Important 2021 Open Enrollment Information

Regardless of which marketplace you shop on, make sure that youre shopping during Open Enrollment . The federal health insurance exchange is open at least Nov. 1, 2021, through Jan. 15, 2022 for you to get a 2022 plan.

Some states may give you longer to enroll. Learn more in our state-by-state guide to health insurance open enrollment.

Ready to shop health insurance?

New Options With Private Exchanges

What does this shopping on a private exchange make possible? For consumers, along with eliminating a pile of paperwork, it allows more flexibility to choose insurance that fits their lifestyle. This range of choices wouldnt have been practical with a cumbersome paper-based process. Private ownership of the exchange also lets consumers spend benefits money more creatively, on things like gym membership or help with quitting smoking. Its a more holistic way to approach health choices. All of these product options, which are referred to as ancillary or voluntary products because they are add-ons to health coverage, can be delivered through a single shopping experience.

The online interface of the exchange makes possible simpler communication about insurance. With the help of dynamic interactions, the interface can filter information and deliver tips and guidance only when and where theyre needed. The consumer gets more usable information about what theyre choosing.For employers, the automation of work formerly done by HR saves money. An even bigger cost savings is the opportunity to cap the amount of money they contribute to healthcare costs. The employer can provide a fixed contribution, with the difference is covered by the employee. This is called a defined contribution, and is especially popular among smaller employers.

Choosing The Proper Healthcare Exchange

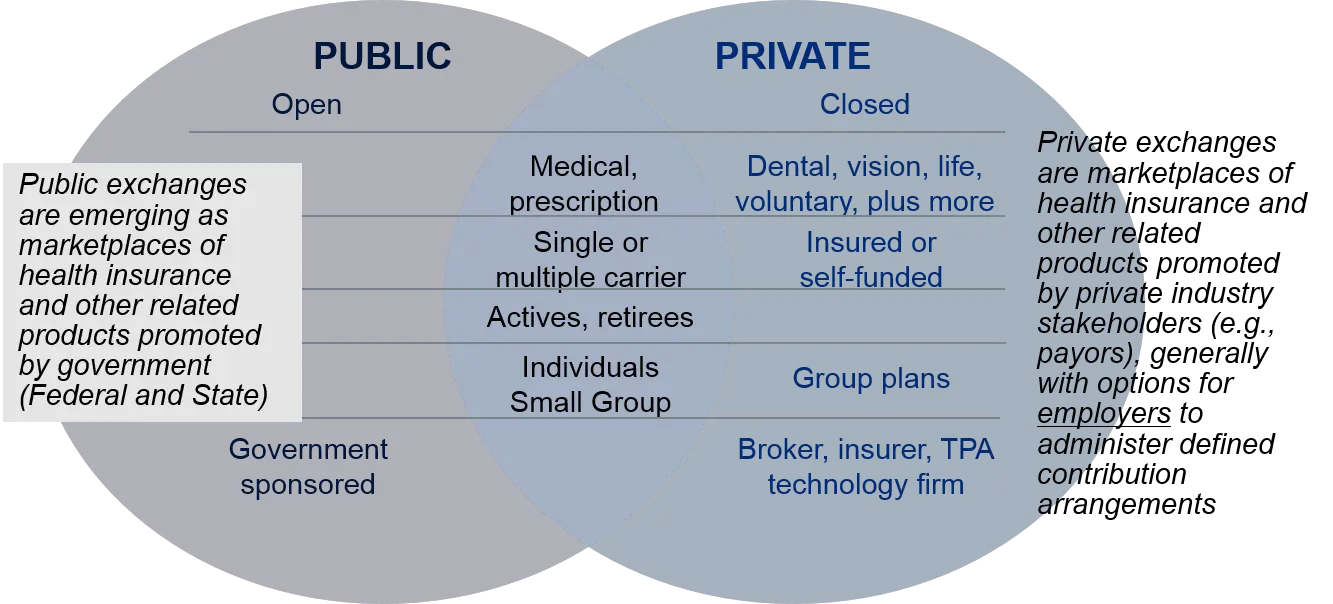

Bolstering private healthcare exchanges and shifting towards defined contribution plans may be interpreted as insurers defensive response to the implementation of the public exchanges required by the ACA. I

ts also worth noting that private healthcare exchanges can function effectively with or without the utilizing the defined contribution model. Contribution model aside, there are still a number of ways that private exchanges differ from public exchanges.

Read Also: What Is Subsidized Health Insurance

What Is The Health Insurance Marketplace

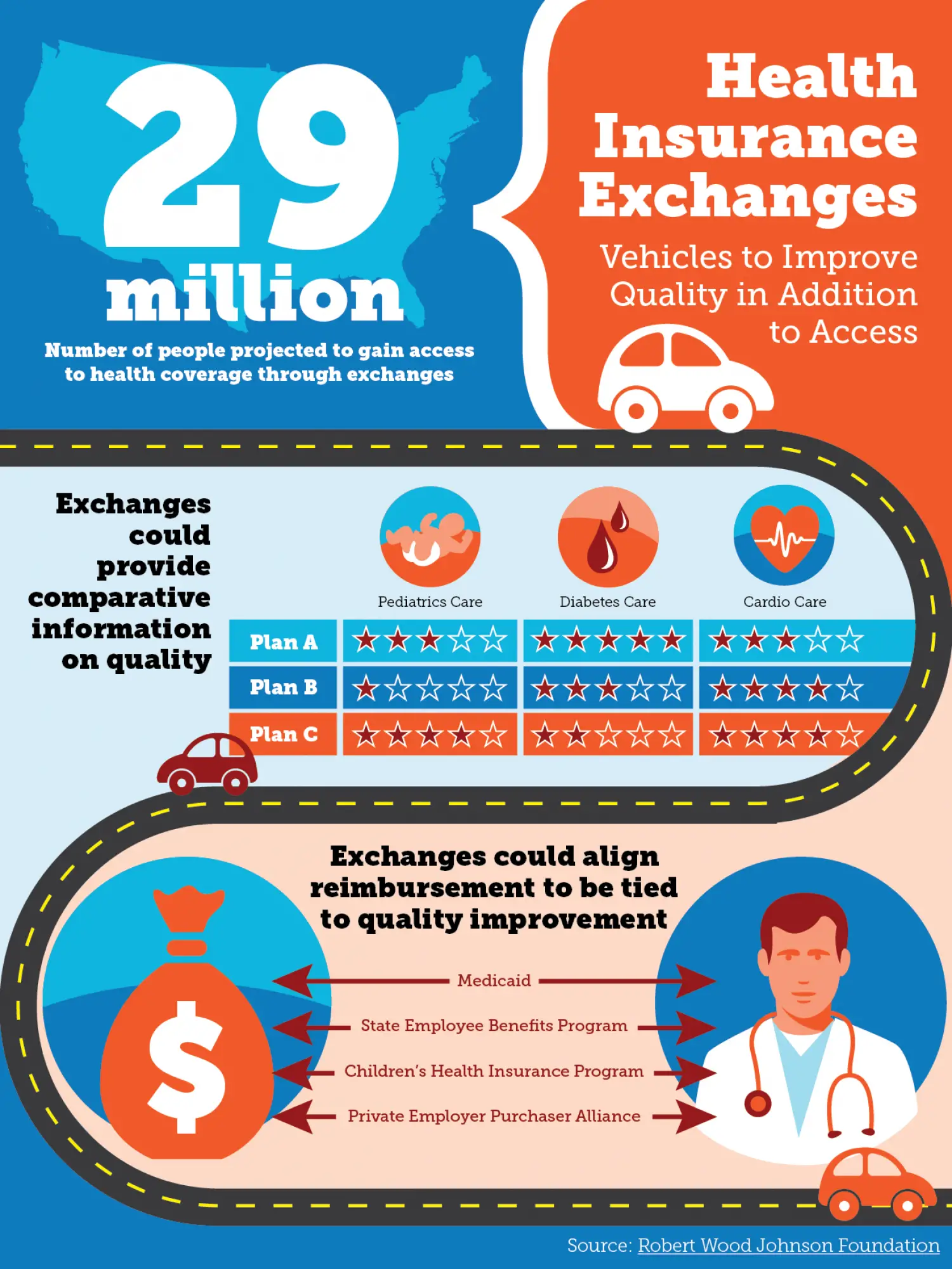

The Health Insurance Marketplace is a government-run health insurance exchange established by The Affordable Care Act . It is located at HealthCare.gov and is often referred to by other names, such as the Health Insurance Exchange or simply the Marketplace. Using the Marketplace, individuals can shop for health insurance plans and easily compare various elements of the coverage across different plans, including:

- Benefits offerings

- Required monthly premiums

What Is A Public Health Insurance Exchange

A public health insurance exchange is a health insurance exchange run by a government entity. In the US, Healthcare.gov and the state-based exchanges are public health insurance exchanges. Plans sold on a public exchange are sometimes referred to as on-exchange.

All plans sold on these exchanges must be qualified as meeting the Affordable Care Acts requirements for Minimum Essential Coverage, which are as follows:

- Have an actuarial value of at least 60%, meaning the plan covers at least 60% of costs .

- Cover the following 10 essential health benefits:

- Prescription Drugs

- Rehabilitative and Habilitative Services and Devices

Plans that meet public exchange requirements can offer additional advantages, namely:

You May Like: What Is Tricare Health Insurance

Reasons To Look At Off Exchange Plan Options

When individuals are shopping for insurance, it is a good idea to carefully look at many insurance options. Run some scenarios to estimate which will result in the best price for coverage for you. If you are someone who does not qualify for subsidies or who finds coverage with an off exchange plan that they cannot find on the exchange, an off exchange plan can be advantageous. Compare the off exchange plan and its cost throughout the year against an on exchange plan. Both on exchange and off exchange plans are offered at eHealth for easy comparison.By thoroughly investigating your options, you can get a better idea of what a reasonable cost for insurance is for someone in your specific circumstances. This information, in turn, can help you find the best deal for your money and the coverage that best fits your lifestyle and your needs.

What Is A Private Exchange

Private exchanges are health insurance ecommerce websites. Employees and individuals can shop there for a commercial health plan, enroll in it, and purchase other related voluntary products and services. Private exchanges come in two main varieties: Insurer-led and multi-carrier. In the insurer-led case, the exchange is a direct sales channel for one insurance company. This is like buying plane tickets from United.com. The multi-carrier approach is like Kayak.com, where you can shop for plane tickets from many airlines. Unlike public exchanges, which are operated by the federal or state government, private exchanges are owned and operated by health insurers and brokers.

The private exchange experienceWhen a consumer signs up for insurance on a private exchange, the experience is a lot like buying anything else online. They make selections, add them to a cart, and check out at the end. If they have employer-sponsored health insurance, they may find that their employer is contributing toward their insurance costs, and this works like having a gift card at a retail site.

Read Also: What Is The Best Individual Health Insurance In Florida

Public Health Insurance Option

The public health insurance option, also known as the public insurance option or the public option, is a proposal to create a government-run health insurance agency that would compete with other private health insurance companies within the United States. The public option is not the same as publicly funded health care, but was proposed as an alternative health insurance plan offered by the government. The public option was initially proposed for the Patient Protection and Affordable Care Act, but was removed after independent Connecticut senator Joe Lieberman threatened a filibuster. Subsequently, Congress did not include the public option into the bill passed under reconciliation. The public option would later be supported by Hillary Clinton and the Democratic Party in the 2016 and 2020 elections and multiple other Democratic candidates, including the current President Joe Biden.

What Is A Special Enrollment Period

If you have experienced a Qualifying Life Event , you can enroll in a health plan through Nevada Health Link even outside the open enrollment period . Currently, enrolled members who have experienced life changes can make changes to their health insurance or choose a new plan. This is known as a Special Enrollment period .

Recommended Reading: What Is The Difference Between Hmo And Ppo Health Insurance

How Would The Public Option Be Run

A public option health insurance program would be run by the government but could be implemented just like private health insurance.

- Self-sustaining: One option is to require a public health insurance to be self-sustaining that is, paid for only by the premiums paid by those who “belong” to that program.

- Tax Subsidized: Another option would be for the premium costs to be subsidized through government taxes.

- Federal or State Administered: Another approach is that the public option might not be handled solely by the federal government instead, it could be administered by individual states, which would set their own requirements.

The public option was not a part of the healthcare reform, to begin with, but if private insurers do not manage to keep pricing fair, and do not keep those with pre-existing conditions covered, it could trigger the implementation of a public option.

A Brief Overview Of Health Insurance Exchanges

Before we dive too deep into the differences between on-exchange and off-change health insurance, a little background will be helpful.

The original health insurance marketplace started as the federal Health Insurance Marketplace – a website where individuals could shop for various health care plans available under the Affordable Care Act , often referred to in earlier years as Obamacare, beginning in 2010. Since that time, 14 states have developed their own individual health insurance exchanges, aka marketplaces. All medical insurance plans sold on the public marketplace must be ACA-compliant, meaning they must cover 10 essential health benefits for consumers.

Every state either has its own public health insurance marketplace, like Minnesotas MNsure, or they rely on HealthCare.gov to support their states public online shopping experience. There is only one official exchange per state.

Recommended Reading: Do Restaurants Offer Health Insurance

Employers On Private Exchanges

Research shows that over half of all employers prefer multi-carrier exchanges to single-carrier exchanges. Less than a third of all employers actually prefer a single-carrier exchange over multiple carriers. The same research study found that 70 to 80 percent of employers prefer purchasing insurance from a private exchange over a public exchange.

The main reasons employers prefer the private exchanges are the superior customer service, design flexibility, and product selection.

Many employers prefer private exchanges because they are immediately wary of government-ran programs. Typically, public exchanges are targeted by lower income individuals so the can receive the premium subsidies sponsored by the government.

Todays consumers expect private exchanges to be superior to public exchanges, offering real-time admin support and guided purchasing experiences that help make the product and plan recommendations based on need.

Affordable Innovative Health Plans

Changes introduced by the Affordable Care Act mean that your business has more coverage choices than ever to offer your employees.

Small businesses now can shop on a public exchange. Public exchanges provide an online marketplace where you can compare health plans before buying. Public exchanges are run by states, the federal government or both. Online tools help you to understand your potential savings, tax credits and costs.

The public exchange option for small businesses is the Small Business Health Options Program or SHOP. Aetna is offering SHOP plans in the District of Columbia and Maryland.

We also have medical plans geared to the unique needs of Members of Congress and designated Congressional staff.

Don’t Miss: How Much Is Insurance For Health

What Is A Public Option

There are primarily two types of public options discussed in the healthcare debate: The first is the expansion of existing government programs, like Medicare and Medicaid. The second is the creation of a new government-run plan for those under 65, that would compete against private insurers in the individual market exchanges. We’re focusing on the latter, since that’s more easily implemented.

An increasing number of counties in the U.S. had just one insurer option in the ACA exchanges this year, and the number of counties will likely grow in 2018. The creation of a new public healthcare plan would intentionally fill the gaps in counties where insurance options are limited, offering consumers choice and competitive pricing. The point is to ensure that all Americans in the individual market have access to an affordable healthcare plan, even if private insurers raise rates or exit the market.

Ideally, the public plan would offer the same coverage and benefits nationwide, with price varying depending on region. But with Republicans in control of Congress and the White House, it would likely need to be introduced state-by-state to be implemented soon.

Helen Halpin, a professor at the U.C. Berkley School of Public Health, says the introduction of a public option could help transition the U.S. to a single-payer program down the road. “The premium will be less expensive and the coverage will probably be better,” she says.

The Private Healthcare Exchange And Define Contribution

The private healthcare exchange is comprised of a marketplace and other products that allow employers to purchase health insurance and choose health plans offered by the participating payors.

These exchanges help employers maintain a more active involvement in employees health care while progressing towards the emerging defined contribution model. This contribution model allows employees to choose from the different plans funded by the savings account of cash contributions made by the insurer.

Recommended Reading: Does Health Insurance Cover Therapy

Finding Your Health Insurance Exchange

Your state may run its own health insurance exchange such as the one run by California, Covered California. Or, your state may have opted not to create a health insurance exchange, or to create an exchange but use the federal enrollment platform. In that case, residents use the federal government’s exchange at HealthCare.gov.

The following states have their own enrollment websites, although you can get to them by starting at HealthCare.gov and clicking on your state or entering your zip code:

In every state, enrollment in the exchange is limited to an annual open enrollment window and special enrollment periods triggered by qualifying events.

Concerns With Private Exchanges

Disintermediation, administrative burden, and margin compression are the three leading concerns associated with running private healthcare exchanges. Disintermediation occurs when the payor loses interactions and influence with the consumer due to the increasingly expansive powers of the exchange administrator.

Administrative burden is a result of customers greater need for decision support for selecting from the larger number of plans available. Margin compression may occur if the private exchange encourages a transition to a lower-margin marketplace, comes attached with higher transaction fees or results in less cross-segment subsidization with the healthiest members.

During 2014, the number of members in private healthcare exchanges totaled at least 3 million. By the end of 2015, there were 6 million members, and 2016 was projected to end with at least 12 million members in private healthcare exchanges. Although they predate the ACA, the rising popularity in private exchanges represents the fundamental shift the health insurance sector is making from the conventional B2B model to operations centered on designing effective B2C campaigns.

Find health insurnace on your own terms with free quotes. Enter your zip code below to start comparing today!

Also Check: How Much Will My Health Insurance Cost

Health Insurance Exchanges: State Roles In Selecting Health Plans And Avoiding Adverse Selection

By Sharon Silow-Carroll, Diana Rodin, Tom Dehner, and Jaimie Bern1

A central feature of the federal health reform legislation is its creation of “health insurance exchanges.” The exchanges, to be operational in 2014, are envisioned as insurance marketplaces in which individuals and small businesses can compare and purchase health plans, and determine and receive premium subsidies for which they are eligible. States have the option to develop and host their own exchanges, or let the federal government establish and run exchanges for them. States that choose to implement exchanges will be able to tailor the exchanges to their states’ particular strengths and circumstances. Yet, they will face a multitude of decisions regarding their governance, design, marketing, administration, technology, and other factors.

What Is an Insurance Exchange? According to the November 2010 Initial Guidance to States on Exchanges from the Department of Health and Human Services:

“An Exchange is a mechanism for organizing the health insurance marketplace to help consumers and small businesses shop for coverage in a way that permits easy comparison of available plan options based on price, benefits and services, and quality. By pooling people together, reducing transaction costs, and increasing transparency, Exchanges create more efficient and competitive markets for individuals and small employers.”

|

Exhibit 2: Resources for States in Developing Health Insurance Exchanges |

New Mexicos Official Health Insurance Marketplace

The New Mexico Health Insurance Exchange, also known as beWellnm, is now your State-Based Health Insurance Marketplace.

Emergency Order in place to help New Mexicans who have been affected by the Wildfires

Click here to learn more.

New Special Enrollment Period

BeWellnm has launched a new special enrollment period that provides qualified New Mexicans, an opportunity to enroll in coverage. The new SEP for New Mexicans with household incomes below 200% of the federal poverty level who arent eligible for Medicaid or the Childrens Health Insurance Program, can enroll anytime.

Examples of how the FPL amounts are valid through December 31, 2022 that applies to you:

A single person making less than $2,147 a monthA family of 3 making less than $3,660 a month

Both are examples of eligible to enroll at any time this year.

Click hereto learn more.

New Mexicans who experience a certain life events have a 60-day window to enroll in coverage. This is known as a Special Enrollment Period. . Apply now!

Shop and Compare Plan Options!

You can shop and compare to find the right plan for you and your family.

A certified assister can help you find coverage that meets your needs and budget.

Financial Assistance!

Thanks to the American Rescue Plan there is more financial assistance available to help pay for your coverage.

Also Check: What Does Health Insurance Cost In Retirement

What Is Health Insurance

Health insurance is a contract that requires an insurer to pay some or all of a person’s healthcare costs in exchange for a premium. More specifically, health insurance typically pays for medical, surgical, prescription drug, and sometimes dental expenses incurred by the insured. Health insurance can reimburse the insured for expenses incurred from illness or injury, or pay the care provider directly.

It is often included in employer benefit packages as a means of enticing quality employees, with premiums partially covered by the employer but often also deducted from employee paychecks. The cost of health insurance premiums is deductible to the payer, and the benefits received are tax-free, with certain exceptions for S corporation employees.

Who Would Be Included In A Public Option Health Insurance Plan

There are two groups that are challenged by health insurance coverage these groups would find more complete, easier access to health insurance with a public option plan.

- First: People who cannot afford expensive, private insurance plans, particularly those who work for employers who don’t offer health insurance as a benefit, would find a more affordable option with a public payer option.

- Second: A public option would also help those with pre-existing conditions purchase more affordable insurance. The Affordable Care Act of 2010 ensured this group could not be discriminated against by insurers. A public option that would modify or replace the ACA would need to continue this protection.

Prior to the ACA, no one was required to participate in health insurance whether you wanted to have health insurance was up to you. In practice, that means the people who participated in insurance were those that used healthcare services the most.

Many professionals and politicians agree that whether or not a public option is implemented, everyone who works should be required to purchase private insurance coverage to control costs. If younger, healthier people paid into the health insurance system, it would alleviate financial strain on others. These younger, healthier people would financially benefit from their participation later in life, or if they became sick.

Recommended Reading: How To Pick A Health Insurance Plan