Health Insurance Would Again Become Unaffordable For Many

Although the Congressional Budget Office projected last year that the enhanced subsidies would increase marketplace enrollment by 1.7 million Americans in 2022, enrollment actually grew by 2.5 million people. Again, some of that was due to the longer open enrollment window and the additional federal funding for enrollment assistance and outreach. But the improved affordability of marketplace coverage is the primary reason for the enrollment growth.

If the ARP subsidy enhancements are not extended, nearly everyone with marketplace coverage will have to pay higher premiums next year. And the 2.5 million additional enrollees who signed up this year may no longer be able to afford their coverage in 2023.

The subsidy cliff would return, as subsidies would no longer be available to households that earn more than 400% of the federal poverty level. As weve explained here, some Americans with household income a little over 400% of the poverty level had to pay a quarter or even half of their annual income for health insurance before the ARPs subsidy structure was implemented.

Thats untenable, obviously.

Explaining Health Care Reform: Questions About Health Insurance Subsidies

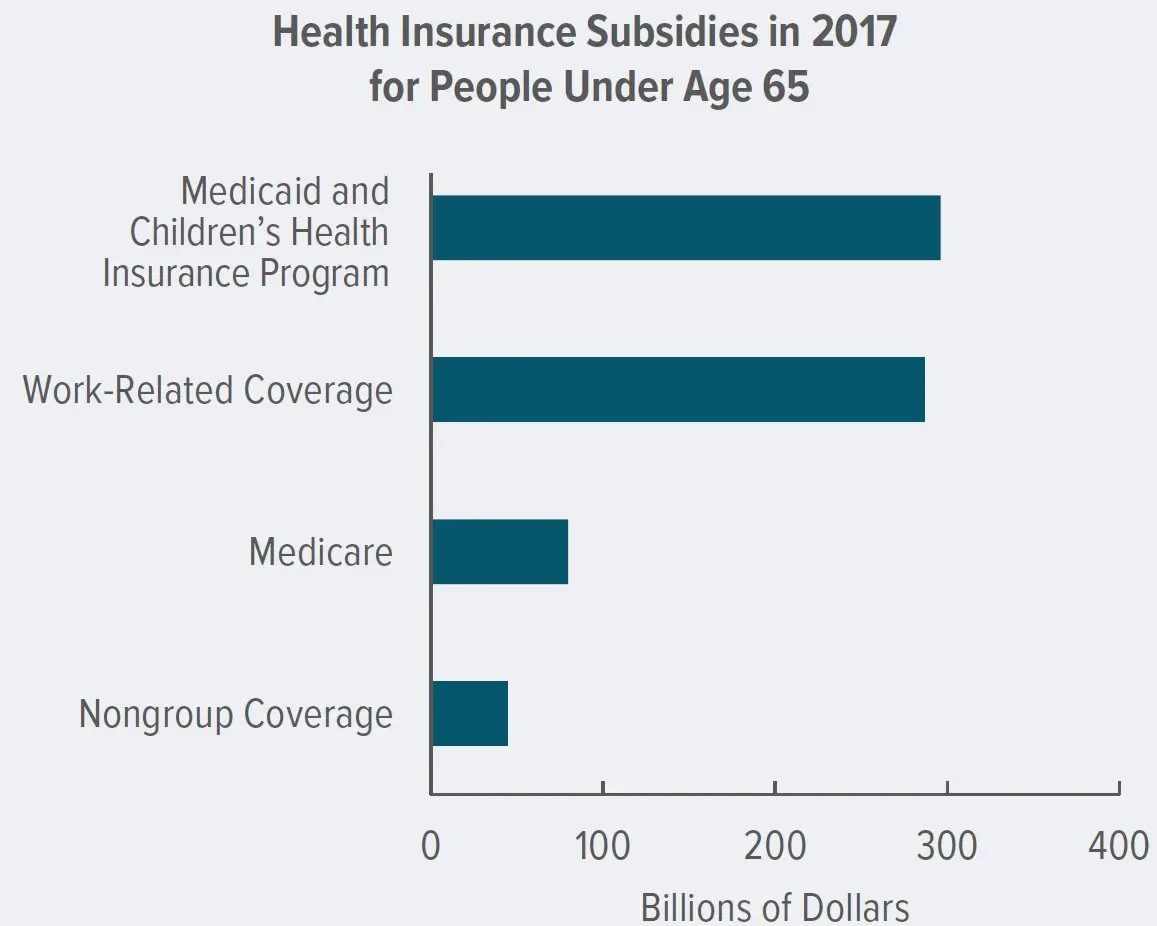

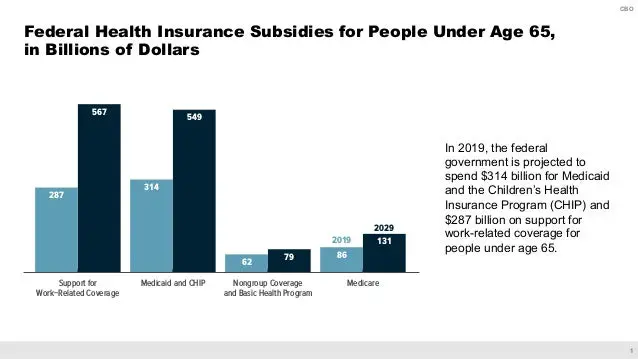

Health insurance is expensive and can be hard to afford for people with lower or moderate income, particularly if they are not offered health benefits at work. In response, the Affordable Care Act provides for sliding-scale subsidies to lower premiums and out-of-pocket costs for eligible individuals.

This brief provides an overview of the financial assistance provided under the ACA for people purchasing coverage on their own through health insurance Marketplaces .

What Will Your Health Insurance Cost You Under The Aca

First, lets clear up some important terminology youll need to understand in this area.

- ACA stands for the Affordable Care Act, signed into law in 2010. According to the government, the purpose of this law was to make health insurance available to more Americans, including those with preexisting conditions.

- The ACA is nicknamed Obamacare.

- Actually, its official full name is The Patient Protection and Affordable Care Act.

- Getting insurance under the ACA is also referred to as getting it from the Marketplace.

At its very simplest level, the cost of a persons health insurance depends on their taxable income. The federal government provides subsidies for those with household incomes between 100 percent and 400 percent of the federal poverty level. This subsidy is officially referred to as a premium tax credit.

You can apply to the Marketplace for health insurance and, based on your medical needs and preferences, choose the best plan. Then, find out what your subsidy will be from the ACA.

Also Check: Starbucks Benefits For Part Time

How Do I Determine If I Qualify For Obamacare Subsidies

According to an analysis completed by Covered California, 922,000 consumers will be eligible for a health insurance subsidy in 2020.

If you think you may be one of these consumers, below are some factors that will impact whether or not you qualify:

- Your income. The most significant factor in determining if you qualify for an insurance subsidy is your total household income. The subsidies are based on the amount you expect to earn in the coming year. If that amount is between 100 and 600 percent of the federal poverty line then you will likely qualify.

- Your household size. As your family size increases so does the income threshold to qualify for a subsidy. For example, you would not qualify for a subsidy as an individual making $75,000 per year, but you would if you had a family of four at the same income level.

- Where you live. You may be eligible for a larger subsidy if you live an area that is more expensive for health insurance.

The end of the open enrollment period is coming! Do not run the risk of a penalty for failing to get health insurance. With Affordable Care Act subsidies, health insurance may cost less than you think. Contact a licensed agent today to help you determine if you are eligible.

Purchase Of Individual Coverage By Families Not Offered Group Plan

Price Elasticity

Estimates of the price elasticity of demand for individual insurance by families in California who do not have access to group coverage are given in Table 3.9 . Our overall elasticity estimate of 0.2 to 0.4 is similar to those found in earlier studies. But we find significant differences in the price elasticities between younger and older families =4.2, p< .05 in Census data, 2=10.7, p< .05 in NHIS data), the self-employed and others =2.9, p< .10 in Census data, 2=3.3, p< .10 in NHIS data), and by poverty group=117.03, p< .05 in Census data, 2=136.81, p< .05 in NHIS data). The price elasticities and the income elasticity estimates did not differ significantly between the CPS and SIPP data =4.8, p> .10), so we present the pooled estimate. The elasticity estimates for some of the subgroups were statistically higher from the NHIS data than the point estimates made from the Census data, but the general pattern of results was very similar.10. We also explored whether price response differs when premiums are high or low. We found a statistically significant greater response when the minimum offer premium was less than $45 per month than at higher premiums in all datasets. However, the effect was very small. The elasticities shown in Table 3 are estimates at higher premium levels at lower premium levels, the overall elasticity increases from .20 to .25 in the Census data the increase in the NHIS data is from .44 to .46 and was not statistically significant.

Also Check: 8448679890

How Do Premium Subsidies Work For Medicaid And Chip

While subsidies for marketplace health insurance plans are calculated using the previous years federal poverty level, Medicaid subsidies are based on the current years federal poverty level.

States can elect their own thresholds, but in most states, youll be eligible for Medicaid benefits if your income does not exceed 138% of the federal poverty level. The table below shows the maximum income limit to qualify for Medicaid in most states.

| Household Size |

|---|

- Wisconsin

- Wyoming

Because these 12 states do not offer Medicaid based on income alone, a coverage gap exists for some people in those states. That is, if your income is less than 100% of the federal poverty level, you may not qualify for an Obamacare subsidy and you may not automatically qualify for Medicaid.

When the Affordable Care Act was enacted, it was done so under the expectation that anyone making less than the federal poverty level would be eligible for Medicaid. But the Supreme Court later ruled that states could not be forced to expand their Medicaid eligibility, and a dozen states have declined to do so.

The income eligibility limits for CHIP are higher than those of Medicaid. Children in households with an income of 200% of the federal poverty level are eligible for CHIP in most states, and in some states the limit reaches 300% of the federal poverty level. CHIP eligibility is also based off the age of the child. You can review the state-by-state breakdown for CHIP income limits.

Private Firms And Competition

The Original Medicare is a federal program the rest of the civilian healthcare systems use private firms to deliver medical services.

Within Obamacare, there are subsidized premiums and cost sharing reduction assistance. Comparison shopping is an excellent way to find the best value in health insurance. The subsidies are important for lowering prices.

Read Also: Kroger Part Time Health Insurance

How Do Premium Tax Credit Health Insurance Subsidies Work

Depending on your income and the plan you choose, premium tax credits may cover part or all of your premium payments in a year. The assistance you receive is calculated based on your estimated annual income. If you overstated the income, your bill may be higher than it should be and you may receive a refund. If you understated your income, you may receive more credit than due, and you may need to return any excess benefits.

The payment can go directly to your plan provider every month, or you may pay the premiums yourself and claim the credit as a tax refund when filing returns. Since the premium subsidy is refundable, you should get the refund even if you have a federal income tax liability.

The American Rescue Plan And Subsidies

The American Rescue Plan Act , signed into law byPresident Biden in 2021, expanded eligibility for subsidies to make healthinsurance affordable for even more Americans. People that are already enrolledin health plans through the marketplace may find they qualify for moresubsidies to bring down the cost of their monthly premiums. Those that couldnot afford to enroll in a plan due to the subsidy cliff may now have theopportunity to sign up for coverage.

The new law allows people with incomes below 150% of the poverty level to enroll in silver plans with a zero premium. Deductibles for these plans will also be dramatically reduced allowing individuals and families with lower incomes the ability to have affordable health benefits. The ARPA also reduces the amount people must pay if they have income between 100% and 400% of the federal poverty level.

The ARPA also provides subsidies for some people with income between 400% and 600% of the poverty line, those considered on the subsidy cliff in the past. This may allow individuals and families within these income levels to find more affordable, ACA-compliant plans, which could positively impact more than 2 million people. Check out our guide to the American Rescue Plan Act to find out more about how it may affect your ability to qualify for subsidies.

Recommended Reading: How Much Does Starbucks Health Insurance Cost

Health Insurance Marketplace Subsidy Calculator

Premium Assistance for Health Insurance Coverage

This insurance subsidy calculator illustrates health insurance premiums and subsidies for people purchasing insurance on their own in new health insurance exchanges created by the Affordable Care Act . Affordable healthcare plans are now more standardized and simplified. Generous subsidies abound and reduce the cost of the policy, allowing those who could not afford health insurance in the past to be able to receive affordable healthcare coverage.

There are a number of policies to choose from in the Health Insurance Marketplace. You can choose a plan with a lower monthly payment with a higher deductible, or you can go with a plan that has a higher monthly premium, but a much lower deductible. WNC Health Insurance is here to help you discover your right fit.

Middle-income individuals under the age of 65, who are not eligible for coverage through their employer, Medicaid, or Medicare, can apply for tax credit subsidies available through the NC Health Insurance Marketplace.

How Does The Subsidy Work

The subsidy will go directly to your health insurance provider when you purchase insurance to lower your monthly health insurance payments or premiums.

Have specific questions about how this impacts you? Ask them below or get health care reform answers in our TurboTax community.

i am 63 single and only get social security of 1195 a month , showing a 13930 net benefit for 2018 I get insurance thru healthmarket place paying 24.00 a month -based on annual total credit of 11208.00,, when I calculate thru turbo tax, turbox tax shows I owe the irs $4.00 . could this be correct I do not get any refund??? thanks for letting me know

The people telling you the subsidy is free, and if you dont use it you get it as a refund are WRONG. This is a fact they are not telling people and it is hurting the very people it is suppose to be helping. The truth is what ever you take in subsidy you have to claim as additional income when you file your taxes, and you will pay taxes on it. It happened to me and other people I know. It will take it out of your refund if you have one, if not you will have to pay, what you owe. Figure what they paid for you, and you will have to pay at least 10% of that back if not more. It is a crime that no where does it tell you that on the website. This same thing happened in Florida after the Hurricanes in 2004, the government offered help to pay for repairs, a subsidy, what they didnt tell people was you had to pay it back when you filed a tax return.

Also Check: Why Do Doctors Hate Chiropractors

Do I Have To Wait Until I File My Taxes To Get The Subsidy Since It’s A Tax Credit

You dont have to wait until you file your taxes. You can get the premium tax credit in advancepaid directly to your insurance company each monthwhich is what most people do. However, if youd rather, you may choose to get your premium tax credit as a tax refund when you file your taxes instead of having it paid in advance.

This option is only available if you enrolled in a plan through the exchange. If you buy your plan directly from an insurance company, you won’t be eligible for up-front premium subsidies, and you also won’t be able to claim the subsidy on your tax return.

If your income is so low that you dont have to file taxes, you can still get the subsidy, although you won’t be eligible for a subsidy if your income is below the poverty level .

When the subsidy is paid in advance, the amount of the subsidy is based on an estimate of your income for the coming year. If the estimate is wrong, the subsidy amount will be incorrect.

If you earn less than estimated, the advanced subsidy will be lower than it should have been. Youll get the rest as a tax refund.

Regardless of whether you take your subsidy up-front throughout the year or in a lump sum on your tax return, you’ll need to file Form 8962 with your tax return. That’s the form for reconciling your premium tax credit .

How Do I Get Access To Medicaid Or The Childrens Health Insurance Program

Getting access to affordable Medicaid coverage or coverage provided by the Childrens Health Insurance Program requires going through the standard application process. Because both government-managed programs offer more financial assistance than the subsidies granted for health insurance premiums, there is not a discount provided to participate in either program.

CHIP allows households with higher incomes to receive financial assistance to pay for the health insurance needed by children. Medicaid requires much lower income standards, which might disqualify a household that would otherwise qualify for the financial assistance provided by CHIP.

Dont Miss: Does Starbucks Provide Health Insurance For Part Time Employees

You May Like: Minnesotacare Premium Estimator

Am I Eligible For A Health Insurance Subsidy

Who is this for?

If you need to buy your own health insurance, this explains how to find out if you can get help paying for it.

With few exceptions, the Affordable Care Act requires everyone to have health insurance. If you’re insured through your employer, or eligible for programs like Medicare or Medicaid, you’re covered.

If not, you’ll need to buy your own health insurance. Otherwise you’ll have to pay a penalty.

Do you already pay for your own insurance? Are you shopping for the first time? Either way, the good news is you may be able to get help paying for individual health insurance. This help is called a subsidy.

How Long Do You Have Health Insurance After Leaving A Job

How long do you have health insurance after leaving a job? If you quit your job without another one with benefits lined up, its worth wondering how long you have health insurance after you resign. After leaving a job, you can have health insurance for up to 36 months with the COBRA health insurance option.

Recommended Reading: Starbucks Health Care Benefits

How Will The Marketplace Check My Income

The Marketplace will check the income you reported on your application and compare it to what the IRS has on file for you. This is called income verification. The Marketplace does this by electronically asking the Internal Revenue Service database and other databases if what you reported is the same as what they have on file. The IRS will not share your personal tax data with your Marketplace. They will just tell the Marketplace if the income you reported does or does not match what they have on file for you.

The IRS information comes from your latest income tax return. When you apply for coverage in 2015, thats probably going to be your 2013 tax return. If your income has changed since then, your reported income may not match the data on file.

- If your estimated income is the same as or more than what is on file, the Marketplace will consider it to be verified.

- If your estimated income is lower than what is on file or if the Marketplace cannot find any electronic data on your income , the Marketplace may ask you to provide more information to prove that your guess is accurate. You will have 90 days to get this done. You will get health insurance and temporary tax credits while you are waiting. If you dont prove your income is what you say it is, your tax credits may end or change to match the information in the electronic files.

Advance Premium Tax Credit

The advance premium tax credit is a tax credit that helps lower the costs of monthly health insurance premiums. You may qualify for the credit if your household income is between 100% and 400% of the federal poverty level.

The value of the APTC, as described in the previous section, is the difference between the premium of the second-lowest cost Silver plan and the premium cap your state has set for your income level. You can use the APTC for any plan available through the marketplace.

There are two ways to use the APTC: You can take it in advance or get a credit when you file your tax return.

If you opt to take the credit in advance, you can use it throughout the year by applying the credit directly to the payments you make to your insurance company. Then, when you file your tax return, you report the exact amount of subsidy you used throughout the year. You only need to provide an estimate of your annual income in order to qualify for a subsidy, so your tax return allows the government to check that you received the proper subsidy based on what your actual income was for the year.

You can also opt to receive the entire credit when you file your taxes. The biggest challenge with this option is that you will still have to pay the full premiums throughout the year, which may not be affordable for many of the people who qualify for subsidies.

Read Also: How To Keep Health Insurance Between Jobs