How Can I Purchase Travel Medical Insurance

You may be able to purchase travel coverage through your existing private insurer, a travel agent, or your credit card. If not, there are specialist companies.

If you are travelling, even for a short period, travel insurance is important. Outside of your province, your provincial medical plan may not cover your expenses. Outside of the country, it will not. Health care in other countries, like the neighbouring United States, can be extremely expensive. In some countries, you may even be denied critical care if you are unable to pay upfront.

Medigap Open Enrollment Period

Age 65 and up

Eligibility for enrollment in Medigap policies in California begins the month you are 65 or older and enrolled in Medicare Part B. This period is called your Medigap Open Enrollment Period and lasts for six months.

The Medigap Open Enrollment Period is the best time to enroll in Medigap in California. During OEP you can get a plan even if you have pre-existing conditions.

The effective date for your new plan is the first day of the month following your application.

Younger than 65

Federal law doesnt require a Medicare insurance company to sell Medigap to people under age 65. However, in California, if you receive Social Security disability benefits or have end-stage renal disease and Medicare coverage, you can purchase at least one type of Medicare Supplement plan.

If you qualify, your OEP begins after you have received Social Security disability benefits for 25 months .

What Is The Cost Of Supplemental Health Insurance For Seniors

The average cost of supplemental health insurance for seniors will depend on where you live, the health insurance company, type of plan, and benefit level you select. While these amounts will vary greatly, we can still give you an idea what you may spend. These are typical costs of supplemental health insurance plans for seniors1:

| Supplemental Health Insurance Product |

|---|

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

The Top Medicare Supplement Insurance Companies For 2021

Since Medicare Supplement plans are standardized, the benefits for each company are mostly the same. There are key categories in which a company can distinguish itself from its counterparts, however. They can include a person’s experience with a company , the cost , and if they provide any additional benefit perks.

We compiled information about the top Medicare Supplement insurance companies in 2021 in the two tables below.

Do Health Insurance Policies Change Depending On The Province

Yes. Each of Canadas ten provinces and three territories offers its own public insurance plan. Some are significantly different. All offer basic health care services. Beyond this basic care, some are more generous than others. As a result, private health insurance policies are also different between provinces and territories.

| Province/Territory |

|---|

Try Safes free health insurance comparison tool to get personalized quotes in just seconds.

Also Check: Starbucks Health Insurance Plan

How Much Do Medicare Supplement Insurance Plans Cost

Medigap plan costs come down to several factors, notably the following:

- Whether it is your open-enrollment period

- Whether youve paid premiums on time

- The particular insurer

- Your age, gender, tobacco use in the past 12 months and ZIP code

- The plan itself

Open enrollment is typically the best time to get a plan. It starts the month you turn 65 and lasts six months. During this period, you get what insurers call the preferred rate regardless of any pre-existing conditions you may have. Enroll outside of this period, and you may have to pay standard rates. Its also possible for your application to be rejected if you seek Medigap outside of open enrollment.

Now, if youre waiting to enroll in Medicare Part B and Medigap because you have a spouse whose insurance covers you, you can still have an open-enrollment period for Medigap past your 65th birthday. It begins when the employers coverage ends .

Theres also something called guaranteed issue in which insurers must give you Medigap coverage even if your open enrollment period has ended. In short, open enrollment can affect your plans cost but does not necessarily do so.

Your protections are stronger in these four states: Connecticut, Massachusetts, Maine and New York. For example, New York has continuous enrollment.

What Is The Best Supplemental Medicare Plan

Theres no single supplemental health insurance plan for seniors that fits everyone. But there is most likely a plan that will fit your specific needs. HealthMarkets can make finding a plan easy. Get a free quote for supplemental health insurance for seniors. Or, if youre looking for the cost of Medicare Supplement plans, answer a few quick questions about your preferences. Then, HealthMarkets FitScore® technology will help you compare Medicare supplement plans and find one thats the right fit for your needs. Get started today!

46568-HM-1020

You May Like: Starbucks Partner Health Insurance

Take Advantage Of Open Enrollment

If you choose to purchase health insurance coverage through the marketplace, you may have to wait to do so until the open enrollment period. Open enrollment usually begins in November and lasts through the middle of December each year. You may be able to sign up for a plan outside of the open enrollment period if you experience a significant life event, such as moving to a different state, losing previous health insurance coverage, getting married, or having a child.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare supplement will be the plan that balances costs and coverage. Unfortunately, the most comprehensive plans, C and F, will not be available for new enrollees. In lieu of these new regulations, it is critical to reassess and evaluate all available Medigap policies.

It is important to note that policies that offer more comprehensive coverage for deductibles and care will have significantly higher monthly premiums. Below you can find an analysis of the level of coverage and monthly premium ranges for all of the Medicare supplement plans.

| Plan A |

|---|

Recommended Reading: What Insurance Does Starbucks Offer

Supplemental Health Insurance Plans

Financial protection against out-of-pocket medical expenses can be important to anyone who relies solely on their provincial health insurance plan. Supplemental health insurance protects against the day-to-day costs that really add up and even more reassuring, it can swoop in to save the day when sudden illness or injury occurs.

Medicare, Canadas publicly-funded health care program, merely covers residents for fundamental medical services. Though the system is ever-changing its benefit policies, youre probably still not receiving coverage for key health care services like:

- Prescription drugs

- Routine and enhanced dental procedures

- Prescription eyewear

- Registered specialists and therapists

Boosting your benefit level

With a supplemental health insurance plan, you can extend your personal protection against health-related expenses well beyond the governments provision. Extended health insurance plans are available for purchase through a number of health benefits providers.

You are the perfect candidate for supplemental health insurance coverage if:

- You have no group health benefits at work, or

- You will lose your group employee health coverage at retirement, or

- You are self-employed, working on contract or freelance.

Can I Qualify For Extra Help If Im Low Income

Extra Help is a nationwide program that helps seniors and Medicare-eligible disabled residents cover their Medicare Part D deductibles, co-pays and premiums. If you are struggling to pay those expenses on top of your Medigap premium, you can apply through your local Social Security office or with the online form. The amount of help that you receive will depend on your income.

Key Take Aways

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

How To Choose The Best Medicare Supplement Plan For You In 2021

As you research which Medigap plan is the best fit for you in 2021, here are some points to consider:

Because there are so many options and people’s individual circumstances differ greatly, what is right for one person may not work for you. However, there are a few generalities we can discuss.

Below are a few scenarios you may find yourself in when choosing your Medicare Supplement plan, and what information you need to know for each:

SCENARIO ONE: If you have high Part A fees

Part A has three categories associated with it. These are:

- Part A coinsurance

- Part A hospice care coinsurance or copayment

- Part A deductible

If you have Original Medicare and are frequently using your Part A coverage but not your Part B coverage, a plan that covers these categories would work best for you. Every plan listed above covers 100% of these categories, except for plans A, M, L and K.

SCENARIO TWO: If you have high Part B fees

There are three categories for supplement plans that cover Part B fees. These are:

- Part B deductible

- Part B coinsurance or copayment

- The Part B excess charge

How We Chose The Best Medicare Plan G Providers

Using the Medigap Find a Plan search engine, all companies offering Plan G and High-Deductible Plan G were considered. Subsidiaries of larger umbrella companies, e.g., Blue Cross Blue Shield, were taken as one entity rather than as separate companies. Of those carriers, the review was narrowed down to those offering plans in 40 states or more.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Humana Medicare Supplement Insurance Plans

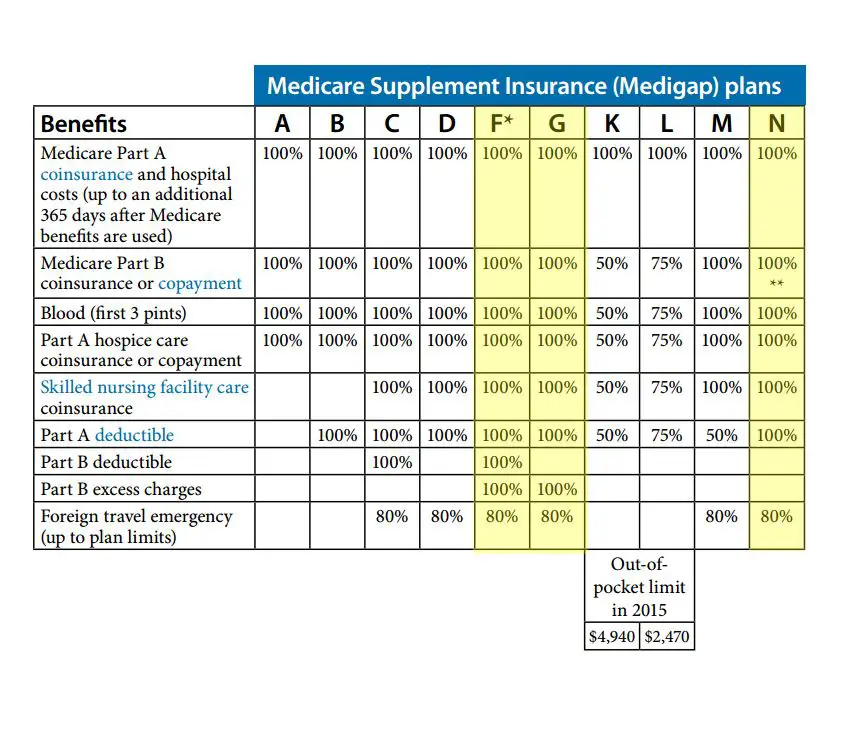

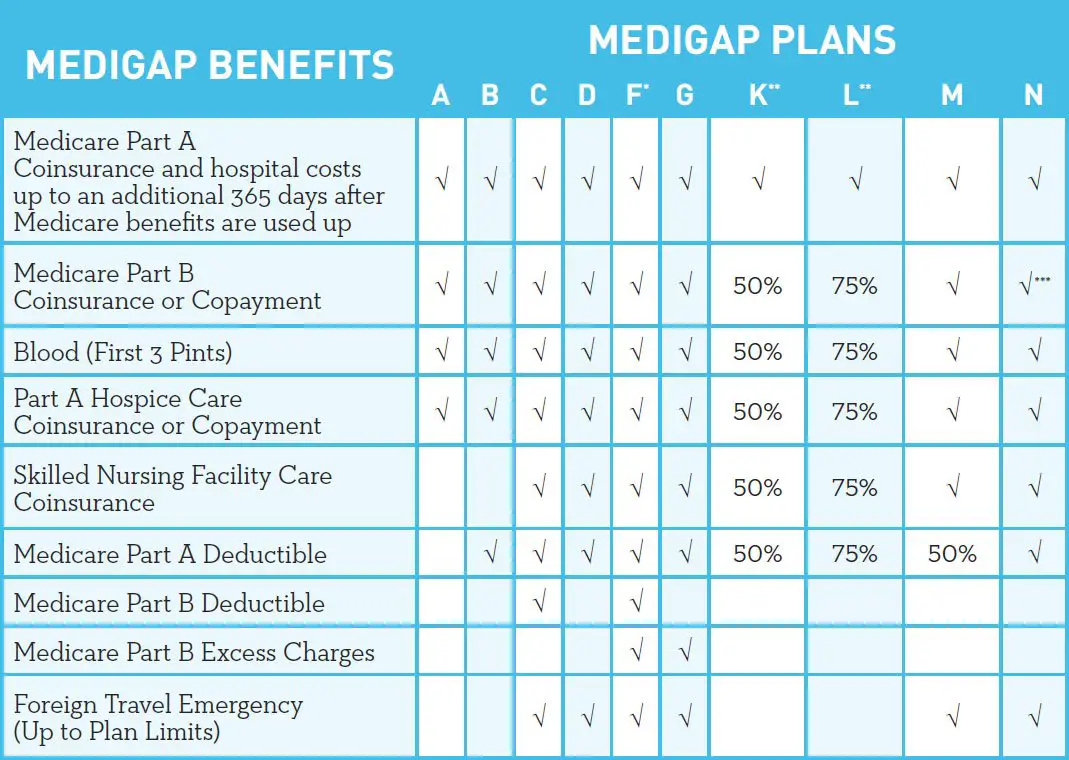

In most states*, policies are standardized into plans labeled A through N. All policies cover basic benefits, but each has additional benefits that vary by plan.

Medicare Supplement insurance plans A through G generally provide benefits at higher premiums with limited out-of-pocket costs compared to plans K through N. Plans K through N are cost-sharing plans offering similar benefits at lower premiums with greater out-of-pocket costs. Some companies may offer additional innovative benefits.

Effective Jan. 1, 2020, plan options C, F and High Deductible Plan F are only available for purchase by applicants first eligible for Medicare prior to 2020.

Best Cheap Medicare Supplement: Plan K

If you are interested in the cheapest Medigap policy that still provides some coverage for Original Medicare costs, you may want to look into Plan K.

Plan K is significantly different from many other Medicare policies since it provides only 50% coverage for Medicare Part B coinsurance, blood, Part A hospice, skilled nursing and the Part A deductible. Many other Medigap plans, such as Plan G, provide full reimbursements for these types of health care.

This is crucial to consider if you need health insurance coverage for skilled nursing. In this case, if you were to get Plan K, only 50% of such costs would be covered.

On the other hand, your monthly premiums will be much cheaper when compared to every other Medicare supplement policy available. Policyholders can expect to pay a monthly premium between $62 and $135.

You May Like: Starbucks Part Time Health Insurance

A Great Idea For Some But Not For Others

Supplemental insurance is extra or additional insurance that you can purchase to help you pay for services and out-of-pocket expenses that your regular insurance doesn’t cover.

Some supplemental insurance plans will pay for the out-of-pocket cost-sharing that goes along with your health insurance plan , or for medical services that your health plan doesn’t cover at all, such as dental and vision costs.

Other supplemental plans may provide you with a cash benefit paid out over a period of time or given to you in one lump sum. The cash can be used for:

- Covering lost wages

- Transportation related to your health condition

- Food, medication, and other unexpected expenses you have due to an illness or injury

The Benefits Of Partnering With Us

At SBIS, we understand the insurance industry and the unique needs of our clients. We are proud to represent Green Shield Canada, Manulife Financial, and GMS in British Columbia.

SBIS offers

- Convenience One-stop shopping that gives you access to some of the best insurance products in the industry

- Quality High-quality British Columbia Health Insurance options with multiple insurers

- Affordable Options Economically-priced insurance products to fit your budget and needs

- Financial Security A practical safety net that helps to reduce your out-of-pocket expenses

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Does Medicare Supplement Insurance Work

Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest.

If your Part B policy says it covers 80% of a doctors visit, Medicare will pay that. Medigap kicks in for the other 20%. Lets suppose your Medigap Plan says that it will pay 75% of your Part B coinsurance. That means you will only pay one-quarter of the total cost of your doctors visit.

Heres an example with numbers: if the doctors visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5. If you didnt have Medigap, you would be responsible for paying the entire $20 that were left over after Medicare paid its share.

Depending on the plan you select, Medicare Supplement Insurance can help you pay for the Part A and Part B deductibles. It can also help you pay for medical expenses if you have a medical emergency outside of the United States.

What Coverage Is Included Under Medicare Supplement Plan G

For those who would have opted to purchase coverage under Plan F but may not be eligible after the cutoff date, Plan G offers comparable benefits, with one exception. It does not cover any portion of your Part B deductible.

In fact, once Plans C and F have been phased out, no Medicare Supplement plans will cover the Part B deductible.

You May Like: Does Starbucks Offer Benefits

Coverage For The Part B Premium

If you became eligible on or after January 1, 2020, you are not able to purchase a plan that covers the Part B premium. These include Medigap Plan C and Plan F.

However, if you already had one of these plans, you can keep it. Additionally, if you were eligible for Medicare before January 1, 2020, you may be able to purchase Plan C or Plan F as well.

When Should I Buy Medicare Supplement Insurance

Its best to buy Medicare Supplement insurance within the first six months after you turn 65 and enroll in Medicare. During that time, you can buy any Medigap policy sold in your state, even if you have health problems. After this six-month period, you may not be able to enroll in a Medicare Supplement plan, or you may have to pay more due to pre-existing conditions or current health problems.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How To Choose The Best Medicare Supplement Plans

The best Medicare supplement plan for you will depend on which Original Medicare parts you need filled and the cost of the plan. You should choose the supplement policy that provides the best benefits for you and fills in the coverage gaps where you expect to spend the most on health care.

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,484 out of pocket before your Original Medicare coverage would kick in.

On the other hand, if you selected Medigap Plan G, the entire $1,484 deductible would be covered by your supplement policy. This means you would not need to incur the out-of-pocket costs and would begin getting your claims paid for immediately. However, you should also consider costs, since Plan G can be more expensive than Plan A.

It is for this reason that you should carefully analyze what each Medigap plan covers and costs so that you can choose the best one for your situation. Often, there is an ideal set of supplemental policies for your health care needs.

Best Overall Medicare Supplement Pre

For Medicare beneficiaries who became eligible for the program before Jan. 1, 2020, Plan F offers the broadest coverage. Plans F and C are the only plans that cover the Part B deductible, which is $203 in 2021 and is projected to be $217 in 2022.

The monthly Plan F premium average for a 65-year-old female, nonsmoker:

- $173.09 in the 28205 zip code in Charlotte, NC, with a range of $122.03 to $240.95 per month

- $218.06 in the 80231 zip code in Denver with a range of $181.14 -$259.85 per month

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Healthmarkets Can Help Find Your Best Medicare Supplement Plan

If you need help finding a Medicare Supplement plan, contact HealthMarkets. We can help you determine whether a Medicare Supplement plan or a Medicare Advantage plan is the right choice for your needs. You can also use our FitScore to compare Medicare Advantage plans, get instant quotes, and even enroll online in minutesall at no cost to you. Get started.

46210-HM-0820

Selecting A Medicare Supplement Insurance Company That Works For You

After youve researched and compared companies, you will select a supplemental insurance company that works best for you. You will want to consider things like the reputation and reviews of the insurance company as well as how easy it is to navigate their website and apply for coverage. Additional factors to consider include types of plans available, pricing, and deductibles. You may also want to select a company that has an app so you can manage your policy on the go.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees