers Silver marketplace health insurance is Blue Cross Blue Shield .

| Health insurance provider |

|---|

Read Also: Can I Go To The Er Without Health Insurance

How Do I Choose The Most Affordable Medical Insurance

The most affordable health insurance depends on your household income. The cheapest option is to enroll in Medicaid if your income falls below 138% of the federal poverty level. Medicaid is a federally funded health insurance program that provides health care benefits to low-income individuals. For those not eligible for this option, the most affordable solution may be through your state marketplace, as well as off-exchange plans, including short-term health insurance policies.

It’s important to note that the cheapest health insurance plan may not always be the right policy for you. Therefore, to find the best value coverage, you should evaluate your medical needs before buying a health insurance policy.

How Much Does A Medical Office Visit Cost

Medical visit payment rates are different between different insurance companies

A rough guide is:

-

New Patient Office Visit: $200 $450 depending on how much time is spent on evaluation and/or how many medical conditions are addressed.

-

Subsequent Office Visits: $75 $300 depending on how much time is spent on evaluation and/or the number of medical conditions being addressed.

-

Any tests performed during the visit are ADDITIONAL cost according to your insurance plan.

-

Most insurances will cover Preventative Visit without deductible or copay e.g. Annual Physical or Medicare Annual Wellness Visit .

-

To understand the difference between a Annual Preventative/Physical visit vs a medical visit please click on the button below.

Dont Miss: Can Health Insurance Deny Pre Existing Conditions

You May Like: Is Starbucks Health Insurance Good

How Much Will My Health Insurance Plan Cost

When you choose a health plan, you need to understand the entire cost of your coverage. You will probably need to pay all or part of the premium. You may also have “cost sharing”. Cost sharing means that you pay for part of the cost of a service covered by your health plan. You need to understand both the cost of the premium and the amount of any cost-sharing you may expect over the next year.

Think about the types of services that you and your family will use and how often they will use them. If you and your family expect to mainly use preventive care services, you might be happy with a plan that has a higher deductible but will cover preventive care before the deductible. However, if anyone has a condition that will require access to lots of services, you may want to choose a plan that has no deductible, but has fixed dollar copayments for each service.

Determine the Cost

Your total premium plus cost sharing will be the total cost of your health plan.

Premiums

Cost Sharing

Most health plans in Massachusetts only cover some of the cost of care and include “cost-sharing” features. Cost-sharing means that the insurance company pays for part of the cost of a health service and you pay the rest. Some of the cost-sharing features you may have in your health benefit plan include:

Copayments

Deductible

Coinsurance

Benefit Limit

Exclusion

Out-of-Pocket Maximum

Minimum Essential Coverage Versus Minimum Value

The terms minimum essential coverage and minimum value both stem from the ACA, and are sometimes conflated. But they mean two different things. Minimum essential coverage, as described above, is coverage that satisfies the ACAs individual mandate.

Minimum value, on the other hand, is a measure of whether a plan offered by a large employer provides adequate coverage. In order to provide minimum value, an employer-sponsored plan must

- cover at least 60 percent of the average medical costs across a standard population , and

- provide substantial coverage for inpatient care and physician treatment.

Large group plans do not have to cover the ACAs essential health benefits, and they do not have to fall into one of the ACAs metal level ranges. The minimum value provision is instead used as the basic requirement that large employer plans must meet or exceed.

A large employers plan has to be both affordable and provide minimum value. If its not, and at least one employee obtains subsidized coverage in the exchange in lieu of the employers plan, the employer will be on the hook for the ACAs employer mandate penalty.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

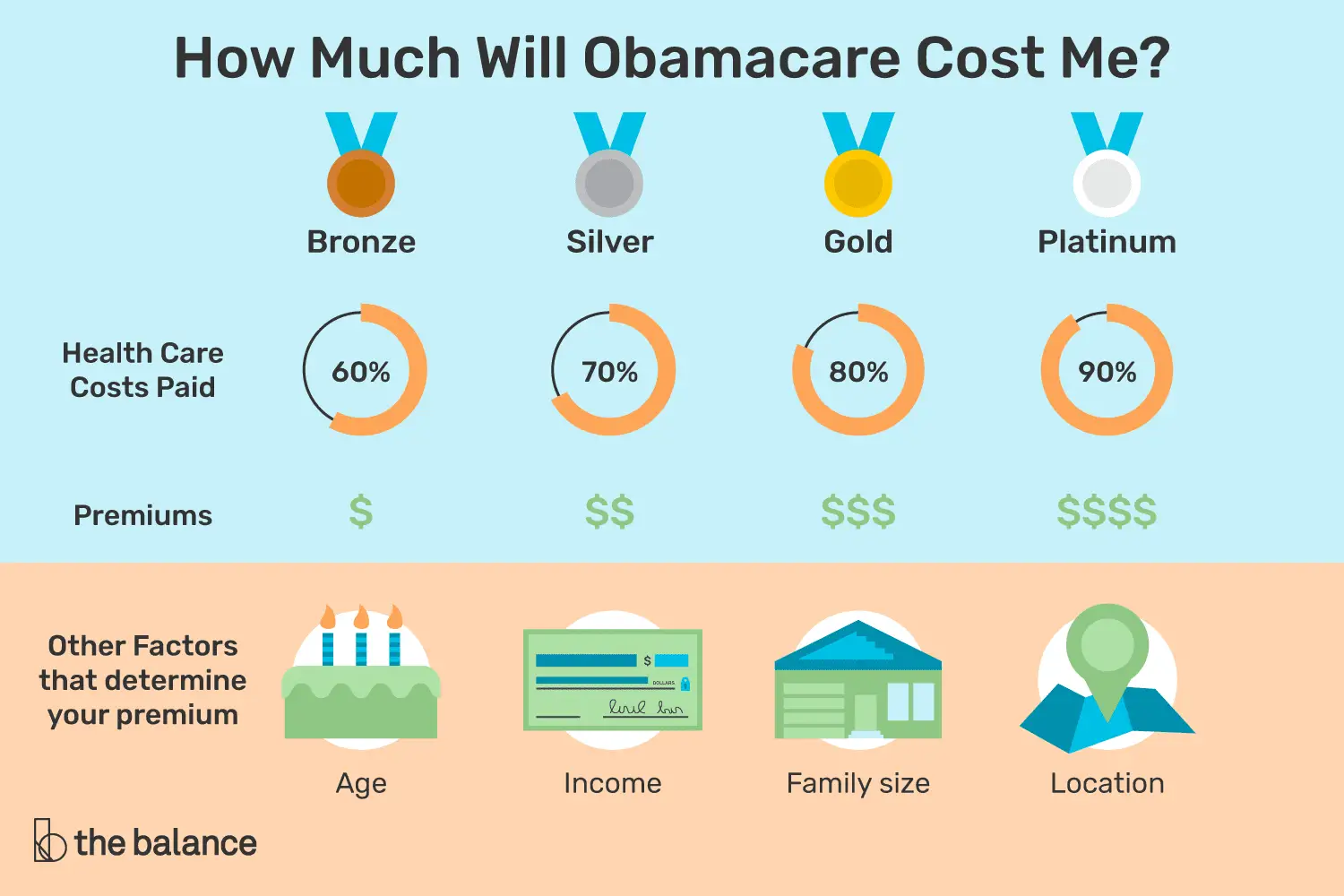

Comparing Bronze Gold Platinum Plans

The cheapest Bronze plan cost $426.31/month or $5,115.72/year. Paying a $5,500 deductible before insurance kicks in sounds terrible. With such a high deductible, you may never get insurance coverage because you may never surpass $5,500 in health insurance costs a year in you life.

The Gold plan cost $587.90/month or $7,054.80/year due to the reasonable $250 deductible. But do you want to pay a 20% co-insurance for all health costs, even though the maximum out of pocket was $5,000? I wouldnt.

The final Platinum plan cost $693.01/month or $8,316.12/year. If it was up to me, Id decide on this plan due to no deductible and only a 10% co-insurance per health expense with a maximum $4,000 out of pocket expense which I hope to never hit.

A $1,262 a year difference in premiums between the Gold plan and the Platinum plan doesnt make a difference to me because they are both in the realm of expensive.

The snapshot above only shows about 3/8 of the total benefits of each plan. I didnt want to stress out getting hung up with some non-covered insurance situation due to the fine print. I essentially am willing to pay a premium for more peace of mind.

Does $8,316.12 a year in health insurance premiums sound reasonable to you? It depends on your annual income amount.