Should I Get An Hmo Or A Ppo Plan

While you weigh your options between signing up for an HMO or PPO plan, many people like you have the same question: Which is the right choice for yourself and/or your family? The main question youll have to ask yourself is whethercost orflexibility is more important to you.

The primary differences between HMO and PPO plans are:

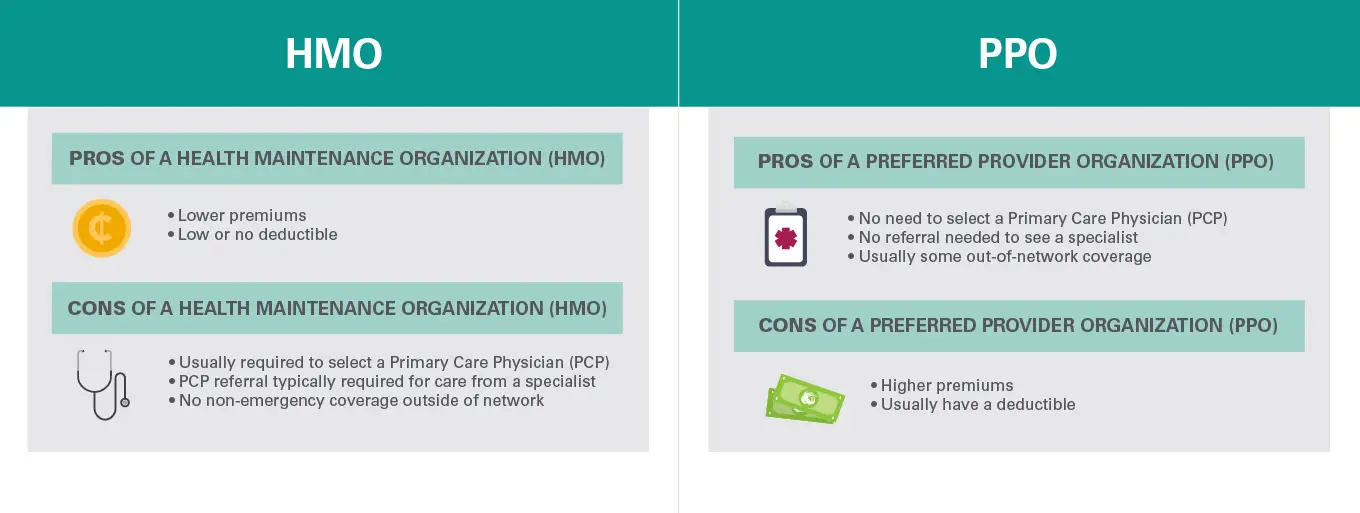

- Cost: HMOs have lower monthly premiums, lower out-of-pocket costs, and sometimes there is no deductible . PPOs typically have higher monthly premiums, higher out-of-pocket costs, and have a deductible you must reach before they pay for your healthcare bills.

- Network coverage: With an HMO plan, you can only see in-network providers unless it is a medical emergency. PPO plans give you much more flexibility to see providers both in- and out-of-network.

- Referrals: HMO policyholders must have a referral from their primary care doctor to see an in-network specialist. With PPO plans, policyholders dont require specialist referrals, and they are not required to have a primary care doctor.

How Eden Health Can Help

With Eden Health, you are not on your own to navigate the intimidating insurance landscape we can help your employees understand the benefits associated with HMO vs PPO insurance.

Our Healthcare Navigators can also help employees find answers for any question they may have, like reviewing insurance claims, finding the in-network specialist they need, managing medications, and estimating costs.

Q What Do I Do If Im Travelling Across The Country And Have A Health Issue Can I See A Doctor Not In My Network

A. With an HMO, you can see doctors outside the network for emergencies. But be aware, the definition of an emergency may be limited. For example, a sore throat may not be considered an emergency. Most HMOs also have some provisions for seeing other doctors when you travel. You should call your plans customer service line before leaving on a trip to make sure you know what to do if you have a health issue while travelling.

PPOs often have separate nationwide network of doctors you can see while travelling. Again, check with customer service before you leave on a trip or contact them before you get medical care when you are travelling.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions.All content and services provided on or through this site are provided “as is” and “as available” for use.QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site.You expressly agree that your use of this site is at your sole risk.

Also Trending

Recommended Reading: Starbucks Open Enrollment 2020

Which Is Health Insurance Plan Is Right For You

Here are a few questions to ask yourself to make your final decision for health care.

- Do I value insurance costs or flexibility more?

- Am I okay with my primary care doctor coordinating my medical treatments? Do I want to deal with minimal paperwork?

- Do I need to see specialists frequently?

- Do I have a PCP I wish to keep?

- Is my current team of specialists in-network or out-or-network of potential providers?

- Am I at least 65 years of age, have a disability, or have ESRD?

- Do I travel often or spend most of my time locally?

If you currently have a doctor or pharmacy in your community that is in the network of health insurance providers youâre considering, find plans that are HMO. If you donât have a doctor you see routinely, are usually on the road, prioritize flexibility, and donât need a specialist, find plans that are PPO. Find a federal health plan with HMO and PPO options if you are 65 years of age, have a disability, or have ESRD. If health plan costs are at the top of your list of priorities vs. the choice of a doctor, see what providers have plans that are HMO.

Plans are not one size fits all, so do your due diligence as you look for new insurance providers with a PPO health plan or HMO dental insurance. Compare all of your HMO and PPO options.

How Does An Hmo Work

An HMO contracts with a network of primary care and other providers and pays them a set fee to offer services to its members. By managing health care costs, the HMO can pass the savings on to members in the form of lower premiums.

In an HMO, your PCP or “family doctor” is typically your first contact when you need medical care. If your PCP determines that you need a specialist, theyll usually refer you to a provider within the HMO network. Some specialized services, such as mammograms, do not require referrals.

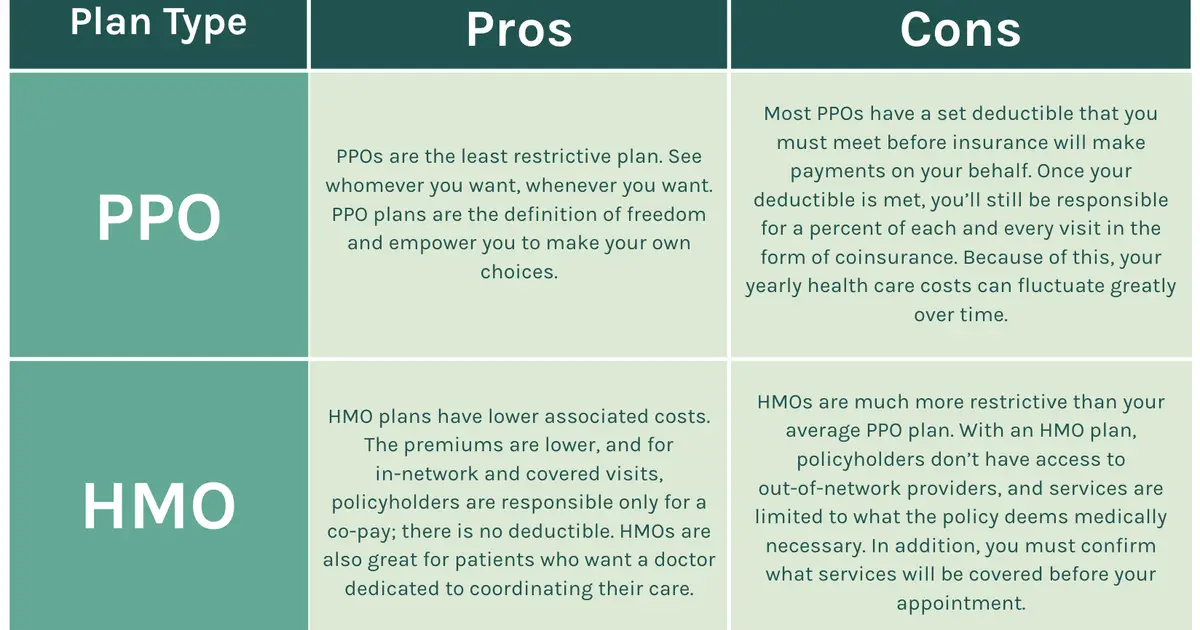

Below is a bit more detail on the advantages and disadvantages of HMO plans.

Recommended Reading: Can You Buy Dental Insurance Anytime

Whats The Difference Between An Hmo And A Ppo

There are plenty of decisions to make when picking a new health insurance plan, but perhaps the hardest is choosing between an HMO and PPO. Those two acronyms can be confusing, especially if you dont know what they mean. Heres exactly what an HMO and PPO are, the differences between them, and how you can decide whether an HMO vs PPO is the best fit for you and your healthcare priorities.

What it stands for:Health Maintenance Organization

What it is: If you chose an HMO, you will likely have to choose one primary care physician who is in the insurance companys network, who in turn will become your gatekeeper of care. So, if you have a doctor you already love, make sure he or she is in-network before switching.

This doctor will become your go-to for everything. If you want to see a specialist, such as a dermatologist, you will need to see your primary care physician first. He or she will then give you a referral. If you decide to see a specialist without a referral, first you will pay 100 percent of the out-of-pocket cost for the specialist visit.

With an HMO you generally do not have any coverage, at all, for out of network care unless it is a bonafide emergency, Louise Norris, health care expert and author of The Insiders Guide to Obamacares Open Enrollment, shared with Real Simple. So, if you go outside the network you are just paying the entire bill yourself.

What it stands for:Preferred Provider Organization

How Does An Hmo Plan Work

An HMO plan is a Medicare Advantage plan that offers everything Medicare covers plus additional benefits such as prescription drug coverage , vision and hearing exams, preventive dental coverage, and discounts on fitness programs. In addition, Medicare Advantage HMO plans can help save you money with monthly premiums as low as $0 and an out-of-pocket maximum that limits what you pay for medical services in a year.

With a Medicare Advantage HMO plan, you choose a primary care physician or PCP to be your main doctor. Your PCP keeps track of all the care you receive and refers you to specialists if needed. Your PCP makes sure you get the care that is right for you. Your PCP can also help you avoid unnecessary expenses such as duplicate tests. This is one of the advantages of an HMO planhaving a team behind you to make sure you are getting the right care.

You May Like: What Benefits Does Starbucks Offer Employees

Find Cheap Health Insurance Quotes In Your Area

Health Maintenance Organizations and Preferred Provider Organizations are managed care insurance programs that provide coverage for basic and specialized health or dental care. There are important differences between HMO and PPO plans as to where you can receive care and how they determine your out-of-pocket expenses. Selecting the right option and following plan guidelines helps you to get the most coverage offered by your plan at the lowest available cost.

Ppo Health Insurance Plans

PPO health plans provide a bit more flexibility in doctor and treatment options compared to a HMO plan. PPO plans also have their own network of doctors, facilities, hospitals, and pharmacies that provide services at a discounted price for policyholders just like an HMO does. The difference is that the network for a PPO health plan usually has more doctors or hospitals that take part in the network. In addition, PPO plans have the following features:

- You can go to any primary care physician that you want, without pre-selecting them.

- If you go to an out of network doctor or treatment center, some of the costs may be covered by your insurance plan, just not as much as if you went in network. Some exclusions or specifications may be listed.

- Under a PPO health plan, seeing a specialist does not require the need for a referral from a primary care physician.

- Premiums are higher for PPO plans and there is usually a deductible.

- PPO health plans are great for those who may need to see a specialist or for those who wish to be covered, even just if its a little bit, in the event that they get care from somewhere out of network. Having additional flexibility and not having to remember to pre-select your PCP can be worth the increase in premium for some.

Whatever your choice, so long as it fits your needs, the needs of your family, and fits your budget then it is the perfect choice.

Don’t Miss: Starbucks Health Plan

Hmo And Ppo Plan Networks

Using in-network services is the lowest cost option on both plans.

HMO plans offer coordinated care with full coverage inside the network. If a person wants to use a service outside of their network, they will have to pay higher costs. The plan benefits will not usually apply.

For example, if a person has an HMO plan and wants to see a dermatologist, their doctor must write them a referral to see an in-network dermatologist, but the insurance covers the visit. Any copayments, deductibles, or coinsurance will apply.

If the same person chooses an out-of-network dermatologist, they must self-fund the fees for the visit.

If a person needs to see several specialists and wants the freedom of using any healthcare service provider they choose, a PPO plan offers this option. However, out-of-network providers can still cost more than in-network providers on a PPO plan.

For example, if a person had a PPO plan, they could visit a dermatologist without first seeing their PCP. If the dermatologist is an in-network specialist, the insurance plan will cover the cost.

However, if the dermatologist is out of network, an individual will usually pay for the service upfront and then submit a claim. Reimbursement will usually be up to the Medicare-approved amount. Deductibles, copayments, and coinsurance will apply.

Other Types Of Health Plans

While HMO and PPO plans are the 2 most common plans, especially when it comes to employer-provided health insurance, there are other plan types you should know about, including EPO and POS plans.

An exclusive provider organization plan is situated between an HMO and PPO in terms of flexibility and costs. With an EPO, you typically dont need a referral to see a specialist, which makes it more flexible than an HMO. However, like an HMO, there are no out-of-network benefits.

A point of service plan also blends elements of HMO and PPO plans. Under a POS plan, like with an HMO plan, you usually need a primary care doctor referral to see a specialist. However, like with a PPO plan, you can see out-of-network health care providers but at a higher cost.

Recommended Reading: Kroger Health Insurance Benefits

Why Do You Need Additional Coverage

Many people discover that relying on Original Medicare doesnt provide enough coverage. With Original Medicare, there are gaps in your coverage. For example, Original Medicare only covers 80% of Part B expenses after the annual Part B deductible is met. The remaining 20% is your responsibility and could add up to thousands of dollars each year. Plus, Original Medicare doesnt include Part D prescription drug coverage, routine vision and hearing exams, and certain other services.

In order to have enough coverage, many people choose to enroll in a Medicare Advantage plan.

Rules For Hmo Subscribers

HMO subscribers pay a monthly or annual premium to access medical services in the organizations network of providers, but they are limited to receiving their care and services from doctors within the HMO network. However, some out-of-network services, including emergency care and dialysis, can be covered under the HMO.

Those who are insured under an HMO may have to live or work in the plan’s network area to be eligible for coverage. In cases where a subscriber receives urgent care while out of the HMO network region, the HMO may cover the expenses. But HMO subscribers who receive non-emergency, out-of-network care have to pay for it out-of-pocket.

In addition to low premiums, there are typically low or no deductibles with an HMO. Instead, the organization charges a co-pay for each clinical visit, test, or prescription. Co-pays in HMOs are typically lowusually, $5, $10, or $20 per servicethereby minimizing out-of-pocket expenses and making HMO plans affordable for families and employers.

Recommended Reading: Insusiance

Are There Other Options

Independence Blue Cross also offers EPO plans, which fall somewhere in between HMO and PPO health plans both in terms of cost and flexibility. EPO stands for Exclusive Provider Organization. Youll only have in-network coverage , but your network includes the BlueCard® PPO network. Plus, you wont be required to select a PCP or get referrals to see specialists.

Which Type Of Managed Health Care Plan Typically Has The Lowest Deductibles

A health maintenance organization plan from a large firm typically offers the lowest out-of-pocket costs. A 2021 study from the Kaiser Family Foundation found that the average annual deductible for single coverage HMO with a large firm was about $847. However, average HMO deductibles with a small firm increase to $2,256. Across all firm sizes, HMOs and PPOs have similar deductible averages.

Don’t Miss: Starbucks Benefits For Part Time Employees

What Does Hmo And Ppo Mean

Health Maintenance Organizations , and Preferred Provider Organizations have distinct and separate characteristics. Deciding which health insurance plan works best for you is dependent entirely on your and your familys situation.

Lets detail the ins and out of each plan. What are the differences and similarities? How can each plan benefit you and your family?

Check out the breakdown HMO vs PPO health insurance plans below.

What Is A Ppo Plan

PPO plans share many features with HMO plans. However, PPO plans offer greater flexibility.

As with HMO plans, there is a network of Medicare-preferred healthcare service providers that offer lower cost options, but individuals are free to choose a doctor, specialist, or hospital that is not part of the network. However, this may cost more.

A person with a PPO plan does not need to choose a PCP, and they can request services from any in- or out-of-network healthcare professional without getting a referral from their doctor.

Also Check: Kroger Associate Discounts

Whats The Difference Between An Hmo Ppo And Pos

How do I compare an HMO vs PPO vs POS? There are many complicated nuances in comparing and contrasting these heathcare plans. Heres the breakdown.

No account yet? Register

One thing is true across the board about health insurance in the United Statesits a complicated system to navigate, to say the least. Between benefits tied to various jobs, employees coming and going, and endless policy changes, it can be a lot to keep up with. However, there are a few things that wont be changing anytime soon: the use of HMO, PPO, and POS plans. In short, theyre different types of health plans, but theres so much more to them than that. A beginners guide to HMO vs PPO vs POS plans is below.

Whats An Hmo Health Maintenance Organization

With an HMO, you are usually required to get your care from doctors and other health care providers who work for or contract with the health plan . If you want to see a doctor who is not in the HMOs provider network, you may have to pay the full cost of the care or services that you get. The plans doctors, hospitals and other providers may be concentrated in a specific geographic area, so you may need to live or work in its service area to be eligible for health insurance coverage.

The number of doctors in the HMOs network may be smaller than the number of doctors in a PPO network. If your current doctor is in the HMOs provider network, or if you dont currently have a regular doctor, an HMO may be a good choice for you. The plans customer service representatives can usually help you find a doctor in the network who is a good match for you.

Another important thing about HMOs is that usually you must choose one doctor who is considered your primary care provider. That doctor coordinates your care with other doctors or services if needed If you want or need to see a specialist, your primary care doctor must give you a referral to see that specialist.

For example, if you woke up with severe back pain, you would first go to your primary care doctor, whod examine you. If your doctor determined you needed additional care, he or she would refer you to a spine specialist.

Don’t Miss: Is Umr Good Insurance

What Is The Difference Between Hmo And Ppo

Health insurance can be a confusing world of acronyms. And being fully educated on the options for insurance plans means running into terms like HMO and PPO. These are the two most popular types of insurance plans for both private and federal health insurance. People act like these terms are common knowledge, but what do they actually mean?