Option : Private Pay For Home Health

If you have resources available, private pay for home health may be an option. Some individuals use a combination of:

- Personal savings

- Home equity loans

- Reverse mortgages, which allow you to convert some of your home equity into cash if youre 62+

- Life insurance plans with cash value or accelerated benefits

- Annuities

Community organizations may also be able to direct you to meal delivery programs, financial grants for home modification and other services. Check with senior centers, religious organizations, nonprofits and your local Area Agency on Aging. These services may make it possible to live at home independently longer.

All these programs and resources help people pay for home health care. Even if youre struggling to make ends meet and/or have complex medical needs, you may be able to live safely and comfortably in your home. Find out which benefits are available to you. Talk with your doctor or local home health agency about eligibility requirements.

How Much Does Medicare Pay For Nursing Home

As Americans are living longer, older individuals are more in need of senior care then ever. For some, this means having someone visit the home once a day or a few times a week to assist with general care and light housekeeping, but for others, around-the-clock medical care is required. In these cases, a nursing home may be a good option, but the question of paying for nursing home care often looms large on the minds of seniors and their loved ones. Nursing home care can cost tens of thousands of dollars per year for basic care, but some nursing homes that provide intensive care can easily cost over $100,000 per year or more.

How Much Does Medicare Pay for Nursing Home Care?For seniors and qualifying individuals with Medicare benefits, theres some good news and some bad news. While Medicare benefits do help recipients with the cost of routine doctor visits, hospital bills and prescription drugs, the program is limited in its coverage of nursing home care. This is because nursing home care varies greatly in terms of scope and amenities. Under Medicare, recipients do not receive benefits for custodial care, but instead, only for required medical care.

Related articles:

What Is Home Health Aide

In most cases, if you or a loved one wish to age in place, home health aid is what youll want. Home health aid agencies will provide you with a trained and experienced home health aide.

Its important to note that home health aides are, with few exceptions, not trained medical professionals. They are not nurses, and typically cannot do any medical tasks beyond basic things like reminding your loved one to take medication and other such things.

Because of this, you may need to hire a specialist, part-time nurse to augment your home health aides services. Why not just hire a nurse full time? Because its much more expensive.

The home health aides mostly provide the same services that a family caregiver would, and are not highly skilled, and their rates are usually lower. In most states, home health aides will charge rates of $20-$30 per hour.

In comparison, a highly-skilled nurse may cost $40-$80 per hour and their services are not usually required all the time. Choosing a home health aide allows you or a loved one to get proper care, without the high cost of a full-time nurse. The cost of home health aide is much lower.

Its also often a good idea not to hire the most inexpensive care provider available to you. They may not have the proper license or home health care provider insurance and you or your loved one may get sub-par treatment. You should do your research before hiring any particular agency, to make sure youre partnering with a reputable company.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Provincial Health Care Plans: Whats Not Covered

- Prescription drugs outside the hospital are not covered by most provincial health care plans, for most people. There are some exceptions, including people on low income and people over 65. Some provinces will cover a percentage of certain prescription drug costs for anyone over the age of 65.

In Ontario, for example, the Ontario Drugs Benefit Program means that retirees over 65 with a moderate to high income will pay the first $100 of any prescription costs in a year and then $6.11 for each subsequent prescription. However, this is only for the 4,400 prescription drugs covered by the program. For any others, you have to pay the full amount. In Alberta, meanwhile, the over 65s pay 30% of the prescription cost, if it is on the Alberta Drug Benefit List. Otherwise, they have to pay the full amount.

Most retirees under 65 pay their full prescription cost, sometimes thousands of dollars a year, unless they have low income. This is one of the key reasons why health insurance for retirees in Canada can be so important.

- Dental treatment is rarely covered by any provincial health care plan. It can also be one of the largest health care expenses for retirees. Simple check-ups can cost $100-plus and major treatments can cost thousands.

Some provinces will provide limited free dental services to people aged 65-plus with low income. Others will only provide these free dental services if you already qualify for other assistance programs.

Using Traditional Health Insurance Plans To Pay For Home Care

Private health insurance plans may pay for select elder care services, but coverage varies from plan to plan. Most forms of private insurance will not pay for non-medical home care services, and in-home skilled care is rarely covered at 100 percent. Research prospective policies for the best coverage options.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Home Health Aide Liability Insurance

CM& F specializes in home health aide malpractice insurance, also known as home health aide liability insurance, that is tailored to your individual needs. Designed to protect your assets, license and reputation, CM& Fs superior professional liability insurance brings peace of mind to home health aides.

CM& Fs home health aide professional liability insurance policies are comprehensive, portable, and flexible offering 24/7 coverage that is inclusive of any services outlined within your scope of practice according to relevant state laws, as outlined within your policy agreement.

CM& F is one of the countrys longest-standing professional liability insurance providers, with over 100,000 healthcare providers across the U.S. putting their careers in the hands of CM& F. With excellent service, innovative technology, and even better coverage, CM& F has your back with the markets best professional liability insurance for home health aides.

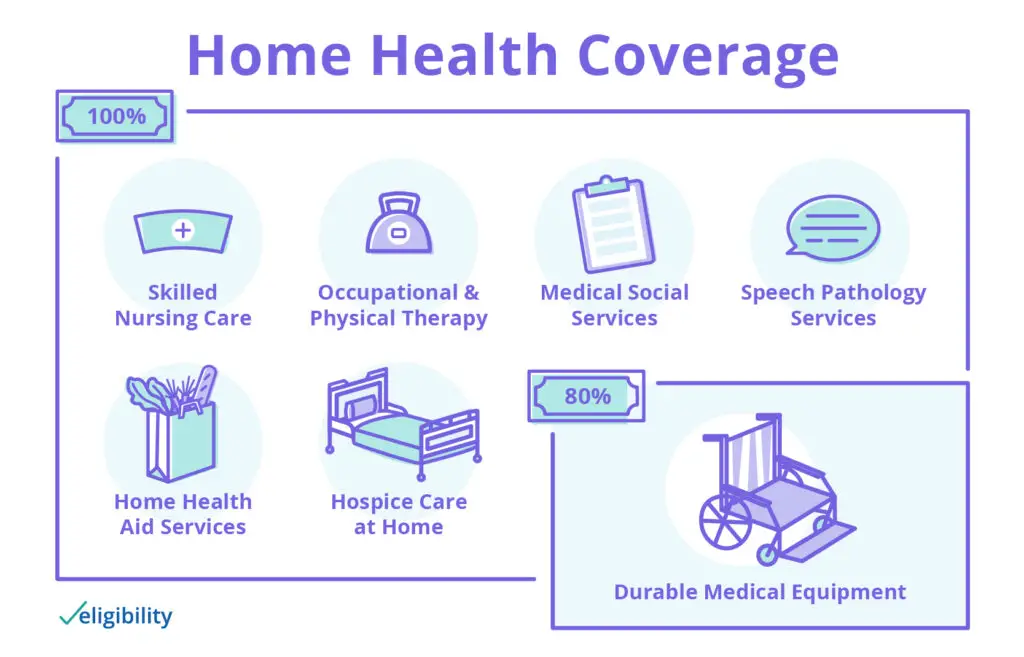

How Much Does Home Health Care Cost With Medicare

Typically, the costs of home health care services covered by Original Medicare are as follows:

-

$0 for home health care services

-

20% of the Medicare-approved amount for durable medical equipment

Keep in mind that you are still responsible for your Original Medicare out-of-pocket costs, which include your Medicare Part A and Part B deductibles, coinsurance and copays.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Does Humana Medicare Coverage Help Pay For Home Health Care

Private health insurers, like Humana, offer Medicare Advantage plans that can provide Part A and Part B benefits, in addition to a variety of additional benefits. Humana also offers Medigap supplemental plans and prescription drug coverage for individuals with original Medicare. Plans offered by Humana and other insurance carriers may help some Medicare recipients save on the costs associated with home health care services.

Understanding Home Health Care Services

Agencies that offer home health care may list several services they provide even if they are not covered by Original Medicare, a Medicare Advantage plan, or supplemental Medicare coverage.

The range of services can include:

- Skilled nursing assistance

- Medication management and wound care

- Physical or occupational therapy

- Help with daily living activities and personal care

- Medical supply delivery

- Medical equipment provision

No matter what agency you choose for these services, they should be in contact with your team of health care professionals in order to understand all your needs. They should also be able to provide you with detailed information about what your Medicare coverage includes and what you may be expected to pay for out of pocket.

Medicare Requirements for Home Health Care Services

The doctor must also certify that you are in need of one or more of the following services:

- Physical therapy

- Speech-language pathology

- Occupational therapy

Humana Medicare Coverage for Home Health Care

Related articles:

Home Health Aide Professional Liability Insurance Benefits

- Coverage Options up to $2 Million per Claim

- Full Consent to Settle Claims

- Telemedicine/Telehealth Coverage

- Defense Costs in Addition to Liability Limits

- Sexual Misconduct Defense

- HIPAA Defense Coverage

- QuoteView coverage options and make sure the price fits your budget.

- ApplyAccess your quote, finalize your options and purchase coverage

- Access your proof of coverage to share or download, instantly.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

When Does Medicare Pay For Home Health Care

Many health care services that were once only available in a doctors office or hospital are now available at your home. This form of care, known as home health care, can encompass a wide range of treatments and services.

Original Medicare covers care at your home in certain circumstances, including:

-

Intermittent skilled nursing care

-

Physical therapy

-

Occupational services

- Medical social services

Once your doctor refers you to a home health care agency, the agency will come to your home and administer care as often as directed by your doctor. The home health agency will also regularly update your doctor on your progress.

To receive skilled nursing care at home, you must be homebound and not require full-time care.

Types Of Home Health Care

There are two primary types of home health care, according to Johnson:

- Skilled home health care is prescribed by a physician and includes physical therapy, occupational therapy and speech therapy, as well as care provided by a registered nurse.

- Non-skilled home health care includes services such as bathing, cleaning and errands. This type of care is typically provided by a certified nurse assistant or home health aide.

You May Like: What Health Insurance Does Starbucks Offer

What Is Home Health Care Provider Insurance

Home health care provider insurance is a policy designed to protect those who work as medical aides in clients homes. There are countless potential liabilities you may face while performing these services. Without coverage, paying damages out of pocket and dealing with lawsuits can potentially destroy your business. Proper coverage will pay for your legal bills and the resulting damages if you are found responsible. Home health care provider insurance is essential for anyone working in this field, even if you just have one client.

How Do I Find A Caregiver

If you want to research certified agencies in your area, Medicare has a tool to help you find a home health agency. Once you locate an agency near you, you can use Medicares home health agency checklist to determine whether the agency will provide the level of care you want.

Your state survey agency keeps an up-to-date report on the quality of care given by home healthcare providers. You can check Medicares resource guide or survey agency directory to find the telephone number or email address of the agency in your state.

Medicare only lets you receive care from one home health agency at a time. If you decide to change which agency you use, you will need a new referral from your doctor. You will also need to inform your old agency that youre switching providers.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Medicare Coverage: What Costs Does Original Medicare Cover

Heres a look at the health-care costs that Original Medicare may cover.

If youre an inpatient in the hospital:

- Part A typically covers health-care costs such as your care and medical services.

- Youll usually need to pay a deductible .

- You pay coinsurance or copayment amounts in some cases, especially if youre an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

- After youve spent more than 90 days in the hospital during a single benefit period, youll generally have to pay a coinsurance amount of $742 per day in 2021. You pay this coinsurance until youve used up your lifetime reserve days . After that, you typically pay all health-care costs.

*A benefit period begins when youre admitted as an inpatient. It ends when you havent received inpatient care for 60 days in a row. You could have more than one benefit period within a year, and you generally pay a deductible for each benefit period.

If youre not a hospital inpatient:

For example, if the Medicare-approved amount for a doctor visit is $85, your coinsurance would be around $17, if youve already paid your Part B deductible.

Be aware that Original Medicare has no annual out-of-pocket maximum spending limit. If you meet your Medicare Part A and/or Part B deductibles, you still generally pay a coinsurance or copayment amount and theres no limit to what you might pay in a year.

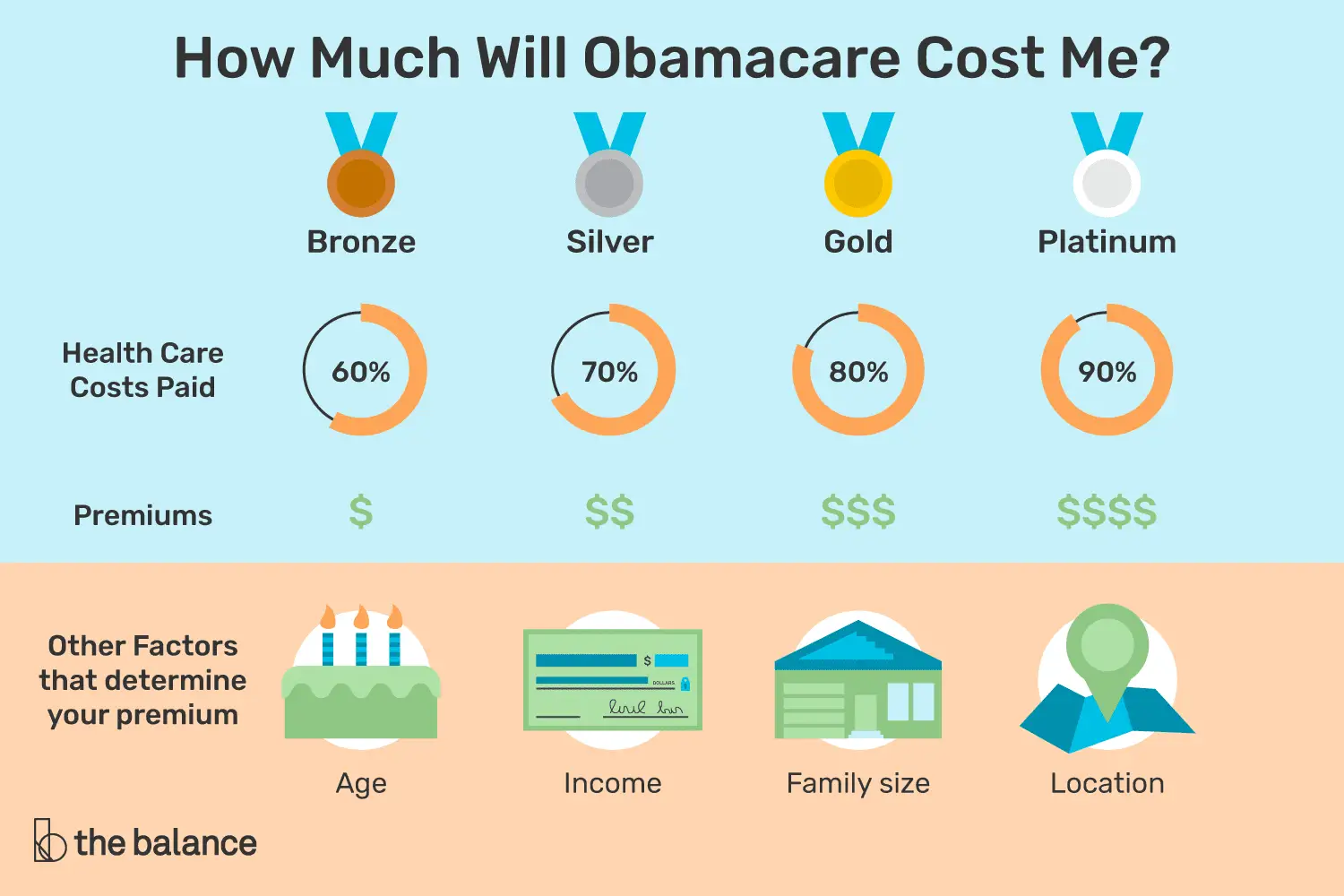

Option : Private Insurance

Private health insurance plans may cover skilled, short-term, medically necessary home health care. If you need long-term care or non-medical home care, youll likely need a special type of insurance policy. Coverage varies from plan to plan and there may be copays in some situations. Review your insurance policy coverage and benefit materials for information about the services available under your specific plan.

Also Check: Can I Go To The Er Without Health Insurance

What Risks Do Home Health Care Providers Face

Home health care services and home health nurses are prone to a variety of health hazards and risks rather than working in a medical facility. Below are some of the risks your business can face:

- Your nurse provides a medical treatment that causes the patient more harm than good. Youll be responsible for expenses coming from the damages caused and if the client sues your business.

- Your nurse catches a communicable disease from a patient. Your business will be responsible for the medical expenses until your nurse is fit to work.

- If you are in the home of a patient providing services and fail to keep items out of their walkway and they end up tripping and falling over an item and injuring themselves, they or their family may decide to hold you responsible.

- Working in other peoples homes leaves you open to damaging their property. If you are rushing around the home and knock over an heirloom, there could be no replacing it which could certainly upset some clients.

- A client who has had surgery recently may develop an infection if you miss changing their bandaging at the right time. They or their family could sue you for negligence and without insurance, you could be in trouble.

Insurance For Home Care Providers Businesses And Agencies

Insurance for professional Home Health Aides is an underpinning to a successful career as a care provider. Whether you are a Home Health Care Provider working as an independent contractor or running your own agency, you should consider Home Health Care Insurance.

Home Health Care Provider and Home Health Care Business insurance is important because it can make the difference between keeping your agency open or having to close because of a costly claim that has arisen due to an accident or error.

You May Like: Does Starbucks Provide Health Insurance

How To Choose The Right Home Health Care Agency For You

Just like with a primary care doctor or therapist, not every home health agency is the right fitand its important to find the one that works best for you. The National Association for Home Care & Hospice suggests asking potential providers the following:

- How long have you been serving the community?

- Do you supply literature explaining your services, eligibility requirements and funding sources?

- How do you select and train your employees?

- What procedures do you have in place to handle emergencies?

- How is patient confidentiality ensured?

Who Provides Home Care

Not all home care services offer the same peace of mind, and there are some important, but often unrecognized, issues to consider when hiring a caregiver. Home care services are best when provided through an agency that employs, trains, bonds and insures, and background checks its caregivers. This allows to you have peace of mind knowing that you are bringing someone into your home that you can trust. In addition, the agency will take care of any legal issues that occur should the caregiver or client be injured on the job.

On the other hand, a home care registry is an organization that helps you locate a caregiver and places one in your home on an independent contractor basis. Registries do not employ caregivers, nor do they take responsibility for their training and supervision. A private caregiver or an independent contractor with a home care registry may be highly compassionate, lower in cost, and an overall good fit with the client, but remember you will be liable for the payroll taxes and possible work related injuries of the caregiver.

Hiring a caregiver that is not background checked on a yearly basis and continuously trained by an agency that employs him or her creates a situation where you don’t know if the caregiver has the skills to perform the needed tasks, and potentially exposes you to the risks of using a caregiver with an unknown background. So, it is vital to check a private caregiver’s criminal and sexual abuse records at least annually.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees