Faq: Does My Small Business Have To Provide Health Insurance

Written by: Josh MinerNovember 10, 2020 at 2:49 PM

As a small organization leader you may be asking, Do I have to provide health insurance to employees? The Affordable Care Act requires large employersthose with over 50 full-time equivalent employeesto either offer qualified and affordable health benefits or pay a tax penalty. This is commonly referred to as the employer mandate, play or pay requirement, or, formally as the employer shared responsibility provisions.

It is important for your organization to understand whether you are defined as an applicable large employer by the IRS, as the mandate and employer tax penalties only apply to your organization if you are an applicable large employer.

Also Check: Trustage Life Insurance Complaints

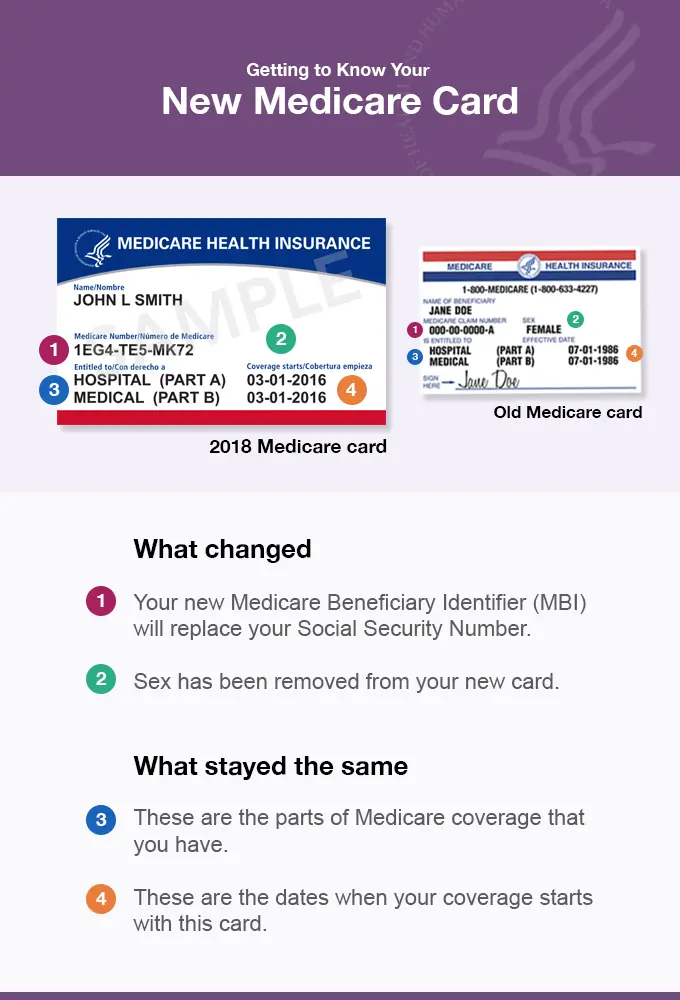

Q My Photo Health Card Has Expired How Do I Renew My Health Card

Your photo health card has an expiry date that is linked to your date of birth. The first time you apply for a photo health card, the expiry date can be anywhere from two to seven years in the future. When your photo health card is renewed, the renewal date will always be five years in the future and linked to your date of birth.

Renewal notices for photo health cards are mailed approximately two months prior to the expiry date shown on the front of the photo health card however, if it is more convenient, you can renew up to six months prior to the date of expiry.

To learn more about renewing your Ontario photo health card, refer to the fact sheet Renewing Your Photo Health Card.

This Article Offers An Overview Of How You Can Check The Status Of Your Health Insurance: How To Know Your Medi

Are you one of those people who say how do I know if my health insurance is active? If yes is the answer, then this article is for you. To keep your health insurance active, you need to regularly pay your premiums to the insurer. Every health insurance company has a different way to handle insurance payments. It is important that you follow the instructions of your health insurer to keep your health insurance active and valid. Some of the most popular health insurance companies in the United States are Medi-Cal and Medicaid. In some situations, people have health insurance but no card. Some people are not sure if they can use health insurance without a card. Keep reading this article to get the answers.

Read Also: Does Amazon Have Health Insurance

Q What Should I Do If I Move

It is important that ServiceOntario has your current address to ensure your coverage remains active and for any direct communication with you.

There are three ways to update your address:

For more information refer to OHIP Bulletin 8089, fact sheets Changes to OHIP Coverage for Eye Care Services and Health Services.

Northern Health Travel Grant :

You may be eligible for a Northern Health Travel Grant to help pay transportation costs if you live in northern Ontario and must travel long distances for specialty medical care.

Services in Other Canadian Provinces and Territories :

Most of your Ontario health coverage benefits can be used across Canada. The province or territory you are visiting will usually bill Ontario directly. If you have to pay for health services you receive in another part of Canada, you can submit your receipts to your local OHIP Claims office to be considered for reimbursement. Prescription drugs from pharmacies, home care services, ambulance services and long-term care services provided in other provinces and territories are not covered.

Services Outside Canada :

Consumer Guide To Understanding Health Insurance

Many of the requirements discussed in this guide do not apply if your employer “self-funds” its health benefits plan. This Self-fund means that the employer pays your health claims from its own funds and does not pay premiums to an insurance company. The employer decides the plan coverage, including employee eligibility, covered benefits and exclusions, employee cost-sharing and policy limits. Federal law exempts these self-funded plans from state insurance laws, so these plans do not need to include state mandated benefits. You can ask your employer if your health plan is self-funded.

Recommended Reading: How To Get Your Parents On Your Health Insurance

Q How Do I Submit My Medical Bills

If you have purchased supplementary insurance, check with your insurance carrier about how you should submit your bills. Otherwise, it is required that you send your itemized bill to your nearest OHIP Claims office within 12 months of receiving treatment. With your bill, send :

- an original, detailed statement, itemized on a fee-for-service basis

- your original receipt for payment

- your name and current Ontario address

- your health number

- a completed Out of Province/Out of Country Claims Submission

To avoid delays, do not hold your bills and receipts until you return to Ontario. Mail them to your insurance carrier or the ministry as soon as you receive them.

For more information : Travelling Outside Canada

How To Find An Affordable Health Insurance Plan

Finding a health insurance plan that fits you and your needs doesn’t have to be a pain. When shopping for an affordable health insurance plan, it’s important to know what makes a plan affordable to you, specifically. Do you rarely utilize health care services? A high deductible, low premium plan probably makes sense for you. Are you managing a chronic illness? A health insurance plan that has higher premiums, but has lower out-of-pocket costs, will probably be more affordable in the long run.

Learn more in this guide on how to get affordable health insurance.

More on Health Insurance

Read Also: How To Stop Health Insurance

If Youre Married But Dont Have Kids

If you’re married but don’t have kids, you don’t need to buy health insurance as a family. You can buy individual plans from separate companies, if that makes sense for you and your spouse. You can also purchase a family plan from the marketplace.

One of you can also be a dependent on the other’s employer-provided health insurance plan, if that’s available.

What Documents Should I Bring When I Register

When applying for a new health card, you must bring three original documents to prove your OHIP-eligible citizenship/immigration status, your residence in Ontario, and your identity.

If you are a member of a military family, refer to the fact sheet Military Family Members and the Military Family Member Document List.

If you have questions about what documents to bring with you when you register for OHIP coverage, contact ServiceOntario INFOline at 1-866-532-3161 or visit your local ServiceOntario Centre.

You May Like: What Is The Best Health Insurance Coverage

Employers Benefits From Workers Health Insurance

Most nonelderly Americans receive their health insurance coverage through their workplace. Almost all large firms offer a health insurance plan, and even though they face greater barriers to providing coverage, so do the majority of very small firms. These employment-based plans cover two-thirds of nonelderly Americans and pay most of working families expenses for health care and about one-quarter of national health spending. Despite employers role in the health insurance market, however, very little attention has been paid to employers motivations for providing health insurance to workers. Why do employers offer health insurance to workers? Is it because workers want it? Because their unions demand it? Or do employers offer health benefits to workers because their productivity and profitability depend on it?

This article makes a case for reassessing the theory. A key flaw in the standard theory is that it ignores the benefits accruing to employers from offering health benefits. According to the conventional view, employees pay the full cost of coverage presumably because they believe that the benefits of health coverage are entirely for themselves. The alternative view that I am investigating posits a business case for employment-based health coverage, acknowledging that employers may want to offer coverage because offering a compensation package composed of both wages and health insurance is more profitable than providing wages alone.

Q I Have Had My Name Legally Changed How Do I Have My New Name Put On My Health Card

To change your name on your health card to reflect your new legal name, you must visit a ServiceOntario Centre, complete a Change of Information and present the original of one of the following:

- Certified copy of the court order for a change in name

- Change of name certificate

- Adoption court order

If you do not already have a photo health card, you must also provide three original documents to prove citizenship, Ontario residence and identity.

If you have any questions regarding your own specific situation, call the ServiceOntario, INFOline at 1-866-532-3161.

Don’t Miss: What Is The Self Employed Health Insurance Deduction

Do I Have A Qualifying Event

What qualifies as a life event depends on whether youre the employee losing coverage, or a spouse or dependent of that employee. Your life-event will qualify you for COBRA coverage if youre the employee and:

- Youre laid off.

- Youre fired, but not for gross misconduct like stealing or assaulting the boss.

- Your employment is terminated for any other reason.

- Youre still employed, but your hours are reduced to a level that causes you to lose your health insurance benefit .

Your life-event will qualify you for COBRA coverage if youre the spouse or dependent of the covered employee and youre losing coverage because:

- One of the above things happened to the employee.

- The employee is becoming eligible for Medicare. If this is your situation, discover your options about losing your health insurance because your spouse is getting medicare?“

- The employee died.

- Youre getting divorced or legally separated from the employee.

- Youre a young adult and youre losing your dependent status with the health plan. If this is your situation, discover your options about turning 26 & getting kicked off your parents health insurance.

Answers To 7 Of The Most Common Questions Nannies Babysitters And Senior Caregivers Have About Finding And Paying For Health Insurance

You may know that every American is required to have health insurance by law. But what exactly does that entail? How do you go about finding the right policy and how much it will cost?

Whether youre a full-time nanny, a part-time senior caregiver or an occasional babysitter, its important for caregivers to understand what the law requires you to do, and how to go about finding and signing up for the right health insurance policy. Its also important to remember that health insurance is for you: Having the right protection in place in case of emergency can save you a whole host of problems, both financially and in terms of your well-being.

Here are answers to seven common questions caregivers have about health insurance:

You May Like: How To Apply For Kaiser Health Insurance

Is Your Small Business Required To Offer Health Insurance

If your company employs fewer than 50 full-time and full-time equivalent workers per year, then you may not be required to offer health insurance. Find the latest news and resources at the Applicable Large Employer Information Center or explore the IRS information page with questions and answers about the employer mandate. Plus, you may want to check out how to afford employee benefits for tips.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

for more expert tips & business owners stories.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Understanding The Rules For Aca Affordability

In general, affordability means the employee contribution for the least expensive health insurance plan is 9.83% for 2021 or less of their total household income.

Since many employers dont know their staffs household income, you can use the following information, known as affordability safe harbors:

- Form W-2 wages.

- Rate of pay.

- Federal poverty line.

You can use one safe harbor calculation for all employees or apply different methods to various worker categories, such as salary versus non-salary staff. Additionally, the law considers other employer arrangements, including wellness program incentives and health reimbursement arrangements .

Learn more by reviewing questions seven through 12 in Notice 2015-87 and the IRS publication about minimum value and affordability.

There are exceptions for seasonal workers and employees with medical care through the military. If your part-time seasonal staff works 120 days or less per year and your workforce exceeds 50 FTEs for 120 days or fewer per year, youre not an ALE.

Read Also: Where Can I Go For Health Care Without Insurance

How To Find Information On Your Policy

The easiest way to get information on your policy is to access your summary of benefits and coverage. All plans on federal and state marketplaces include this report. Insurance companies and employer-sponsored insurance plans must provide you with this info, too.

Every plan page includes a copy. They are easy to read and navigate. The summary lists out questions and answers. Then it explains why this information matters.

The summary includes information like:

- The coverage period

- Who the coverage is for

- Common medical events and how much each will cost you

- What happens if you need tests, schedule surgery, or visit a hospital

The summary breaks down exactly what services your plan covers. It also explains what it does not, and even provides sample scenarios with example costs.

Heres a sample of what each document looks like and the type of info it includes.

You can use the Healthcare.gov site to pull up your summary of benefits and coverage. Its right on the site if you bought your plan through a government marketplace. The site includes a search engine you can use to look up plans from private companies, too.

If you have an insurance policy from another source, contact the insurance company to ask for a copy. Or ask your HR department for help finding health insurance policy information.

Remember:

Health insurance language is confusing for everyone.

Dont get frustrated and give up! Use Healthcare.govs glossary to look up terms you dont understand.

How To Shop For Health Insurance

Note: Some parts of the Affordable Care Act are being changed or eliminated via government policies and laws. It is likely that some of the rules and regulations affecting the health insurance marketplace will continue to change over time. To stay up to date on Obamacare and other health insurance issues, visit healthcare.gov and the website of the health commissioner’s office in your state.

In America today, we all need health insurance. You do. Your kids do. It’s not a “nice to have” anymore it’s a “must-have.” And that’s the law. In most cases, parents who aren’t covered by health insurance might have to pay a fine each year. Going without also means that if someone gets sick or is injured, a family might have to pay all the bills for care received. That can cost a whole lot more than paying for coverage.

To help people get health insurance, the federal and state governments set up a health insurance marketplace . This makes it easier than ever to get coverage, but the process can seem a bit confusing.

Here’s what to do to get health insurance.

Also Check: How To Apply For Health Insurance As A College Student

What Does Covered Mean Anyway

If a service is covered, it means your health plan will pay for some or all of the cost. In most cases, your doctor also needs to be on the list of doctors that take your insurance, called a network. How much your health plan pays for depends on what type of care you use and where you get it.

For example:

- Some covered services are completely free to you, like going to the doctor for your annual exam. Your plan pays everything.

- For others like seeing the doctor for a lingering sinus infection or filling a prescription for covered antibiotics youll pay a fee. The amount you pay will be different depending on the type of plan you have and whether or not youve taken care of the amount you have to pay before your plan starts helping you .

To get the biggest bang for your buck, use services your health plan covers whenever possible.

What The Law Means For Employers

The Affordable Care Act established new standards and opportunities for access to health care in the United States. Congress enacted this law in March 2010.

Now almost everyone must have insurance. To help enforce these rules, the law set up new reporting requirements and penalties. They affect both individuals and employers. We want to help you understand what the law means for you.

Here are a few highlights of the law:

- Large employers those with 50 or more full-time-equivalent employees must provide health insurance that meets certain standards, or potentially pay a penalty.

- Smaller employers and individuals have another option for buying coverage. Its called a public exchange, or marketplace.

- If you offer health insurance to your employees, you or your insurance company must provide a Summary of Benefits and Coverage in a standard format.

- Health insurers must spend a set percentage of premium dollars on health care expenses. If we dont hit this target, we have to send you a rebate. This rule is called the minimum medical loss ratio rule. It applies only to fully insured plans.

- If the cost of health insurance for some of your employees exceeds a certain dollar amount, you may have to pay an excise tax beginning in 2020.

- Reporting rules are in effect to confirm that you and your employees comply with the law.

- Most health plans must include preventive care at no cost to the individual.

You can find more details about the Affordable Care Act below.

Recommended Reading: How Do I Know If I Have Private Health Insurance